Market Size & Trends

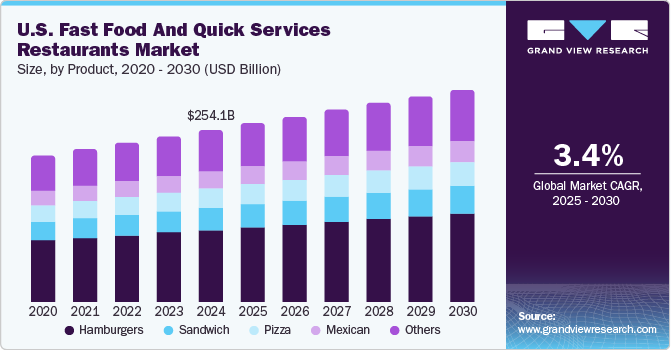

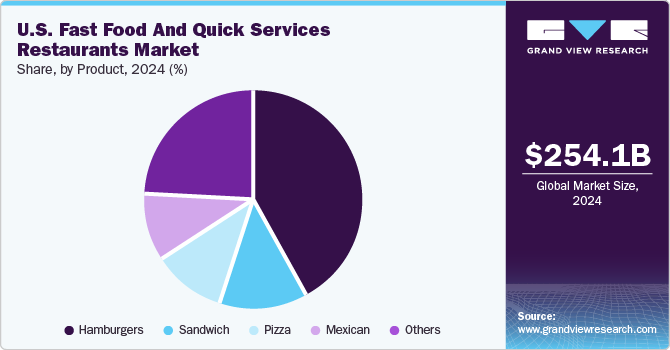

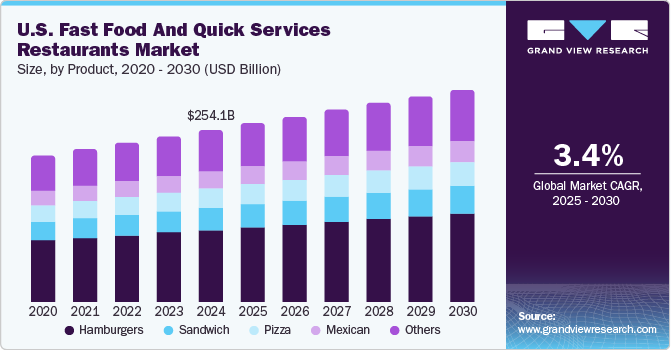

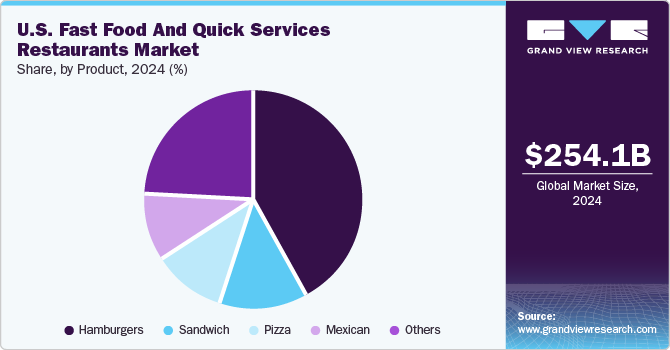

The U.S. fast food and quick services restaurants market size was valued at USD 254.11 billion in 2024 and is projected to grow at a CAGR of 3.4% from 2025 to 2030. The growing population in the economy and continued popularity and sales of fast food items such as burgers, sandwiches, and pizza have helped maintain a strong demand for fast food outlets and quick service restaurants (QSRs). Moreover, technological trends such as mobile ordering applications, restaurant automation, drive-thru technology, and deployment of business intelligence tools are expected to further enhance customer experience in the long term, aiding the growth of the industry in the U.S.

The U.S. fast food and QSR industry is driven by the emergence of new menus and culinary concepts, particularly in the limited-service category. International cuisines such as Korean barbecue are inspiring the development of new food items that incorporate unique ingredients. American consumers are seeking healthier options in fast food as a means to follow healthy lifestyle practices. Consequently, many QSRs are introducing plant-based menu items, focusing on fresh ingredients, and offering low-calorie or nutrient-dense alternatives. The growing presence of companies such as Impossible Foods and Beyond Meat has forced conventional market players to diversify their menus, aiding market expansion. Sustainability is also a major area that brands are aiming to address, sourcing ingredients more responsibly and aiming to reduce their environmental footprint.

Consumers are increasingly demanding fast and economical breakfasts from QSRs, which has driven these establishments to modify their menus and incorporate advanced processes. Major chains such as McDonald’s, Taco Bell, Hardee’s, Carl’s Jr., and Jack in the Box have launched various marketing campaigns and menu items that are breakfast-focused. For instance, in April 2023, Taco Bell collaborated with comedian and actor Pete Davidson to promote its breakfast menu for American consumers. This campaign included a limited-time availability of the company’s newly launched ‘California Breakfast Crunchwrap’ at selected locations in the country. Taco Bell offers a range of breakfast options, including the Cheesy Toasted Breakfast Burrito with Potato, the Breakfast Quesadilla with Steak, and the Bell Breakfast Box. Such initiatives are expected to boost the expansion of the U.S. fast food and quick services restaurants industry in the coming years. The increasing market competition has provided consumers with a growing number of options to buy quality food at reasonable rates, placing a great demand on fast-food operators to provide the highest levels of food quality and service.

