U.S. Extruded Polystyrene Market Summary

The U.S. extruded polystyrene market size was estimated at USD 1.47 billion in 2024 and is projected to reach USD 2.41 billion by 2033, growing at a CAGR of 5.7% from 2025 to 2033. Expanding cold-chain and refrigerated warehouse investments boost demand for extruded polystyrene (XPS) insulation in temperature-sensitive supply chains.

Key Market Trends & Insights

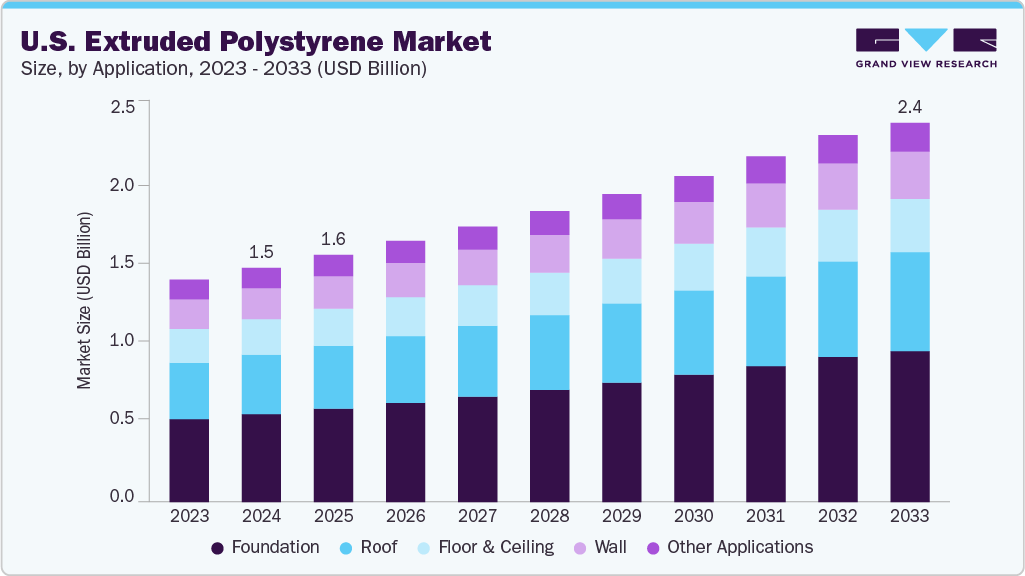

- By application, the foundation segment is expected to grow at a considerable CAGR of 6.4% from 2025 to 2033 in terms of revenue.

- By application, the roof segment is anticipated to grow at a significant CAGR of 6.1% through the forecast period.

