- Home

- »

- Medical Devices

- »

-

U.S. External Analgesics Market Size, Industry Report, 2030GVR Report cover

![U.S. External Analgesics Market Size, Share & Trends Report]()

U.S. External Analgesics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Hot/Cold Products, Kinesiology Tape, TENS Devices, and Infrared Therapy Products), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-093-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

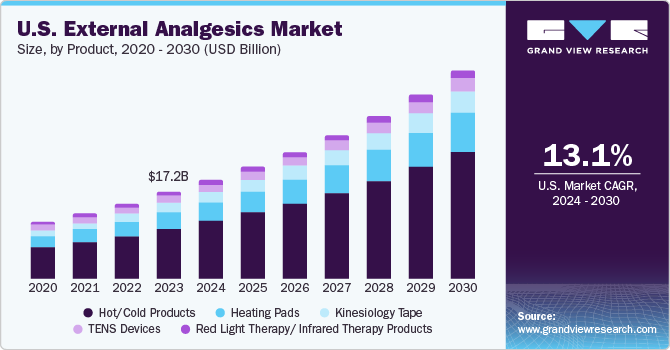

The U.S. external analgesics market size was estimated at USD 2.78 billion in 2023 and is projected to grow at a CAGR of 13.1% from 2024 to 2030. The market is driven by the increasing incidence of chronic & lifestyle diseases, rising incidence of muscle pain & strain due to sports and recreational activities, leading to a higher demand for external analgesics. In addition, growing investments from private and government organizations in pharmaceutical manufacturing and R&D activities for developing analgesic products are expected to influence market growth positively.

The growing incidence of chronic disorders is main factor contributing to the market growth. The increasing incidence of lifestyle-related conditions such as obesity and diabetes has led to a higher need for muscle & nerve stimulators. For instance, according to the Diabetes Research Institute Foundation, diabetes affects a significant portion of the U.S. population, affecting 37.3 million individuals, equivalent to 11.3% of the population, have diabetes. Patients tend to have diabetic neuropathy, making the disease one of the primary reasons for using electrical stimulators devices such as TENS Devices. In addition, rising incidence of sports accidents or equipment exercise injuries in sports is also driving the market growth. For instance, in 2022 the National Safety Council (NSC), highlighted that the exercise equipment injuries accounted for about total 445,642 injuries in the U.S., the most number of in sports and recreation category.

The growing geriatric population suffering from incurable health issues, such as joint pain, muscle pain, migraines, and muscle strains has accelerated the demand for pain treatment therapies.In 2022, according to migraine epidemiology by gender, migraines are more frequent in women, with 17.0% of women reporting a migraine attack compared to 6.0% of men, every year. This demand has led to the utilization of various types of pain-relief medications, consequently driving market expansion in the various regions.

The incidence of musculoskeletal disorders, such as arthritis, osteoarthritis, orthopedic degenerative disorders, and rheumatoid arthritis, is significantly increasing. For instance, in June 2023 according to data published by CDC, about 1 in 5 adults in the U.S., totaling around 53.2 million individuals, are affected by some form of arthritis. Among the various types of arthritis, osteoarthritis (OA) is the most commonly diagnosed arthritis, accounting for more than 32.5 million individuals in the country. In January 2024, according to the Population Reference Bureau (PRB), the number of people aged 65 and above is expected to reach 82 million in 2050 (a 47% growth) from nearly 58 million in 2022, which accounts nearly for 23% share of the country’s population.

The rising number in population susceptible to arthritis, which together drives the demand for external analgesics in treatment of chronic pain caused due to mild or severe arthritis. For instance, according to Arthritis & Rheumatology, around 78 million adults are expected to be diagnosed with arthritis by 2040 in the U.S. This has fueled the demand for pain management stimulators to help manage chronic pain. In addition, the demand for reduced hospital stays is increasing in the U.S., consequently, there is a growing focus on shifting certain treatments and services from inpatient to outpatient settings.

The COVID-19 pandemic has had far-reaching effects on the management of chronic pain and the U.S. market. The reduction of non-urgent procedures and the closure of specialty pain management centers disrupted patient care and increased home-based device usage which impacted the market growth. The shift toward telehealth and the increased demand for self-medication have influenced the choice of pain management methods, with medications gaining prominence over devices. Supply chain disruptions, e-commerce growth, and regulatory changes have also shaped the market landscape.