Product Insights

Hamburgers emerged as the leading product segment in the U.S. fast food and quick services restaurants industry, accounting for a revenue share of 42.0% in 2024. The widespread popularity of these fast food items across the economy, increasing consumer preference, and availability of various burger types have helped drive segment growth. A YouGov survey conducted by White Castle found that approximately 20 billion burgers are consumed in the country per year, which translates to an average of 60 patties per person. Restaurants and fast-food outlets increasingly utilize premium and exotic ingredients to appeal to a wider customer demographic and boost their sales, driving the launch of novel burger varieties. Hamburger joints focus on the changing tastes and preferences of customers by incorporating classic organic or plant-based ingredients to drive product demand and increase their penetration in the U.S.

The sandwich segment is expected to grow at the highest CAGR from 2025 to 2030. The increasing demand for sandwiches and subs among U.S. consumers due to awareness about their nutritional value has driven the steady expansion of this segment. Restaurants are adopting strategies such as introducing new menu options, healthier low-fat sub and sandwich variants, and economical products to attract customers and ensure repeated visits. Popular fast food chains such as Subway, Jimmy John’s, and Chick-fil-A have focused heavily on sandwiches, considering them a key driver of their sales. Fast food brands have introduced higher-quality ingredients, such as artisanal breads, specialty meats, and plant-based options. They cater to consumers looking for more sophisticated or healthier options than traditional fast food offerings. For instance, plant-based sandwiches that use Impossible or Beyond Meat products have gained notable interest.

Key U.S. Fast Food And Quick Services Restaurants Company Insights

Some major companies involved in the U.S. fast food and quick services restaurants industry include McDonald’s, Pizza Hut, and KFC, among others.

-

McDonald’s is a multinational foodservice retail chain operator that operates and franchises McDonald’s restaurants, which serve a locally relevant menu of food and beverages. Its menu offerings include cheeseburgers and hamburgers, chicken sandwiches, wraps, chicken nuggets, salads, French fries, shakes, oatmeal, desserts, soft serve cones, coffee, soft drinks, and other beverages. The company has further introduced the McPlant plant-based burgers that utilize patties from Beyond Meat to cater to the steadily increasing vegan demographic.

-

Pizza Hut is a U.S.-based multinational pizza restaurant chain and international franchise specializing in making pan pizza, stuffed crust pizza, thin crust pizza, and a variety of toppings. It also offers pasta options, such as lasagna and spaghetti, as well as desserts and beverages. Pizza Hut has invested heavily in digital innovation, including online ordering and a mobile app, making it easier for customers to place orders. The company has increased its offerings in areas such as lower-calorie pizzas, vegetarian options, and gluten-free crusts to address the growing demand for healthier menu choices.

Key U.S. Fast Food And Quick Services Restaurants Companies:

- McDonald's

- Pizza Hut, LLC

- KFC Corporation

- Domino's Pizza, Inc.

- Taco Bell IP Holder, LLC

- CFA Properties, Inc.

- Subway IP LLC

- Chipotle Mexican Grill

Recent Developments

-

In December 2024, Pizza Hut inaugurated a new restaurant concept featuring self-service kiosks, pick-up cabinets, and the company’s first Hut ‘N Go drive-thru menu. The restaurant, located in Plano, Texas, also utilizes sustainable concepts such as energy-efficient lighting and ovens, an Energy Management System (EMS, and auto-lift fryers. The new concept, introduced for the first time in the U.S., has already operated across Pizza Hut’s outlets in several global markets.

-

In October 2024, Taco Bell announced that it would be relaunching five of its most popular menu items from the company’s first five decades of operation as a limited-time offer. These items included the Tostada (1960s), Green Sauce Burrito (1970s), Meximelt (1980s), and Gordita Supreme (1990s), all of which were launched on October 31. Meanwhile, the ‘00s Caramel Apple Empanada was added to the menu on November 21, with each of these offerings available for under USD 3.

U.S. Fast Food And Quick Services Restaurants Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 263.80 billion

|

|

Revenue forecast in 2030

|

USD 311.99 billion

|

|

Growth Rate

|

CAGR of 3.4% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product

|

|

Key companies profiled

|

McDonald's; Pizza Hut, LLC; KFC Corporation; Domino's Pizza, Inc.; Taco Bell IP Holder, LLC; CFA Properties, Inc.; Subway IP LLC; Chipotle Mexican Grill

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Fast Food And Quick Services Restaurants Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. fast food and quick services restaurants market report based on product: