- Home

- »

- Healthcare IT

- »

-

U.S. Emergency Medical Services Billing Software Market, Report, 2030GVR Report cover

![U.S. Emergency Medical Services Billing Software Market Size, Share & Trends Report]()

U.S. Emergency Medical Services Billing Software Market Size, Share & Trends Analysis Report By Component (In-house, Outsourced), By Type (Land Ambulance Services, Air Ambulance Services), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-138-2

- Number of Report Pages: 140

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

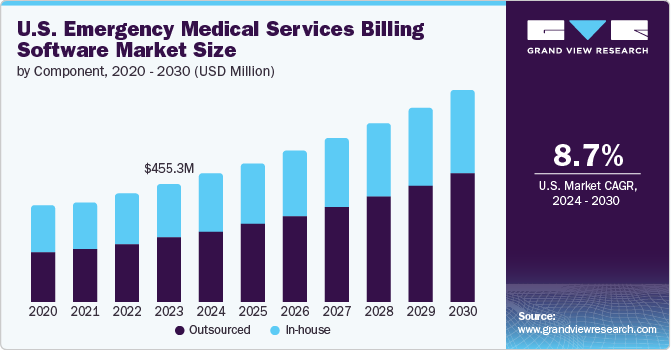

The U.S. emergency medical services billing software market size was valued at USD 455.26 million in 2023 and is anticipated to witness a CAGR of 8.72% from 2024 to 2030. The increasing demand for efficient billing processes in the healthcare sector, government initiatives to digitalize healthcare operations, and the rising number of ambulance service providers are some of the major factors expected to facilitate market growth over the forecast period.

The healthcare industry in the U.S. is currently undergoing significant changes due to technological advancements and digitization. This has led to the sector becoming more data-intensive, resulting in the adoption of innovative solutions to advance healthcare development. The increasing demand for software solutions is being driven by higher healthcare spending and government initiatives aimed at efficiently maintaining digital health records. The U.S. government has actively promoted the efficient functioning of digital health records, particularly in integrating EMS billing software. This initiative aims to reduce billing errors and improve the accuracy of medical billing, thereby enhancing overall healthcare delivery. As healthcare becomes more data-intensive, the need for innovative software solutions has grown, propelled by government policies encouraging digitization in the healthcare sector.

Furthermore, the demand for cloud-based EMS billing software is increasing as software users seek flexible, easy-to-use solutions that can be accessed remotely from any location at any moment. Many vendors, including Zoll Data Systems, AngleTrack LLC, MP Cloud Technologies, ESO, and Digitech, are offering cloud deployment options for their EMS billing software products to meet this growing need. Cloud-based solutions are becoming popular due to their affordability, scalability, flexibility, and ease of use. They are particularly attractive to small and medium-sized organizations looking to optimize their billing payment processes. This shift to cloud-based EMS billing software is driven by the desire to leverage the benefits of affordability, scalability, flexibility, and ease of use., which is expected to drive the market's growth.

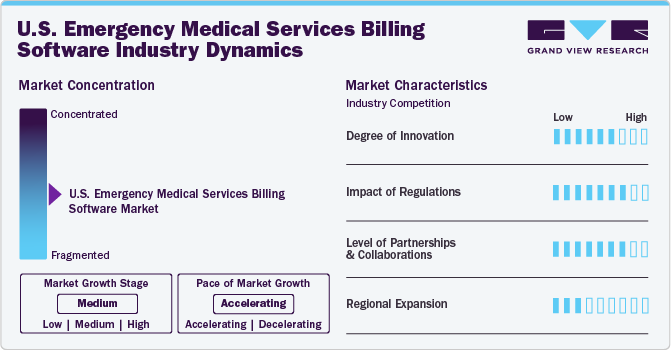

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, market characteristics, and market participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including industry competition, degree of innovation, level of M&A activities, impact of regulations, product expansion and geographic expansion. For instance, the market is highly competitive, with the presence of many small to mid-sized companies in the market. The degree of innovation is high, and the level of M&A activities is also high. The impact of regulations on the market is medium, and the geographic expansion of the market is low.

Technology-driven solutions are improving the efficiency and accuracy of EMS billing records. Modern EMS billing software incorporates automation to streamline processes such as claims submission and tracking. This reduces manual errors and administrative burdens, enhancing operational efficiency. Furthermore, the ability to integrate with electronic health records (EHRs) and other healthcare systems is crucial for accurate billing and compliance.

