- Home

- »

- Medical Devices

- »

-

U.S. Emergency Department Market Size Report, 2030GVR Report cover

![U.S. Emergency Department Market Size, Share, & Trends Report]()

U.S. Emergency Department Market Size, Share, & Trends Analysis Report By Type (Hospital Emergency Department, Freestanding Emergency Department), By Condition, By Service, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-188-8

- Number of Report Pages: 145

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

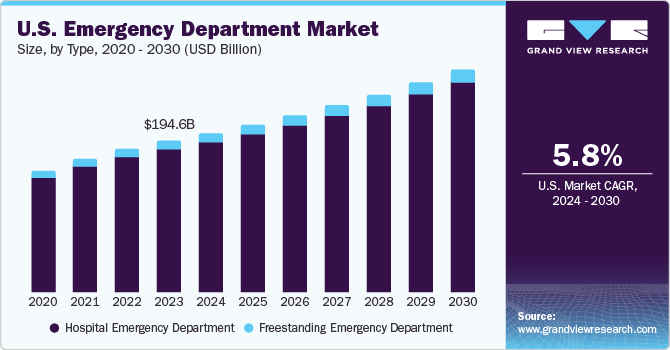

The U.S. emergency department market size was estimated at USD 194.60 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.80% from 2024 to 2030. Major factors expected to drive the market include increasing visits to hospital Emergency Departments (EDs) and growing availability of insurance. Furthermore, the rising prevalence of diseases, heart failure, and accidental injuries is expected to propel market growth over the forecast period. The growing number of emergency department visits is a significant factor driving market growth. According to the CDC, around 140 million visits to Emergency Departments (ED) in the U.S. in 2021. The overall ED visit rate was 43 visits per 100 people in the same year. Infants under the age of 1 year had the highest ED visit rates at 103 visits per 100 infants, while adults aged 75 and over had an ED visit rate of 66 per 100 people. A significant percentage of emergency care (about 60%) was provided outside of regular business hours (other than 8 am to 5 pm), suggesting that the lack of less expensive alternatives is a major factor contributing to the high number of ED visits.

Moreover, hospitals are incorporating new technologies and engaging in various business activities to address the rising demand for EDs and raise awareness. For instance, in August 2023, Rush University System for Health partnered with Cadence to launch an RPM pilot program for Medicare and Medicaid patients with chronic conditions such as hypertension, congestive heart failure, and type 2 diabetes. Patients are expected to use remote monitoring devices to track their vitals, which are expected to be transmitted to Cadence’s data platform & monitored by the startup’s care teams. The pilot program aims to implement RPM technology as a true population health tool and reduce costs & unnecessary healthcare use.

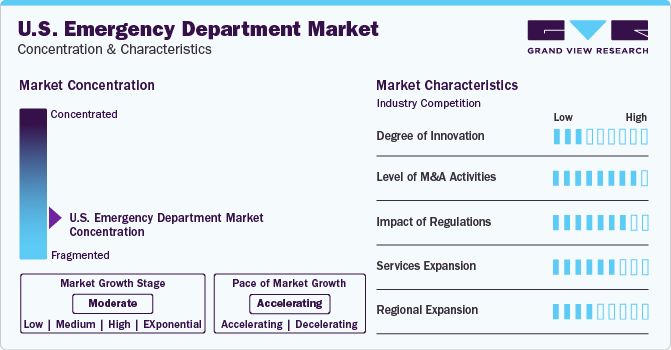

Market Concentration & Characteristics

The degree of innovation in the market is expected to increase gradually with the increasing adoption of digitization. An increasing number of hospitals are adopting technologically advanced tools, such as Artificial Intelligence (AI), for improved diagnosis and to expedite routine procedures, such as devising treatment plans & prescriptions. For instance, in January 2022, Novant Health and Aidoc partnered to use AI for faster treatment of patients in the emergency department. The collaboration drives leverage to Aidoc's enterprise-grade AI solutions for medical imaging to improve patient outcomes and enhance the efficiency of emergency medical services across Novant Health's 15 medical centers across three states.

Market players such as Natchitoches Regional Medical Center (NRMC), Lifepoint Health, Inc. HCA Management Services, L.P., TH Medical (Tenet Healthcare Corporation) are engaged in merger and acquisition activities. For instance, in January 2023, Beckman Coulter Diagnostics acquired StoCastic, LLC, a prominent AI corporation that provides decision support for hospital emergency departments. StoCastic's TriageGo will be integrated into Beckman Coulter's AI-supported Clinical Decision Support portfolio, enhancing patient care through data-driven insights.

Impact of regulations is high, the Emergency Medical Treatment and Labor Act (EMTALA) of 1986 recognizes EDs as an essential part of the social safety net that provides emergency medical care to all patients, regardless of their demographic characteristics or financial ability to pay. Medicare-participating hospitals that offer emergency services are required under Section 1867 of the Social Security Act to provide a Medical Screening Examination (MSE) upon request for treatment or examination for an Emergency Medical Condition (EMC), including active labor, regardless of the patient's ability to pay.

