- Home

- »

- Advanced Interior Materials

- »

-

U.S. Flash Bang Market Size, Share & Growth Report, 2030GVR Report cover

![U.S. Flash Bang Market Size, Share & Trends Report]()

U.S. Flash Bang Market (2023 - 2030) Size, Share & Trends Analysis Report By End-use (Law Enforcement, Military, Others), And By Segment Forecasts

- Report ID: GVR-4-68040-061-2

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

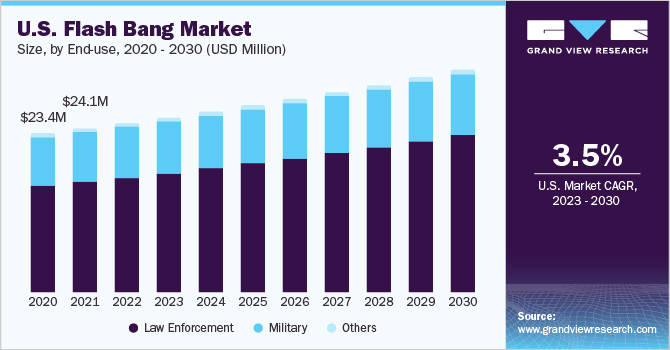

The U.S. flash bang market size was estimated at USD 24.89 million and is expected to grow at a compounded annual growth rate (CAGR) of 3.5% from 2023 to 2030. This growth is owing to the growing incidents of civil disputes and disorders. The U.S. flash bang industry is growing on account of the increasing use of less lethal weapons by law enforcement agencies such as police forces to control public riots & commotions and maintain order in public gatherings and events. Flash bangs are devices that explode and release light along with excessive noise.

Flash bangs are categorized under less lethal ammunition, which is used to disperse the crowds without causing any intentional physical harm to the masses. Less Lethal Ammunition (LLA) is defined as ammunition that is intended to briefly disable, stun, or injure a person without actually entering the body. Law enforcement and military organizations typically employ it to control crowds and riots.

Flash bangs are disorientation devices that were created for military applications. However, with the growing population, these are now mainly used to disorient a large group of people from public places. These are manufactured like traditional grenades and explode with a delay of 1.5 seconds. The explosion causes a bright flash and loud sound of about 160-180 decibels. This results in temporary blindness, loss of balance, along with a sense of panic. These are also referred to as stun grenades and flash grenades.

Terrorism and political violence risks are expected to incline on account of rising geopolitical tensions and the weakening of liberal democratic governance. In addition, the repercussive effects of chronic conflicts are also emerging as one the major factors, intensifying the political violence across the globe. This has largely influenced the overall ammunition market, including the demand for flash bangs.

The United States military and law enforcement entities each have an inventory of authorized, less-lethal ammunition. However, as this less lethal ammunition technology is constantly developing, agencies are willing to obtain advanced ammo samples and carry out internal testing, which is to have a favorable impact on the demand over the forecast period.

The population of the U.S. experienced socio-political disputes over the last few years, which increased the use of less lethal weapons such as flash bangs in the market. Flash bangs are mainly used by military and law enforcement agencies such as the United States Armed Forces and SWAT teams to contain and manage crowds during civil riots and discrepancies. The companies are trying to strengthen their market position through acquisition, investment, and innovation. The majority of the players in the market have long-standing trade agreements with end-use organizations, which adds to their competitive advantage in the market.

Flash bang manufacturers procure the components from raw material suppliers either directly or through third-party distributors under competitively priced supply contracts or bidding arrangements. The product manufacturers procure raw materials from the suppliers to further offer customized solutions to their clients. They also enter into long-term contracts with raw material suppliers to maintain a robust supply. The involvement of several entities in the product flow from suppliers to manufacturers incurs a notable price share, thus influencing the value chain.

The population of the U.S. experienced an upheaval during the COVID-19 pandemic, which resulted in a higher number of public gatherings and riots against the COVID protocols. Due to this, the demand for flash bangs surged in the market, irrespective of the negative impact of COVID-19 on other industries.

However, there have been certain incidents of accidents caused due to the use of flash bangs which have caused harm to individuals. This has negatively affected the market demand for a flash bang. Hence, proper training is provided to law enforcement officers and workforces to use the flash bangs adequately, without harming individuals during crowd dispersion.

