- Home

- »

- Pharmaceuticals

- »

-

U.S. Erleada Market Size And Share, Industry Report, 2033GVR Report cover

![U.S. Erleada Market Size, Share & Trends Report]()

U.S. Erleada Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Branded, Generic), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies), And Segment Forecasts, Key Companies, And Competitive Analysis

- Report ID: GVR-4-68040-662-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

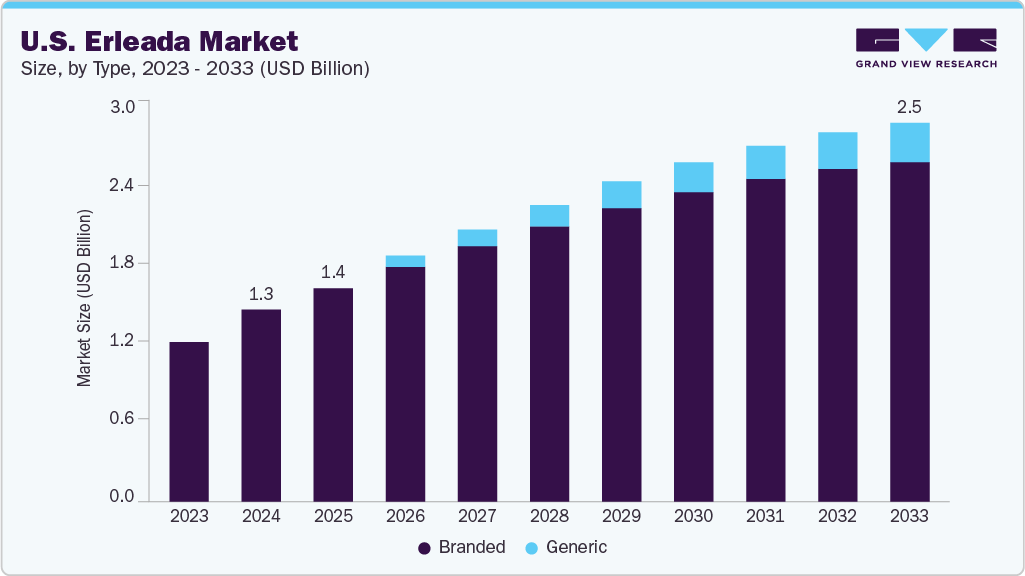

The U.S. erleada market size was estimated at USD 1.28 billion in 2024 and is projected to reach USD 2.5 billion by 2033, registering a CAGR of 7.44% from 2025 to 2033. Growth is driven by rising prostate cancer prevalence, increasing adoption of novel hormonal therapies, and favorable reimbursement policies. The market is concentrated in urban healthcare centers with advanced oncology facilities, while rural areas show potential for growth due to improving access. Branded Erleada dominates, but generic competition is expected post-patent expiry.

Hospital pharmacies lead distribution due to specialized treatment needs. Key trends include advancements in combination therapies and digital health integration for patient monitoring. Erleada has maintained a strong market position in the U.S. due to its early approval for non-metastatic castration-resistant prostate cancer (nmCRPC) and metastatic castration-sensitive prostate cancer (mCSPC). The drug benefits from inclusion in updated NCCN and AUA clinical guidelines, which recommend next-generation androgen receptor inhibitors for these indications. Utilization has been supported by the broad reimbursement coverage from Medicare and commercial payers, which has led to widespread adoption in urology and oncology practices.

U.S. prescribing patterns also reflect a preference for oral therapies that delay progression and avoid chemotherapy, contributing to consistent uptake in both community and hospital settings. Despite competition from other androgen receptor pathway inhibitors such as Xtandi and Nubeqa, Erleada retains a significant share due to its dual-label advantage and Janssen’s targeted promotion to high-volume oncology networks. Prescription volume has been stable, although growth has moderated due to increased competition and formulary-based preferences. The expiration of patent exclusivity in 2031 is expected to shape long-term planning for generic entry, but no generic versions are available as of mid-2025. Market access is influenced by prior authorization requirements and step therapy protocols in some payer systems, which vary by region and plan type.

Erleada’s inclusion in major U.S. treatment guidelines such as those by the NCCN and AUA has significantly driven its adoption. These endorsements have led to consistent prescribing across community and academic oncology settings. In addition, its dual approval for nmCRPC and mCSPC has allowed broader positioning within the prostate cancer treatment pathway, enabling early-line use and supporting continuous therapy over longer durations.

