- Home

- »

- Medical Devices

- »

-

U.S. Electrotherapy Market Size, Industry Report, 2033GVR Report cover

![U.S. Electrotherapy Market Size, Share & Trends Report]()

U.S. Electrotherapy Market (2025 - 2033) Size, Share & Trends Analysis Report By Therapy Type (Transcutaneous Electrical Nerve Stimulation (TENS), NMES/FES), By Application, And Segment Forecasts

- Report ID: GVR-4-68040-807-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Electrotherapy Market Summary

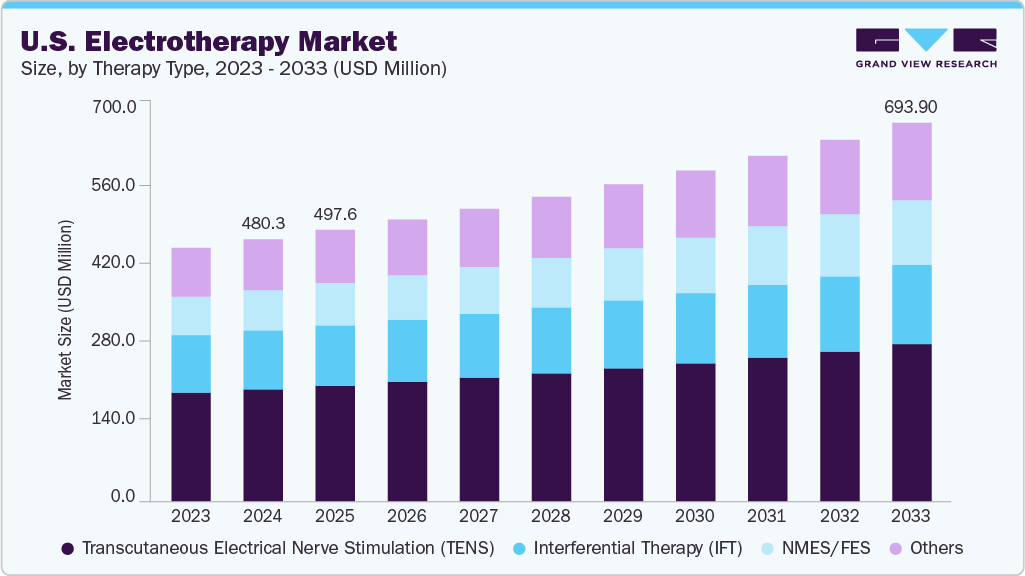

The U.S. electrotherapy market size was estimated at USD 480.31 million in 2024 and is anticipated to reach USD 693.90 million by 2033, expanding at a CAGR of 4.24% from 2025 to 2033. This growth is attributed to the growing prevalence of chronic pain, musculoskeletal disorders, and sports-related injuries, which have increased the demand for non-invasive and drug-free pain management solutions.

Key Market Trend & Insights

- By therapy type, the transcutaneous electrical nerve stimulation (TENS) segment led the market with the largest revenue share in 2024.