Market Concentration & Characteristics

The market for U.S. external analgesic is driven by technological advancements and innovative approaches with product approvals, clinical phase trials driving this evolution. Innovations in disposable hot/cold products, wireless app connected Transcutaneous Electrical Nerve Stimulation (TENS) and wearable TENS therapy devices aim to address unmet needs and provide targeted solutions for chronic pain, inflammation and pain management. Novel systems and pain management products support the expanding landscape of osteoarthritis management.

The U.S. market is characterized by a moderate level of merger and acquisition (M&A) activity by the key players. Many players in the market are involved in such strategies in order to expand clientele. For instance, in January 2024, Sun Pharma entered into a definitive merger for TARO Pharmaceutical, specializing in generic dermatology analgesics. Through this merger, the two companies would utilize their combined capabilities in developing enhanced patient care therapies for the U.S. market.

Regulations are crucial in shaping the U.S. market, as regulatory bodies may impose restrictions or guidelines on the types of material that can be used in external analgesics. FDA regulates pre-market clearance or approval, labeling requirements, and GMP standards for manufacturing particularly concerning safety and efficacy. In addition, manufacturers are required to report adverse events associated with their products, and the FDA may take regulatory action if safety concerns arise.

The presence of large manufacturing companies that produce and distribute analgesic devices such as heating pads, patches/wraps with heating/cooling properties are increasing to counter pain.

Product Insights

The hot/cold products segment led the market with the largest revenue share of 58.3% in 2023 and is expected to grow at the fastest CAGR over the forecast period. Growth of the segment can be attributed to its effectiveness in providing relief for a wide range of pain conditions. Adoption of hot and cold therapies has increased in the long-term treatment of chronic pain diseases, such as arthritis, lower back pain, and others. The hot/cold product segment also has the advantage of being non-invasive and easy to use, making hot/cold products a convenient pain management solution for individuals seeking non-pharmacological approaches. With the growing demand for natural and self-directed pain management solutions, hot/cold products are expected to continue to dominate the U.S. market.

The kinesiology tape (KT) segment is anticipated to grow at a significant CAGR over the forecast period. It is a specialized adhesive tape that has gained significant popularity in the field of sports medicine and rehabilitation. KT is made from elastic cotton fabric with a wave-like acrylic adhesive, mimicking the properties of human skin. It further proves beneficial in alleviating both temporary and persistent pain, particularly in instances where the discomfort exceeds the expected severity of an injury. This versatile tape helps reduce swelling and inflammation, accelerates healing from bruises and contusions, and provides relief from muscle contractions and cramps.

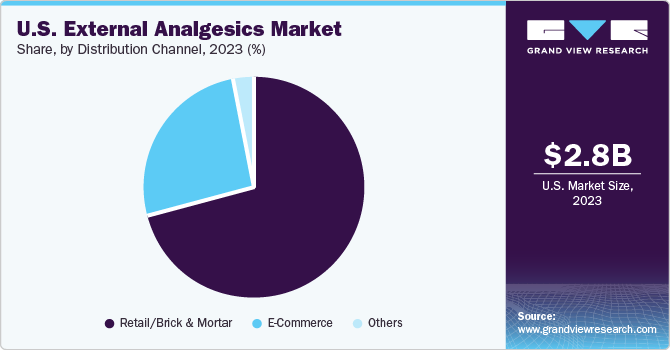

Distribution Channel Insights

Based on distribution channel, the retail/ brick & mortar segment led the market with the largest revenue share of 71.0% in 2023. This dominance is attributable to the established presence of physical stores that sell over-the-counter pain relief products for external use. In 2022, according to a report by Forbes, for the first time, traditional brick and mortar stores demonstrated a faster growth rate compared to e-commerce, with a 18.5% increase in physical store sales, while e-commerce expanded by 14.2%. Although this 14.2% growth is slightly higher than the usual annual growth rate, it is lower than in comparison to the 31.8% surge experienced by online retail in the previous year. Brick-and-mortar stores can adapt to local market trends and customer preferences more quickly than online retailers, which is one of the key factor for segment large market share.