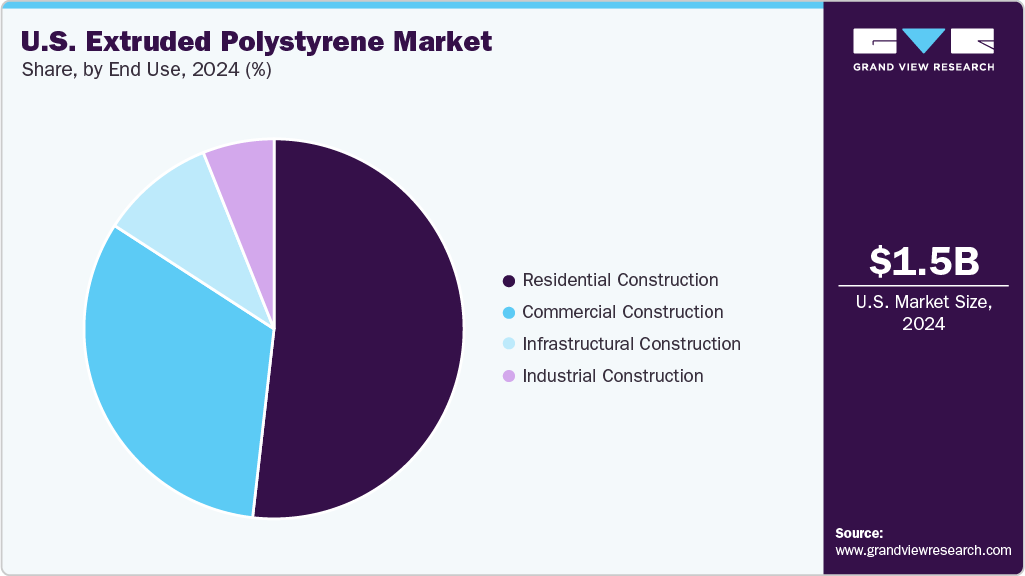

- By end use, the residential construction segment is expected to grow at a considerable CAGR of 6.1% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 1.47 billion

- 2033 Projected Market Size: USD 2.41 billion

- CAGR (2025-2033): 5.7%

Companies in food storage and pharmaceuticals rely on XPS for reliable thermal stability and moisture resistance under extreme conditions. In recent years, the market has witnessed a steady shift toward high-performance building envelopes. Specifiers increasingly favor XPS's consistent thermal resistance and moisture management in residential and commercial projects. Manufacturers are optimizing board densities and edge profiles to meet evolving energy codes. At the same time, logistics and supply chain improvements are enabling faster delivery to regional distribution centers. This focus on specification accuracy and supply reliability shapes the market’s trajectory.

Drivers, Opportunities & Restraints

Rising demand for energy-efficient construction is driving robust uptake of extruded polystyrene insulation nationwide. Stricter building codes and sustainability targets compel architects and contractors to incorporate materials that deliver proven thermal performance over decades. In addition, growing emphasis on lifecycle cost savings motivates developers to invest in higher insulation values at the outset. Together, these factors propel XPS consumption in new builds and retrofit applications.

The transition to low-carbon building materials presents a significant growth avenue for XPS producers that innovate with recycled and bio-based feedstocks. Suppliers can capture market share among green builders and public infrastructure projects by introducing reduced embodied carbon and end-of-life recyclability products. Moreover, there is scope to expand into cold storage and transportation refrigeration, where performance under moisture exposure is critical. Leveraging these specialty segments can elevate margins and diversify revenue streams.

Persistent raw material and energy cost volatility challenge stable pricing for extruded polystyrene boards. Since XPS manufacturing is energy-intensive and relies on petroleum derivatives, feedstock fluctuations directly impact production economics. Tightening environmental regulations around blowing agents also adds compliance costs and technical complexity. As a result, some downstream users may seek alternative insulations when overall project budgets tighten.

Market Concentration & Characteristics

The market growth stage of the U.S. XPS market is medium, and the pace is accelerating. The market exhibits fragmentation, with key players dominating the industry landscape. Major companies like Owens Corning, DuPont de Nemours, Inc., Johns Manville, Atlas Roofing Corporation, Carlisle Construction Materials (CCM), BASF SE, Kingspan Group, and others significantly shape the market dynamics. These leading players often drive innovation, introducing new products, technologies, and applications to meet evolving industry demands.

In response to price pressures and sustainability demands, building professionals evaluate alternatives such as polyisocyanurate boards, expanded polystyrene, and mineral wool. Each offers distinct attributes in thermal performance, moisture management, and fire resistance. Polyisocyanurate leads in R-value per inch, while mineral wool brings superior acoustic properties. As a result, XPS producers emphasize board durability and installation efficiency to differentiate their offerings.

Tighter federal and state energy codes are raising minimum required insulation levels in building envelopes, benefiting extruded polystyrene volumes. Meanwhile, Environmental Protection Agency rules on blowing agents are compelling manufacturers to transition away from high global warming potential chemicals. Compliance investments in research and retooling lift production costs and spur innovation in low-impact formulations. Consequently, regulatory landscapes are both a hurdle and a catalyst for XPS market evolution.

