- Home

- »

- Communication Services

- »

-

U.S. Enterprise Governance, Risk, And Compliance Market, Industry Report, 2030GVR Report cover

![U.S. Enterprise Governance, Risk, And Compliance (eGRC) Market Size, Share & Trends Report]()

U.S. Enterprise Governance, Risk, And Compliance (eGRC) Market Size, Share & Trends Analysis Report By Component, By Software, By Service, By Application, By Organization Size, By Vertical, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-239-8

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

U.S. eGRC Market Size & Trends

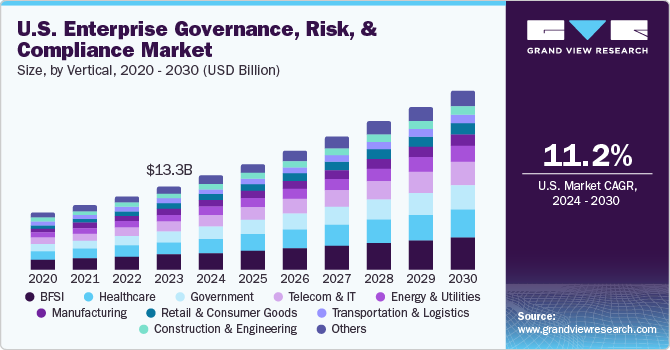

The U.S. enterprise governance, risk, and compliance (eGRC) market size was estimated at USD 13.34 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 11.2% from 2024 to 2030. The U.S. accounted for 24.4% of the global enterprise governance, risk, and compliance market. The eGRC is the set of policies, regulatory controls, procedures, risk monitoring, and internal controls that an organization develops to manage risk and governance for all its employees. Increased governance & risks such as legal mandates, ethical responsibilities, financial accuracy and transparencies are pushing companies to implement GRC solutions. The adoption of robust policies and rising compliance standards are driving the demand for the eGRC services, powered by the fusion of new technologies.

Enterprise governance, risk and compliance implementation brings an innovative approach for all enterprises where technologies help end-user enterprises gain efficient business processes, reduce risk costs, improve workflows, and get maximum visibility. The important driving factor of this market is that enterprises, either small or big, emphasize incorporating new changes such as regulatory requirements, corporate governance, and compliance. A firm governance policy is vital for an enterprise's financial growth and for instilling trust in investors, facilitating efficient funding. The incident management software and solutions are expected to experience the highest growth rate due to their ability to handle all kinds of incidents related to legal, HR, IT security, and compliance norms implemented by the U.S. Government and state authorities. Moreover, the software aids in service restoration, increasing customer satisfaction and minimizing negative impacts on the business.

The pandemic resulted in a greater adoption of digital devices and unprotected networks for remote business communication in the U.S. Consequently, it increased the cyber threats & data breaches such as leak of business data while sharing information remotely through different applications. Therefore, the market for eGRC solutions is proliferating to monitor unwarranted risk, data breach threats, and employee adherence to regulations and company standards. Furthermore, the outbreak of COVID-19 has intensified price competition among vendors who want to capture more customers and provide a solution that addresses the challenges of remote work environments.

Meanwhile, the financial sector of the U.S. is increasingly deploying GRC solutions to comply with complex regulatory frameworks and avoid huge penalties associated with errors and non-compliance. The deployment of eGRC solutions offers financial institutions transparency in their operations and the ability to identify and mitigate risks related to frauds, contributing to the growth of the market. For instance, the use of secure payment gateways in sports betting applications and providing ease to end-users while managing accounts online have contributed to the shift towards the growth of online sports betting in the U.S. Hence, usage of eGRC is increasing the possibilities of minimizing risks and secure financial transactions will help the growth of eGRC market.

However, U.S. enterprises need to monitor their software functioning and must manage software upgrades periodically due to changing regulations by the U.S. authorities, businesses should adhere to the rules and regulations in this highly complex and dynamic regulatory environment. Staying updated with the latest trends and industry regulations is challenging for enterprises. Aligning eGRC management strategists through software solutions is bit hard, but eGRC solution providers are assisting companies to gauge their compliance and risk postures, avoid any security lapses, and strengthen their compliance and risk management. The emergence of several key players in the U.S. eGRC market is expected to enable end-users to find the best SaaS product and increase market share in the near future.

