- Home

- »

- Pharmaceuticals

- »

-

U.S. Enteral Feeding Formulas Market Size Report, 2030GVR Report cover

![U.S. Enteral Feeding Formulas Market Size, Share & Trends Report]()

U.S. Enteral Feeding Formulas Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Flow Type, By Stage (Adults, Pediatrics), By Indication (Cancer Care, Diabetes), By End use (Hospitals, Home Care), By Sales Channel, And Segment Forecasts

- Report ID: GVR-4-68040-613-4

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

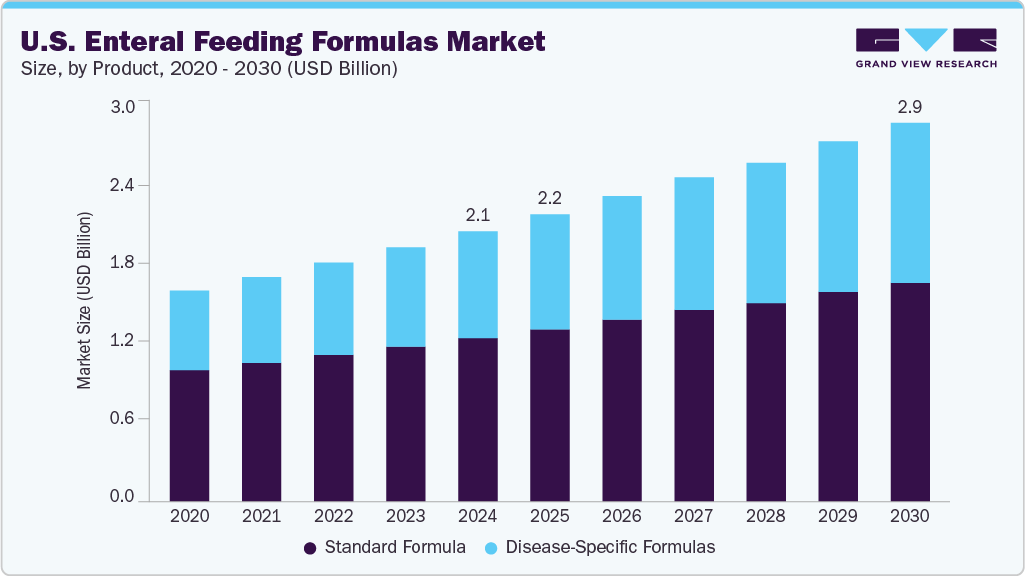

The U.S. enteral feeding formulas market size was estimated at USD 2.06 billion in 2024 and is projected to grow at a CAGR of 5.7% from 2025 to 2030. The increasing prevalence of chronic diseases, including cancer, stroke, multiple sclerosis, dementia, chronic liver disease, chronic obstructive pulmonary disease (COPD), and diabetes, is anticipated to increase the demand for products addressing oral intake challenges. The Centers for Disease Control and Prevention (CDC) reports published in May 2024 states that approximately 38.4 million people in U.S. have diabetes, which is around 11.96% of the overall population.

The growing prevalence of Alzheimer’s disease is boosting demand for enteral feeding formulas, as patients in advanced stages often face difficulty in swallowing and require nutritional support. According to the CDC, around 6.9 million people in the U.S. are living with Alzheimer’s disease. Furthermore, in 2022, it was the 7th leading cause of death among U.S. adults and the 6th leading cause of death among adults 65 years or older. The rising aging population in the U.S. is another key factor driving the demand for enteral feeding formulas. As individuals age, they often experience physiological changes such as reduced appetite, swallowing difficulties (dysphagia), and decreased digestive efficiency, leading to malnutrition if not properly managed. Enteral feeding provides a practical solution to ensure adequate nutrient intake among elderly individuals, particularly those residing in assisted living or long-term care facilities.

Increased awareness among caregivers and healthcare providers regarding the importance of early nutritional intervention in geriatric care is further fueling the adoption of enteral nutrition products.

Rise in preterm births is one of the significant factors boosting the demand for sip feeds to meet the nutritional requirements of newborns. According to the CDC in 2022, preterm birth affected about 1 of every 10 infants born in the U.S. In addition, the continued rise in nutritional and other deficiencies, including severe deficiency of micronutrients, proteins, and other nutrients, especially in infants and pregnant women, is leading to an increase in the demand for enteral feeding formulas.

Regulatory Framework

Supportive regulatory frameworks played a critical role in driving the growth of the U.S. enteral feeding formulas market. The U.S. Food and Drug Administration (FDA) classifies clinical nutrition products, including enteral feeding formulas, under medical foods as defined by the Orphan Drug Act Amendments of 1988. These products are intended for the dietary management of diseases or conditions that require specific nutritional support under medical supervision. Unlike conventional foods or dietary supplements, medical foods do not require premarket approval by the FDA but must comply with specific labeling, manufacturing, and quality standards as outlined in the FDA’s Medical Food Guidance Documents.