The U.S. reimbursement environment for Erleada remains favorable, with coverage extended across Medicare Part D, commercial insurers, and VA healthcare systems. Access programs and co-pay assistance initiatives by Janssen have further reduced financial barriers for patients. The consistent formulary placement of Erleada in preferred drug tiers has contributed to sustained prescribing momentum, especially in high-volume urology networks. The U.S. market for Erleada is shaped by the shift toward value-based care models, where payers prioritize treatments that demonstrate long-term clinical and economic benefits.

Clinical outcomes from the TITAN trial, such as the 33% reduction in mortality risk (HR 0.67), have supported its favorable positioning among Medicare and commercial plans. In 2024, Medicare Advantage programs observed a measurable decline in hospitalizations among nmCRPC patients treated with Erleada, reinforcing its real-world utility over some alternative therapies. To sustain competitive positioning and manage future pricing pressures from potential generics, stakeholders focus on expanding real-world data collection and provider education initiatives to support evidence-based prescribing and optimize treatment integration.

Erleada faces growing competition in the U.S. from other androgen receptor inhibitors, notably Xtandi and Nubeqa, which are also approved for similar indications. Differences in dosing schedules, safety profiles, and payer-driven formulary decisions have influenced physician preferences and prescribing dynamics. Prior authorizations or step therapy requirements favor alternate agents in certain regions, limiting Erleada’s market share expansion despite clinical comparability.

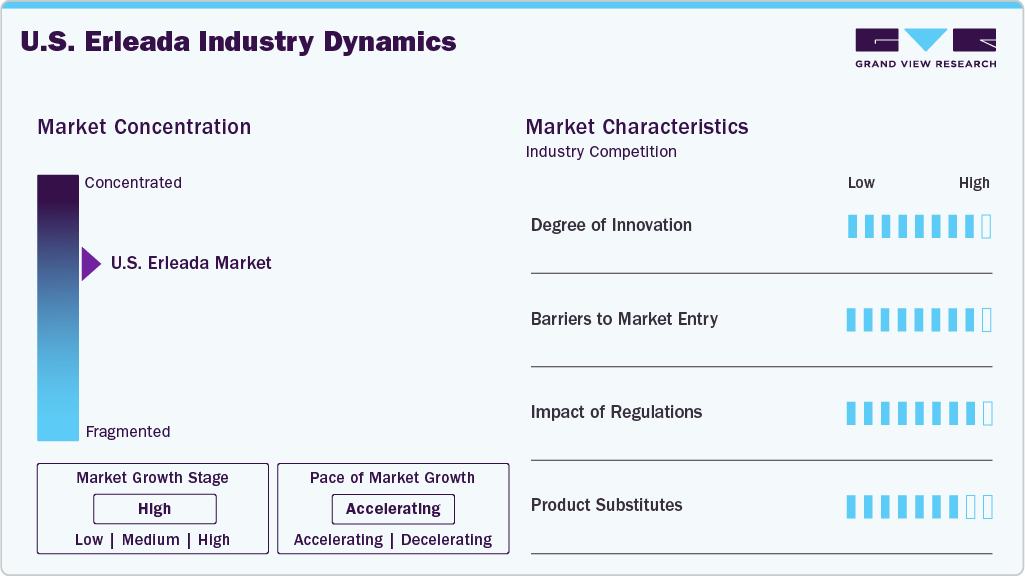

Market Concentration & Characteristics

The market remains consolidated, with Janssen Biotech, Inc. maintaining a dominant position in the androgen receptor inhibitor space for prostate cancer. Entry barriers are significant due to the capital-intensive nature of oncology drug development and the regulatory stringency of the FDA. Long development timelines and the requirement for extensive clinical validation create substantial risks for new entrants. Furthermore, U.S. manufacturing requires adherence to current Good Manufacturing Practices (cGMP), contributing to elevated operational costs. The recent U.S. FDA approval granted to Zydus Lifesciences to manufacture apalutamide tablets indicates an approaching shift in competitive dynamics, potentially affecting Janssen’s exclusivity and pricing strategy in the short to medium term.

Janssen continues to drive innovation in the U.S. Erleada industry through clinical and formulation advancements. The FDA's 2023 approval of a once-daily 240 mg dose reduced pill burden and improved regimen adherence. Concurrently, Janssen is expanding its evidence base with global Phase 3 trials, including studies targeting earlier stages of prostate cancer. These efforts allow for lifecycle management and positioning Erleada for future label expansions. In the U.S., payers and providers increasingly rely on such innovations to inform formulary placement and treatment decisions, especially in value-based care environments.

High R&D costs, multi-year clinical development timelines, and regulatory challenges restrict entry into the market. Oncology drugs targeting prostate cancer require robust survival and progression-free endpoints to secure FDA approval. Furthermore, manufacturers must invest in specialized facilities that comply with regulatory inspections, raising production costs. These conditions reinforce market control by established companies like Janssen. New entrants must demonstrate clinical comparability, cost-effectiveness, and manufacturing readiness to gain a foothold in the U.S. landscape.

