- Home

- »

- Nutraceuticals & Functional Foods

- »

-

U.S. Energy Gels Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. Energy Gels Market Size, Share & Trends Report]()

U.S. Energy Gels Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Carbohydrate, Isotonic/Electrolyte, Caffeinated), By Flavor, By Application, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-830-9

- Number of Report Pages: 60

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Energy Gels Market Summary

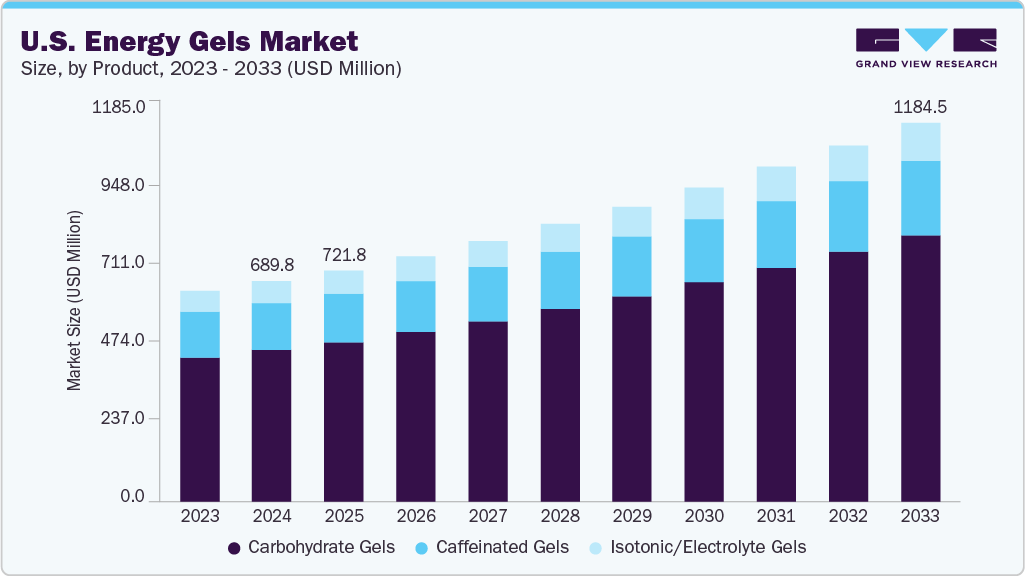

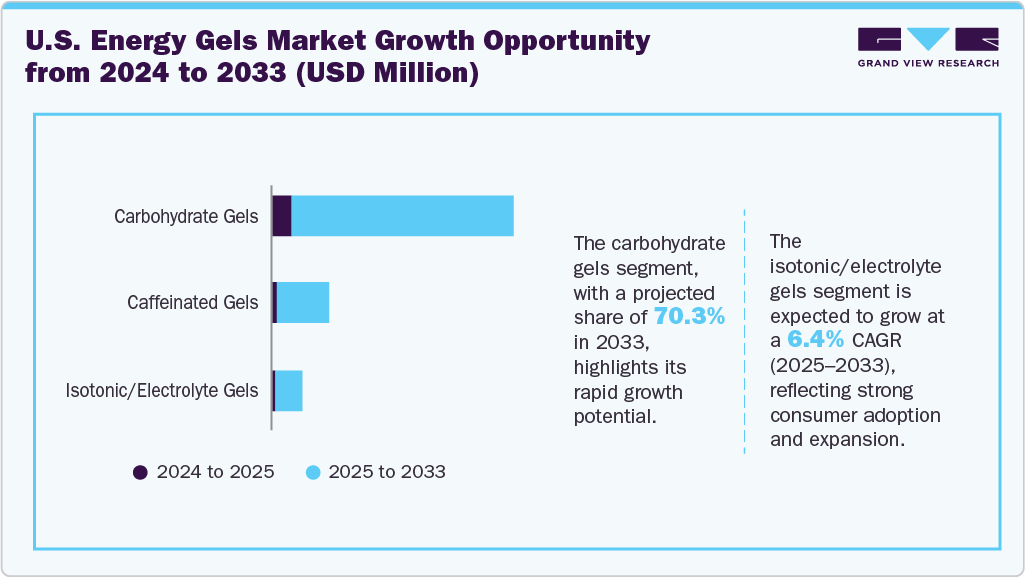

The U.S. energy gels market size was valued at USD 689.8 million in 2024 and is projected to reach USD 1,184.5 million by 2033, growing at a CAGR of 6.4% from 2025 to 2033. The growth of the market can be attributed to the rising involvement in endurance sports and a growing focus on structured nutrition.