Many enteral products, especially those used in hospital settings or dispensed through home healthcare, are often subject to oversight under the FDA’s Center for Food Safety and Applied Nutrition (CFSAN). These regulatory distinctions ensure product safety, efficacy, and proper usage while facilitating quicker market entry and innovation, encouraging manufacturers to develop targeted nutritional solutions for complex medical conditions. For instance, in September 2023, EnteraLoc Flow direct-connect feeding solution received approval from FDA for enteral patients. This approval allows patients and caregivers to purchase the system without a prescription, providing greater flexibility and convenience. The system simplifies the feeding process by delivering nutrition directly into the patient's feeding tube without the need for mixing or transferring from syringes, thereby reducing preparation time and potential for contamination. This advancement not only improves patient autonomy and adherence to nutritional regimens but also exemplifies how regulatory approvals can facilitate the development and adoption of innovative enteral feeding solutions in the U.S. market.

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion.

The degree of innovation in the industry is moderately driven by nutritional science and technology advancements. Companies are developing specialized formulas tailored to specific medical conditions, such as diabetes or renal diseases, to meet patient needs better. For instance, in September 2023, Vonco Products LLC, a manufacturer of risk-free plastic and packaging solutions announced that the U.S. Food and Drug Administration (FDA) granted over-the-counter (OTC) clearance for its innovative product, EnteraLoc Flow. EnteraLoc Flow is a fully integrated, closed-loop enteral feeding system that offers a direct-connect ENFit interface, spill-resistant pouch, tubing, and pre-filled nutritional formula-delivering a convenient, hygienic, and user-friendly solution for enteral patients.

M&A activities in the enteral feeding industry are moderate. Companies are forming strategic partnerships to combine expertise and resources. For instance, in May 2024, Danone completed the acquisition of Functional Formularies from Swander Pace Capital. This acquisition enhances Danone’s Medical Nutrition portfolio in the US by expanding its range of enteral tube feeding products as part of its Renew Danone strategy.

The impact of regulations on the market is high. The U.S. enteral feeding formula market is significantly influenced by various regulations. Products must comply with the U.S. Food and Drug Administration (FDA) regulations, particularly those for medical foods, as defined by the Orphan Drug Act Amendments of 1988. These formulas must meet strict manufacturing, labeling, and quality standards but are exempt from premarket approval.

The level of regional expansion in industry is moderate. While most companies operate nationally, there is a growing focus on expanding into specific high-opportunity regions such as California, Texas, Florida, and New York.

Product Insights

Standard formula segment led the market with the largest revenue share of 60.5% in 2024. This high share can be attributed to the broad adoption of standard formulas among all types of patients and their associated cost-effectiveness. In addition, easy availability of polymeric nutritional complete formulas, suitable for use in hospitals and home care settings, is anticipated to accelerate segment growth in the coming years. The high preference and recommendations by physicians to consume standard formulas for gastrostomy tube (G-tube) patients to enhance children’s nutrition are supporting the segment's growth.

Disease-specific formulas segment is expected to grow at the fastest CAGR during the forecast period, due to an increase in the prevalence of several chronic disorders, such as diabetes, cancer, and cardiovascular diseases. These formulas provide nutritional support to individuals suffering from specific diseases that are often characterized by organ dysfunction. These formulations are used for patients suffering from hepatic and pulmonary diseases, Chronic Obstructive Pulmonary Disease (COPD), Acute Respiratory Distress Syndrome (ARDS), and diabetes. In addition, an increase in the development and launch of disease-specific nutritional products by manufacturers as per the patient's needs is accelerating segment growth. An increase in the adoption of immune-modulating and disease-specific formulas for treating several chronic diseases is also projected to boost segment growth over the forecast period.

Flow Type Insights

Intermittent feeding flow segment accounted for the largest revenue share in 2024, attributed to several patient-centric and clinical advantages. Intermittent feeding closely replicates the body’s natural eating rhythms, which helps improve gastrointestinal tolerance and reduces the risk of common complications such as bloating, nausea, or aspiration that are more frequently associated with continuous feeding. This mode of nutrition delivery is particularly beneficial in home care and long-term care settings, where it provides greater flexibility and allows patients to maintain daily routines with minimal disruption.