The U.S. has the highest defense budget in the world. This is due to the increasing geopolitical tensions around the globe. Moreover, the use of stun grenades is made available to common people for self-defense applications. This is to propel the demand for flash bangs over the coming years. An initiative by NATO (North Atlantic Pacific Organization) countries to increase their defense spending to enhance the ability to deal with terrorist and extremist activities is expected to drive the market for flash bangs.

End-use Insights

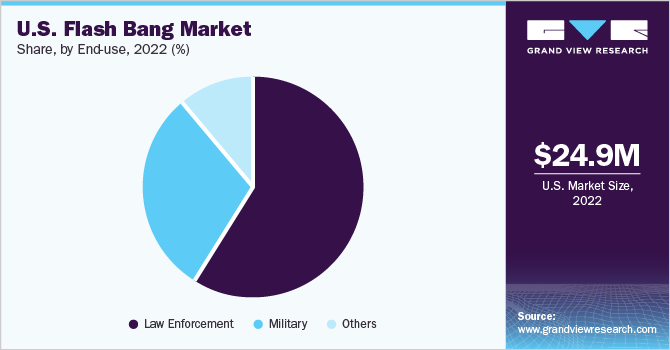

Based on end-use, the U.S. flash bang market is categorized into law enforcement, military, and others. The law enforcement end-use segment dominated the market with the highest revenue share of 67.8% in 2022. The segment is further forecasted to grow at a CAGR of 4.0% from 2023 to 2030.

There are more than 17,000 law enforcement organizations in the U.S. each with a different jurisdiction. These include the Drug Enforcement Administration, the Federal Bureau of Investigation (FBI), and the Bureau of Alcohol, Tobacco, and Firearms. These agencies work in collaboration with the police forces in case of emergencies to contain crowds and riots.

The growing number of cross-border conflicts has resulted in an increase in the military budget for the major economies, including China and India. This has positively influenced the market for flash bangs across the world. The U.S. government's substantial expenditures for military and armed forces are further estimated to contribute to the country's less lethal ammunition market expansion.

The military end-use segment was estimated at USD 7.4 million in 2022 and the segment is forecasted to reach USD 8.8 million in 2030. The military end-use segment is estimated to grow at a CAGR of 2.3% from 2023 to 2030. This is attributed to the increasing military defense budgets and technological advancements in the development of less lethal ammunition in the market.

The U.S. military budget spending is the highest in the world and is still growing faster than other countries. This is due to growing geo-political tensions between Russia & Ukraine in Europe. The U.S. military is highly investing in acquiring modernized weaponry and machines to maintain a stronger position concerning its competitors. This is to positively influence the demand for flash bangs in the market.

Key Companies & Market Share Insights

Some of the major manufacturers of flash bang in the U.S. include Liberty Dynamic, Combined Systems, Tasmanian Tiger USA, Flashbang Studio, and EDGE PJSC Group. The leading companies in the industry are creating focused on creating flash bangs with a variety of calibers and cutting-edge designs which will result in high efficiency and impact. Moreover, these players are working to secure long-term agreements with premier security organizations around the world, giving them a competitive advantage in the overall market. Some prominent players in the U.S. flash bang market include:

-

Liberty Dynamic

-

Combined Systems

-

Tasmanian Tiger USA

-

Flashbang Studio

-

EDGE PJSC Group

-

PEZT Co.

U.S. Flash Bang Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 32.6 million

Growth rate

CAGR of 3.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

End-use

Country scope

U.S.

Key companies profiled

Liberty Dynamic; Combined Systems; Tasmanian Tiger USA; Flashbang Studio; EDGE PJSC Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Flash Bang Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. flash bang market report based on end-use:

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Law Enforcement

-

Military

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. flash bang market size was estimated at USD 24.8 million in 2022 and is expected to reach USD 25.7 million in 2023.

b. The U.S. flash bang market is expected to grow at a compound annual growth rate a CAGR of 3.5% from 2023 to 2030 to reach USD 32.6 million by 2030.

b. The law enforcement end-use segment accounted for the largest revenue share of 67.8% in 2022 and the market is further forecasted to grow on account of increased budgets of law enforcement agencies.

b. Some key players operating in the U.S flash bang market include Liberty Dynamic, Combined Systems, Tasmanian Tiger USA, Flashbang Studio, and EDGE PJSC Group.

b. The growing civil unrest among the population in U.S. has resulted in increased budgets for law enforcement agencies and military, which is driving the market demand for flash bang in the U.S.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.