FDA approvals 2018 for nmCRPC and in 2019 for mCSPC enabled early U.S. market access for Erleada. Regulatory designations such as priority review and expedited pathways supported its time-to-market. However, current regulatory processes for generics, including bioequivalence and therapeutic substitution reviews, are expected to accelerate market diversification. The recent FDA approval of Zydus Lifesciences’ apalutamide formulation highlights this shift. U.S. stakeholders must navigate evolving regulatory timelines and post-marketing requirements, particularly with generics poised to impact market exclusivity in the coming years.

In the U.S., Erleada competes with multiple androgen receptor pathway inhibitors, including Xtandi and Nubeqa, which are approved for overlapping indications. Xtandi has had a longer presence and established prescriber familiarity, while Nubeqa has gained traction due to its safety profile and payer-driven access. Moreover, off-patent agents such as abiraterone acetate may be favored in cost-sensitive settings. To defend its position, Erleada’s strategy includes real-world outcomes reporting, payer engagement, and support services targeting treatment continuity and adherence.

While Erleada’s initial launch and strongest performance are in the U.S., growth is supplemented by international markets. Within the U.S., geographic variations in access exist due to payer restrictions, regional clinical guidelines, and prescriber preferences. Larger oncology networks and academic centers adopt the drug more readily, whereas uptake in smaller or rural practices may be slower. To enhance reach and adoption, stakeholders focusing on U.S. market expansion prioritize integration with value-based care frameworks, Medicare Advantage plans, and electronic health record-based prescribing tools.

Type Insights

The branded segment dominated the market with 100% of total revenue share, driven by Johnson & Johnson’s strong patent protection and established clinical reputation. Patent protections extending through 2038, including Patent 17200298, safeguard market exclusivity and limit competitive entry. This allows Janssen to sustain premium pricing and maintain a stable presence across major U.S. oncology networks. Strategic engagement with payers, supported by clinical outcome data, enables long-term formulary placement. Stakeholders can reinforce performance in this segment by negotiating multiyear supply contracts and aligning with institutional treatment pathways.

The generic segment will grow in the market, propelled by the USFDA approval of Zydus Lifesciences’ Apalutamide Tablets (60 mg) in March 2025. This milestone marks the entry of lower-cost alternatives, which are expected to benefit cost-conscious payers and providers. Medicare Advantage programs, in particular, may accelerate uptake due to pressure to lower treatment costs, as seen in other high-cost oral oncology therapies. To succeed in this evolving space, stakeholders should focus on building competitive pricing frameworks, engaging pharmacy benefit managers, and ensuring nationwide distribution capacity to increase access across retail and specialty channels.