Market players leverage the strategy of facility expansion to increase their capabilities and promote the reach of their service offerings. For instance, in July 2023, The UAB Hospital University Emergency Department is expanding its capacity to deal with unmet demand for emergency medical services in Alabama and Birmingham. The expansion plan includes temporary waiting room space and 59 new exam rooms with additional imaging facilities for emergency clinical care.

Regional expansion is a significant factor in the market, driven by new government programs and initiatives. These expansions have the potential to deliver invaluable healthcare and economic benefits, transforming regions for future generations. For instance, in November 2022, Lakeland Regional Health established a standalone emergency department in South Lakeland, which would be situated at the junction of South Florida Avenue and C.R. 540A.

Type Insights

Hospital emergency department segment dominated the market in 2023 with a revenue share of 94.15% and is anticipated to witness the fastest growth rate during the forecast period. The growth of the segment can be attributed to the increasing number of hospitals adopting technologically advanced tools, such as Artificial Intelligence (AI), for improved diagnosis and expedited routine procedures, such as devising treatment plans & prescriptions.

The substantial increase in visits to hospital EDs and widespread availability of insurance are expected to be the primary segment drivers over the coming years. Medicaid and Medicare provide insurance for emergency health services. According to the CDC, in 2019, over 40% of ED visits by adults aged over 65 years were by ambulance, which is covered under Medicare Part B. In addition, part B Medicare covers air ambulance trips by airplane or helicopter if necessary. Part A Medicare contributes to the expenses when a patient enters the emergency room and is subsequently admitted as an inpatient. In contrast, Part B Medicare covers the costs associated with receiving care from a doctor when admission as an inpatient is not required.

The Freestanding Emergency Department (FSED) segment is highly influenced by the overcrowding of EDs at hospitals, the increasing number of patients opting for direct treatment options, and advanced healthcare infrastructure in the country. Moreover, increasing number of injuries due to accidents and the rising incidence of chest pain, epilepsy, stroke, and other diseases requiring immediate attention are expected to drive the need for freestanding emergency departments in the country.

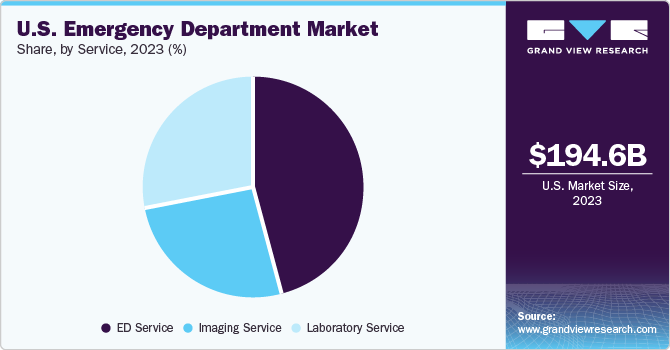

Service Insights

The emergency department services segment accounted for the largest revenue share in 2023, owing to a wide variety of services being provided for immediate care. Common medical services include treatment for stomach & abdominal pain, fever, headache, cough, back symptoms, shortness of breath, unspecified pain, throat symptoms, & vomiting. The growth of the segment can be attributed to increasing utilization of data-driven technologies, rising patient footfall in EDs, and growing adoption of Emergency Department Information Systems (EDIS).

Furthermore, the imaging services segment is expected to witness the fastest growth rate during the forecast period. The segment is experiencing growth due to increased awareness of medical screening to assess the urgency of medical conditions, the prevalence of chronic yet manageable diseases, and the availability of ample economic resources. The majority of EDs offer basic imaging services, such as X-ray, ultrasound, and CT. FSEDs are either large facilities serving as many as 100 patients per day or small facilities serving 20 or fewer patients per day. Larger FSEDs can also offer MRI and primary care.

Furthermore, technological advancements and new product launches by companies are expected to drive the segment during the forecast period. For instance, in October 2023, Philips introduced its Point-of-care Ultrasound (POCUS) innovations at the 2023 American College of Emergency Physicians Scientific Assembly in Philadelphia, U.S. POCUS technology provides physicians with immediate insight into a patient's condition, expediting care and providing bedside treatment in various emergency care settings.

Condition Insights

Infectious segment held the largest market share in 2023 and is expected to register the fastest growth over the coming years. Service providers are undertaking measures to maintain preparedness for treating infectious diseases, which is propelling segment growth medical conditions, such as influenza, pneumonia, Sexually Transmitted Infections (STIs), viral hepatitis, and measles, require emergency medical care.

According to CDC, in National Hospital Ambulatory Medical Care Survey 2021, around 3.8 million people visited EDs with parasitic and infectious diseases as primary diagnosis. In addition, as per the same source, in 1st week of January 2024, Seasonal influenza activity has increased and may continue to increase in most parts of the country. This can lead to an increase in outpatient visits for respiratory illness by 6.9%.

