- Home

- »

- Advanced Interior Materials

- »

-

U.S. Fracking Water Treatment Market, Industry Report 2033GVR Report cover

![U.S. Fracking Water Treatment Market Size, Share & Trends Report]()

U.S. Fracking Water Treatment Market (2025 - 2033) Size, Share & Trends Analysis Report By Water Source (Flowback Water, Produced Water), By Process (Media Filtration, Electrocoagulation, Reverse Osmosis, Microbial Treatment), And Segment Forecasts

- Report ID: GVR-4-68040-676-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Fracking Water Treatment Market Summary

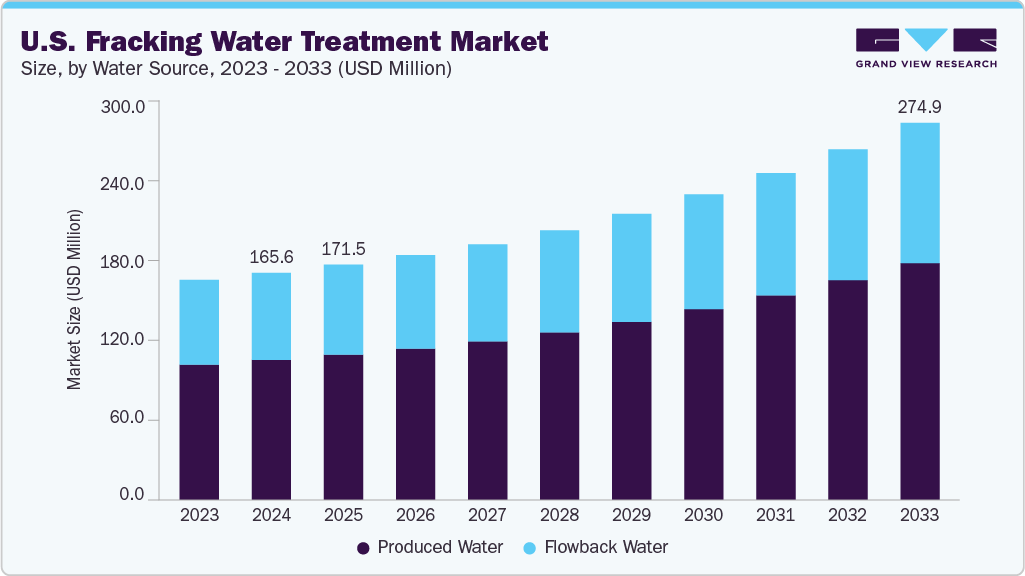

The U.S. fracking water treatment market size was estimated at USD 165.6 million in 2024 and is projected to reach USD 274.9 million by 2033, growing at a CAGR of 6.1% from 2025 to 2033. The market growth is primarily driven by the rising regulatory pressure to mitigate the environmental impacts of hydraulic fracturing.

Key Market Trends & Insights

- The fracking water treatment market in the U.S. is expected to grow at a substantial CAGR of 6.1% from 2025 to 2033.

- By process, the reverse osmosis segment is expected to grow at a considerable CAGR of 6.9% from 2025 to 2033 in terms of revenue.

- By water source, the produced water segment is expected to grow at a considerable CAGR of 6.3% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 165.6 Million

- 2033 Projected Market Size: USD 274.9 Million

- CAGR (2025-2033): 6.1%

Federal and state-level agencies, including the EPA, have imposed stringent guidelines on wastewater disposal and reuse, pushing companies to adopt advanced treatment technologies. Additionally, the economic benefits of water reuse and recycling are encouraging fracking operators to invest in on-site treatment systems. Rising costs associated with freshwater sourcing and wastewater disposal in high-production states such as Texas and Pennsylvania are making treatment solutions more attractive. Companies are increasingly deploying mobile and modular treatment units to reduce transport costs and minimize downtime. This shift toward cost-effective, closed-loop water systems is expected to significantly bolster the demand for fracking water treatment services in the U.S.

