- Home

- »

- Paints, Coatings & Printing Inks

- »

-

U.S. Fluoropolymer Coating Market, Industry Report, 2033GVR Report cover

![U.S. Fluoropolymer Coating Market Size, Share & Trends Report]()

U.S. Fluoropolymer Coating Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (PTFE Coatings, PVDF Coatings, FEP Coatings, ETFE Coatings), By End Use (Chemical Processing, Electrical & Electronics), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-644-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S Fluoropolymer Coating Market Summary

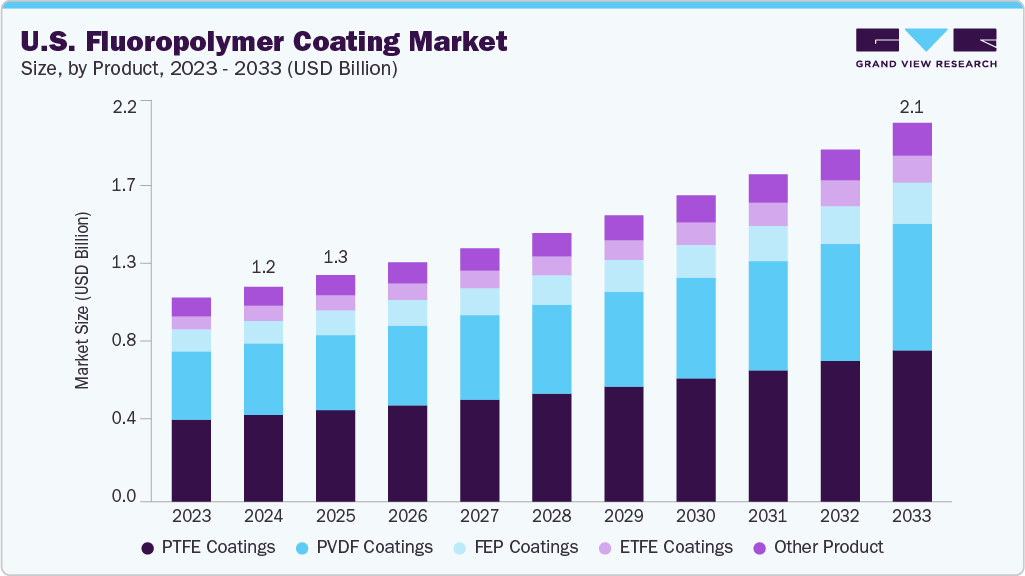

The U.S. fluoropolymer coating market size was estimated at USD 1,205.9 million in 2024 and is projected to reach USD 2,126.6 million by 2033, growing at a CAGR of 6.6% from 2025 to 2033. The growth is attributed to chemical processing end uses due to their exceptional resistance to harsh chemicals, high temperatures, and mechanical stress.

Key Market Trends & Insights

- The U.S. Fluoropolymer Coating market is projected to grow at a CAGR of 6.6% from 2025 to 2033.

- The ETFE Coatings Fluoropolymer Coating market is expected to witness the fastest growth of 7.1% from 2025 to 2033.

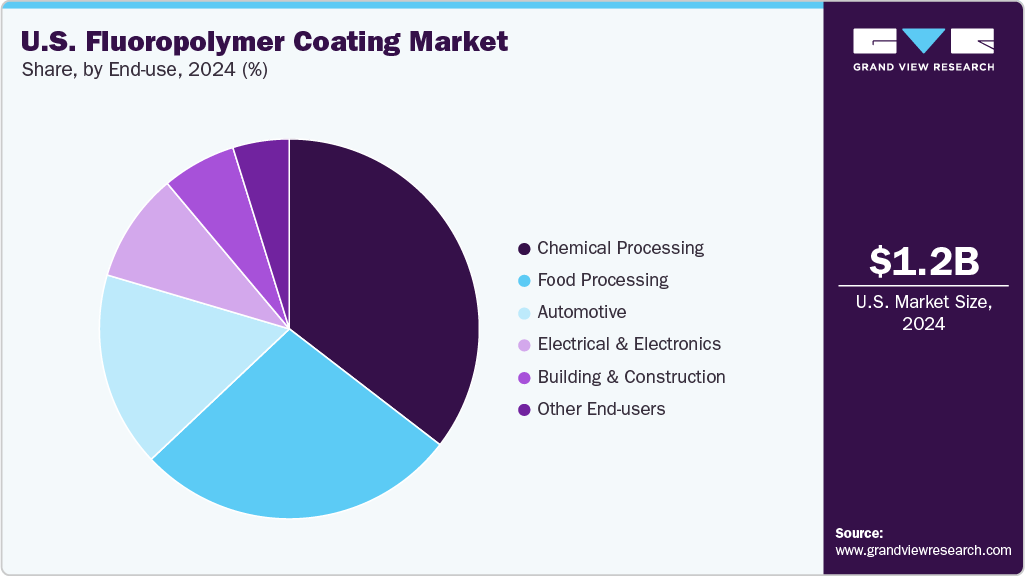

- By end use, chemical processing dominated the market with a revenue share of 35.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,206 Million