The e-commerce segment is anticipated to grow at the fastest CAGR over the forecast period. Owing to the increasing adoption of e-commerce and the growth of online sales, retailers are now exploring omni-channel strategies to enhance their reach and better cater to the evolving needs and preferences of consumers. E-commerce allows analgesic manufacturers and retailers to reach a broader customer base beyond their local area, making their products accessible to a larger audience. E-commerce platforms allow customers to share their experiences and opinions about analgesic products, helping others make informed purchasing decisions.

Key U.S. External Analgesics Company Insights

Key participants in the U.S. market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key U.S. External Analgesics Companies:

- Baxter

- Boston Scientific Corporation

- Enovis

- Medtronic

- ICU Medical Inc.

- Abbott

- Stryker

- Nevro Corp.

- OMRON Healthcare, Inc.

Recent Developments

-

In November 2023, Nutriband Inc. introduced a new addition of Kinesiology Tape (pre-cut strips) to their Active Intelligence (AI Tape) brand portfolio. This innovative product combines the stretch, support, and advantages of traditional kinesiology tape with pain-alleviating ingredients that offer both heating and cooling sensations. These unique features are designed to provide temporary relief for minor muscle and joint aches and pains

-

In October, 2023, Kinesiology Tape Brand KT partnered with Boxout, a nationwide distributor in the sports medicine sector. Through this collaboration, they are introducing an exclusive KT Tape Pro for Sports Medicine Professionals. In addition, they aim to raise awareness about the KT Tape mobile application, which serves as a valuable tool for both sports medicine professionals and their users

-

In September 2023, Boston Scientific announced the acquisition of Relievant Medsystem Inc., based in U.S. for expanding its neuromodulation portfolio of Intracept Intraosseous Nerve Ablation System for providing novel treatment to treat chronic lower back pain

-

In July 2023, Motive Health, launched its Motive Knee, a muscle stimulation device approved by the US Food and Drug Administration (FDA) in U.S.This provides a non-invasive, non-opioid alternative for managing arthritis-induced knee discomfort. Its primary objective is to provide effective means of alleviating pain without requiring invasive procedures or relying on opioid-based treatments

-

In March 2022, Omron Healthcare started conducting research studies to evaluate the positive effectiveness of its Focus TENS (Transcutaneous Electrical Nerve Stimulation) therapy device (PM-710), used in reducing pain for individuals experiencing mild to moderate knee "wear and tear." This innovative product from OMRON aims to provide relief for those affected by this common condition

-

In February 2022, STRATA Skin Sciences unveiled its latest innovation, the XTRAC Momentum 1.0 excimer laser system and announced further first installation in the U.S. This advanced device is designed to provide targeted UVB light therapy for treating various inflammatory skin conditions, such as psoriasis, vitiligo, and atopic dermatitis, in both children and adults. By employing sophisticated excimer laser technology, the system delivers accurate and efficient treatment to specific skin areas, ultimately accelerating the healing process and enhancing overall effectivenes

U.S. External Analgesics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.18 billion

Revenue forecast in 2030

USD 6.66 billion

Growth rate

CAGR of 13.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Country scope

U.S.

Key companies profiled

Baxter; Boston Scientific Corporation; Enovis; Medtronic; ICU Medical Inc.; Abbott; Stryker; Nevro Corp.; OMRON Healthcare, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. External Analgesics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. external analgesics market report based on product and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hot/Cold Products

-

Disposable

-

Non-Disposable

-

-

Kinesiology Tape

-

Heating Pads

-

TENS Devices

-

Red Light Therapy/ Infrared Therapy Products

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail/Brick & Mortar

-

E-Commerce

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. external analgesics market size was valued at USD 2.78 billion in 2023 and is expected to reach USD 3.18 billion in 2024.

b. The U.S. external analgesics market is expected to expand at a compound annual growth rate (CAGR) of 13.1% from 2024 to 2030 to reach USD 6.66 billion in 2030.

b. The hot/cold products segment held the majority of the market share of 58.3% in the product segment in 2023. The segment is anticipated to witness remarkable growth during the forecast period. Growth of the segment can be attributed to its effectiveness in providing relief for a wide range of pain conditions.

b. Some of the prominent players in the market include: • Baxter • Boston Scientific Corporation • Enovis • Medtronic • ICU Medical Inc. • Abbott • Stryker • Nevro Corp. • OMRON Healthcare, Inc.

b. The market is driven by the increasing incidence of chronic & lifestyle diseases, leading to a higher demand for external analgesics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.