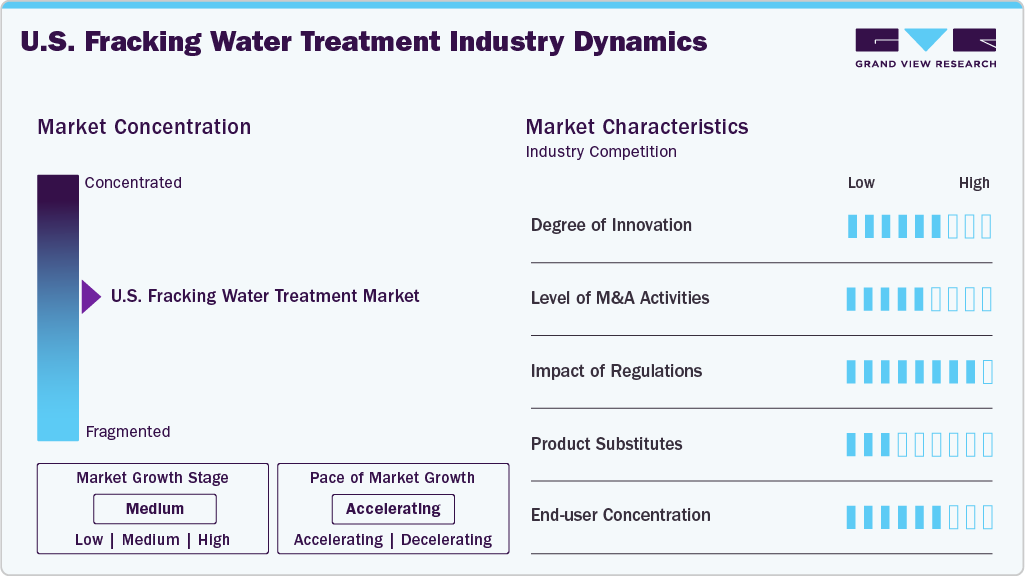

Market Concentration & Characteristics

The U.S. fracking water treatment market is moderately concentrated, with a few key players holding significant market share. Major companies operate across multiple shale regions and offer comprehensive treatment solutions, giving them a competitive edge. However, numerous regional and specialized service providers also contribute to market activity, particularly in niche or localized operations. This blend of dominant firms and smaller players results in a semi-consolidated competitive landscape.

The U.S. fracking water treatment industry exhibits a high degree of innovation driven by the need for cost-effective and sustainable water solutions. Companies are developing advanced filtration systems, chemical-free treatments, and mobile units tailored to harsh shale conditions. Innovations also focus on increasing treatment speed and recovery rates to support continuous drilling operations. This technological evolution helps operators comply with regulations while optimizing operational efficiency.

Mergers and acquisitions play a notable role in shaping the competitive dynamics of the U.S. fracking water treatment industry. Larger firms are acquiring smaller, specialized companies to expand service offerings and regional presence. These strategic deals often aim to integrate advanced technologies or enter emerging shale basins. As competition intensifies, M&A activity is expected to continue as a path to consolidation and market expansion.

Regulatory oversight in the U.S. has a strong influence on the fracking water treatment market, particularly regarding wastewater discharge and reuse. Federal and state-level regulations enforce strict compliance with water quality and environmental protection. This regulatory framework drives demand for reliable and compliant treatment technologies. As regulations evolve, operators must adapt quickly, making regulatory compliance a key market driver.

Drivers, Opportunities & Restraints

The U.S. fracking water treatment market is driven by increasing environmental regulations aimed at reducing water contamination and promoting reuse. Rising shale gas and oil production across states like Texas and Pennsylvania also fuels demand for efficient water management solutions. Operators seek cost-effective treatment methods to reduce freshwater dependency and disposal costs. Technological advancements further support the adoption of mobile and modular treatment systems.

There is significant growth potential in expanding treatment infrastructure in underdeveloped shale regions and remote drilling areas. Investments in R&D can unlock new solutions for high-salinity and chemical-laden wastewater. Government incentives for water reuse and sustainable operations create favorable conditions for innovation. Additionally, partnerships between oilfield service providers and technology firms can enhance service offerings and regional reach.

