- Home

- »

- Pharmaceuticals

- »

-

U.S. And Europe Pharmaceutical Manufacturing Market Report, 2030GVR Report cover

![U.S. And Europe Pharmaceutical Manufacturing Market Size, Share & Trends Report]()

U.S. And Europe Pharmaceutical Manufacturing Market (2023 - 2030) Size, Share & Trends Analysis Report By Product Type, By Type, By Drug Development Type, By Formulation, By Routes of Administration, And Segment Forecasts

- Report ID: GVR-4-68040-027-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

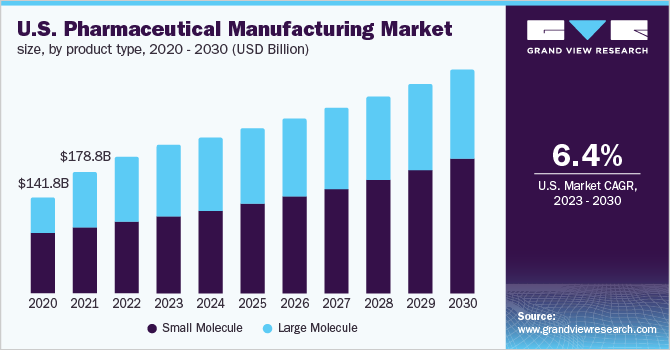

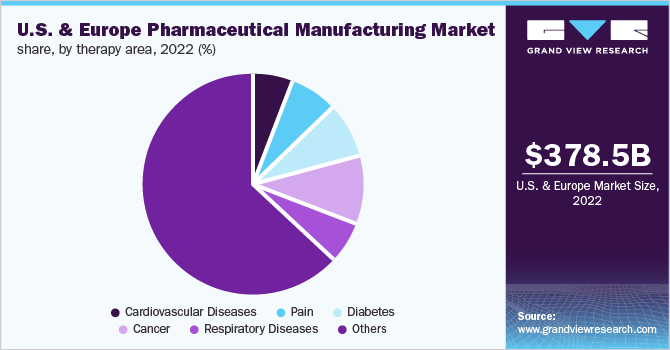

The U.S. and Europe pharmaceutical manufacturing market was valued at USD 378.51 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.81% from 2023 to 2030. The introduction of novel technologies, adoption of more efficient & cost-effective manufacturing processes, increasing investment by key pharmaceutical manufactures, and a large number of pharmaceutical manufacturing plants in the region are expected to increase the market growth. Moreover, the shift in paradigm toward data-rich, smart, paperless, integrated operations, and increasing penetration of automation & artificial intelligence has led to precise & efficient manufacturing. Such ongoing developments and progress have transformed the U.S. & Europe pharmaceutical manufacturing industry.

The rise in R&D spending by pharmaceutical companies is escalating the pharmaceutical manufacturing market expansion. Pharmaceutical manufacturers are investing heavily to cut down expenses, accelerate the speed of production, maintain high quality, and engage in the development of novel products. It is reported that in 2021, the 15 largest pharmaceutical companies invested around USD 133 billion in R&D. For instance, in 2021, Pfizer, Inc. spent 17.0% of its revenue on R&D. Similarly, F. Hoffmann-La Roche Ltd. spent around 27.1% of its revenue on R&D in 2021. On the other hand, small-sized companies have less revenue generation; therefore, they often spend significantly higher amounts of their budget on R&D.

Pharmaceutical companies are being encouraged to streamline their processes and reduce the costs of drug development and manufacturing processes. Thus, companies are optimizing complex processes by adopting cloud computing and AI technologies. For instance, in April 2022, Sanofi announced a partnership with McLaren to develop advanced pharmaceutical manufacturing sites in many countries. Thus, advancements in pharmaceutical manufacturing technologies and optimization of processes are facilitating the market growth.

Moreover, the surge in new product approvals by regulatory authorities is anticipated to facilitate the U.S. & Europe pharmaceutical manufacturing market. For instance, in 2021, the CDER, a division of the U.S. FDA approved around 50 new drugs under New Drug Applications and Biologics License Applications (BLAs). The approval of novel drugs is expected to increase the demand for CMOs in the U.S. and Europe. Moreover, the increasing number of clinical trials to develop new therapeutic drugs have created potential growth opportunities for the market. For instance, according to the U.S. National Library of Medicine, around 31% of trials are being conducted in the U.S. only.