- 2033 Projected Market Size: USD 2,126.6 Million

- CAGR (2025-2033): 6.6%

Materials such as PTFE, FEP, and PFA, known for their inertness, can withstand exposure to highly corrosive substances, such as hydrofluoric acid, nitric acid, acetone, and sulfur dioxide, without degrading, making them ideal for lining tanks, pipes, valves, and fluid control components. The demand for fluoropolymer-coated products, like PTFE tubing, encapsulated sensors, heat shrink sleeving, coated springs, sealing tapes, and machined parts, continues to rise in chemical environments that require durability, safety, and low maintenance. Their versatility in form and function makes fluoropolymer coatings a critical enabler of reliable and cost-effective chemical processing solutions. Fluoropolymer coatings are becoming increasingly vital in the medical device industry, driven by the growing demand for minimally invasive technologies, enhanced device performance, and patient safety. The market is expanding rapidly in response to rising procedure volumes and innovations like surgical robotics, real-time diagnostics, and single-use sterile instruments, and fluoropolymer materials play a crucial enabling role. Their exceptionally low friction, chemical resistance, biocompatibility, and thermal stability make them ideal for various end uses, from catheter liners and guidewires to endoscopes and cryopreservation containers.

Advanced fluoropolymer-based composites, such as coextruded EFEP-PEBA and PEEK/fluoropolymer hybrid tubes, further push the boundaries of catheter design by improving flexibility, bond strength, and wear resistance, essential for next-generation diagnostic and therapeutic tools. As a result, demand for fluoropolymer coatings in medical devices is expected to remain strong, aligning with trends toward smaller, safer, and more effective healthcare technologies.

Market Concentration & Characteristics

The U.S. fluoropolymer coatings market is highly consolidated, with a few dominant multinational corporations controlling significant portions of raw material sourcing and finished coating production. Leading industries benefit from vertical integration, proprietary fluoropolymer technologies, and robust regional manufacturing infrastructure, enabling them to achieve economies of scale, consistent product quality, and strong supply chain reliability. These companies operate large-scale facilities with integrated capabilities, ranging from monomer production to advanced polymer processing and coatings formulation. Their close adherence to strict regulatory standards, including FDA, EPA, and REACH compliance, is critical in serving demanding sectors such as electronics, medical devices, and food processing, where purity, performance, and safety are non-negotiable.

Despite the concentration, competition persists from niche players, focusing on specialty fluoropolymer coatings or custom-engineered solutions for industries such as oil & gas, aerospace, and industrial equipment. Furthermore, companies investing in ISO-certified production, low-VOC technologies, and PFAS-free formulations are gaining a competitive edge in high-value and environmentally sensitive markets.

The fluoropolymer coatings market structure, characterized by technology-driven differentiation, regulatory barriers, and end use-specific innovation, ensures that only technically advanced and compliance-focused firms can effectively compete in premium fluoropolymer coating segments across the U.S.

A key characteristic of the fluoropolymer coatings market is the increasing emphasis on downstream collaboration, where raw material suppliers, fluoropolymer producers, coating formulators, and end-use OEMs work closely to develop tailored coating solutions that meet precise performance requirements. Whether the goal is ultra-low friction for medical catheters, high dielectric insulation for electronics, or chemical resistance for industrial valves, this end-to-end integration ensures that product formulations align with specific functional and regulatory demands.

This collaborative approach is further enhanced by adopting digital tools, such as predictive modeling, simulation-based formulation, and real-time performance monitoring, accelerating development cycles and improving end use efficiency. Moreover, on-demand manufacturing models and custom batch production are reshaping how value is delivered across the fluoropolymer coatings value chain, enabling faster response times, reduced inventory burdens, and greater agility in addressing specialized or small-batch market needs. This evolution underscores a shift from commodity-driven supply to performance-oriented partnerships across the ecosystem.

Product Insights

Polytetrafluoroethylene (PTFE) coatings segment led the market and accounted for the largest revenue share of 40.2% in 2024, due to its crucial role in industrial end uses, technology/tool production, and its exceptional properties, such as high-temperature resistance, chemical inertness, and low friction. In industrial settings, PTFE is widely used to coat components like gears, bearings, and sliding parts, significantly reducing wear and preventing mechanical failures caused by friction and heat buildup. Its durability enhances equipment lifespan and operational efficiency.