Key Market Trends & Insights

- By product, the carbohydrate gels segment held the largest market share of 68.7% in 2024.

- The isotonic/electrolyte gels segment is expected to grow at a CAGR of 6.4% from 2025 to 2033.

- By flavor, the flavored segment held the largest market share of 83.4% in 2024.

- By application, the endurance sports and activities segment dominated the market with a revenue share of 86.4% in 2024.

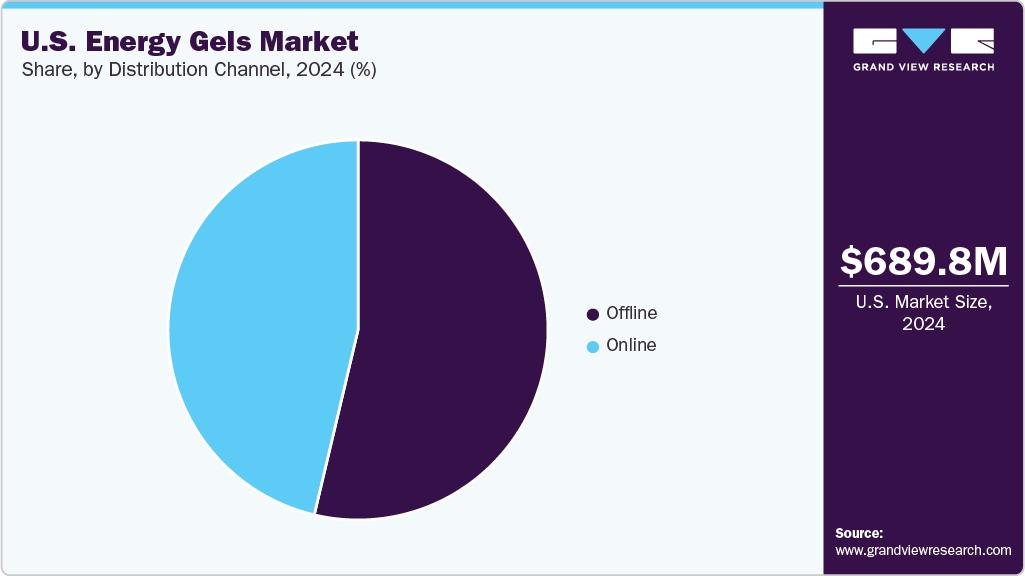

- By distribution channel, the offline segment dominated the U.S. energy gels market with a revenue share of 53.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 689.8 Million

- 2033 Projected Market Size: USD 1,184.5 Million

- CAGR (2025-2033): 6.4%

More people are becoming aware of the benefits of energy gels and the availability of these products is rising. In addition, the continuous training routines of runners, cyclists, and triathletes are further driving demand for various energy gel options.The U.S. hosts several endurance events such as marathons, gravel races, and triathlons, which play an important role in consumer preferences, mainly for energy gels. These events provide the brands, such as GU Energy Labs, Huma Gel, and Styrkr, with an opportunity to present their products to the endurance sports participants, through partnerships or by setting booths at expos. This direct interaction allows consumers to try products firsthand. This builds trust as well as familiarity mostly among the amateur participants. As the number of such events is increasing, more athletes are getting exposed to energy gels. This is further driving the U.S. energy gels market growth during the forecast period.

The U.S. energy gels market is driven by a mature sports nutrition culture emphasizing on the convenience, performance, and brand credibility. Consumers prefer products that offer fast energy, clean ingredients, also better digestibility during long efforts. Retail visibility through physical stores and online channels keeps the demand steady. At the same time, continuous product improvements make sure that energy gels remain a core fueling choice for all athletes.