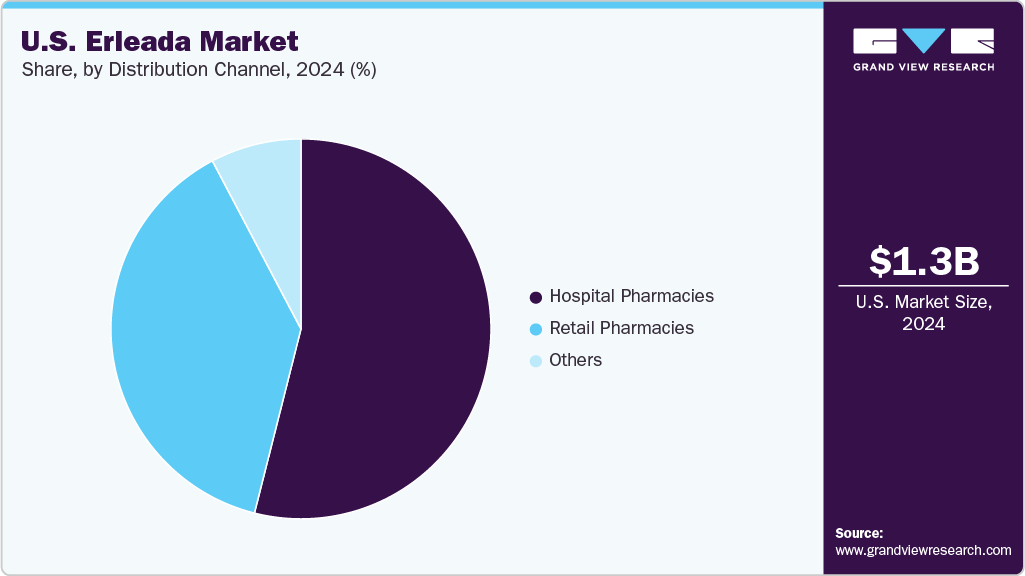

Distribution Channel Insights

Hospital pharmacies represent the largest distribution channel for Erleada, with a revenue share of 53.94%, driven by their role in managing complex prostate cancer treatments requiring specialized oversight. These settings play a central role in oncology care delivery, where multidisciplinary coordination supports the timely initiation of therapies like Apalutamide. In 2024, integrated cancer centers such as the Cleveland Clinic reported improved patient access due to in-system dispensing efficiencies and close alignment between pharmacy teams and oncology units. Stakeholders can reinforce this channel by establishing institutional agreements, offering clinical training to hospital pharmacists, and aligning educational initiatives with treatment protocols to ensure optimal administration and continuity of care.

The others segment, including specialty and online pharmacies, is the fastest-growing distribution channel for Erleada, fueled by demand for specialized and convenient delivery options. In 2024, partnerships with specialty providers like Accredo supported growth, whose care model includes comprehensive patient engagement through services such as remote counseling, medication adherence monitoring, and coordinated shipping logistics. These services enhance the experience for patients managing long-term prostate cancer therapy outside of hospital settings. Market participants can capitalize on this trend by expanding their reach through specialty pharmacy networks, implementing telepharmacy support, and integrating patient assistance tools that align with payer and provider expectations for home-based oncology care.

Key U.S. Erleada Company Insights

Janssen Biotech, Inc. holds a leading position in the United States market, supported by its established oncology infrastructure and continued investment in clinical research. The company’s strategic focus includes strengthening its evidence base through real-world data initiatives central to payer negotiations and guideline reinforcement. The 2019 FDA approval for Erleada’s use in metastatic castration-sensitive prostate cancer (mCSPC) expanded its U.S. market applicability and has since contributed to broader prescribing across urology and oncology practices. Janssen’s extensive provider outreach and patient support programs further reinforce its brand preference among prescribers.

While Janssen remains dominant, competitive dynamics are shifting with the March 2025 FDA approval of Zydus Lifesciences’ 60 mg apalutamide tablets. Despite the regulatory clearance, commercial entry is expected to be delayed due to patent protections covering key formulations until 2040. Generic manufacturers preparing for entry focus on establishing cost-efficient supply chains and navigating exclusivity barriers. In the near term, Janssen’s market leadership is expected to continue, anchored by clinical credibility and established healthcare system relationships. However, long-term market evolution will depend on how innovators and generic entrants manage the tension between clinical differentiation and affordability within U.S. healthcare systems.

Key U.S. Erleada Companies:

- Janssen Biotech, Inc.

- Zydus Lifesciences

Recent Developments

-

In March 2025, Zydus Lifesciences received final FDA approval to manufacture and market a generic version of apalutamide 60 mg tablets, the active ingredient in Erleada, for treating metastatic castration-sensitive prostate cancer (mCSPC). This approval marks the first FDA-approved generic of Erleada, although Janssen’s patents on apalutamide are expected to delay the generic’s commercialization despite the regulatory nod.

-

In May 2025, Janssen announced updated results from the ongoing Phase 3 PRESTO study evaluating Erleada plus androgen deprivation therapy (ADT) in patients with high-risk biochemically relapsed prostate cancer (BRPC) following radical prostatectomy. The study, involving over 500 patients, showed that Erleada plus ADT significantly improved progression-free survival compared to ADT alone, with manageable safety and quality-of-life profiles.

Erleada Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,425.20 million

Revenue forecast in 2033

USD 2,531.37 million

Growth rate

CAGR of 7.44% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, distribution channel

Country scope

U.S.

Key companies profiled

Janssen Biotech, Inc.; Zydus Lifesciences

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Erleada Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. Erleada market report based on type and distribution channel:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Branded

-

Generic

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. Erleada market size was estimated at USD 1.28 billion in 2024 and is expected to reach USD 1.43 billion in 2025.

b. The U.S. Erleada market is expected to grow at a compound annual growth rate of 7.44% from 2025 to 2033 to reach USD 2.5 billion by 2033.

b. Based on type, the branded segment dominates the U.S. Erleada market with 100% of total revenue share, driven by Johnson & Johnson’s strong patent protection and established clinical reputation.

b. In the United States, Janssen Biotech, Inc. holds a leading position in the Erleada market, supported by its established oncology infrastructure and continued investment in clinical research.

b. The U.S. Erleada market is primarily driven by rising prostate cancer prevalence, increasing adoption of novel hormonal therapies, and favorable reimbursement policies. The market is concentrated in urban healthcare centers with advanced oncology facilities, while rural areas show potential for growth due to improving access.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.