- Home

- »

- Advanced Interior Materials

- »

-

U.S. Flatroof Fasteners Market Size, Industry Report, 2033GVR Report cover

![U.S. Flatroof Fasteners Market Size, Share & Trends Report]()

U.S. Flatroof Fasteners Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Mechanically fixed, Glued, Ballasted), By Roofing Membrane (Single-ply Membranes, Two-Ply Bitumen, Other Composite Systems), By End-use, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-641-2

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Flatroof Fasteners Market Summary

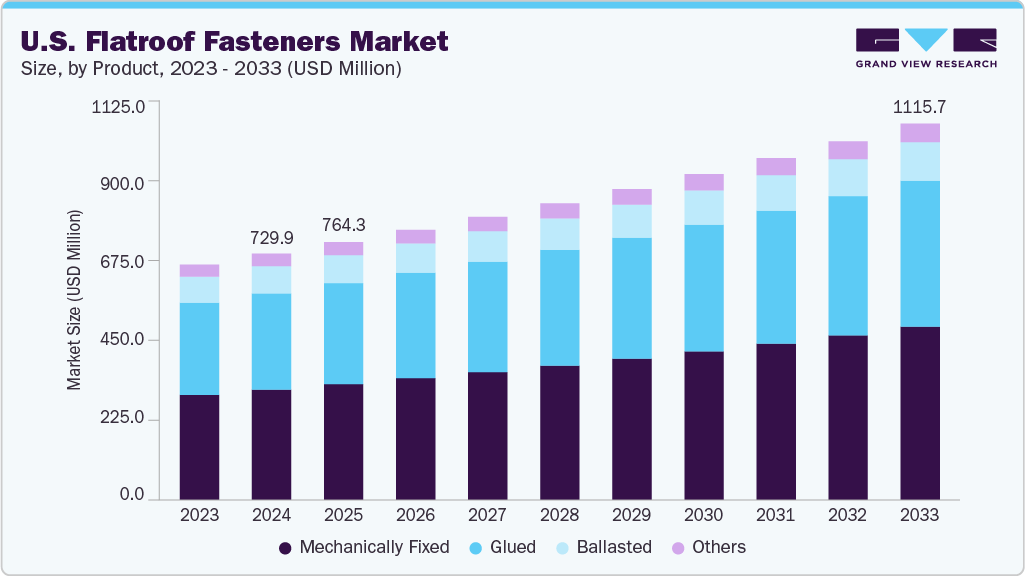

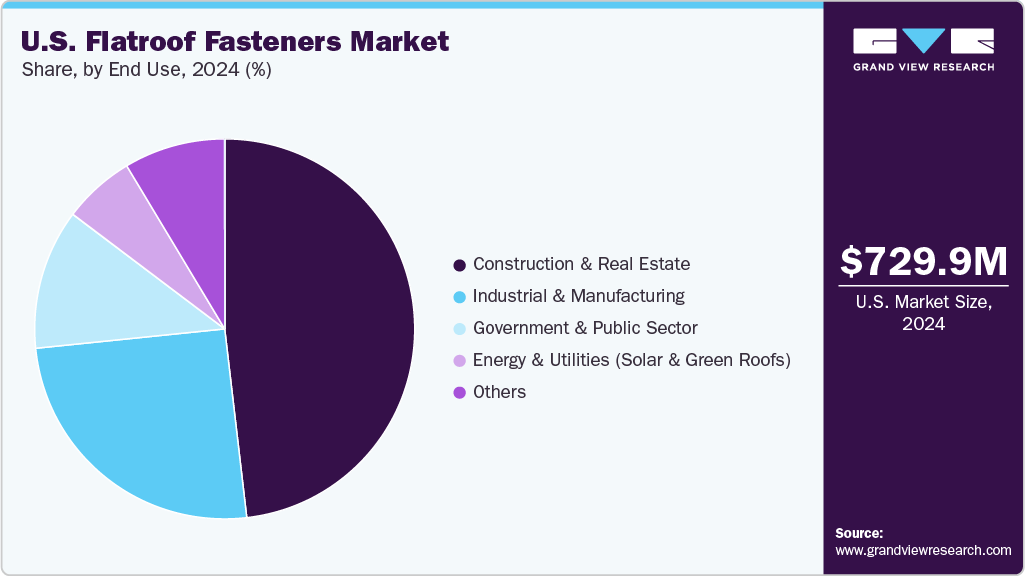

The U.S. flatroof fasteners market size was estimated at USD 729.9 million in 2024 and is projected to reach USD 1115.7 million by 2033, growing at a CAGR of 4.9% from 2025 to 2033, driven by a strong commercial construction sector, rising renovation and re-roofing activities, and increasing adoption of energy-efficient and solar-integrated roofing systems.