Continuous feeding flow segment is anticipated to grow at the fastest CAGR during the forecast period, driven by its clinical advantages for critically ill and nutritionally vulnerable patients. According to a study published by PubMed in 2022, continuous feeding-compared to intermittent feeding-may be associated with a reduction in mortality among critically ill ICU patients. Continuous feeding ensures a steady and controlled delivery of nutrients over extended periods, which is especially beneficial for individuals with compromised digestive function or those at high risk of aspiration, such as patients with neurological disorders, severe trauma, or undergoing intensive care.

Stage Insights

Adult segment accounted for the largest market revenue share in 2024. Increased prevalence of chronic disorders, such as Alzheimer’s disease, sarcopenia, cancer, and diabetes among the older population increases the demand for enteral feeding formulas, which are frequently used to feed these patients when they are unable to take food and nutrients naturally.

Pediatrics segment is expected to grow significantly in the enteral feeding formulas market due to the increasing incidence of premature births, congenital disorders, and gastrointestinal conditions in infants and children that require nutritional support. Rising awareness among parents and healthcare providers about the importance of early and adequate nutrition for growth and development is further driving demand for pediatric enteral formulas.

Indication Insights

Cancer care segment accounted for the largest market revenue share of 19.8% in 2024, driven by the rising prevalence of cancer and the increasing use of nutritional support as an integral component of oncology care. For instance, National Cancer Institute estimated that in 2025, approximately 14,690 children and adolescents are expected to diagnose with cancer and around 1,650 will die of the disease in the U.S. Cancer patients often experience malnutrition due to the disease itself and the adverse effects of treatments such as chemotherapy and radiation, which impair appetite and nutrient absorption. Enteral feeding formulas offer a viable solution to maintain nutritional status, improve treatment tolerance, and enhance quality of life. Growing clinical emphasis on personalized nutrition and introducing disease-specific formulas are further fueling adoption in this segment.

Other indications segment is expected to grow at the fastest CAGR over the forecast period. Some of the other indications include COPD, respiratory disorders, cystic fibrosis, postoperative stress, inflammation, and infections. Due to an increase in the prevalence of various conditions wherein enteral nutrition can be used to restore nutritional balance, the market is anticipated to grow at a significant rate over the forecast period.

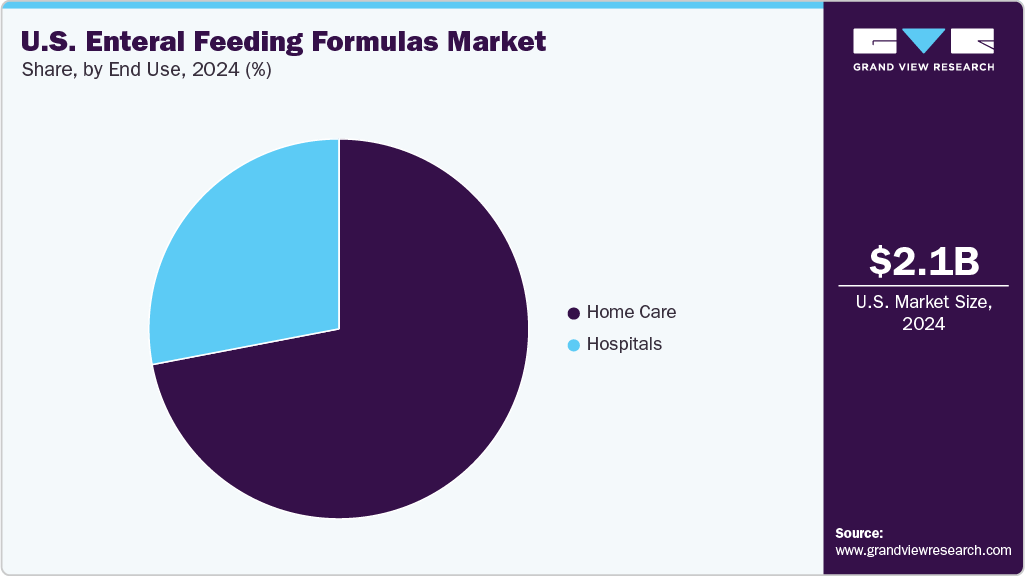

End Use Insights

Home care segment accounted for the largest market revenue share in 2024. Home enteral nutrition includes different subtypes such as hospices, home health agencies, nursing homes, adult day care centers, and residential care communities. According to the CDC National Health Statistics Report Number 208 (August 2024), in 2022, there were approximately 5,200 hospices in the U.S. Regarding patients opting for hospice care, about 1.6 million people received hospice services in that year.

Hospital segment is anticipated to grow at the fastest CAGR during the forecast period. The rising number of hospital-associated cases of malnutrition is a notable factor in the growing demand for enteral feeding formulas in hospitals. Tube feeding requires proper training & precision and is recommended to be used under proper guidance; hence, many hospitalized patients are recommended to receive enteral feeding to meet the daily requirement of nutrition.