Market Concentration & Characteristics

The U.S. enterprise governance, risk & compliance (eGRC) market growth stage is moderate, and the pace of the market growth is accelerating. The market highlights several remarkable market characteristics. The market can be described as moderately concentrated, with a few dominant players holding significant market share. This concentration is primarily due to the complex and specialized nature of eGRC solutions, which require substantial expertise and resources to develop and maintain. As a result, established vendors with strong product offerings and established customer bases tend to dominate the market, creating new entrants' entry challenges.

The eGRC market has experienced a notable trend of mergers and acquisitions in recent years. More prominent players in the market have pursued Mergers & Acquisitions (M&A) to expand their product portfolios, enhance their technological capabilities, and gain access to new customer base. These acquisitions have fairly consolidated U.S. market which led to the integration of complementary solutions, offering customers more comprehensive and integrated eGRC offerings.

In addition, the U.S. eGRC market is characterized by a growing focus on technological advancements and innovation. With the increasing complexity of business environments and regulatory requirements, organizations are seeking advanced eGRC solutions that can effectively address their needs. As a result, market players are investing in Research and Development (R&D) to enhance their existing offerings and develop new capabilities such as Artificial Intelligence (AI), Machine Learning (ML), cloud computing, and predictive analytics to improve risk assessment and compliance processes.

The eGRC (Enterprise Governance, Risk, and Compliance) market in the United States is greatly influenced by regulatory developments and industry standards. The regulatory landscape is constantly evolving, and agencies like the Securities and Exchange Commission (SEC) and the Department of Justice (DOJ) play a key role in shaping the demand for eGRC solutions. In order to comply with regulations like the Sarbanes-Oxley Act (SOX) and the Health Insurance Portability and Accountability Act (HIPAA), organizations are compelled to adopt eGRC solutions to ensure effective risk management and regulatory complianceTherefore, U.S. market performance is anticipated to propel the U.S. enterprise governance risk and compliance market growth in the forecasted period.

Component Insights

Software led the market and accounted for the largest revenue in 2023. The U.S. eGRC market witnessing dominance of the software companies due to increasing demand for cost-effective solutions to comply with numerous regulations implemented by U.S. regulatory bodies and government which has contributed to the market's growth. Many U.S. based companies have global presence in the eGRC market, which has resulted in the wider adoption of eGRC software. Therefore, the EGRC software is widely adopted in the U.S., leading to increased adoption of software solutions over the forecast period.

Software is anticipated to witness significant CAGR of 12.1% from 2023 to 2030 in the market. The software segment is dominant in the market due to the rising demand for cost-effective solutions to comply with various regulations notified by U.S. authorities, such as Occupational Safety and Health Administration (OSHA), Health Insurance Portability and Accountability Act (HIPAA), and Foreign Account Tax Compliance Act (FATCA). The major companies' wide reach in the U.S. market has resulted in high market growth from 2024 to 2030.

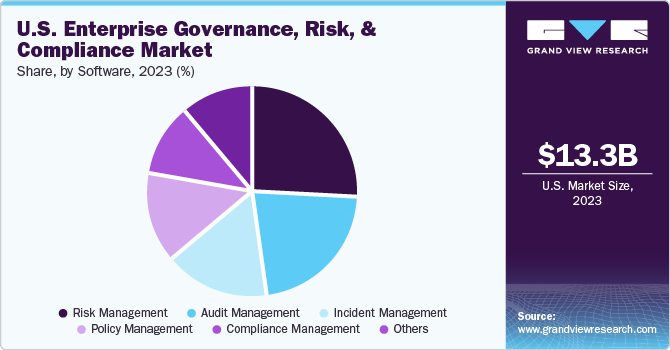

Software Insights

Risk management led the market and accounted for more than 25.0% of the global revenue in 2023. The growth of the risk management segment is due to the rising demand for addressing and managing various risks encountered by organizations during their development. To this end, risk management vendors are offering services that govern risk assessment and follow-up, which have proven quite effective in the United States. Additionally, the remote working approach adopted by companies after the COVID-19 outbreak has created an urgent need to manage unforeseen risks, further boosting the growth of the risk management segment. It's worth noting that certain business processes require specialized risk management solutions to ensure optimal performance and success.