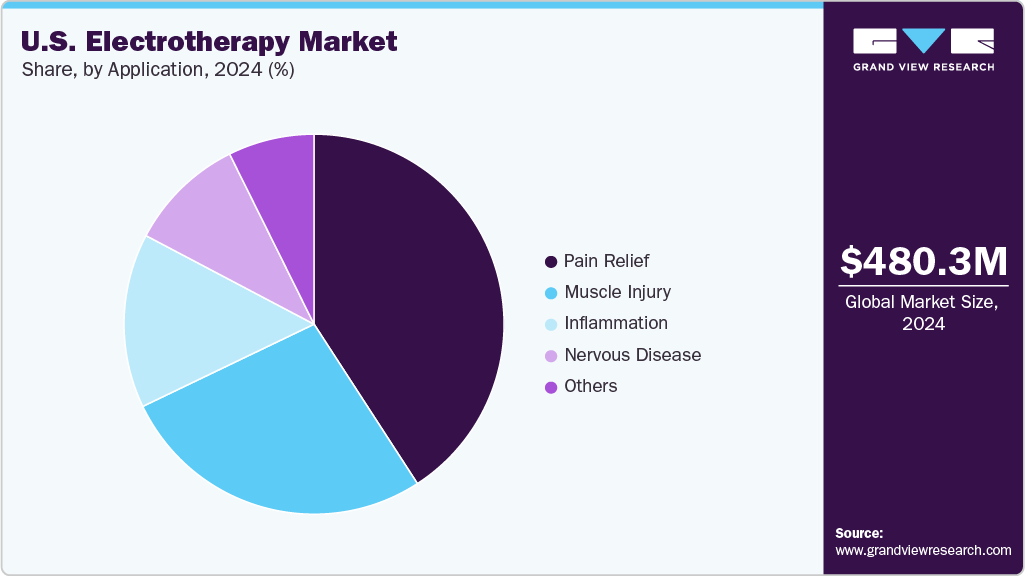

- By application, the pain relief segment led the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 480.31 Million

- 2033 Projected Market Size: USD 693.90 Million

- CAGR (2025-2033): 4.24%

The aging population, which is more prone to arthritis, neuropathy, and post-surgical pain, further fuels market growth. In addition, advancements in technology, such as portable, wearable, and smart electrotherapy devices integrated with digital monitoring, are enhancing treatment efficacy and patient convenience. The rising preference for home healthcare and rehabilitation therapies, combined with the shift away from opioid-based pain management, continues to strengthen the adoption of electrotherapy devices across clinical and home settings in the U.S.

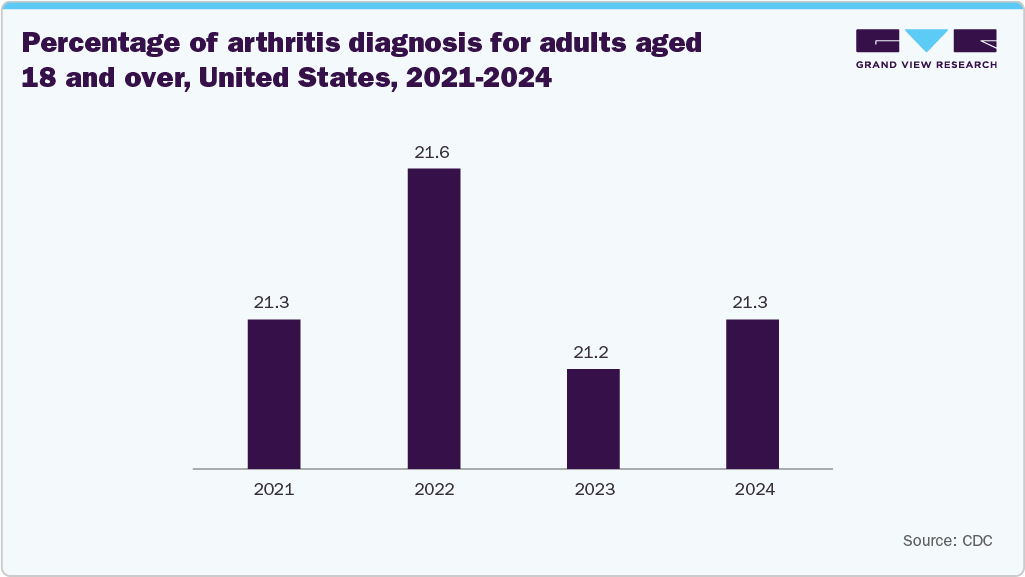

Another key growth driver in the U.S. market is the rapidly aging population, which is highly susceptible to conditions such as arthritis, neuropathy, and post-stroke mobility limitations. The U.S. Census Bureau projects that by 2035, older adults (aged 65 and above) will outnumber children for the first time in U.S. history, creating a substantial patient base requiring long-term pain and muscle management therapies. Electrotherapy is increasingly being adopted in geriatric care to improve muscle function, circulation, and overall mobility, thereby enhancing quality of life. Moreover, the ongoing opioid crisis in the U.S. has strengthened the focus on non-opioid pain management solutions. Federal initiatives, such as the CDC’s guidelines promoting non-pharmacological treatments for chronic pain, have further encouraged physicians and patients to opt for electrotherapy as a safer, non-addictive alternative.

