- Home

- »

- Medical Devices

- »

-

U.S. Fetal & Neonatal Care Equipment Market, Industry Report 2030GVR Report cover

![U.S. Fetal & Neonatal Care Equipment Market Size, Share & Trends Report]()

U.S. Fetal & Neonatal Care Equipment Market Size, Share & Trends Analysis Report By Product (Ultrasound, MRI, Fetal Monitors, Infant Warmers & Incubators, Neonatal Monitoring), By End-use (Hospitals, Clinics), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-224-1

- Number of Pages: 83

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Healthcare

Market Size & Trends

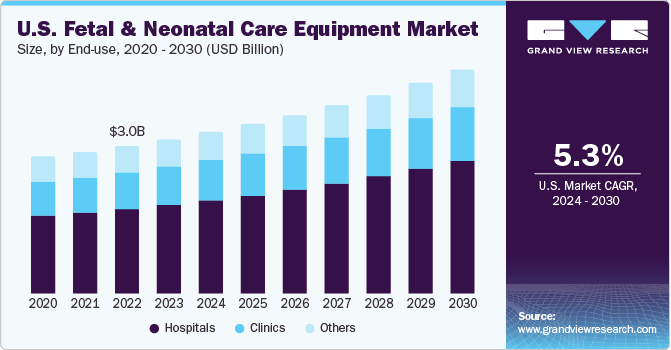

The U.S. fetal & neonatal care equipment market size was valued at USD 3.13 billion in 2023 and is expected to grow at a CAGR of 5.3% from 2024 to 2030. Increasing awareness about fetal & neonatal care paired with many (NICU) Neonatal Intensive Care Unit admissions are significantly driving the market growth in the country. The increasing prevalence of HAI (hospital acquired infections) among neonates is expected to contribute towards the market growth. Medical conditions Pregnancy are leading to alarming rates of fetal mortality worldwide. According to the National Vital Statistics Reports, in 2021, over 21,105 fetal fatalities were reported in U.S. at 20 weeks of gestation. This emphasizes the pressing need for infant care devices.

According to the CDC, preterm births affect 1 of every ten infants born in the country. In 2022, the rate of preterm births among African-American women was 14.6%, which was higher than preterm births among white women (9.4%) and Hispanic women (10.1%). Furthermore, a significant number of babies born in the U.S. were at low birth weight. All such factors are further expected to contribute towards the market growth .

In 2023, the U.S. accounted for a market share of over 36% in the global fetal and neonatal care equipment market. Some of the key companies in the U.S. include GE Healthcare, Medtronic PLC, Koninklijke Philips NV, and Masimo. Manufacturers are involved more in R&D to obtain approvals for new product commercialization. For instance, in September 2020, GE Healthcare launched the Voluson SWIFT ultrasound system, which includes an AI tool, SonoLyst, with applications in fetal imaging.

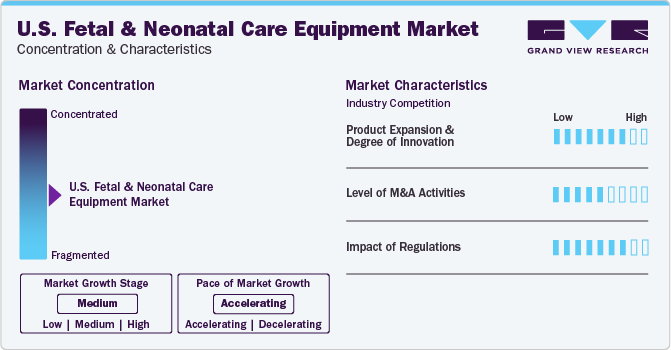

Market Concentration & Characteristics

The industry growth stage is medium (CAGR: 5-10%) and the pace of growth depicts an accelerating trend. A significant number of neonatal deaths and preterm births, along with availability of financial assistance for equipment research & procurement, is expected to boost the product demand. Moreover, product innovations by manufacturers are increasing treatment efficiency and affordability, which is expected to reduce treatment costs.