Key Market Trends & Insights

- By product, the mechanically fixed segment is expected to grow at the fastest CAGR of 5.2% over the forecast period.

- By roofing membrane, single-ply membrane segment is expected to grow at the fastest CAGR of 5.1% over the forecast period.

- By end use, industrial & manufacturing segment is expected to grow at the fastest CAGR of 5.2% over the forecast period.

- By distribution channel, direct segment is expected to grow significantly at CAGR of 5.0% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 729.9 Million

- 2033 Projected Market Size: USD 1115.7 Million

- CAGR (2025-2033): 4.9%

Flat roofs are widely used in warehouses, office buildings, and retail centers due to their cost-effectiveness and ease of HVAC and solar panel installation. Additionally, federal incentives for sustainable construction and strict building codes requiring high-performance roofing components are pushing the demand for durable, weather-resistant fasteners that ensure long-term structural integrity.Moreover, the growing frequency of extreme weather events across the U.S. has intensified the need for resilient roofing systems, further driving demand for high-strength and corrosion-resistant fasteners. Building owners and contractors are increasingly prioritizing products that offer enhanced wind uplift performance and long-term durability, especially in hurricane-prone regions like the Gulf Coast and southeastern states. This shift leads to greater adoption of advanced mechanical fastening solutions that ensure compliance with evolving safety and performance standards.

A key trend shaping the U.S. flat roof fasteners market is the integration of smart construction practices and sustainable building certifications such as LEED. There is rising interest in green roofing, reflective membranes, and rooftop solar installations, all of which rely on secure fastening systems for long-term functionality. Additionally, labor shortages in the construction sector are pushing the demand for easy-to-install fastening products that reduce time on site. Digital procurement platforms and direct-to-contractor sales models are also gaining traction, helping streamline supply chains and improve accessibility for end users.

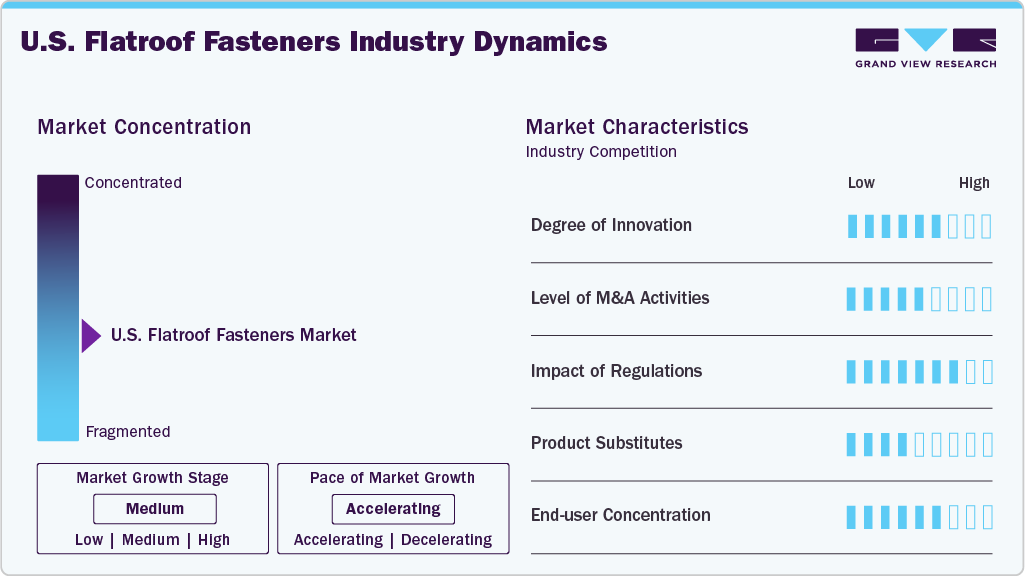

Market Concentration & Characteristics

The U.S. flat roof fasteners market exhibits moderate to high market concentration, with a few dominant players such as SFS Group U.S., 3M, and Grainger Canada holding significant shares due to their strong brand presence, technical expertise, and established distribution channels. These companies benefit from long-standing relationships with contractors and large construction firms, enabling them to maintain a competitive edge. However, regional and niche players continue to operate effectively by offering customized solutions, competitive pricing, and quicker turnaround times, adding diversity and competition within the market.