Mergers & acquisitions in the pharmaceutical industry have grown in the past few years. For instance, in April 2022, FUJIFILM Diosynth Biotechnologies acquired Atara Biotherapeutics, Inc.’s cell therapy manufacturing facility. This would further strengthen the company’s product portfolio. Similarly, in August 2020, Catalent, Inc. signed an agreement with AstraZeneca to further support the manufacturing of AstraZeneca’s COVID-19 vaccine, AZD1222. This is aimed to increase the company’s revenue generation. Moreover, pharmaceutical companies are collaborating with contract manufacturing organizations to outsource the production of pharmaceutical products.

Product Type Insights

The small molecule segment held the largest share in 2022 and is anticipated to grow at a lucrative rate during the projected period. High consumption volume of conventional drugs, rapid advancements in pharmaceutical research, and increasing approvals of novel small molecules is fueling the segment uptake. For instance, the U.S. FDA approved 32 small molecules in 2021.

Moreover, market players are actively engaged in the expansion of their manufacturing services to fulfill the market demand. For instance, in April 2021, Lonza announced the construction of a new small molecule manufacturing complex in Europe. Similarly, in September 2021, AstraZeneca established a next-generation API facility in Europe for small molecules. This expansion aims to develop and commercialize new medicines, thereby expanding the company’s supply network.

Whereas, in recent years, large molecules such as biosimilars, biologics, vaccines, and others are gaining momentum owing to their promising effect on cancer, autoimmune diseases, and other diseases. For instance, in the last two years, the market share of large molecules has increased significantly due to the increasing production of COVID-19 vaccines. In addition, due to innovative approaches and substantial investments, large molecules are attaining significant traction. In 2021, the top-selling drugs in the U.S. and Europe were biosimilars and biologics such as Comirnaty COVID-19 vaccine, Humira, Keytruda, Revlimid, and others

Drug Development Type Insights

The outsource segment dominated the market and is anticipated to grow at the fastest rate during the forecast period. Various benefits such as cost-effectiveness and better production facilities enabling outsourced manufacturers are anticipated to propel the segment at a rapid pace. Outsourcing service reduces drug development costs, minimizes investment, and boosts the efficiency of the manufacturing procedure.

Moreover, the rising demand for customized products, the rising need for enhanced productivity, and continuous pressure from regulatory authorities on medicine pricing have forced the majority of drug makers to depend on CMOs to produce medicinal products.

However, the in-house type of drug production allows key companies to have better control over the quality and quantity of the products. It allows companies to easily change the scope, adjust timelines, and alter the volume of drug products according to the demand in the market. Moreover, the production of drugs in their facilities keeps the intellectual property of the company safe, thereby minimizing the risk of critical product information loss.

Route of Administration Insights

In 2022, the oral segment held the largest market share owing to the high availability of top selling oral preparations and high consumption rate of oral formulations. In addition, the oral dosage form is the most convenient, safe, and affordable approach. A wide variety of drugs can be administered orally, such as tablets, liquids, chewable tablets, elixirs, effervescent powders, and capsules. In addition, the development of controlled-release formulations to minimize the frequency of dosing and enhanced patient compliance boosts segment growth.

A significant increase in the adoption of automated systems & barrier systems, including restricted access barrier systems (RABS), isolators, and closed RABS, in parenteral manufacturing, is expected to boost the parenteral segment growth at the fastest CAGR over the forecast period. Moreover, the introduction of a wide range of innovative packaging styles, such as ready-to-fill syringes, cartridges, and vials, has significantly transformed the parenteral manufacturing sector. For instance, in May 2022, Terumo Pharmaceutical Solutions launched a prefilled polymer syringe for low-dose applications such as ophthalmic formulations.

Formulation Insights

Tablet segment held the leading share of the market in 2022 and its high market share is due to factors such as wide acceptance of tablets by both patients & physicians, ease of manufacturing, and continuous advancements in the pharmaceutical sector that have resulted in the development of tablets with desired properties. In addition, the advent of 3D-printed tablets designed for personalized needs also augments segment growth. For instance, in February 2020, Merck announced a partnership with AMCM to conduct clinical testing on 3D-printed tablets.