Additionally, in the technology sector, PTFE’s outstanding insulating and heat-resistant qualities make it ideal for electrical components, including wiring, circuit boards, plugs, and cables, even those used in aerospace end uses. These characteristics ensure safe and reliable performance in high-demand environments, fueling continued demand for PTFE coatings across critical high-tech and manufacturing industries.

The Ethylene Tetrafluoroethylene (ETFE) coatings segment is expected to grow fastest with a CAGR of 7.7% from 2025 to 2033. They are highly valued in automotive and electrical & electronic end uses due to their exceptional chemical resistance, thermal stability, and electrical insulation properties. In the automotive sector, ETFE is used for O-rings, gaskets, valve stem seals, fuel hose linings, and transmission components due to its excellent resistance to petroleum-based fluids and low fuel permeation, driving significant growth in its use for fuel tubing and power systems.

Additionally, in electrical and electronic parts, ETFE is utilized for wire insulation, sleeving, jacketing, and coatings on compact wires and connectors due to the product's dielectric strength and durability in harsh environments. Its use in battery components, sockets, and insulators highlights its critical role in ensuring reliable performance in temperature-sensitive systems.

End Use Insights

Chemical processing end use dominated the fluoropolymer coating market, with a revenue share of 35.4% in 2024, due to its crucial role in chemical plants, equipment such as tanks, pipes, valves, and mixers, and reactors routinely exposed to aggressive chemicals, high temperatures, and pressure, chemical processing end use dominated the fluoropolymer coating market. Fluoropolymer coatings like PTFE, FEP, and PFA provide a chemically inert barrier that protects metal surfaces from acidic, alkaline, or solvent-based corrosion, significantly extending equipment lifespan. These coatings also reduce maintenance needs, prevent material contamination, and ensure smooth, nonstick surfaces that enhance process efficiency and product purity.

The electrical & electronics end use is expected to grow fastest with a CAGR of 7.0% from 2025 to 2033, due to their exceptional insulating properties, thermal stability, and chemical resistance. These coatings provide reliable protection in demanding environments, making them ideal for high-voltage end uses and sensitive electronic components. Fluoropolymer coatings help prevent electrical leakage and short circuits by acting as effective electrical insulators. They support the performance and safety of transformers, motors, relays, switches, sensors, and encapsulated coils. They can insulate substrates up to 5,000 volts, offering dependable protection even on complex or tight-tolerance components.

Additionally, these coatings deliver multifunctional benefits, including non-stick surfaces, wear resistance, and chemical shielding, making them suitable for both industrial and medical electronics, such as cauterization tools and cooling tube protection. Their use improves component lifespan, reduces maintenance, and enhances system reliability, driving continued demand across various electronic and electrical end uses.

Key U.S. Fluoropolymer Coating Company Insights

Some key players operating in the fluoropolymer coating market include The Chemours Company and DAIKIN INDUSTRIES, Ltd.

- DAIKIN INDUSTRIES, Ltd. serves many applications in the fluoropolymer coatings market, including automotive, electronics, chemical processing, cookware, building & construction, semiconductor manufacturing, and renewable energy. The company’s fluoropolymer product portfolio includes PTFE, PFA, FEP, ETFE, and other high-performance resins and coatings known for their superior chemical resistance, thermal stability, and non-stick properties. DAIKIN operates through several business segments, such as Chemicals, Air Conditioning, and Others, with its fluoropolymer business falling under the Chemicals segment. The company has a strong global presence with sales and manufacturing operations across Japan, North America, Europe, China, Southeast Asia, and other regions. Its fluoropolymer coatings are distributed in more than 150 countries, supported by a network of R&D centers and production facilities that ensure tailored solutions for diverse industry needs worldwide.

Axalta Coating Systems, LLC and Endura Coatings are emerging market participants in the fluoropolymer coating market.

- Axalta Coating Systems, LLC serves a broad range of industries through its high-performance coating solutions, including the specialized fluoropolymer coatings segment. These coatings are widely used in applications such as architectural structures, automotive parts, chemical processing equipment, and general industrial surfaces due to their exceptional resistance to corrosion, UV radiation, and harsh environmental conditions. Axalta’s operations are structured across several business segments, including Performance Coatings and Mobility Coatings, with a global sales presence spanning North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The company delivers its products and technologies to customers in over 130 countries, supported by manufacturing sites, technology centers, and sales offices worldwide.

