- Home

- »

- Green Building Materials

- »

-

U.S. Environmental Testing Market, Industry Report, 2030GVR Report cover

![U.S. Environmental Testing Market Size, Share & Trends Report]()

U.S. Environmental Testing Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Rapid, Conventional), By Sample (Soil, Air), By Target Tested, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-298-2

- Number of Report Pages: 134

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Environmental Testing Market Trends

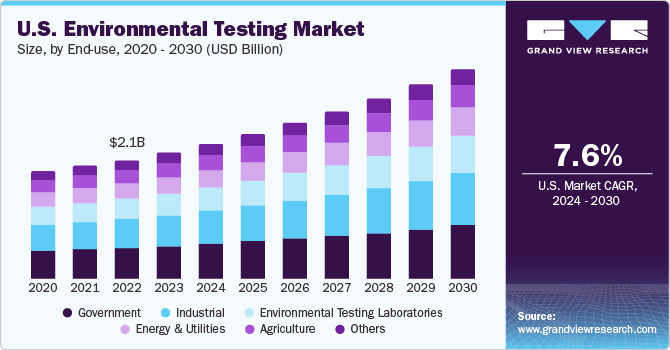

The U.S. environmental testing market size was estimated at USD 2.20 billion in 2023 and is projected to grow at a CAGR of 7.6% from 2024 to 2030. The federal government's stringent measures to safeguard the environment and control pollution have necessitated the implementation of high-tech testing tools and services to maintain environmental standards. These regulations have been propelling the requirement of environmental testing, driving the market's growth. In addition, the growing involvement in monitoring and analyzing changes in environmental conditions to monitor the level of pollution for natural resources such as water, air, and soil has contributed to the rising demand for environmental testing services.

The rise in pollution due to increased industrialization and urbanization has been a major factor driving the market growth. To monitor and control pollution, businesses, and governments have established a notable increase in the establishment of environmental testing service stations. These stations play a crucial role in evaluating the basic environmental standards and patterns, thereby aiding in implementing and monitoring environmental regulations.

Advancements in technology is playing a significant role in driving the global environmental testing market. Rapid technological advancements have led to the development of high-tech testing tools and methods, which are essential for maintaining environmental standards and monitoring contamination levels. These developments have improved efficiency, automation, precision, and sensitivity in environmental testing procedures.

Moreover, the concerns about the impact of environmental pollution on public health is propelling the requirement of environmental testing. Assessing the effects of pollution on the environment and identifying potential health risks is a vital aspect of environmental testing. The increasing focus on public health and the necessity to tackle environmental pollution have resulted in a growing need for environmental testing services.

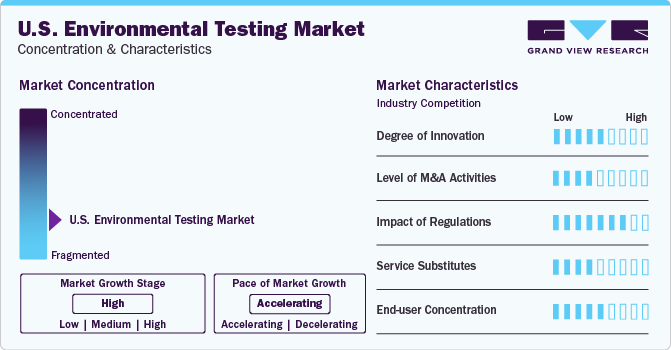

Market Concentration & Characteristics

Industry growth stage is high, and pace of the market growth is accelerating. The degree of innovation factor is significantly important in the market. Service providers in this market are increasingly prioritizing incorporation of artificial intelligence (AI) to offer innovative analysis solutions. For instance, Agilent Technologies, in February 2022, announced the acquisition of advanced AI technology developed by virtual control. The company integrated this AI technology with its industry-leading gas chromatography and mass spectrometry (GS/MS) platforms to improve the accuracy, efficiency, and productivity of labs across the globe.

The market is impacted by stringent government regulations. For instance, the Safe Drinking Water Act (SDWA) and the Clean Water Act (CWA) in the United States mandate to maintain high water quality standards to protect public health and the environment. Under the SDWA, water suppliers must ensure their water meets health-based standards for more than 90 contaminants, which necessitates regular testing for contaminants. Similarly, the CWA requires industries to monitor and report the quality of their wastewater discharges, encouraging the need for environmental testing services. These measures are increasing the need for water quality testing and assessment, leading to the growth of the environmental testing industry.

