- Home

- »

- Healthcare IT

- »

-

U.S. And Europe Cleanrooms Market Share Report, 2030GVR Report cover

![U.S. And Europe Cleanrooms Market Size, Share & Trends Report]()

U.S. And Europe Cleanrooms Market Size, Share & Trends Analysis Report By End-use (Hospitals, Compounding Pharmacies), By Region (U.S., Europe), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-613-4

- Number of Report Pages: 66

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

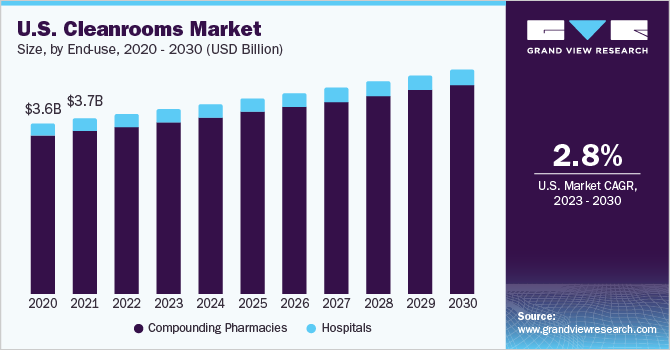

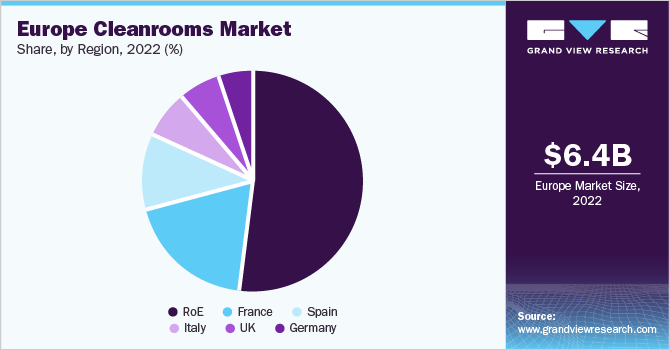

The U.S. and Europe cleanrooms market size was estimated at USD 6.37 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 2.7% from 2023 to 2030. Growing government regulations for sterile & hazardous drug compounding, especially in the U.S., and increasing incidence of Hospital-acquired Infections (HAIs) are some of the key factors boosting demand for cleanrooms in hospitals & compounding pharmacies. Moreover, technological advancements are also positively impacting the market growth over the forecast period.

In the U.S., market penetration in compounding pharmacies is high due to regulations such as USP 797 and USP 800. According to the Pharmacy Purchasing and Products report published in 2022, compounding sites reported 75% compliance with USP 797 standards, and about 47% of compounding sites were compliant with the newly proposed USP 800 standards. Thus, stringent regulations for drug compounding contribute to market growth.

The growing incidence of hospital-acquired infections (HAIs) is one of the major factors boosting demand from hospitals. According to a report by the Centers for Disease Control and Prevention (CDC), there were nearly 722,000 HAIs in the U.S. Similarly, according to the data published by the National Institute for Health and Care Excellence, in England, about 300,000 patients contract HAIs every year due to care within the National Health Service.

Modular cleanrooms are replacing conventional cleanrooms owing to their advanced features, such as low cost of installation, ease of mobility, and flexibility. They provide intrinsic versatility, as they can be assembled, disassembled, and relocated. In September 2022, Guardtech Cleanrooms Ltd expanded its CleanCube Mobile Cleanrooms range by launching three new models CleanCube Equip, CleanCube Bio, and CleanCube Pharma.

There are several benefits associated with modular cleanrooms, which include fast installations and reconfiguration based on requirements. Furthermore, modular cleanrooms in pharmaceutical compounding provide flexibility and cost-effectiveness while enabling compliance with regulation and maintaining contamination control for high-quality medications.

Many prominent companies are engaging in developing modular cleanrooms. For instance, North Central Instruments (NCI) offers a range of these in softwall and hardwall configurations. Their adoption is high in compounding pharmacies as compared to hospitals.