Sales Channel Insights

Institutional sales segment accounted for the largest market revenue share in 2024. Institutions that purchase enteral nutrition products include hospitals, long-term care centers, hospices, and disability facilities. The growing number of private and public healthcare institutions and the increasing chronic disease patient population across the globe are propelling the segment. According to the data published by the American Hospital Association in 2024, 6,120 hospitals in the U.S. provided healthcare services to 33,679,935 patients. In addition, the collaboration between manufacturers and healthcare institutions has led to improved product visibility and accessibility within clinical settings.

Online sales channel segment is projected to grow at the fastest CAGR over the forecast period. There is a shift in the trend toward direct selling to customers via e-commerce platforms. The preference for online purchase of enteral feeding formulas is rising owing to the convenience offered by this sales channel. Although consumed under medical surveillance, these products are intended for long-term nutrition management, resulting in growing sales through e-commerce.

Key U.S. Enteral Feeding Formulas Company Insights

The market is consolidated to fragmented, with small and large players operating in this space. This leads to intense competition between smaller players to sustain their position. Strategies such as new product launches and partnerships play a key role in propelling market growth.

Key U.S. Enteral Feeding Formulas Companies:

- Ajinomoto Cambrooke

- Global Health Products, Inc.

- Kate Farms

- Abbott

- Danone S.A

- Fresenius Kabi AG

- Nestlé

- Primus Pharmaceuticals, Inc.

- Mead Johnson & Company, LLC

- Alcresta Therapeutics

- Real Food Blends

- B. Braun SE

Recent Developments

-

In May 2024, Danone acquired Functional Formularies, a U.S.-based whole food tube feeding producer, strengthening the company’s medical foods product portfolio and expanding its market in the U.S.

-

In June 2023, The American Diabetes Association (ADA) and Abbott collaborated to develop a therapeutic nutrition program aiming at designing a personalized nutrition program for diabetes patients using continuous glucose monitoring systems.

-

In September 2022, Kate Farms introduced Adult Standard 1.4, a high-calorie medical formula now offered in chocolate. This product is designed to assist in weight gain, weight maintenance, and improved tolerance while providing a delicious taste.

U.S. Enteral Feeding Formulas Market Report Scope

Report Attribute

Details

Market size value 2025

USD 2.18 billion

Revenue forecast in 2030

USD 2.88 billion

Growth rate

CAGR of 5.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, flow type, stage, indication, end use, sales channel

Key companies profiled

Ajinomoto Cambrooke; Global Health Products Inc.; Kate Farms; Abbott; Danone S.A; Fresenius Kabi AG; Nestlé; Primus Pharmaceuticals, Inc.; Mead Johnson & Company, LLC; Alcresta Therapeutics; Real Food Blends; B. Braun SE.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Enteral Feeding Formulas Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. enteral feeding formulas market report based on product, flow type, stage, indication, end use, and sales channel.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Standard Formula

-

Disease-specific Formulas

-

-

Flow Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Intermittent Feeding Flow

-

Continuous Feeding Flow

-

-

Stage Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Pediatrics

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Alzheimer’s

-

Nutrition Deficiency

-

Cancer Care

-

Diabetes

-

Chronic Kidney Diseases

-

Orphan Diseases

-

Dysphagia

-

Pain Management

-

Malabsorption/GI Disorder/Diarrhea

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Cardiology

-

Neurology

-

Critical Care (ICU)

-

Oncology

-

Others

-

-

Home Care

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online Sales

-

Retail Sales

-

Institutional Sales

-

Frequently Asked Questions About This Report

b. The global U.S. enteral feeding formulas market size was estimated at USD 2.06 billion in 2024 and is expected to reach USD 2.18 billion in 2025.

b. The global U.S. enteral feeding formulas market is expected to grow at a compound annual growth rate of 5.71% from 2025 to 2030 to reach USD 2.88 billion by 2030.

b. Standard formula segment dominated the market with the largest revenue share of 60.5% in 2024. This high share can be attributed to the broad adoption of standard formulas among all types of patients and their associated cost-effectiveness.

b. Some key players operating in the U.S. enteral feeding formulas market include Ajinomoto Cambrooke, Global Health Products, Inc., Kate Farms, Abbott, Danone S.A, Fresenius Kabi AG, Nestlé, Primus Pharmaceuticals, Inc., Mead Johnson & Company, LLC, Alcresta Therapeutics, Real Food Blends, and B. Braun SE

b. Key factors that are driving the market growth include the increasing prevalence of chronic diseases, including cancer, stroke, multiple sclerosis, dementia, chronic liver disease, chronic obstructive pulmonary disease (COPD), and diabetes, is anticipated to increase the demand for products addressing oral intake challenges.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.