The end-user concentration for this market remains high, which includes government agencies, environmental testing laboratories, agriculture, and energy & utility industry. For the industrial sector, the industries deploy environmental testing to monitor the level of hazardous contaminants present in the air and water emitted from their plant. In some cases, before establishing the plants, the companies undertake thorough research to understand the level of contaminants present in the water and soil.

Technology Insights

The rapid segment dominated the market, accounting for a share of 67.46% in 2023, and is anticipated to witness the highest CAGR over the forecast period. These methods are cost-efficient and can achieve significant efficiency in particulate identification with greater accuracy. They also have high sample throughput and are highly precise.

The conventional segment is expected to grow lucratively during the forecast period. These methods often require less specialized equipment and expertise, making them more accessible and cost-effective for many organizations. Furthermore, conventional testing methods often have established regulatory acceptance, which can be beneficial for comparison adopting these methods.

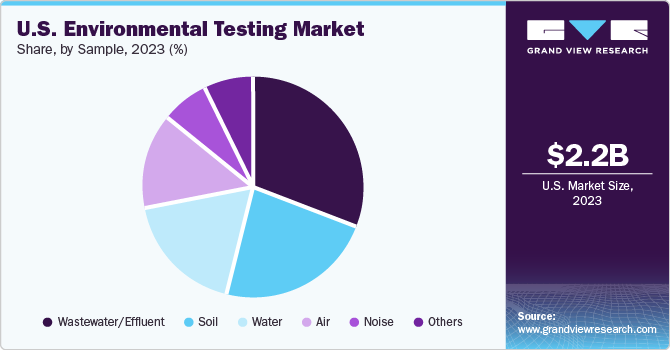

Sample Insights

Wastewater/effluent segment accounted for the largest market revenue share of 31.45% in 2023. Wastewater treatment is required to preserve public health and the environment and keep industrial processes running smoothly. Most regulatory authorities require regular analytical testing of wastewater effluents at various treatment stages. For instance, the requirements of the MCERT standard for wastewater effluents, treated sewage effluents, and untreated sewage effluents sampling and chemical testing.

The air segment is expected to register the fastest CAGR during the forecast period. The environmental testing market is likely to be boosted by the increased demand for air quality services to monitor air pollution and take actionable actions to mitigate it over the forecast period. It helps determine the impact of industrial emissions, vehicular exhaust, and other sources of pollution on the environment and public health.

Target Tested Insights

The chemical segment dominated the market in 2023 with a market share of 24.60%. Industries require chemical analysis for a variety of reasons. Over the projected period, the market is anticipated to grow as people become more aware of the need to eliminate chemical pollution in water, air, and soil. Identification of chemicals in natural resources such as water, air, and soil allows us to monitor the quality of these resources at a particular point in time. This is important for ensuring that these resources are safe for consumption and use and for identifying any potential risks to public health and the environment.

The biological segment is anticipated to witness the highest CAGR over the forecast period. Biological testing techniques are standardized trials that assess a substance’s or material’s toxicity to living things. In the coming years, there is projected to be an increase in demand for tests to determine the presence of biological agents and assess their contamination. By analyzing the substance’s toxicity, environmental scientists can identify potential risks to human health and living organisms present in an ecosystem.

End-use Insights

The government segment dominated the market in 2023 by holding the highest revenue market share of 26.44%. Environmental testing helps government agencies in the U.S., like the Environmental Protection Agency (EPA), in monitoring and analyzing changes in environmental conditions, such as the level of pollution in natural resources like water, air, and soil. This is crucial for creating and enforcing environmental regulations and ensuring the well-being of the public and the environment.

Environmental testing laboratories is expected to witness the highest CAGR over the forecast period. The concerns about the impact of environmental pollution on public health have propelled the requirement for environmental testing laboratories. Environmental laboratories play a pivotal role in enforcing and implementing environmental laws. These laboratories provide crucial data on the presence and concentration of pollutants in air, soil, and other environmental mediums through meticulous testing and analysis. This information serves as evidence, helping regulatory bodies to hold entities accountable for environmental violations.

Key U.S. Environmental Testing Company Insights

Some of the key players operating in the U.S. environment testing market include SGS SA, ALS, SCS Global Services, MICROBAC, Eurofins Scientific

-

SGS SA has been offering environment, health, and safety solutions through services such as auditing and compliance, sampling and monitoring, and technical staffing services. The company’s sampling service portfolio offers expert solutions for air quality monitoring and sampling, noise monitoring, and soil and water sampling. Established in 1878, it began its industrial services business in 1955.

