- Home

- »

- Medical Devices

- »

-

U.S. External Catheter Market Size, Industry Report, 2033GVR Report cover

![U.S. External Catheter Market Size, Share & Trends Report]()

U.S. External Catheter Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Self-adhesive, Non-adhesive), By Material (Silicone, Latex), By Gender (Male, Female), By End Use (Home Care, Hospitals), And Segment Forecasts

- Report ID: GVR-4-68040-679-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. External Catheter Market Summary

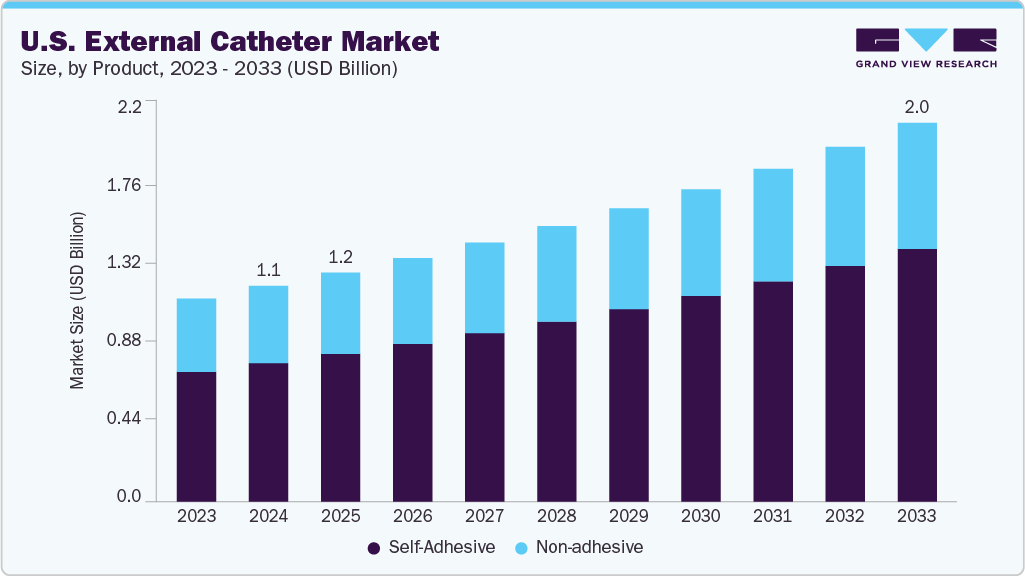

The U.S. external catheter market size was valued at USD 1,134.90 million in 2024 and is projected to reach USD 2,021.03 million by 2033, growing at a CAGR of 6.65% from 2025 to 2033. This growth is driven by the rising prevalence of urinary incontinence, increasing adoption of non-invasive urological solutions, and advancements in catheter design to improve patient comfort and reduce infection risks.

Key Market Trends & Insights

- Based on product, the self-adhesive segment led the market with the largest revenue share of 64.36% in 2024.

- Based on material, the silicone segment is expected to witness the fastest CAGR of 6.84% due to its superior biocompatibility, flexibility, and reduced risk of skin irritation compared to alternative materials.

- By gender, the male segment led the market with the largest revenue share in 2024.