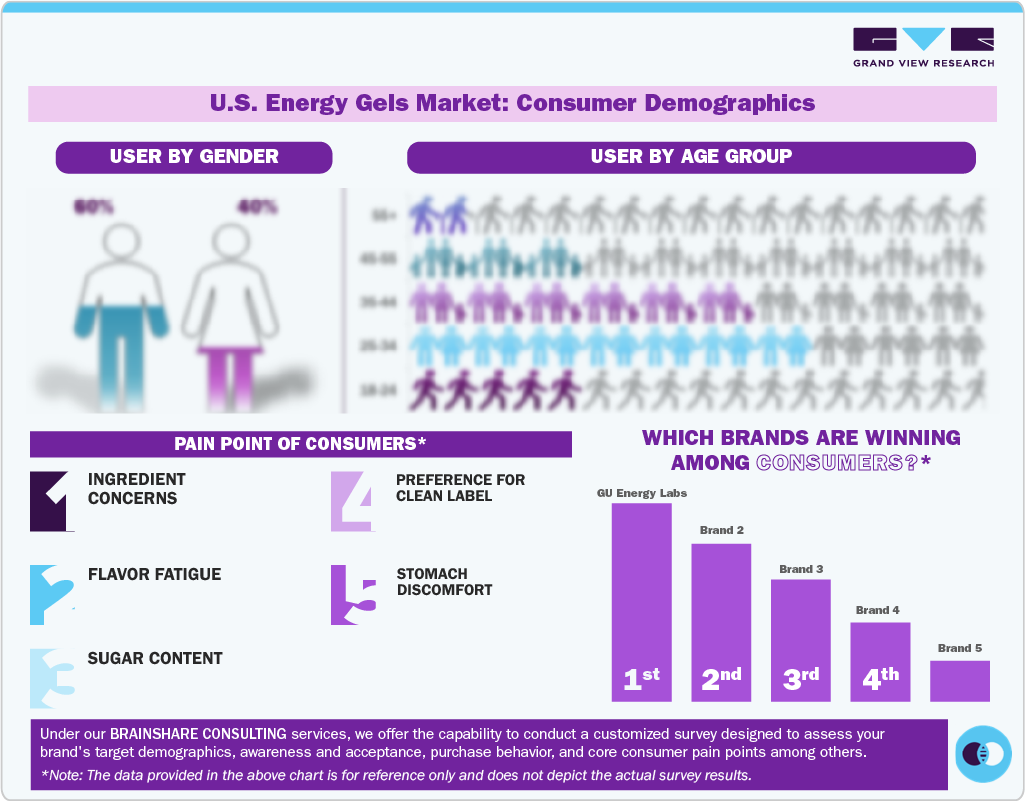

Consumer Insights

Consumers in the U.S. energy gels market are more selective when it comes to choosing products that provide quick energy without any digestive discomfort. They look for products with clean labels, balanced nutrition, low sugar levels, and easy to consume. Convenience is an important factor as consumers want energy gels that are easy to carry and consume while moving or running. At the same time, brand reputation and visibility play an important role in influencing the purchasing decisions of buyers.

Consumer Demographics

Consumer demographics in the U.S. have a larger proportion of males consuming energy gels than females, because they are more active in sports and endurance activities. However, it is observed that female participation is on the rise as they are getting involved in fitness activities and sports. Most of the consumers are young and middle-aged athletes who are regularly involved in such activities. On the other hand, percentage of old aged people consuming energy gels has been lower typically because they are not engaged in endurance activities.

Product Insights

The carbohydrate gels segment held the largest market revenue share of 68.7% in 2024 and is expected to grow at the fastest CAGR over the forecast period.The segment is driven by its ability to provide quick energy for endurance athletes. The runners, cyclists, triathletes choose carbohydrate gels to prevent fatigue and improve performance. It proves the point with a real U.S. event. In November 2025, a study was published in the International Journal of Disabilities, Sport & Health Science. This study found that caffeine-based and carbohydrate energy gels resulted in higher blood glucose levels and improved time trial performance compared to sessions where no gels were consumed. Furthermore, in the U.S., the popularity of these energy gels is supported by the strong visibility in the retail stores.

The isotonic/electrolyte gels segment is projected to grow over the forecast period, due to its dual ability to provide quick energy as well as replenish electrolytes without the need for additional water. This is an advantage for the athletes who do not want to carry heavy fluids or risk stomach discomfort during their activities. In June 2025, Science in Sport launched the world's first isotonic energy gel, which provides a quick supply of energy, has a clean taste, is easily digestible, and can be absorbed without additional water. Isotonic gels deliver energy efficiently while being gentle on the gut, isotonic/electrolyte gels are increasingly popular in long training sessions and high-sweat endurance efforts.