The growing shift toward non-invasive and drug-free pain management therapies is a significant factor driving the U.S. electrotherapy device market. With the nation grappling with an ongoing opioid crisis, both healthcare providers and patients are increasingly seeking safer alternatives to traditional pain medications. Electrotherapy offers effective, localized pain relief without the risk of addiction, dependency, or systemic side effects associated with opioids. Federal initiatives, such as the Centers for Disease Control and Prevention (CDC) guidelines promoting non-pharmacological approaches for chronic pain, have further accelerated the adoption of electrotherapy devices across hospitals, rehabilitation centers, and home care settings. As awareness of opioid-related risks continues to rise, the demand for electrotherapy devices, such as Transcutaneous Electrical Nerve Stimulation (TENS) and Neuromuscular Electrical Stimulation (NMES) systems, is expected to grow significantly, supporting the broader shift toward safer, technology-driven pain management solutions in the U.S. healthcare landscape.

The growing awareness and adoption of rehabilitation therapies indirectly drive the U.S. electrosurgery market by enhancing the overall continuum of care following surgical procedures. As more patients and clinicians recognize the importance of post-surgical rehabilitation for faster recovery and improved functional outcomes, the demand for minimally invasive surgical techniques, including those performed with electrosurgical devices, is increasing. Electrosurgery enables precise tissue cutting, coagulation, and hemostasis with minimal thermal damage, which helps reduce surgical trauma and accelerates postoperative recovery, allowing patients to begin rehabilitation sooner. This alignment between advanced surgical methods and rehabilitation-focused treatment pathways encourages hospitals and surgical centers to adopt modern electrosurgical systems that support quicker healing, fewer complications, and improved patient mobility, ultimately fueling market growth in the U.S.