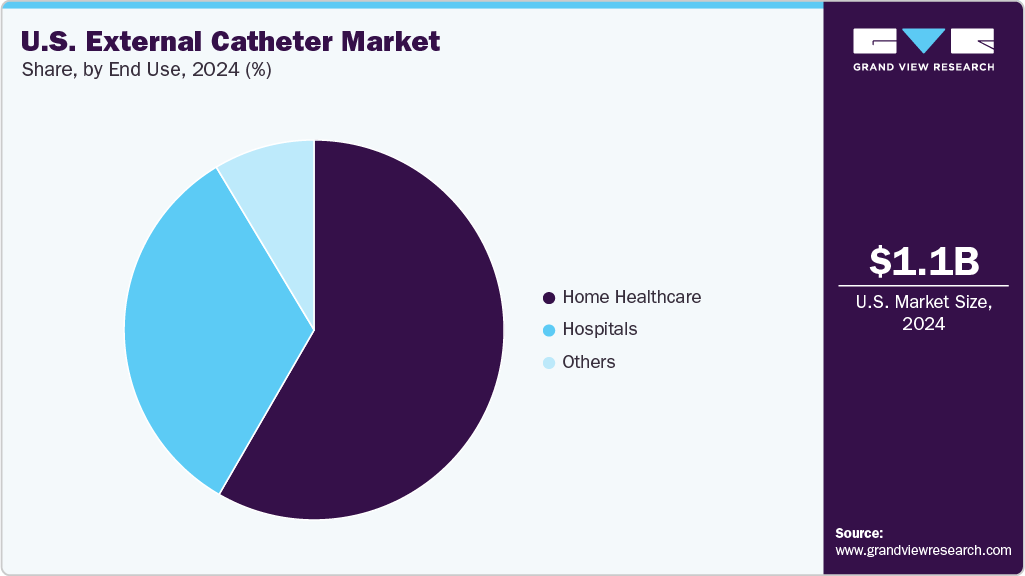

- By end use, the home healthcare segment led the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,134.90 Million

- 2033 Projected Market Size: USD 2,021.03 Million

- CAGR (2025-2033): 6.65%

In addition, the aging population and growing awareness of home-based care are contributing to increased demand for external catheters across the country. According to the data published by the Population Reference Bureau in January 2024, the number of Americans ages 65 and older is projected to increase from 58 million in 2022 to 82 million by 2050 (a 47% increase), and the 65-and-older age group’s share of the total population is projected to rise from 17% to 23%.

Growing awareness and prevention efforts for catheter-related infections drive the U.S. external catheter market. Healthcare-associated infections, particularly catheter-associated urinary tract infections, have been a long-standing concern in hospital and home care settings. In response, healthcare providers, public health agencies like the CDC, and catheter manufacturers focus on infection prevention through education, training, and safer, more hygienic products. External catheters, being non-invasive and less likely to introduce pathogens into the urinary tract than indwelling catheters, are gaining preference among clinicians and patients alike. This shift is further supported by updated clinical guidelines and infection control protocols that promote the use of external devices when appropriate.

Top 15 U.S. States by Inpatient Locations Reporting CAUTIs (2023)

Rank

State

No. of Acute Care Hospitals Reporting

Total Inpatient Locations

ICU Locations

Ward Locations

1

California

334

2,639

554

2,085

2

Texas

356

2,138

473

1,665

3

New York

178

1,801

372

1,429

4

Florida

226

1,959

405

1,554

5

Pennsylvania

189

1,508

263

1,245

6

Ohio

147

1,161

232

929

7

Illinois

133

1,010

198

812

8

Michigan

100

799

155

644

9

North Carolina

105

859

168

691

10

Georgia

110

855

183

672

11

New Jersey

71

652

129

523

12

Missouri

75

629

129

500

13

Indiana

93

581

108

473

14

Massachusetts

65

545

120

425

15

Louisiana

108

525

127

398

Source: CDC, National and State Healthcare-Associated Infections Progress Report, 2023

Increasing awareness of urinary incontinence is a key driver of the industry, as it leads to higher diagnosis rates, improved patient engagement, and a shift toward proactive condition management. Organizations and industry stakeholders are actively working to educate the public and reduce the stigma surrounding UI through awareness campaigns, caregiver training, and community outreach programs. These efforts have encouraged more individuals, particularly older adults, post-surgical patients, and those with chronic conditions-to seek medical help and explore non-invasive management options like external catheters.

For instance, in May 2025, the National Association for Continence (NAFC) launched a nationwide awareness initiative titled “We Count,” focused specifically on Stress Urinary Incontinence (SUI). Running throughout May and June, the campaign aims to:

-

Educate the public about what SUI is and its underlying causes.

-

Encourage women to consult healthcare providers regarding their symptoms.

-

Elevate awareness around the mental health impacts of SUI, such as isolation and reduced self-esteem.

-

Engage women through digital resources, including symptom checkers, treatment options, and wellness strategies.

“We want women to know: You’re not alone, and your condition is treatable. By launching the We Count campaign, we are breaking the silence around incontinence, particularly SUI, and empowering women to reclaim their quality of life,” said Sarah Jenkins, Executive Director of NAFC.