High initial investment and operating costs of advanced treatment technologies limit adoption among smaller operators. Variability in state-level regulations can create compliance challenges for companies operating across multiple regions. Limited infrastructure in certain basins also hampers large-scale treatment and reuse. Additionally, market uncertainty due to fluctuating oil prices can delay investment in new water treatment systems.

Water Source Insights

The produced water segment led the U.S. fracking water treatment industry with the largest revenue share of 61.6% in 2024, due to its large volume generated throughout the life of a well. It often contains high levels of salts, hydrocarbons, and other contaminants, requiring advanced treatment before reuse or disposal. The continuous production of this wastewater stream makes treatment solutions essential for long-term operations. Regulatory mandates and cost-saving strategies are driving increased focus on produced water management across major shale plays.

The flowback water segment is expected to grow at a significant CAGR of 5.7% from 2025 to 2033 in terms of revenue. The flowback water segment is experiencing significant growth as a focus area in treatment due to its early and concentrated presence post-fracturing. It contains a mix of fracturing fluids and formation contaminants, demanding rapid and efficient treatment to support reuse. The rising trend of closed-loop systems and water recycling in regions like the Permian Basin is boosting demand for flowback water treatment. Increasing pressure to reduce freshwater use is further accelerating investment in this segment.

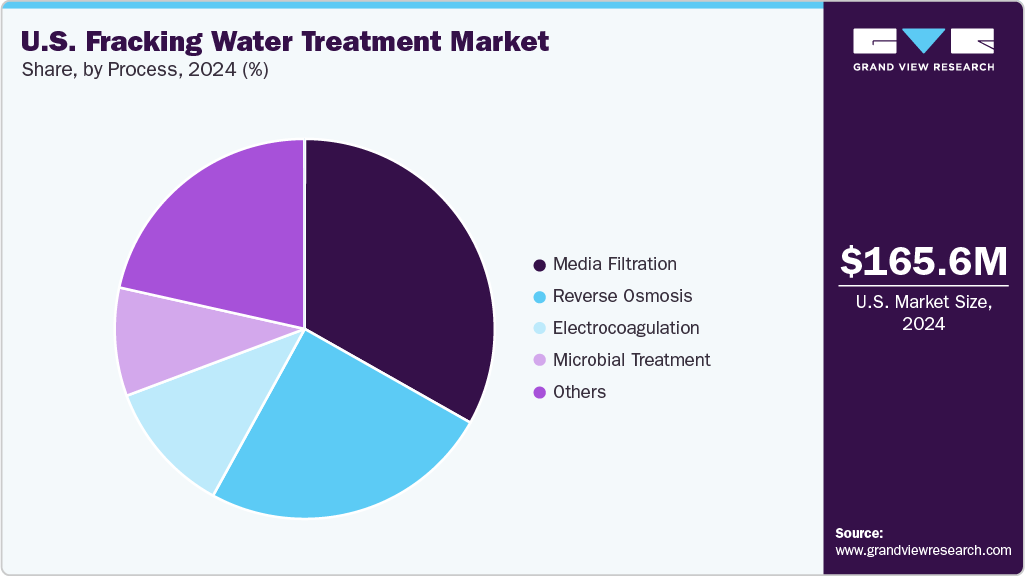

Process Insights

The media filtration segment dominated the U.S. fracking water treatment market with the largest revenue share of 33.2% in 2024, due to its reliability and cost-effectiveness. It efficiently removes suspended solids, sediments, and particulates, making it ideal for pretreatment in multi-stage systems. Operators prefer this method for its simplicity, scalability, and low maintenance in remote shale locations. Its widespread use across major U.S. basins like Bakken and Eagle Ford underscores its market leadership.

The reverse osmosis segment is expected to grow at a fastest CAGR of 6.9% from 2025 to 2033 in terms of revenue, as operators seek higher-purity water for reuse and environmental compliance. It effectively removes dissolved salts, heavy metals, and chemical residues from both produced and flowback water. The push for zero liquid discharge systems and stricter water quality regulations is accelerating their adoption. Despite higher operational costs, its efficiency in handling complex contaminants is driving growth in the U.S. market.