Application Insights

Foundation dominated the U.S. market across the application segmentation in terms of revenue, accounting for a market share of 38.05% in 2024, and is anticipated to grow at a 6.4% CAGR over the forecast period. In foundation applications, extruded polystyrene excels at controlling subgrade moisture and arresting frost heave beneath slabs. Builders appreciate its compressive strength, which maintains long-term performance under soil loads. The material’s resistance to groundwater infiltration reduces waterproofing needs while enhancing structural durability. As developers seek to mitigate foundation cracking and settlement risks, XPS adoption at footing and slab interfaces continues climbing.

The roof segment is anticipated to grow at a significant CAGR of 6.1% through the forecast period. On roofing systems, extruded polystyrene offers a compelling balance of low thermal conductivity and dimensional stability under foot traffic. Its closed-cell structure curbs water absorption and helps sustain insulation values even in ponding conditions. Contractors targeting extended roof lifecycles value XPS to minimize thermal cycling stresses on membranes. This reliability is increasingly prized as building owners pursue reduced maintenance intervals and predictable operating costs.

End Use Insights

Residential construction led the U.S. market across the end use segmentation in terms of revenue, accounting for a market share of 51.80% in 2024, and is expected to grow at a CAGR of 6.1% through the forecast period. Growing homeowner interest in year-round comfort and lower utility bills drives wider use of XPS insulation. Remodel projects leverage their thin-board profiles to boost thermal performance without sacrificing interior space. Energy efficiency incentives and rebate programs further encourage the installation of high-performance insulation packages. Consequently, XPS is becoming the standard choice for new and retrofit homes' walls, crawlspaces, and attic floors.

The commercial construction segment is expected to expand at a substantial CAGR of 5.9% through the forecast period. Within commercial projects, demand for LEED and WELL certification is fueling XPS uptake as part of holistic building envelopes. Facility managers prioritize materials that deliver consistent R-values over multi-decade operations to safeguard revenue from tenant occupancy. Furthermore, the lightweight material simplifies installation on elevated structures such as podiums and balconies. As asset owners seek to optimize total cost of ownership, XPS plays a pivotal role in achieving stringent energy benchmarks.

Key U.S. Extruded Polystyrene Company Insights

The U.S. market is highly competitive, with several key players dominating the landscape. Major companies include Owens Corning, DuPont de Nemours, Inc., Johns Manville, Atlas Roofing Corporation, Carlisle Construction Materials (CCM), BASF SE, and Kingspan Group. The market is characterized by a competitive landscape, with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance their types' performance, cost-effectiveness, and sustainability.

Key U.S. Extruded Polystyrene Companies:

- Owens Corning

- DuPont de Nemours, Inc.

- Johns Manville

- Atlas Roofing Corporation

- Carlisle Construction Materials (CCM)

- BASF SE

- Kingspan Group

Recent Developments

-

In March 2024, Owens Corning converted all of its XPS insulation production in the U.S. and Canada to its FOAMULAR NGX (Next Generation Extruded) product. This change eliminated HFC 134a blowing agents a year ahead of the new 2025 regulations, significantly reducing greenhouse gas emissions by over 80% in embodied carbon. FOAMULAR NGX maintains high performance with R-5 insulation per inch, strong moisture resistance, durability, and compressive strength up to 100 psi.

U.S. Extruded Polystyrene Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 1.55 billion

|

|

Revenue forecast in 2033

|

USD 2.41 billion

|

|

Growth rate

|

CAGR of 5.7% from 2025 to 2033

|

|

Historical data

|

2021 - 2023

|

|

Forecast period

|

2025 - 2033

|

|

Quantitative units

|

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, competitive landscape, growth factors, and trends

|

|

Report Segmentation

|

Applications, end use

|

|

Country Scope

|

U.S.

|

|

Key companies profiled

|

Owens Corning; DuPont de Nemours, Inc.; Johns Manville; Atlas Roofing Corporation; Carlisle Construction Materials (CCM); BASF SE; Kingspan Group

|

|

Customization scope

|

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Extruded Polystyrene Market Report Segmentation

This report forecasts volume & revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. extruded polystyrene market report based on applications and end use:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Foundation

-

Roof

-

Wall

-

Floor & Ceiling

-

Other Applications

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)