Key U.S. Fluoropolymer Coating Companies:

- Akzo Nobel N.V.

- Arkema

- Axalta Coating Systems, LLC

- DAIKIN INDUSTRIES, Ltd.

- Endura Coatings

- Jotun

- PPG Industries, Inc.

- Linde PLC

- Solvay

- The Chemours Company.

- The Sherwin-Williams Company

- Tnemec

- Walter Wurdack Inc.

Recent Developments

-

In November 2023, Solvay confirmed plans to build North America’s largest battery-grade PVDF (polyvinylidene fluoride) production facility in Augusta, Georgia, in partnership with Orbia. PVDF, a thermoplastic fluoropolymer, is crucial for lithium-ion battery end uses, serving as a binder and separator coating, an area overlapping with high-performance fluoropolymer coatings. The facility, supported by a $178 million U.S. Department of Energy grant, will supply material for over 5 million EV batteries annually by 2026. This project strengthens the U.S. EV supply chain, boosts regional fluoropolymer production, and reflects growing demand for advanced, sustainable coatings in energy storage technologies.

-

In May 2025, PPG launched PPG EnviroLuxe Plus powder coatings, a new sustainable product line that eliminates the use of polytetrafluoroethylene (PTFE), a common fluoropolymer in coatings, marking a significant shift in the fluoropolymer coatings market. By replacing PTFE and incorporating up to 18% post-industrial recycled plastic (rPET), the coatings reduce carbon footprint by up to 30% compared to standard durable powders, without compromising performance. This move reflects growing industry trends toward PFAS-free (per- and polyfluoroalkyl substances) solutions and environmentally responsible formulations, highlighting a shift away from traditional fluoropolymer-based coatings in favor of more sustainable alternatives.

-

In February 2025, Arkema announced a 15% expansion of its PVDF (polyvinylidene fluoride) production capacity at its Calvert City, Kentucky facility, backed by a 20-million-dollar investment. This move aligns with the company's global strategy to meet rising demand for high-performance fluoropolymers, particularly in electric vehicle batteries, semiconductors, and cable end uses. The expanded capacity, targeted to begin operations by mid-2026, will support North America's increasing need for sustainable and locally manufactured PVDF grades.

U.S. Fluoropolymer Coating Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,272.3 million

Revenue forecast in 2033

USD 2,126.6 million

Growth rate

CAGR of 6.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product and end use

Key companies profiled

Akzo Nobel N.V.; Arkema; Axalta Coating Systems, LLC; DAIKIN INDUSTRIES, Ltd.; Endura Coatings; Jotun; PPG Industries, Inc.; Linde PLC; Solvay; The Chemours Company.; The Sherwin-Williams Company; Tnemec; Walter Wurdack Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Fluoropolymer Coating Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the U.S. fluoropolymer coating market report based on product, and end use.

-

Product Outlook (Revenue, USD Million, Volume, Kilotons, 2018 - 2033)

-

PTFE Coatings

-

PVDF Coatings

-

FEP Coatings

-

ETFE Coatings

-

Other Product

-

-

End Use Outlook (Revenue, USD Million, Volume, Kilotons, 2018 - 2033)

-

Food Processing

-

Automotive

-

Chemical Processing

-

Electrical & Electronics

-

Building & Construction

-

Other End Users

-

Frequently Asked Questions About This Report

b. The U.S. fluoropolymer coating market size was estimated at USD 1205.9 million in 2024 and is expected to reach USD 1272.3 million in 2025.

b. The U.S. fluoropolymer coating market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2033 to reach USD 2,126.6 million by 2033.

b. Polytetrafluoroethylene (PTFE) coatings segment led the market and accounted for the largest revenue share of 40.2% in 2024, due to its crucial role in industrial end uses and technology/tool production due to its exceptional properties, such as high-temperature resistance, chemical inertness, and low friction.

b. Some key players operating in the U.S. fluoropolymer coating market include Akzo Nobel N.V., Arkema, Axalta Coating Systems, LLC, DAIKIN INDUSTRIES, Ltd., Endura Coatings, Jotun, PPG Industries, Inc., Linde PLC, Solvay, The Chemours Company., The Sherwin-Williams Company, Tnemec, and Walter Wurdack Inc.

b. The growth is attributed to chemical processing end uses due to their exceptional resistance to harsh chemicals, high temperatures, and mechanical stress. Materials like PTFE, FEP, and PFA known for their inertness, can withstand exposure to highly corrosive substances, such as hydrofluoric acid, nitric acid, acetone, and sulfur dioxide, without degrading, making them ideal for lining tanks, pipes, valves, and fluid control components.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.