Key U.S. Fracking Water Treatment Company Insights

Some of the key players operating in the market include DuPont de Nemours Inc., Ecologix Environmental Systems LLC, and Halliburton Co.

-

DuPont is actively involved in water treatment for oil and gas operations, offering advanced membrane technologies, including reverse osmosis and ultrafiltration systems. The company’s separation and purification division supports the treatment of fracking wastewater by removing dissolved solids, hydrocarbons, and heavy metals. DuPont is also advancing sustainable water reuse strategies tailored for energy-intensive applications. It partners with oilfield service providers to deliver modular and scalable water treatment units. Through innovation and customization, DuPont enables operators to meet strict environmental and operational standards in shale regions.

-

Ecologix specializes in designing and manufacturing integrated water treatment systems specifically for the oil and gas industry. The company offers patented solutions such as the Integrated Treatment System (ITS) that combines chemical, mechanical, and filtration processes for treating produced and flowback water. Its systems are designed to reduce trucking, disposal costs, and freshwater dependency. Ecologix is known for its mobile and modular units that offer flexibility for remote and large-scale fracking operations. The firm has a strong presence in U.S. shale basins and emphasizes rapid deployment and on-site efficiency.

Key U.S. Fracking Water Treatment Companies:

- DuPont de Nemours Inc.

- Ecologix Environmental Systems LLC

- Halliburton Co.

- Veolia Environnement SA

- Xylem Inc.

- Alfa Laval AB

- Baker Hughes Co.

- Aquatech International LLC

- Filtra Systems Co.

- Evoqua Water Technologies LLC

Recent Developments

-

In January 2024, New Mexico’s governor proposed a $500 million plan to treat and reuse fracking wastewater, aiming to develop an alternative water source. The funding would support new treatment and desalination facilities. Environmental groups have raised concerns, warning it could encourage more fracking.

-

In May 2023, Xylem completed its $7.5 billion all-stock acquisition of Evoqua Water Technologies, forming the world’s largest dedicated water technology company. The merger enhances Xylem’s treatment capabilities and service offerings across the water cycle. Together, they aim to address U.S. water challenges like scarcity and quality. Evoqua shareholders now own about 25% of the combined company.

U.S. Fracking Water Treatment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 171.5 million

Revenue forecast in 2033

USD 274.9 million

Growth rate

CAGR of 6.1% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Water source, process

Country scope

U.S.

Key companies profiled

DuPont de Nemours Inc.; Ecologix Environmental Systems LLC; Halliburton Co.; Veolia Environnement SA; Xylem Inc.; Alfa Laval AB; Baker Hughes Co.; Aquatech International LLC; Evoqua Water Technologies LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Fracking Water Treatment Market Report Segmentation

This report forecasts revenue growth at the U.S. level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. fracking water treatment market report based on water source, and process:

-

Water Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Flowback Water

-

Produced Water

-

-

Process Outlook (Revenue, USD Million, 2021 - 2033)

-

Media Filtration

-

Electrocoagulation

-

Reverse Osmosis

-

Microbial Treatment

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. fracking water treatment market size was estimated at USD 165.6 million in 2024 and is expected to be USD 171.5 million in 2025.

b. The U.S. fracking water treatment market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2033 to reach USD 274.9 million by 2033.

b. Produced water holds the largest share of 61.6% in the U.S. fracking water treatment market due to its large volume generated throughout the life of a well. It often contains high levels of salts, hydrocarbons, and other contaminants, requiring advanced treatment before reuse or disposal.

b. Some of the key players operating in the U.S. fracking water treatment market include DuPont de Nemours Inc.; Ecologix Environmental Systems LLC; Halliburton Co.; Veolia Environnement SA; Xylem Inc.; Alfa Laval AB; Baker Hughes Co.; Aquatech International LLC; Xylem Inc.; Evoqua Water Technologies LLC.

b. Key factors driving the U.S. fracking water treatment market include stringent environmental regulations and rising concerns over groundwater contamination. The increasing cost of freshwater sourcing and wastewater disposal is pushing operators toward recycling and reuse solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.