Additionally, psychiatric, gastrointestinal, and cardiac conditions segments are expected to grow at a moderate rate during the forecast period. According to the National Hospital Ambulatory Medical Care Survey, in 2021, 5.4 million ED visits occurred due to circulatory system diseases. Atrial fibrillation is one of the most common causes of ED visits, which is increasing annually despite a reduction in hospitalization rates for atrial fibrillation. The U.S.'s increasing incidences of digestive and cardiac diseases are expected to lead both segments' growth.

Key U.S. Emergency Department Company Insights

The market is highly fragmented, with the presence of multiple major players. Key players are adopting growth strategies to enhance their market presence, including collaborations and mergers & acquisitions. Hospitals face the challenge of ED overcrowding and use strategies such as expanding EDs and partnering with emergency service management providers. The market is highly competitive, and hospitals aim to improve patient experience by obtaining accreditations and certifications to increase their credibility among patients.

Key U.S. Emergency Department Companies:

The following are the leading companies in the U.S. emergency department market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these U.S. emergency department companies are analyzed to map the supply network.

- Hospital Emergency Departments:

- Parkland Health

- Lakeland Regional Health

- St. Joseph’s Health

- Natchitoches Regional Medical Center

- Schoolcraft Memorial Hospital

- Clarion Hospital

- USA Health

- Baptist Health South Florida

- Montefiore Medical Center

- LAC+USC Medical Center

- Freestanding Emergency Departments:

- Tenet Healthcare Corporation

- Universal Health Services, Inc.

- Community Health System

- HCA Management Services, L.P.

- Legacy Lifepoint Health, Inc.

- Ardent Health Services

- Ascension Health

- Deerfield Management Company

- Emerus

- USA Health

Recent Developments

-

In May 2023, Alaska Regional Hospital plans to build a freestanding emergency department in South Anchorage for USD 18 million. The facility comprises 12 emergency rooms, X-ray machines, a CT scanner, ultrasound machine, and 5 cardiac monitoring stations.

-

In August 2022, Virginia Mason Franciscan Health (VMFH) is building a hybrid ER/urgent care center in Washington state, with plans to create more such facilities in the Puget Sound region over the next four years. These centers will adopt Intuitive Health's innovative care methodology, integrating emergent and urgent care services under one roof

U.S. Emergency Department Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 204.95 billion

Revenue forecast in 2030

USD 287.37 billion

Growth rate

CAGR of 5.80% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, service, condition

Country scope

U.S.

Key companies profiled

Parkland Health; Lakeland Regional Health; St. Joseph’s Health; Natchitoches Regional Medical Center; Schoolcraft Memorial Hospital; Clarion Hospital; USA Health; Baptist Health South Florida; Montefiore Medical Center; LAC+USC Medical Center; Tenet Healthcare Corporation; Universal Health Services, Inc.; Community Health System; HCA Management Services, L.P.; Legacy Lifepoint Health, Inc.; Ardent Health Services; Ascension Health; Deerfield Management Company; Emerus;

USA Health

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Emergency Department Market Report Segmentation

This report forecasts revenue growth, country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. emergency department market report based on type, service, and condition:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospital Emergency Department

-

Freestanding Emergency Department

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Emergency Department (ED) Service

-

Imaging Service

-

Laboratory Service

-

-

Condition Outlook (Revenue, USD Billion, 2018 - 2030)

-

Traumatic

-

Infectious

-

Gastrointestinal

-

Psychiatric

-

Neurologic

-

Cardiac

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. emergency department market size was estimated at USD 194.60 billion in 2023 and is expected to reach USD 204.95 billion in 2024.

b. The U.S. emergency department market is expected to grow at a compound annual growth rate of 5.80% from 2024 to 2030 to reach USD 287.37 billion by 2030.

b. Hospital emergency department segment dominated market in 2023 with market share of 94.15% and is anticipated to witness fastest growth rate during forecast period. The growth of the segment can be attributed to increasing number of hospitals adopting technologically advanced tools, such as Artificial Intelligence (AI), for improved diagnosis and expedited routine procedures, such as devising treatment plans & prescriptions.

b. Some key players operating in the U.S. emergency department market include Parkland Health; Lakeland Regional Health; St. Joseph’s Health; Natchitoches Regional Medical Center; Schoolcraft Memorial Hospital; Clarion Hospital; USA Health; Baptist Health South Florida; Montefiore Medical Center; LAC+USC Medical Center; Tenet Healthcare Corporation.

b. Key factors that are driving the U.S. emergency department market growth include increasing visits to hospital Emergency Departments (EDs) and growing availability of insurance. Furthermore, rising prevalence of diseases, heart failure, and accidental injuries is expected to propel market growth over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."