The threat of substitutes in the U.S. flat roof fasteners market remains low, as mechanical and adhesive fasteners are critical to ensuring the stability and performance of flat roofing systems. While adhesive-based systems are becoming more popular due to their clean finish and thermal efficiency, they still cannot replace mechanical fasteners in all situations, especially in areas with high wind loads or large-scale commercial projects. Alternative roofing systems with integrated fastening solutions exist but are limited by cost, installation complexity, or lack of widespread adoption, keeping the threat of substitution relatively minimal.

Product Insights

Mechanically fixed segment held the largest revenue share of 44.8% in 2024, due to their proven performance in providing strong wind uplift resistance, quick installation, and adaptability to a variety of roofing substrates. These systems are widely favored in commercial and industrial buildings where structural reliability, cost efficiency, and code compliance are key considerations. Their compatibility with single-ply membranes further enhances their utility. Contractors also prefer mechanical fasteners for their ease of inspection and ability to be installed in a variety of weather conditions. Ongoing innovations in fastening technology are also improving installation speed and long-term durability.

Glued segment is expected to grow at a significant CAGR of 5.1% over the forecast period in the U.S. as architects and contractors increasingly adopt adhesive fastening for its clean finish, improved insulation performance, and reduced thermal bridging. This method is especially gaining traction in green building projects and high-end residential construction, where aesthetics and energy efficiency are critical. Advanced low-VOC adhesives are aligning with LEED and environmental standards. Additionally, labor savings and noise reduction during installation are making glued systems more appealing. As climate-conscious construction grows, adhesive solutions are expected to play a larger role in flat roofing systems.

Roofing Membrane Insights

Single-ply membranes segment held the largest revenue share of 45.3% in 2024 in the U.S. market, due to their lightweight nature, ease of installation, and strong performance in diverse climates. Materials such as TPO, EPDM, and PVC are widely used in commercial buildings, supported by low labor requirements and compatibility with mechanical fasteners, making them a cost-effective and reliable roofing choice. Their reflective properties also support energy efficiency goals. The dominance of these membranes is reinforced by their proven track record in re-roofing and new builds. Moreover, improvements in membrane formulation have extended their service life, increasing their appeal across industries.

Two-ply bitumen segment is expected to grow at a significant CAGR of 4.8% over the forecast period. This is driven by its superior durability and ability to withstand extreme weather conditions. As building owners seek longer-lasting, waterproof roofing solutions-especially in regions with heavy rainfall or snowfall-this segment is gaining momentum in both re-roofing and new construction. Its multilayer protection system offers enhanced puncture and tear resistance. Growing awareness of lifecycle cost savings is contributing to its adoption in institutional and industrial settings. Moreover, advancements in modified bitumen technology are reducing installation times and improving flexibility.

End Use Insights

Construction & Real Estate segment held the largest revenue share of 48.1% in 2024, driven by a steady pipeline of commercial developments, multi-family housing, and institutional projects. The widespread use of flat roofs in these structures boosts the demand for reliable fasteners that ensure long-term structural integrity and weatherproofing. Flat roofs are also preferred for rooftop utilities and solar panels, further driving demand. The segment benefits from favorable financing conditions and zoning regulations in urban areas. Additionally, high demand for sustainable construction practices encourages the use of certified and compliant fastening systems.

Industrial & manufacturing segment is expected to grow significantly at CAGR of 5.2% over the forecast period as the U.S. witnesses increased investments in logistics hubs, factories, and warehousing facilities. These large, flat-roofed structures require high-performance fasteners capable of supporting extensive roofing systems and accommodating heavy equipment loads. Growth in e-commerce and supply chain infrastructure is driving demand for new construction. Industrial users prioritize long-term durability and low maintenance, making fastener quality a key selection factor. The trend toward energy-efficient manufacturing facilities is also boosting demand for compatible fastener systems used in solar-ready roofs.

Distribution Channel Insights

Direct distribution channel segment held the largest revenue share of 67.7% in 2024 in U.S., as major manufacturers prefer selling directly to contractors and developers to streamline supply chains, improve margins, and maintain better control over product availability and pricing. This model also allows quicker response to customer needs and project-specific requirements. Online platforms and dedicated sales teams are being leveraged to enhance service and reduce dependency on intermediaries. Direct relationships also support customization and technical support for large-scale roofing projects. As digital procurement tools evolve, direct sales models are expected to further strengthen in high-volume markets.