Rising emphasis of government and key companies to leverage new innovative technologies to make fetal & neonatal care more efficient, safer, and cost-effective has steered the development of smarter and wireless technologies. Advancements in monitoring and sensing devices have enabled faster and easier measurement of the physiological parameters of newborns. In addition, technological advancements have led to the launch of modern equipment, including ventilators, imaging systems, and advanced wireless monitoring systems.

The U.S. fetal and neonatal care equipment industry is witnessing an increasing number of mergers & acquisitions (M&A) and collaboration activities that the prominent players are undertaking. Several key U.S. fetal and neonatal care equipment companies are adopting these strategies to upgrade their portfolio. For instance, in April 2022, Cardinal Health entered into a strategic collaboration with Innara Health to redesign the NTrainer System, a non-nutritive suck device, and assist premature babies with feeding.

Equipment manufacturers need to adhere to norms of regulatory agencies, such as the FDA. The technical specifications for Neonatal Resuscitation Devices are provided by WHO, which act as baseline for procurement of appropriate, affordable, and good quality neonatal resuscitation devices for medical practitioners. The Affordable Care Act (ACA) has made a provision to provide insurance for mother and baby, both before and after birth, under small employer and individual insurance plans.

Product Insights

The fetal care equipment segment had established its dominance in this market with a significant revenue share of 65.9% in 2023. This segment can be further broken down into different equipment types, such as ultrasound devices, MRI systems, dopplers, monitors, and pulse oximeters. Among these, the ultrasound devices segment is expected to hold the largest share due to its increasing application in studying the movement and state of the fetus during pregnancy. With the rising awareness, technological advancements, and ease in utility, the usage of portable and do-it-yourself ultrasound devices for home-use has also seen a significant surge.

During the forecast period, the neonatal care equipment segment is projected to register the fastest CAGR. In particular, the neonatal monitoring devices segment is expected to witness significant growth due to constant technological advancements, including improvements in connectivity and ease of use in home settings. Furthermore, respiratory devices are expected to witness lucrative growth owing to the increasing demand for respiratory care in neonates. These devices help reduce the length of hospital stay and the risk of long-term disability. As nearly all newborns are prone to respiratory difficulties at birth, neonate respiratory devices ease the process, ensuring better health for the baby.

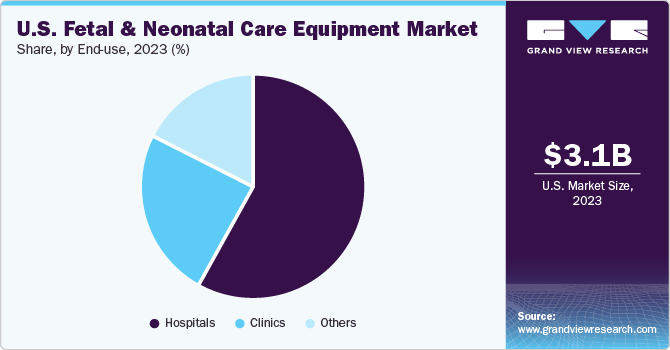

End-use Insights

The hospitals segment accounted for a revenue share of 57.7% in 2023. Factors attributing to the dominant share are the presence of latest and technologically advanced equipment to improve patient care and availability of specialists. Furthermore, increasing number of NICUs in hospitals and high patinet volume are propelling the segment growth.

The clinics segment is expected to grow at the significant rate during the forecast preriod. Clinics offer specialized services and are often preferred where large facilities are not available. The demand for clinic is growing due to the increasing need for specialized care and quick diagnsis and effective care offered by specialty clinics.

The others segment include home care, nursing homes, diagnostic centers and others. The rising prevelance of the genetic disorders in infants is driving the demand for nursing homes and diagnostic centers. In addition, increasing preference for wearble devices that can help in remote monitoring from home are anticipated to boost the segment growth.

Key U.S. Fetal & Neonatal Care Equipment Company Insights

The market is considerably fragmented with the presence of various players. Key manufacturers are working with leading networks of child care providers to increase awareness and drive product sales. Several companies are involved in approvals and product launches. For instance, in May 2023, Sibel Health received the U.S. FDA 510 (k) clearance for its Anne One neonatal and infant monitoring platform. It is a wireless, clinical-grade, and continuous monitoring solution developed specifically for adults, infants, and neonates.