Flavor Insights

The flavored segment held the largest market revenue share of 83.4% in 2024. The growth of the segment can be attributed to a variety of tastes in energy gels that help athletes stick to their nutrition plans during extended workouts. Consumers often prefer refreshing flavors that can be repeated during workouts or races. The segment offers a wide range of flavors, including coffee, berry, tropical fruits, desert-inspired flavors, and others. This allows consumers to try new flavors and avoid taste fatigue. Therefore, flavored energy gels remain highly attractive to athletes, making sure they continue to lead the market as the most consumed format.

The unflavored segment is expected to grow at the fastest CAGR over the forecast period,driven by the athletes who prefer minimal or no flavors, especially those who are sensitive to sweetness and artificial additives. In the U.S., unflavored energy gels are increasingly used as consumers seek natural and simple formats with clean labels that fit easily into their endurance routines. Companies such as the UCAN company and Neversecond Nutrition Inc. are addressing these demands by offering energy gels that are neutral or low in sweetness. These energy gels can be taken without water, provide consistent energy, and are easier on the stomach. As more athletes are preparing for the training sessions and endurance events, the demand for these unflavored gels continues to grow.

Application Insights

The endurance sports and activities segment dominated the market with a revenue share of 86.4% in 2024, as it is the core application for energy gels. This growth is driven by the need for quick and sustained energy during long-distance performance. Athletes in the country depend on these gels to improve performance and maintain their energy levels. The robust growth in the number of endurance events is clear from organizers such as the Endurance Race Series (ERS), which has been hosting a trail series in San Diego, California, since 2014. With a total of 10 events, it hosts around 4000 runners each year. This increasing participation underscores a thriving market for energy gels and performance nutrition products.

The military and defense segment is expected to grow at the fastest CAGR over the forecast period. The segment experiences rapid growth driven by the service members' need for easy-to-carry energy sources during training and tough tasks. Energy gels are a great option as they provide lightweight carbohydrates without needing preparation or water. This ability of energy gels makes them useful for soldiers in unpredictable environments. In the U.S., there is a rising interest for energy gels as military units seek easy nutrition options for activities such as marches, drills, and training sessions. With a high focus on performance and convenience, energy gels are growing rapidly in the U.S. market.

Distribution Channel Insights

The offline segment accounted for the largest revenue share of 53.7% in 2024, as athletes prefer buying energy gels from specialized retailers such as running stores, outdoor outlets, and sports nutrition shops. These locations allow customers to compare different products and receive knowledgeable advice. These retailers have a stock of products from various brands, and also have sample products where consumers can make confident choices. The visibility of these products is also supported by the presence at race expos, training events, and local sports communities.

The online segment is projected to grow at the fastest CAGR over the forecast period, driven by the consumers who prefer home delivery, subscriptions, and access to a wide range of products online. E-commerce platforms make it easier to compare ingredients, discover new formulations for specific needs, and read reviews to make better purchases. Many athletes also buy energy gels in bulk online for their regular training sessions, with the added benefit of discounts. Rising digital engagement and strong promotional activities further drive the market growth.

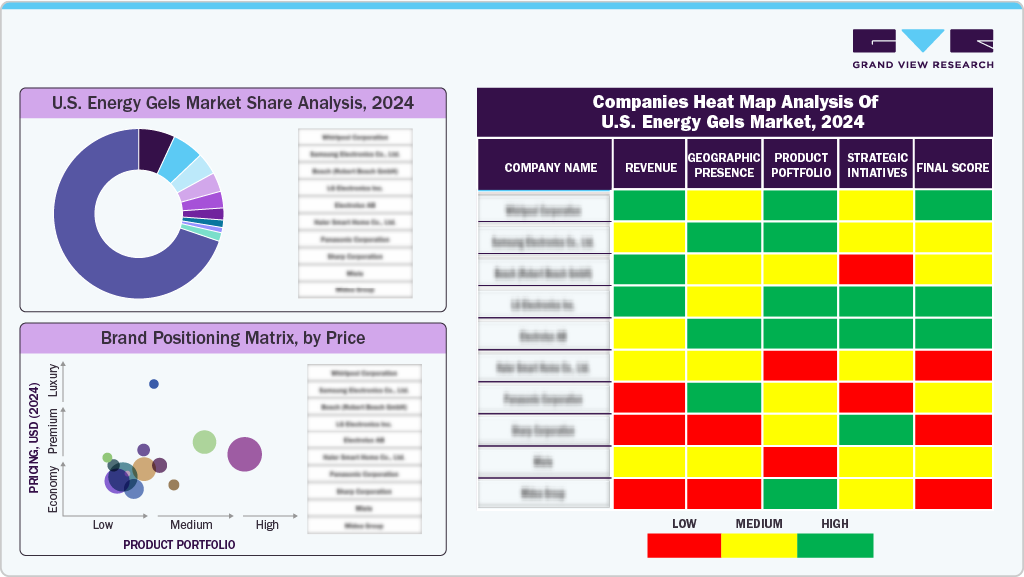

Key U.S. Energy Gels Company Insights

Some key players in the U.S. energy gels market include GU Energy Labs, Huma Gel, Styrkr, and others. Major players embrace strategies such as innovation, new product development, distribution, and partnerships to address changing consumer preferences and growing demand for extensive product portfolios by diverse consumer groups.

-

GU Energy Labs was established in 1993, and it offers nutrition solutions to support performance and enhance endurance. The company's products include energy gels, chews, waffles, capsules, and hydration drink mix & tabs.

-

Huma Gel was established in 2012 by Ian and Kevin, who were tired of awful energy gels. The company provides great-tasting and 100% natural energy gels and protein smoothies designed to act as a healthy glycogen supplement for endurance activities.

Key U.S. Energy Gels Companies:

- GU Energy Labs

- Huma Gel

- Neversecond Nutrition Inc.

- The UCAN Company

- Boom Nutrition Inc.

- Hammer Nutrition

- Science In Sport

- Bare Performance Nutrition, LLC

- Styrkr

- Carbs Fuel

- High Five by Associated British Foods PLC

- PepsiCo Inc.

- Honey Stinger

- BOKA Energy Products

Recent Developments

-

In February 2025, BOKA Energy distributed its “real fruit energy gels” to the runners at the 2025 Miami Marathon. These energy gels, made with natural ingredients and organic glucose, were provided as a clean and sustained energy option that’s gentle on the stomach, especially useful in Miami’s hot and humid conditions.

-

In November 2022, GU Energy Labs became the official Energy Gel partner for The McCourt Foundation's premier running events, including the Los Angeles Marathon. GU Energy Labs will supply its popular and easy-to-use energy gels to runners at aid stations, helping to fuel their performance during TMF events until 2025.

U.S. Energy Gels Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 721.8 million

Revenue forecast in 2033

USD 1,184.5 million

Growth rate

CAGR of 6.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, flavor, application, distribution channel

Country scope

U.S.

Key company profiled

GU Energy Labs; Huma Gel; Neversecond Nutrition Inc.; The UCAN Company; Boom Nutrition, Inc.; Hammer Nutrition; Science In Sport; Bare Performance Nutrition, LLC; Styrkr; Carbs Fuel; High Five by Associated British Foods PLC; PepsiCo, Inc.; Honey Stringer; BOKA Energy Products

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

The U.S. Energy Gels Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the U.S. energy gels market report on the basis of product, flavor, application, and distribution channel.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Carbohydrate Gels

-

Isotonic/Electrolyte Gels

-

Caffeinated Gels

-

-

Flavor Outlook (Revenue, USD Million, 2021 - 2033)

-

Flavored

-

Citrus & Tangy Flavors

-

Berry & Tropical Fruit Flavors

-

Coffee Flavors

-

Dessert-Inspired (Vanilla, Chocolate, Salted Caramel Flavors, etc.)

-

Others (Neutral/Classic Flavors, etc.)

-

-

Unflavored

-

- Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Endurance Sports and Activities

-

Military and Defense

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Online

-

Company-Owned Websites

-

Third-Party Aggregators

-

-

Offline

-

Hypermarket/Supermarket

-

Sports & Fitness Stores

-

Others (Retail Pharmacy Stores, etc.)

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.