Moreover, the injectable segment held the second-largest share in 2022. The increase in product approvals for auto-injectors, prefilled syringes, and biologics can be attributed to an estimated growth rate. In addition, pharmaceutical product manufacturers are increasingly using injection systems for the treatment of several diseases. For instance, in April 2022, Consegna Pharma acquired Fathom Pharma to expand its injectable online portfolio, to offer treatment for chronic pain in terminally sick patients.

The sprays segment is anticipated to expand at a lucrative growth rate in the coming years. The increasing availability of these formulations, cosmeceutical appearance, flexibility in dosage design, and low irritation to the skin are some of the advantages escalating segment uptake over the forecast period.

Prescription Requirements Insights

Prescription medicines accounted for the highest market share and are anticipated to expand at a compound annual growth rate of 6.19% during the forecast period. The increasing reimbursement for prescription drugs, rising sales of prescription medicines, and surge in approval of prescription drugs is anticipated to propel segment expansion. For instance, in 2020, the U.S. FDA approved 20,000 prescription drugs for marketing and about 66% of U.S. adults take prescription drugs.

The increasing demand for self-medication and cost-effective treatment is supporting the OTC drugs segment growth over the forecast period. In addition, factors like penetration of generics, rising consumer awareness, favorable government initiatives, and entry of local manufacturers are also driving segment uptake. According to the Consumer Healthcare Products Association (CHPA), there are around 80 therapeutic categories of over-the-counter drugs ranging from dermatology applications, weight control drugs, cold & cough, and others.

Age Type Insights

An increase in the geriatric population along with rising life expectancy drives the demand for pharma products and this is responsible for higher revenue share of the geriatric segment. The geriatric population is at higher risk of developing chronic and life-threatening diseases. Around 80% of the adult population over 65 years suffers from at least one chronic disorder. Chronic obstructive pulmonary disease (COPD), Alzheimer’s disease, dementia, depression, heart failure, chronic kidney diseases, diabetes, ischemic heart diseases or coronary heart diseases, arthritis, high cholesterol, and hypertension are among the few common medical conditions reported in the geriatric population.

The adult segment held a significant revenue share of the market. The high incidence of lifestyle-associated and chronic disorders in the adult population coupled with increasing awareness about early treatment of diseases among adults are supporting segment expansion. Moreover, the rise in overall spending on drugs per person has increased, which further drives segment growth.

Sales Channel Insights

The retail segment dominated the U.S. and Europe pharmaceutical manufacturing market in 2022 due to the rising penetration and generics and OTC medications owing to their cost effectiveness fueled the demand for retail segment. Moreover, retail pharmacies are collaborating with health professionals and healthcare facilities to improve clinical outcomes and remain competitive with other businesses in the market. For instance, in June 2022, LloydsPharmacy expanded its partnership with Deliveroo to include additional 150 Lloyds stores in the collaboration.

The non-retail segment is anticipated to exhibit a significant growth rate during the forecast period. Hospital pharmacies and other research & institutional drug suppliers are some of the non-retail pharmacies. Factors like high hospital admissions owing to high disease burden, favorable reimbursement policies, increasing research activities, and rapid penetration of online pharmacies are contributing to the growth of non-retail segment.

Therapy Area Insights

The cancer segment captured a significant revenue share in 2022 and is anticipated to hold a lucrative share during the projected period. Increased prevalence of cancers, high cost of production of cancer drugs, and increasing approval of novel products are anticipated to support the segment share. In addition, many clinical tests related to immune-oncology and surge in healthcare spending on cancer treatment also contributed to the segment growth.

Factors such as high burden of respiratory disorders like pneumonia, COVID-19, COPD, asthma, and other infectious diseases are contributing to the lucrative growth rate of the respiratory disease segment. In addition, the rising efforts from the leading market participants to develop therapeutics for respiratory conditions is escalating the segment uptake. For instance, in March 2021, VeriSIM Life launched its pharmaceutical subsidiary PulmoSIM Therapeutics to address unmet needs in the management of respiratory conditions.

Regional Insights

The U.S. led the overall market due to the presence of many strong market players coupled with various strategic initiatives undertaken by them in the country. Moreover, the strategic pharma collaborations among well-established and emerging participants also fuels the region’s expansion. In addition, high R&D expenditures, large number of drug efficacy studies conducted, and the presence of a large number of CMOs are supporting the country’s high market.