The impact of regulations on the use of EMS billing software in the U.S. is significant, influencing both operational efficiency and compliance within the healthcare sector. Key regulations include the Health Insurance Portability and Accountability Act (HIPAA), Medicare and Medicaid guidelines, and the No Surprises Act, among others. No Surprises Act: regulation, effective from January 2022, aims to protect patients from unexpected out-of-network charges. EMS billing software must be capable of providing transparent cost estimates and obtaining patient consent for out-of-network services, which enhances compliance and patient trust. These regulations shape the development and functionality of EMS billing software, which is designed to streamline billing processes while ensuring adherence to legal requirements.

EMS billing software partnerships highlight significant advancements aimed at enhancing revenue cycles for emergency medical services (EMS) organizations in the U.S. For instance, in January 2024, eServices Payment Technology partnered with AIM EMS Software & Services. This partnership aims to integrate their respective strengths to streamline revenue cycles for EMS organizations. This partnership is expected to enhance the efficiency and effectiveness of billing processes for their mutual clients, ultimately improving patient service and operational performance.

Major players in the EMS billing software market are engaging in strategic partnerships and product developments to enhance their service offerings and expand their geographical reach. Companies like MP Cloud Technologies/MTech are actively expanding their geographical presence. For instance, in November 2021, MP Cloud Technologies/EMTech announced plans to open a division in Spartanburg County, Columbia, to better serve EMS providers across the U.S. Such strategic moves are indicative of the competitive landscape and the ongoing efforts to enhance service delivery.

Component Insights

On the basis of components, the outsourced segment dominated the market, accounting for the largest share of 54.8% in 2023 and is expected to witness the fastest growth over the forecast period. This segment growth is attributed to the cost-effectiveness of outsourcing compared to developing in-house solutions. Outsourced services allow EMS agencies to focus on patient care while leveraging advanced billing technologies.

Furthermore, the availability of integrated and advanced billing software has made the billing process more efficient for service providers. Furthermore, the presence of upcoming software developers allows the EMS providers to select EMS billing software that best suits its requirements. Hence, the outsourced segment is anticipated to witness significant over the forecast period.

The in-house billing segment is expected to gain traction as healthcare providers seek greater authority and effectiveness in managing their financial operations. This shift allows organizations to streamline their billing processes and maintain oversight, which can lead to improved efficiency and reduced operational costs. In addition, recent strategic partnerships and mergers are also shaping the landscape of EMS billing software. For instance, in April 2024, ESO acquired Logis Solutions, a global provider of logistics and billing software serving emergency medical services (EMS), computer-aided dispatch (CAD), emergency communications, fire departments, and hospitals. ESO and Logis are collaborating to integrate data and workflows from dispatch, call taking, and billing across the emergency response continuum.

Type Insights

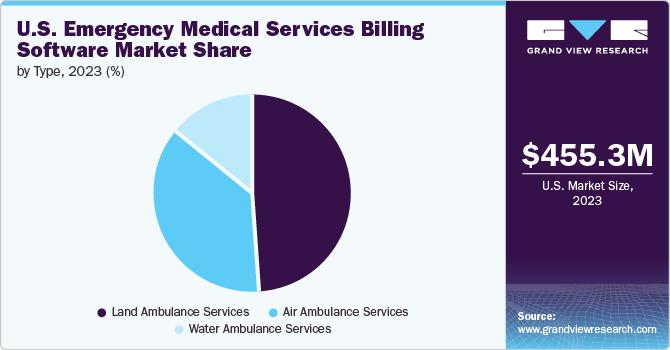

On the basis of type, the land ambulance services segment dominated the market in 2023 and is expected to retain its position during the forecast period. Many ambulance services are transitioning to cloud-based EMS billing software that offers real-time data access, automated workflows, and seamless integration with electronic patient care reporting (ePCR) systems. This allows for faster claim submission, improved cash flow, and reduced administrative overhead.

Private ambulance services agencies such as American Medical Response which has a presence across the nation with more than 8,000 land ambulances and 123 fixed-wing aircraft are gaining a monopoly in the market.However, these agencies face challenges in managing the billing process and recovering the claims from privately insured or Medicaid patients. Billing software specially developed for EMS providers and billing companies is significantly improving the collection leading to an increase in revenue for the providers.