Key U.S. Fetal & Neonatal Care Equipment Companies:

- Cardinal Health

- Drägerwerk AG & Co. KGaA

- Koninklijke Philips N.V

- GE Healthcare

- Medtronic

- Vyaire

- BD

- Utah Medical Products, Inc.

- Natus Medical Incorporated

- Ambu A/S

- Inspiration Healthcare Group plc

- Atom Medical Corp

- Fisher & Paykel Healthcare Limited

- Masimo

- Phoenix Medical Systems (P) Ltd

Recent Developments

-

In June 2023, Dräger (Drägerwerk AG & Co.) KgaA launched an FDA-cleared Babyroo TN300 device that offers supportive lung protection and temperature stability for newborn infants.

-

In April 2023, Cardinal Health commenced two distribution centers in Central Ohio. Both these facilities support the Medical Segment of the company, emphasizing on U.S. Medical Products and Distribution (USMPD) and at-Home Solutions segments.

-

In January 2023, Medspray Pharma BV received a second round of funding from the Bill & Melinda Gates Foundation to develop a noninvasive liquid-based surfactant nebulizer for preterm infants.

-

In June 2022, GE Healthcare, along with Medtronic received CE Mark approval and FDA 510(k) clearance for integrating Microstream capnography & INVOS regional oximetry technologies on the CARESCAPE precision monitoring platform, assisting providers in improving patient outcomes and safety.

U.S. Fetal & Neonatal Care Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.28 billion

Revenue forecast in 2030

USD 4.55 billion

Growth rate

CAGR of 5.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use

Country scope

U.S.

Key companies profiled

Cardinal Health; Drägerwerk AG & Co. KGaA; GE Healthcare; Koninklijke Philips N.V.; Medtronic; BD; Vyaire; Utah Medical Products, Inc.; Ambu A/S; Natus Medical Incorporated; Inspiration Healthcare Group plc.; Atom Medical Corp; Fisher & Paykel Healthcare Limited; Masimo; Phoenix Medical Systems (P) Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Fetal & Neonatal Care Equipment Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. fetal & neonatal care equipment market report based on product, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fetal Care Equipment

-

Ultrasound Devices

-

Fetal MRI Systems

-

Fetal Monitors

-

Fetal Pulse Oximeters

-

-

Neonatal Care Equipment

-

Infant Warmers

-

Incubators

-

Convertible Warmers & Incubators

-

Phototherapy Equipment

-

Respiratory Devices

-

Neonatal Ventilators

-

Continuous Positive Airway Pressure (CPAP) Devices

-

Oxygen Analyzers and Monitors

-

Resuscitators

-

Others

-

-

Neonatal Monitoring Devices

-

Blood Pressure Monitors

-

Cardiac Monitors

-

Pulse Oximeters

-

Capnographs

-

Integrated Monitoring Devices

-

-

Other

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. fetal & neonatal care equipment market size was valued at USD 3.13 billion in 2023 and is expected to reach USD 3.28 billion in 2024.

b. The U.S. fetal & neonatal care equipment market is growing at a a CAGR of 5.3% from 2024 to 2030 to reach USD 4.55 billion in 2030.

b. The hospitals segment accounted for a revenue share of 57.7% in 2023. Factors attributing to the dominant share are the presence of latest and technologically advanced equipment to improve patient care and availability of specialists.

b. Some of the prominent players in the U.S. fetal & neonatal care equipment market include Cardinal Health, Drägerwerk AG & Co. KGaA, Koninklijke Philips N.V, GE Healthcare, Medtronic, Vyaire, BD, Utah Medical Products, Inc., Natus Medical Incorporated, Ambu A/S, Inspiration Healthcare Group plc, Atom Medical Corp, Fisher & Paykel Healthcare Limited, Masimo, Phoenix Medical Systems (P) Ltd.

b. Increasing awareness about fetal & neonatal care paired with many (NICU) Neonatal Intensive Care Unit admissions are significantly driving the market growth in the country.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."