The rising prevalence of Alzheimer’s and Parkinson’s diseases in the U.S. is significantly driving the demand for external catheters, especially in long-term care and home care settings. Both neurodegenerative conditions commonly impair bladder control due to the progressive loss of motor function and cognitive decline. As a result, patients with Alzheimer’s or Parkinson’s often experience urinary incontinence, increasing their reliance on urinary management products like external catheters. External catheters are preferred for these patients because they are non-invasive, more comfortable, and pose a lower infection risk than indwelling catheters. Caregivers and healthcare providers often choose external catheters to maintain hygiene, improve patient comfort, and reduce the risk of catheter-associated urinary tract infections, which are particularly dangerous in elderly and immunocompromised individuals.

-

According to the Alzheimer's Association 2025, an estimated 7.2 million Americans aged 65 and older are projected to be living with Alzheimer’s dementia in 2025.

-

74% of those affected are aged 75 or older.

-

Among the total U.S. population: Approximately 1 in 9 people (11%) aged 65 and older have Alzheimer’s dementia.

-

33.4% of people aged 85 and older are affected.

-

According to the Parkinson's Foundation, an estimated 1.1 million people in the U.S. are currently living with Parkinson's disease, a number projected to rise to 1.2 million by 2030.

Market Characteristics & Concentration

The market growth stage is high, and the pace of the market growth is accelerating. The U.S. industry for external catheters is characterized by increasing cases of chronic diseases, growing prevalence of urinary incontinence among women, coupled with growing demand for discreet and convenient urinary management solutions for women.

The industry has witnessed a moderate to high degree of innovation in recent years. The market has seen the introduction of new products with advanced features, improved designs, and enhanced materials, which have significantly impacted the industry. One of the key drivers of innovation is the increasing demand for discreet and comfortable products that cater to the specific needs of women with urinary incontinence. As a result, manufacturers have developed products with ergonomic designs, soft and breathable materials, and advanced drainage systems.

The industry has seen moderate to high M&A activity as companies aim to expand product portfolios, acquire innovative technologies, and strengthen distribution networks. These strategic moves enhance competitiveness, accelerate innovation, and support market consolidation. For instance, in January 2022, VitalPath-a developer of custom, highly complex catheter solutions-acquired Modern Catheter Technologies (ModernCath), a Minnesota-based manufacturer of advanced catheter delivery systems. This acquisition expands VitalPath’s manufacturing footprint to over 80,000 sq ft, including 35,000 sq ft of ISO 7 and 8 cleanroom space.

Regulations are crucial in shaping the development, approval, marketing, and post-market surveillance of external catheters in the U.S. The FDA classifies most external urinary catheters as Class II medical devices requiring a 510(k) premarket notification. This regulatory pathway ensures that new products are safe and effective, encouraging innovation by allowing manufacturers to demonstrate substantial equivalence to existing devices. Stringent quality control standards under the FDA’s Quality System Regulation (QSR) mandate that manufacturers maintain concentrated design, production, and labeling practices.

Product expansion is a key growth strategy in the U.S. external catheter market, driven by increasing patient demand for comfort, hygiene, and disease-specific solutions. Leading manufacturers continuously broaden their product portfolios to cater to diverse user needs across gender, age, and care settings (home care, hospitals, and long-term care).

Regional expansion within the industry is being driven by increased healthcare access, aging demographics, and the rising prevalence of chronic conditions such as urinary incontinence, Alzheimer’s disease, and Parkinson’s disease. While traditionally concentrated in urban centers and extensive healthcare facilities, manufacturers and distributors focus on penetrating underserved and rural regions, where demand for home-based and long-term care solutions is growing.

Product Insights

Self-adhesive external catheters dominated the market in 2024 due to their ease of use, comfort, and ability to provide secure placement without the need for straps or adhesives applied separately. These catheters are particularly favored in home and long-term care settings, where patients or caregivers require quick and hygienic application. The self-adhesive design minimizes skin irritation, leakage, and dislodgement-critical issues for users with limited mobility or chronic incontinence. Manufacturers continue improving adhesive formulations to offer better skin compatibility and durability, further supporting widespread adoption.