The air ambulance segment is expected to witness substantial growth over the forecast period. The use of air ambulances for transporting patients with health issues is on the rise. The growing number of accidents and health emergencies like heart attacks and strokes is driving the demand for air ambulance services. Partnerships between governments and helicopter emergency medical services (HEMS) providers are also contributing to the market's growth.

Key U.S. Emergency Medical Services Billing Software Company Insights

The market for emergency medical services (EMS) billing software is highly competitive, with small to mid-sized companies competing with global players for market share. As the healthcare industry becomes more advanced and digitalized, the demand for this software is on the rise. This presents a great opportunity for companies to establish their presence in the market and secure a significant share. The emerging players in the market includes AngelTrack LLC, MP Cloud Technologies, and ImageTrend.

Key U.S. Emergency Medical Services Billing Software Companies:

- MEDAPOINT (MP CLOUD TECHNOLOGIES)

- eso

- Ambubill - Ambulance Billing Service.

- AIM EMS SOFTWARE & SERVICES

- ImagineSoftware, Technology Partners, LLC

- Change Healthcare

- Isalus Healthcare

- Lexipol (EMS1)

- iTech Workshop Pvt Ltd

- Kareo, Inc.

- AdvancedMD, Inc.

- Digitech Computer LLC

- Intermedix (R1 RCM)

- Wittman Enterprises, LLC

- Traumasoft

- ZOLL Medical Corporation

Recent Developments

-

In October 2022, Optum completed a merger with Change Healthcare, aiming to enhance clinical, administrative, and payment processes across healthcare systems. This merger is expected to improve service delivery for EMS billing and other healthcare services.

-

In May 2018, R1 Technologies Inc., a leading provider of technology-enabled RCM services for healthcare providers, has acquired Intermedix Corporation.The merger of R1 and Intermedix will enhance R1’s integrated revenue cycle capabilities across various care settings

U.S. Emergency Medical Services Billing Software Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 814.8 billion

Growth Rate

CAGR of 8.72% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component and type

Key companies profiled

MEDAPOINT (MP CLOUD TECHNOLOGIES), eso, Ambubill - Ambulance Billing Service., AIM EMS SOFTWARE & SERVICES, ImagineSoftware, Technology Partners, LLC, Change Healthcare, Isalus Healthcare, Lexipol (EMS1), iTech Workshop Pvt Ltd, Kareo, Inc., AdvancedMD, Inc., Digitech Computer LLC, Intermedix (R1 RCM), Wittman Enterprises, LLC, Traumasoft, and ZOLL Medical Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Emergency Medical Services Billing Software Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. emergency medical services billing software market report on the basis of component and type:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

In-house

-

Outsourced

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Land Ambulance Services

-

Air Ambulance Services

-

Water Ambulance Services

-

Frequently Asked Questions About This Report

b. The U.S. emergency medical services (EMS) billing software market size was estimated at USD 455.26 million in 2023 and is expected to reach USD 493.20 million in 2024.

b. The U.S. emergency medical services (EMS) billing software market is expected to grow at a compound annual growth rate of 8.72% from 2024 to 2030 to reach USD 814.8 million by 2030.

b. Outsourced dominated the U.S. emergency medical services (EMS) billing software market with a share of 54.8% in 2023. This is attributable to the availability of integrated and advanced billing software making the billing process more efficient for the service providers

b. Some key players operating in the U.S. emergency medical services (EMS) billing software market include MEDAPOINT (MP CLOUD TECHNOLOGIES), eso, Ambubill - Ambulance Billing Service., AIM EMS SOFTWARE & SERVICES, ImagineSoftware, Technology Partners, LLC, Change Healthcare, Isalus Healthcare, Lexipol (EMS1), iTech Workshop Pvt Ltd, Kareo, Inc., AdvancedMD, Inc., Digitech Computer LLC, Intermedix (R1 RCM), Wittman Enterprises, LLC, Traumasoft, and ZOLL Medical Corporation

b. Key factors that are driving the market growth include Improving the collection rate of unpaid bills and a reduction in claim processing time leading to increased revenue for emergency medical services (EMS) providers resulting in high demand for EMS billing software among billing companies and EMS providers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."