Compliance Management is anticipated to witness significant CAGR of more than 12.0% from 2024 to 2030 in the market. Compliance management software benefits companies by making collaboration easy, automating compliance processes, simplifying tracking of regulatory changes, reducing operation costs, and increasing customer satisfaction. The compliance management segment has grown significantly due to several companies offering compliance management solutions, such as Microsoft and IBM.

Services Insights

Consulting led the market and accounted for the highest global revenue in 2023. Every company has its own unique requirements based on factors such as their industry type, enterprise size (whether it is a large or small enterprise), and the complexity of their challenges. All these aspects have resulted in the growth of the consulting segment of the enterprise governance, risk & compliance market during from 2024 to 2030.

Integration segment is anticipated to witness significant CAGR from 2024 to 2030 in the market.It highlights the growth in the U.S. due to the significant benefits witness by companies after receiving integration solutions. Integration services help companies to implement GRC measures consistently and effective compliance programs and proactively respond to risks by breaking down restrictive organizational silos and functions. It also helps address constant changes in technology and regulations. All the aspects of integrated GRC solutions mentioned above have resulted in the growth of the integrated segment of the eGRC market during the forecast period.

Application Insights

Environment, Social and Governance (ESG) segment accounted for the largest market revenue share in 2023. In the U.S., ESG compliance refers to an organization's comprehension of the ESG guidelines assigned by various autonomous regulatory bodies, state authorities, environmental and social framework-making bodies, and others. It also refers to implementing these guidelines in internal policies and practices. ESG frameworks serve as comprehensive guidelines and standards for ESG compliance that organizations can choose from.

Environment, Health and Safety (EHS) is expected to register the fastest CAGR during the forecast period. ESG compliance refers to an organization's comprehension of the ESG rules set by regulatory bodies, specific norms of the United States, and frameworks, and their execution in internal policies and practices. To ensure ESG compliance, organizations can adopt various ESG frameworks available that serve as guidelines and standards.

Organization Size Insights

Large enterprises have accounted for largest market revenue share in 2023. Large companies collect information about their customers from various sources and must ensure that this data is secure and private. If they fail to do so, they may face legal consequences and severe financial penalties. As digital data grows, these companies must continually monitor their activities to comply with regulations. Moreover, large businesses are at higher risk for cyber-attacks and are considering using blockchain technology to enhance transaction security. For instance, due to eGRC compliance, many organizations add cyber insurance to their business insurance policies to protect themselves from these risks.

However, Small & Medium Enterprises (SMEs) is expected to register the fastest CAGR during the forecast period.The growth in this particular segment can be attributed to U.S. based Small and Medium-sized Enterprises (SMEs) focusing on implementing advanced cloud-based risk compliance policies and cost-effective services. With the outbreak of the COVID-19 pandemic, technological innovations and digital transformation increased, which compelled companies to migrate to the cloud to maximize their business performance and customer success.

Vertical Insights

Banking, Financial Services and Insurance (BFSI) vertical have accounted for largest market revenue share in 2023.Data protection is becoming increasingly important for BFSI organizations, as cyberattacks continue to cause more damage. The legal risks have increased with the ability to transfer sensitive and valuable information such as client files, customer data, employee files, financial records, and medical records. As the BFSI sector is responsible for storing large volumes of critical data, companies are at a constant risk of cyberattacks.

Telecom and IT is expected to register the fastest CAGR during the forecast period. IT and telecommunication companies are developing solutions that provide managed, risk-based approaches for implementing privacy and security. The eGRC solutions are customized to meet the specific demands of the information technology industry, enabling companies to keep up with fast-paced technological advancements and legal changes in the U.S., which need to be addressed while meeting the expectations of all stakeholders.

Key U.S. Enterprise Governance, Risk, And Compliance (eGRC) Company Insights

Some key players operating in the U.S. enterprise governance, risk, and compliance (eGRC) market include Oracle, Microsoft, Genpact, and MetricStream, among others.

-

Genpact provides cutting-edge solutions that are customized to satisfy various company requirements. Genpact provides eGRC services, which offer skill sets ranging from policy design and enforcement to regulatory reporting and audit management. The company has proficiency in process optimization and risk management. The company's use of technology-driven solutions improves transparency and efficiency, allowing businesses to handle complexity with grace.

-

Oracle Access Governance has been updated to assist IT teams in assigning, tracking, and managing user access to apps and other digital resources more effectively. The company limits access to restricted assets like source code, patents, databases, apps, and infrastructure resources like cloud servers and services; only authorized users can use, view, or interact with them. This cloud-native service helps lower risk by offering a comprehensive insight into how users interact with tech resources.