The non-adhesive segment is projected to grow at a significant CAGR during the forecast period, driven by its suitability for patients with sensitive or fragile skin, such as elderly individuals or dermatological conditions. These catheters are often used in clinical settings where medical staff can ensure secure application using external securing devices. Rising awareness about skin safety and the growing prevalence of pressure injuries from adhesive use are pushing healthcare providers to consider non-adhesive alternatives. As product innovation and material quality improve, the non-adhesive segment is expected to gain greater traction, especially in specialized and acute care scenarios.

Material Insights

Silicone dominated the market in 2024, owing to its superior biocompatibility, flexibility, and reduced risk of allergic reactions. Silicone catheters are preferred in both hospital and homecare settings because they are soft on the skin, breathable, and capable of maintaining adhesion without irritating. Their non-reactive nature makes them ideal for long-term use, especially in elderly and chronically ill patients. Moreover, silicone's ability to maintain structural integrity over extended periods enhances patient comfort and reduces the frequency of replacement, thereby driving its widespread adoption. Key manufacturers continue to invest in improving silicone-based technologies, further solidifying their dominance in the market.

The latex segment is expected to grow at a significant CAGR during the forecast period, primarily due to its cost-effectiveness and high elasticity. Latex catheters offer a snug fit and firm grip, making them suitable for short-term or intermittent use. With improvements in material processing to reduce allergenicity, newer generations of latex catheters are becoming more acceptable in the clinical community. Additionally, increasing demand in budget-constrained healthcare facilities and among patients seeking affordable alternatives is expected to fuel the growth of this segment. As latex catheters become more refined and accessible, they are expected to capture a growing market share, particularly in institutional settings.

Gender Insights

The male segment dominated the market in 2024, primarily due to the higher availability and usage of male-specific external urinary catheters, such as condom catheters. These products are widely used in both homecare and hospital settings, especially for elderly males suffering from urinary incontinence, neurogenic bladder, or mobility impairments. Male external catheters are generally easier to design and apply due to anatomical considerations, leading to broader adoption and more product options in the market. Furthermore, strong clinical evidence supporting their effectiveness and lower risk of catheter-associated urinary tract infections than indwelling catheters has reinforced their use in long-term care.

Key product launches in the male segment are crucial in driving growth within the market by addressing longstanding clinical challenges and enhancing user comfort, safety, and accessibility. For instance, in April 2024, Medline and Consure Medical have entered a pivotal agreement leveraging Medline’s extensive distribution network to exclusively bring the QiVi MEC Male External Urine Management Device to acute care settings across the U.S. The device aims to reduce CAUTI and incontinence-associated dermatitis by utilizing continuous suction to divert urine in real time into a closed system, minimizing skin exposure.

“Medline Urology is committed to providing essential solutions that empower clinicians to reduce the risk of CAUTIs and IADs. QiVi MEC is Medline’s newest male external urine management device that bridges the needs of both infection prevention and WOC in their pursuit of lowering hospital-acquired infections. QiVi MEC helps clinicians provide their patients with quality urological care to achieve optimal outcomes. We are excited to add QiVi MEC to Medline’s robust urology portfolio. - Mike Gerskovich, General Manager, Medline.

“Our vision is to develop products that improve clinical outcomes, reduce healthcare costs, and expand coverage of use. We are incredibly excited to work with Medline to help make QiVi a standard of care across U.S. acute care hospitals,” - Nish Chasmawala, co-founder & CEO, Consure Medical.

The female segment is expected to grow at the fastest CAGR during the forecast period, driven by increasing awareness, product innovation, and unmet needs in female urinary incontinence management. Historically, the lack of anatomically appropriate external catheter options limited market penetration among women. However, recent advancements-such as introducing devices like PureWick-have significantly improved female patients' comfort, efficacy, and usability. Rising awareness campaigns, greater attention to women’s health issues in aging populations, and the demand for non-invasive alternatives to indwelling catheters fuel rapid growth in this segment. As more gender-specific solutions enter the market, female adoption rates are expected to rise substantially.

End Use Insights

The home care segment dominated the market in 2024 with a share of 58.34%, driven by the rising preference for at-home treatment among elderly patients and individuals with chronic conditions such as stroke, Alzheimer’s disease, Parkinson’s disease, and diabetes. External catheters are particularly well-suited for home care settings due to their ease of use, non-invasive design, and ability to improve hygiene and comfort without requiring professional catheterization. The growing availability of portable and user-friendly catheter systems and increased caregiver training and telehealth support have further supported this trend. Additionally, favorable reimbursement policies for urinary incontinence management products under Medicare and Medicaid have encouraged greater home care adoption.