Indirect distribution channels are growing significantly in the U.S., at a CAGR of 4.6% over the forecast period, particularly in regional and mid-sized construction markets. Local dealers and distributors play a vital role in extending market reach, offering technical support, and ensuring fast product availability to smaller contractors who prefer working through trusted local suppliers. These channels help manufacturers enter underserved or remote areas without setting up costly infrastructure. Partnerships with independent distributors also provide valuable insights into shifting regional demands. Additionally, indirect channels contribute to maintaining inventory buffers and enabling faster delivery in time-sensitive projects.

Key U.S. Flatroof Fasteners Company Insights

Some of the key players operating in the U.S. market include Fastenal Company, The Hillman Group, Inc.

-

astenal Company is a leading North American distributor of industrial and construction supplies, including a comprehensive range of fasteners, safety products, tools, and industrial maintenance solutions. Headquartered in Winona, Minnesota, the company serves a broad customer base through its extensive network of branches, on-site locations, and distribution centers.

-

The Hillman Group, Inc. is a leading North American provider of complete hardware solutions, specializing in fasteners and related products for the retail and industrial markets. With a strong presence across home improvement centers, mass merchants, pet supply stores, and OEM customers, Hillman delivers a wide range of innovative fastening systems tailored to meet diverse application needs. Among its notable offerings, the company provides ILC (Industrial Lightweight Construction) Fasteners, which are engineered to support advanced assembly methods in industries such as automotive, aerospace, and industrial manufacturing.

KD Fasteners, Inc, Grainger Canada are some of the emerging market participants in flatroof fasteners market.

-

KD Fasteners, Inc. is a U.S.-based manufacturer and distributor specializing in providing high-performance fastening solutions tailored to diverse industrial applications. With a strong focus on quality and durability, the company offers an extensive range of fasteners, including custom and standard bolts, screws, nuts, washers, and specialty items designed for demanding environments.

-

Grainger Canada is one of the country’s largest distributors of industrial products, serving businesses across sectors such as manufacturing, construction, automotive, and maintenance. With a strong presence in procurement and supply chain services, the company offers an extensive portfolio that includes fasteners, safety equipment, tools, HVAC components, and material handling solutions.

Key U.S. Flatroof Fasteners Companies:

- Fastenal Company

- The Hillman Group, Inc.

- EFC International

- Atlas Bolt and Screw LLC

- KD Fasteners, Inc

- PENCOM

- Grainger Canada

- Bossard Canada Inc.

- Richelieu Hardware Ltd.

- STANLEY Engineered Fastening

U.S. Flatroof Fasteners Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 764.3 million

Revenue forecast in 2033

USD 1115.7 million

Growth rate

CAGR of 4.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, roofing membranes, end use, distribution channel

Country scope

U.S

Key companies profiled

Fastenal Company; The Hillman Group, Inc.; EFC International; Atlas Bolt and Screw LLC; KD Fasteners, Inc; PENCOM; Grainger Canada; Bossard Canada Inc.; Richelieu Hardware Ltd.; STANLEY Engineered Fastening

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Flatroof Fasteners Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. flatroof fasteners market report based on product, roofing membranes, end use, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Mechanically Fixed

-

Glued

-

Ballasted

-

Others

-

-

Roofing Membrane Outlook (Revenue, USD Million, 2021 - 2033)

-

Single-ply Membranes

-

Two-Ply Bitumen

-

Other Composite Systems

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Construction & Real Estate

-

Energy & Utilities (Solar & Green Roofs)

-

Industrial & Manufacturing

-

Government & Public Sector

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Direct

-

Indirect

-

Frequently Asked Questions About This Report

b. The U.S. flatroof fasteners market size was estimated at USD 729.9 million in 2024 and is expected to reach USD 764.3 million in 2025.

b. The U.S. flatroof fasteners market is expected to grow at a compound annual growth rate of 4.9% from 2025 to 2033 to reach USD 1115.7 million by 2033.

b. The mechanically fixed segment in the U.S. market accounted for the largest revenue share of 44.8% in 2024, due to its strong wind resistance, ease of installation, and suitability for a wide range of roofing materials and climates.

b. Some of the prominent companies in the flatroof fasteners market include Fastenal Company, The Hillman Group, Inc., EFC International, Atlas Bolt and Screw LLC, KD Fasteners, Inc, PENCOM, Grainger Canada, Bossard Canada Inc., Richelieu Hardware Ltd., STANLEY Engineered Fastening.

b. Key factors driving the U.S. flatroof fasteners market include rapid urbanization, growing commercial construction, rising demand for energy-efficient roofing systems, and advancements in fastening technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.