-

ALS offers businesses legally defensible, analytical, and accurate data about pollution levels and undertakes the sampling requirements promptly and efficiently through its network of laboratories and service centers. It has a presence across the globe and its global operations center is located in Texas, U.S. It offers testing services to a wide range of industries across the globe with its state-of-the-art technology and innovative methodologies.

Hydrologic Associates, ALPHA ANALYTICAL, Inc., and Agilent Technologies are some of the emerging market participants in the market.

-

Hydrologic Associates is a geological, hydrological, and environmental consulting firm headquartered in Miami. Its service portfolio includes environmental services, water resource investigations, and drilling and testing services. It offers a wide range of services to governmental agencies, private industry players, and universities. It has a strong presence in Miami, Orlando, Puerto Rico, and the Bahamas.

-

ALPHA ANALYTICAL has service portfolio that offers analytical testing services such as, air testing, sediment & tissue analysis, hydrocarbon forensics, water analysis, soil analysis, and determination of emerging contaminants such as per- and polyfluoroalkyl substances (PFAS) analysis of drinking water by EPA method 533. It has more than 50,000 square feet state of the art laboratory facility in Massachusetts.

Key U.S. Environmental Testing Companies:

- SGS SA

- Bureau Veritas

- MICROBAC

- ALS

- SCS Global Services

- TUV Nord AG

- Eurofins Scientific

- Agilent Technologies

- Hydrologic Associates

- ALPHA ANALYTICAL, Inc.

Recent Developments

-

In March 2024, the U.S. Environmental Protection Agency (EPA) announced the fourth Toxic Substances Control Act (TSCA) test order, targeting PFAS for testing. This move is part of the EPA's National PFAS Testing Strategy. It represents a significant step in the agency's PFAS Strategic Roadmap to address the widespread contamination of these forever chemicals, such as NMeFOSE. The implications of this move extend beyond regulatory compliance, significantly impacting the environmental testing market over the forecast period.

-

In October 2023, SGS signed an agreement to divest its powertrain testing operations in the US to Columbia River Partners. This move is in line with its strategic plans to evolve its portfolio. Columbia River Partners is a private equity firm based in California focused on industrials, business services, and IT services. The sold powertrain testing operations specialize in services for environmental simulation of combustion engines, evaluating powertrain components, and additive testing.

U.S. Environmental Testing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.35 billion

Revenue forecast in 2030

USD 3.65 billion

Growth rate

CAGR of 7.6% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, sample, target tested, end-use

Country scope

U.S.

Key companies profiled

SGS SA; Bureau Veritas; MICROBAC; ALS; SCS Global Services; TUV Nord AG; Eurofins Scientific; Agilent Technologies; Hydrologic Associates; ALPHA ANALYTICAL, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Environmental Testing Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. environmental testing market report based on technology, sample, target tested, and end-use:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Rapid

-

Mass Spectrometer Testing

-

Molecular Spectroscopy

-

Chromatography Testing

-

Acidity/Alkalinity Testing

-

Turbidity Testing

-

PCR Testing

-

Immunoassay Testing

-

Others

-

-

Conventional

-

Culture Plate Method

-

Biological & Chemical Oxygen Demand (BOD & COD)

-

Dissolved Oxygen Determination (DOD)

-

-

-

Sample Outlook (Revenue, USD Million, 2018 - 2030)

-

Wastewater/Effluent

-

Soil

-

Water

-

Air

-

Noise

-

Others

-

-

Target Tested Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemical

-

Biological

-

Temperature

-

Particulate Matter

-

Moisture

-

Noise

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Government

-

Industrial

-

Environmental Testing Laboratories

-

Energy & Utilities

-

Agriculture

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. environmental testing market size was estimated at USD 2.20 billion in 2023 and.is expected to reach USD 2.35 billion in 2024.

b. The U.S. environmental testing market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.6% from 2024 to 2030 and reach USD 3.65 billion by 2030.

b. Rapid technology segment accounted for the largest market revenue share of 67.5% in 2023, as technologies under this segment offers high accuracy, reliability, and cost effectiveness as compare to other methods.

b. Some of the key players operating in the U.S. environmental testing market include, SGS SA, Bureau Veritas, MICROBAC, ALS, SCS Global Services, TUV Nord AG, Eurofins Scientific, Agilent Technologies, Hydrologic Associates, ALPHA ANALYTICAL, Inc.

b. The stringent environmental regulations, growing need to monitor& control pollution, rising industrialization & urbanization, and growing public health concerns are acts as a drivers for the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.