The hospital segment is expected to register a significant CAGR during the forecast period due to its critical role in the acute management of urinary incontinence, especially among post-operative, immobile, and elderly female patients. Hospitals increasingly prefer external catheters as a safer alternative to indwelling catheters to reduce the risk of catheter-associated urinary tract infections, improve patient comfort, and support infection control initiatives. The rising incidence of stroke, Parkinson’s, and other neurologic conditions requiring hospitalization has further fueled demand for non-invasive urinary management solutions. Additionally, advancements in hospital-grade external catheter systems-such as suction-enabled designs-have enhanced usability and hygiene, contributing to their growing adoption. As hospitals prioritize patient safety and adhere to strict infection prevention protocols, the use of external catheters is expected to expand, driving strong growth in this segment.

Key U.S. External Catheter Companies Insights

Key players operating in the U.S. external catheter market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. External Catheter Companies:

- Coloplast

- Hollister Incorporated

- Bard

- TillaCare

- Sage Products (Stryker)

- Medline Industries, LP.

- Boehringer Laboratories, LLC

- Consure Medical

- Ur24Technology, Inc.

- Medalliance (Changzhou) Medical Instrument Co., Ltd.

- Zhanjiang Star Enterprise Co., Ltd.

- BD

Recent Developments

-

In February 2025, BD announced that its Board has approved plans to spin off its Biosciences and Diagnostic Solutions division into a separate, standalone entity, with the split expected to be finalized by fiscal 2026.

-

In August 2024, Avalon GloboCare’s subsidiary, Laboratory Services MSO (LSM), announced the commercial launch of its proprietary GeeWhiz External Condom Catheter, an FDA-registered device designed to manage male urinary incontinence.

-

In February 2023, Tillacare obtained a U. S. patent for the UriCap Female. The UriCap Female received U.S. Patent No. 11,666,474. This strengthens TillaCare’s position in the U.S. market.

-

In January 2023, Ur24Technology Inc. introduced the TrueClr catheter product line, a latex-free external device engineered to actively drain bladders in both adults and children.

U.S. External Catheter Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,207.52 million

Revenue forecast in 2033

USD 2,021.03 million

Growth rate

CAGR of 6.65% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Product, material, gender, end use

Regional scope

U.S.

Key companies profiled

Coloplast; Hollister Incorporated; Bard; TillaCare; Sage Products (Stryker); Medline Industries, LP.; Boehringer Laboratories, LLC; Consure Medical; Ur24Technology, Inc.; Medalliance (Changzhou) Medical Instrument Co., Ltd.; Zhanjiang Star Enterprise Co., Ltd., BD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. External Catheter Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. external catheter market report based on product, material, gender, and end use:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Self-Adhesive

-

Non-adhesive

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Silicone

-

Latex

-

Others

-

-

Gender Outlook (Revenue, USD Million, 2021 - 2033)

-

Male

-

Female

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Home Care

-

Hospitals

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. external catheter market size was estimated at USD 1,134.90 million in 2024.

b. The U.S. external catheter market is expected to grow at a compound annual growth rate of 6.65% from 2025 to 2033 to reach USD 2,021.03 million by 2033.

b. Based on material, the silicone segment is expected to witness the fastest growth during the forecast period, registering a CAGR of 6.84% due to its superior biocompatibility, flexibility, and reduced risk of skin irritation compared to alternative materials.

b. Some key players operating in the U.S. external catheter market include Coloplast, Hollister Incorporated, Bard, TillaCare, Sage Products (Stryker), Medline Industries, LP., Boehringer Laboratories, LLC, Consure Medical, Ur24Technology, Inc., Medalliance (Changzhou) Medical Instrument Co., Ltd., Zhanjiang Star Enterprise Co., Ltd., and BD

b. The U.S. external catheter market is driven by the growing elderly population, rising cases of urinary incontinence, and increasing preference for non-invasive, comfortable solutions. Technological advancements, such as improved male and female external catheters, and their use in reducing catheter-associated infections in hospitals further boost adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.