End-use Insights

The compounding pharmacies segment accounted for the largest revenue share of 92.9% in 2022 and is expected to grow at the fastest CAGR of 2.8% during the forecast period. Pharmacies involved in compounding sterile and hazardous drugs are required to meet certain cleanliness standards. The abovementioned factors have led to increased penetration in compounding units. Growing demand is driving prominent players to develop cleanrooms for compounding pharmacies. For instance, Terra Universal, Inc. offers FDA-accredited cleanrooms under its All-Steel Pharmaceutical Cleanrooms range. The product line includes USP 797 BioSafe and USP 800 BioSafe All-Steel Cleanrooms, along with USP 797 and USP 800 Hardwall Cleanrooms.

The hospital segment held a considerable market share in 2022. Hospital laboratories process biological samples such as urine, serum, plasma, & tissue. It is essential to keep these instruments contamination-free for executing accurate processing of a sample. In such laboratories, the presence of a clean environment is crucial. Factors such as growing cases of HIAs and increasing adoption in oncology, burn & operating units, and gene therapy departments within the hospital facilities contribute toward segment growth.

Regional Insights

The U.S. dominated the market and accounted for the largest revenue share of 58.8% in 2022 and it is also expected to grow at the fastest CAGR of 2.7% during the forecast period. Well-established healthcare infrastructure and a large number of cleanroom providers in the country contribute toward increased market share. In addition, the growing number of hospital admissions also propels the market. It is estimated that around 34 million hospital admissions were reported in 2023. Moreover, the increasing prevalence of HIAs also boosts demand. According to the CDC, HIAs account for almost 1.7 million infections each year in the U.S.

Europe is expected to witness a lucrative CAGR over the forecast period. Europe’s cleanroom market is majorly fueled by high healthcare expenditure and the presence of well-developed healthcare infrastructure, especially in Western Europe. Favorable government initiatives toward infection control and healthcare infrastructure improvements are among the few factors responsible for the increase in demand for cleanrooms. In addition, the rising prevalence of nosocomial infections is one of the major factors boosting demand among hospitals in the region. According to a report by World Health Organization (WHO), 8.9 million healthcare-acquired infections occur annually in the European Region.

Key Companies & Market Share Insights

The market comprises a large number of participants accounting for a majority of the market share. Product up-gradation, new launches, geographical expansions, and merger and acquisition are some of the key strategies adopted by these players to gain a competitive edge. For instance, in November 2022, Mecart launched its new production facility in Greenville, South Carolina, thereby expanding its production capabilities in the U.S. market. Furthermore, in May 2022, G-CON supplied the cleanroom infrastructure to CytoImmune Therapeutics, Inc. In addition, in January 2022, Angstrom Technology completed the acquisition of UK-based Connect 2 Cleanrooms. The acquisition will aid the company in global expansion. Some prominent players in the U.S. and Europe cleanrooms market include:

-

ISOLTECH Srl

-

ALLIED CLEANROOMS

-

Angstrom Technology

-

Nicomac Srl

-

Terra Universal, Inc.

-

MECART

-

Clean Room Depot

-

Clean Air Products

-

Asgatech Holding Ltd.

U.S. And Europe Cleanrooms Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.54 billion

Revenue forecast in 2030

USD 7.93 billion

Growth rate

CAGR of 2.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, region

Regional scope

U.S.; Europe

Country scope

U.S.; UK; Germany; France; Italy; Spain; RoE

Key companies profiled

ISOLTECH Srl; ALLIED CLEANROOMS; Angstrom Technology; Nicomac Srl; Terra Universal, Inc.; MECART; Clean Room Depot; Clean Air Products; Asgatech Holding Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. And Europe Cleanrooms Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. and Europe cleanrooms market report based on end-use and region:

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Compounding Pharmacies

-

Hospitals

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Frequently Asked Questions About This Report

b. The U.S. and Europe cleanrooms market size was estimated at USD 6.37 billion in 2022 and is expected to reach USD 6.54 billion in 2023.

b. The U.S. and Europe cleanrooms market is expected to grow at a compound annual growth rate of 2.8% from 2023 to 2030 to reach USD 7.93 billion by 2030.

b. Compounding pharmacies dominated the U.S. and Europe cleanrooms market with a share of 92.9% in 2022. This is attributable to the presence of stringent regulations for drug compounding, which has increased the penetration of cleanrooms in compounding pharmacies.

b. Some key players operating in the U.S. and Europe cleanrooms market include Mecart, Clean Air Products, Terra Universal, and Nicomac Srl.

b. Key factors that are driving the market growth include growing presence of stringent regulations for sterile compounding of hazardous drugs, increasing incidence of Hospital-acquired Infections (HAIs) and technological advancements in cleanrooms.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."