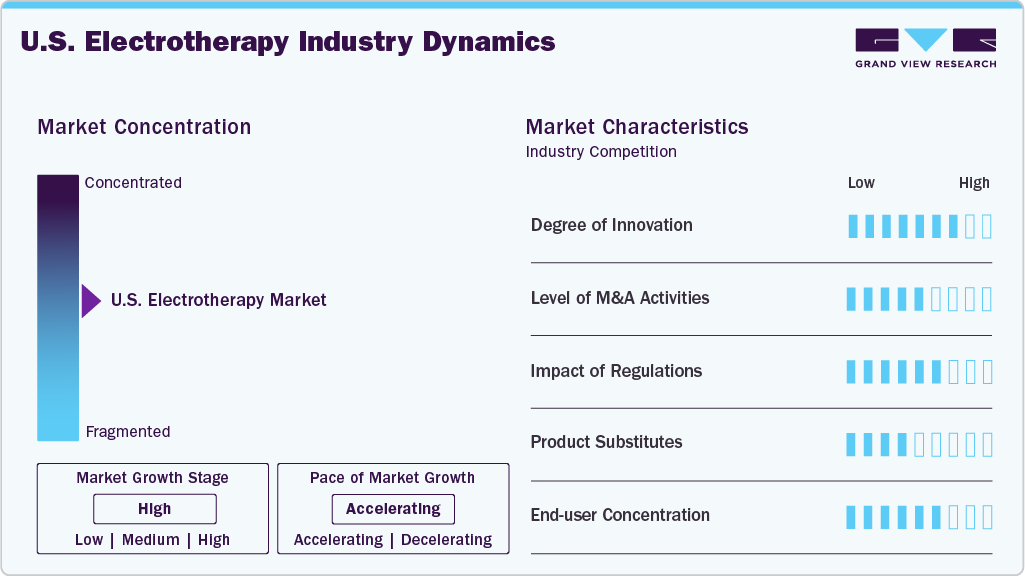

Market Concentration & Characteristics

The degree of innovation in the U.S. electrotherapy market is high, reflecting rapid advancements in technology and increasing focus on personalized, connected healthcare solutions. Manufacturers are developing modern electrotherapy devices that incorporate wireless communication, digital interfaces, and AI-enabled feedback systems to enhance treatment precision and patient engagement. The introduction of wearable, portable, and home-use devices has further transformed the market, making therapy more accessible and convenient. In addition, ongoing research in neuromuscular stimulation and targeted electrotherapy applications is broadening the scope of clinical use beyond pain relief to include rehabilitation and functional restoration. This continuous innovation, supported by strong regulatory oversight and a growing emphasis on digital health integration, underscores the dynamic and evolving nature of the U.S. electrotherapy market.

The level of mergers and acquisitions activity in the U.S. electrotherapy market is moderate but steadily increasing as companies seek to expand their technological capabilities and strengthen their product portfolios. Larger medical device manufacturers are acquiring or partnering with smaller innovators specializing in electrotherapy and neuromodulation technologies to accelerate product development and market entry. Strategic collaborations are also common, particularly between device makers and digital health companies, to integrate connectivity and remote monitoring features into electrotherapy systems. These M&A activities are primarily driven by the growing demand for non-invasive, home-based rehabilitation solutions and the need for competitive differentiation in a rapidly evolving pain management landscape.

The impact of regulation on the U.S. electrotherapy market is significant, as strict oversight by the U.S. Food and Drug Administration (FDA) ensures the safety, efficacy, and performance of electrotherapy devices before they reach the market. Most devices require 510(k) clearance or de novo authorization, depending on their intended use and risk classification, which can influence the time and cost of product development. While these regulatory processes maintain high clinical standards and patient safety, they can also slow innovation and market entry for smaller companies. However, the FDA’s recent initiatives to streamline approvals for non-invasive and digital medical technologies have encouraged the development of next-generation electrotherapy devices with improved design and functionality.

The U.S. electrotherapy market faces competition from several product substitutes that offer alternative approaches to pain management and rehabilitation. These include pharmacological therapies such as analgesics and anti-inflammatory drugs, as well as physical therapy, acupuncture, ultrasound therapy, and cryotherapy, which are commonly used for similar indications. In addition, emerging technologies such as laser therapy and magnetic stimulation are gaining traction as non-invasive pain relief and muscle recovery methods. While these substitutes provide patients with multiple treatment choices, electrotherapy remains preferred for its ability to deliver targeted, drug-free pain relief and muscle stimulation with minimal side effects. Nonetheless, the availability and effectiveness of these alternatives can influence market adoption, making continuous innovation and clinical validation critical for maintaining electrotherapy’s competitive advantage.

Therapy Type Insights

The transcutaneous electrical nerve stimulation (TENS) segment held the largest share of the U.S. electrotherapy market in 2024. This dominance is attributed due to its widespread adoption in pain management and rehabilitation. TENS devices are widely used to treat various pain conditions, including chronic and acute pain, as well as arthritis, neuropathy, postoperative pain, and musculoskeletal disorders. Their non-invasive nature, ease of use, and affordability make them a preferred choice among patients and healthcare providers. Furthermore, the increasing prevalence of chronic pain, affecting over 51 million adults in the U.S., according to the CDC, along with growing awareness of drug-free pain management alternatives, has significantly driven the demand for TENS therapy.