Also, the country has favorable government policies for the pharmaceutical sector and supportive domestic environment for the commercialization of new therapeutics. For instance, in April 2022, BeiGene Ltd., a global biotechnology company, established a new manufacturing and clinical R&D center in New Jersey.

Europe region is projected to witness the fastest growth rate over the forecast period. The higher investments from multinational companies in the region, increasing adoption of outsourced services, and supportive regulatory framework are expected to drive the market over the forecast period. In addition, rising demand for innovative therapeutics and constant research activities in the region is anticipated to cater to lucrative demand for Europe.

Key Companies & Market Share Insights

Key players are adopting strategies such as new product development, merger & acquisition, and partnership to increase their market share. Market players such as Pfizer Inc., Novartis AG, F. Hoffmann-La Roche Ltd, and others are actively involved in pharmaceutical manufacturing in U.S. and Europe. For instance, in November 2021, Sanofi announced the acquisition of Kadmon Holdings, Inc. This acquisition enabled the company to strengthen its general medicines portfolio. Some prominent players in the U.S. & Europe pharmaceutical manufacturing market include:

-

AbbVie Inc

-

Novartis AG

-

F. Hoffmann-La Roche Ltd

-

Merck & Co., Inc

-

Johnson & Johnson Services, Inc

-

GSK plc

-

Sanofi

-

Lonza

-

Samsung Biologics

-

Lily

- Pfizer,Inc

U.S. And Europe Pharmaceutical Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 412.50 billion

Revenue forecast in 2030

USD 641.22 billion

Growth rate

CAGR of 6.81% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, drug development type, formulation, therapy area, route of administration, prescription requirements, age type, sales channel, region

Regional scope

U.S.; Europe

Country scope

U.S.; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway

Key companies profiled

Pfizer Inc.; Novartis AG, F. Hoffmann-La Roche Ltd; Merck & Co., Inc.; Johnson & Johnson Services, Inc.; GSK plc; Sanofi; AbbVie Inc.; Lonza; Samsung Biologics; Lily

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. And Europe Pharmaceutical Manufacturing Market Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the U.S. and Europe pharmaceutical manufacturing market report on the basis of product type, drug development type, route of administration, formulation, therapy area, prescription requirements, age type, sales channel, and region:

-

Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Molecule

-

Monoclonal Antibodies

-

Vaccines

-

Cell & Gene Therapy

-

Others

-

-

Small Molecule

-

-

Drug Development Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Outsource

-

In-house

-

-

Formulation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tablets

-

Capsules

-

Injectables

-

Sprays

-

Suspensions

-

Powders

-

Others

-

-

Route of Administration Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oral

-

Topical

-

Parenterals

-

Inhalations

-

Others

-

-

Therapy Area Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cardiovascular Diseases

-

Pain

-

Diabetes

-

Cancer

-

Respiratory Diseases

-

Others

-

-

Prescription Requirements Outlook (Revenue, USD Billion, 2018 - 2030)

-

Prescription Medicines

-

Over-the-counter (OTC) Medicines

-

-

Age Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Children & Adolescents

-

Adults

-

Geriatric

-

-

Sales Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail

-

Non-retail

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

U.S.

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Frequently Asked Questions About This Report

b. The U.S. and Europe pharmaceutical manufacturing market size was estimated at USD 378.51 billion in 2022 and is expected to reach USD 412.50 billion in 2023.

b. The U.S. and Europe pharmaceutical manufacturing market is expected to grow at a compound annual growth rate of 6.81% from 2023 to 2030 and is expected to reach USD 641.22 billion by 2030.

b. The small molecule segment is expected to dominate the U.S. and Europe pharmaceutical manufacturing market with a share of 52.13% in 2022 due to the high prescription rate and market players’ activities to expand their manufacturing services in these regions.

b. Some key players operating in the U.S. and Europe pharmaceutical manufacturing market include AbbVie Inc, Novartis AG, F. Hoffmann-La Roche Ltd, Merck & Co., Inc, Johnson & Johnson Services, Inc, GSK plc, and Sanofi among others.

b. Introduction of novel technologies in pharmaceutical production, increasing investment by key players, and increasing approval of novel products are the major factors driving the U.S. and Europe pharmaceutical manufacturing market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.