Maclearglobal.com, metricStream and NAVEX Global, Inc., are some of the emerging market participants in the U.S. enterprise governance, risk and compliance (eGRC) market.

-

Maclearglobal.com offers innovative solutions for organizations navigating complex regulatory landscapes. The company specializes in digital governance, risk management, and compliance services that are tailored to enhance operational efficiency and transparency. The company uses advanced technologies to address the evolving challenges of the eGRC landscape and position itself as a forward-thinking contributor.

-

MetricStream introduced a cloud GRC solution that leverages Amazon Web Services (AWS) AWS Audit Manager in conjunction with MetricStream CyberGRC. Customers can manage risks, compliance standards, frameworks centrally, and controls with MetricStream's new cloud GRC solution, which offers automated evidence collecting and assessments for both on-premises and AWS settings.

Key U.S. Enterprise Governance, Risk, And Compliance (eGRC) Companies:

- FIS

- Genpact

- IBM

- Maclearglobal.com

- MetricStream

- Microsoft

- NAVEX Global, Inc.

- Oracle

- RSA Security LLC

- SAI Global Pty Limited

- SAP SE

- SAS Institute Inc.

Recent Developments

-

In February 2024, SAS announced Redington as its new Middle East, Africa, and Turkey (META) distributor. SAS is a global leader in data and artificial intelligence. The expansion will boost the company's market share and provide them more resources to generate greater value for both their businesses and their customers.

-

In December 2023, IBM announced that its platform, Watsonx.governance, will be available for widespread use. The platform aims to help organizations dispel misconceptions about AI models, the data fed into the system, and the resulting outputs.

-

In February 2023, In December 2023, NAVEX, a global leader in integrated risk and compliance management software, has recently launched its advanced data intelligence technology on the NAVEX One platform. Compliance and risk professionals can now collect, analyze, and manage data in the cloud with improved security and consistency. It will ensure a strong and dependable approach to governance, risk, and compliance.

U.S. Enterprise Governance, Risk, And Compliance (eGRC) Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.06 billion

Revenue forecast in 2030

USD 28.41 billion

Growth Rate

CAGR of 11.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, software, service, application, organization size, vertical

Country scope

U.S.

Key companies profiled

FIS; Genpact; IBM; Maclearglobal.com; MetricStream; Microsoft; NAVEX Global, Inc.; Oracle; RSA Security LLC; SAI Global Pty Limited; SAP SE; SAS Institute Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Enterprise Governance, Risk, And Compliance (eGRC) Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. enterprise governance, risk, and compliance market report based on component, software, service, application, organization size, and vertical:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Services

-

-

Software Outlook (Revenue, USD Billion, 2018 - 2030)

-

Audit Management

-

Compliance Management

-

Risk Management

-

Policy Management

-

Incident Management

-

Others

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Integration

-

Consulting

-

Support

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Director Board

-

EHS

-

ESG

-

Legal Services

-

Others

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Construction & Engineering

-

Energy & Utilities

-

Government

-

Healthcare

-

Manufacturing

-

Retail & consumer goods

-

Telecom & IT

-

Transportation & Logistics

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. enterprise governance, risk, and compliance (eGRC) market size was estimated at USD 13.34 billion in 2023 and is expected to reach USD 15.06 billion in 2024.

b. The U.S. enterprise governance, risk, and compliance (eGRC) market is expected to grow at a compound annual growth rate of 11.2% from 2024 to 2030 to reach USD 28.41 billion by 2030.

b. The Risk management segment accounted for the largest revenue share of 25.0% in 2023. The growth of the risk management segment is due to the rising demand for addressing and managing various risks encountered by organizations during their development.

b. Some key players operating in the U.S. enterprise governance, risk, and compliance (eGRC) market include FIS; Genpact; IBM; Maclearglobal.com; MetricStream; Microsoft; NAVEX Global, Inc.; Oracle; RSA Security LLC; SAI Global Pty Limited; SAP SE; SAS Institute Inc.

b. Increased governance & risks such as legal mandates, ethical responsibilities, financial accuracy and transparencies are pushing companies to implement GRC solutions. The adoption of robust policies and rising compliance standards are driving the demand for the eGRC services, powered by the fusion of new technologies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."