NMES/FES are expected to grow at the fastest CAGR in the U.S. electrotherapy market due to its expanding use in rehabilitation and muscle re-education for patients recovering from stroke, spinal cord injuries, and neurological disorders. These devices help restore motor function by stimulating muscle contractions and improving blood circulation, making them integral to modern physical therapy and neurorehabilitation programs.

Application Insights

The pain relief segment held the largest share of the U.S. electrotherapy market in 2024. This dominance is attributed due to the rising incidence of chronic pain conditions such as arthritis, neuropathy, and lower back pain among the population. Growing awareness of non-invasive and drug-free pain management options has led to increased adoption of electrotherapy devices in both clinical and home care settings. The shift away from opioid-based treatments, driven by national efforts to combat addiction and dependency, has further accelerated the use of electrotherapy for safe and effective pain control.

Muscle injury are expected to grow at the fastest CAGR in the U.S. electrotherapy market due to the growing prevalence of sports-related injuries, overuse syndromes, and post-surgical muscle rehabilitation needs. Increasing participation in athletic and fitness activities, coupled with a rise in muscle strain and soft-tissue damage cases, has fueled the demand for electrotherapy devices that aid in pain relief, muscle stimulation, and faster recovery. The technology’s ability to enhance blood circulation, reduce inflammation, and prevent muscle atrophy has made it a preferred choice among physical therapists and sports medicine professionals.

Key U.S. Electrotherapy Company Insights

The industry players are undertaking several strategic initiatives such as acquisitions, partnerships and collaborations. Moreover, the launch of novel products is anticipated to boost the competitive rivalry in the U.S. electrotherapy market.

Key U.S. Electrotherapy Companies:

- Zynex Medical

- BTL Group of Companies

- Omron Healthcare, Inc.

- NeuroMetrix, Inc.

- GymnaUniphy

- Enovis Corporation

- Medtronic

- Omron Healthcare, Inc.

- Stymco

- RS Medical

- Orthofix Medical

Recent Developments

-

In September 2024, Zynex Inc., a leading medical technology company focused on non-invasive devices for pain management and rehabilitation, has announced that its new TensWave device has received FDA clearance.

U.S. Electrotherapy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 497.64 million

Revenue forecast in 2033

USD 693.90 million

Growth rate

CAGR of 4.24% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Segments covered

Therapy type and application

Regional scope

U.S.

Report coverage

Revenue, competitive landscape, growth factors, and trends

Key companies profiled

Zynex Medical; BTL Group of Companies; Omron Healthcare, Inc.; NeuroMetrix, Inc.; GymnaUniphy; Enovis Corporation; Medtronic; Omron Healthcare, Inc.; Stymco; RS Medical; Orthofix Medical

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Electrotherapy Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the U.S. electrotherapy market report on the basis of therapy type and application:

-

Therapy Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Transcutaneous Electrical Nerve Stimulation (TENS)

-

Interferential Therapy (IFT)

-

NMES/FES

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Nervous Disease

-

Muscle Injury

-

Inflammation

-

Pain Relief

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. electrotherapy market size was estimated at USD 480.31 million in 2024 and is expected to reach USD 497.64 million in 2025

b. The U.S. electrotherapy market is expected to grow at a compound annual growth rate of 4.24% from 2025 to 2033 to reach USD 693.90 million by 2033.

b. Transcutaneous electrical nerve stimulation (TENS) dominated the U.S. electrotherapy market with a share of 42.73% in 2024. This is attributable to its widespread adoption in pain management and rehabilitation.

b. Some key players operating in the U.S. electrotherapy market include Zynex Medical; BTL Group of Companies; Omron Healthcare, Inc.; NeuroMetrix, Inc.; GymnaUniphy; Enovis Corporation; Medtronic; Omron Healthcare, Inc.; Stymco; RS Medical ; Orthofix Medical

b. Key factors that are driving the market growth include the growing prevalence of chronic pain, musculoskeletal disorders, and sports-related injuries, which have increased the demand for non-invasive and drug-free pain management solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.