- Home

- »

- Medical Devices

- »

-

U.S. Freestanding Emergency Department Market, 2030GVR Report cover

![U.S. Freestanding Emergency Department Market Size, Share & Trends Report]()

U.S. Freestanding Emergency Department Market (2025 - 2030) Size, Share & Trends Analysis Report By Ownership (OCED, IFSED), By Services (ED Services, Laboratory Services, Imaging Services), And Segment Forecasts

- Report ID: GVR-3-68038-207-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

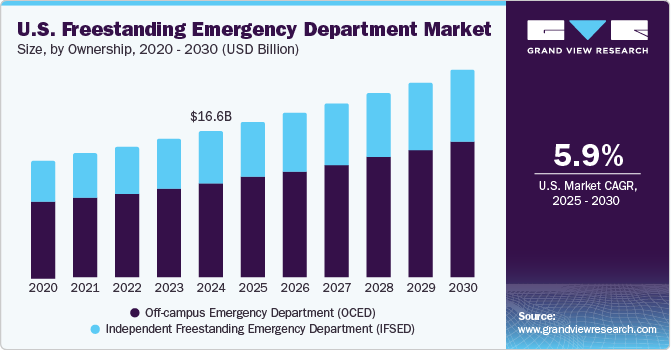

The U.S. freestanding emergency department market size was estimated at USD 16.55 billion in 2024 and is projected to grow at a CAGR of 5.9% from 2025 to 2030. The increasing overcrowding of hospital emergency departments drives the market growth in the country. In 2021, approximately 140 million visits to emergency departments underscored the pressing need for alternative care options. With a growing elderly population and a rising prevalence of chronic diseases, the demand for urgent care services is anticipated to escalate further, highlighting the necessity for FSEDs to alleviate congestion in traditional hospital settings.

Accessibility and convenience are pivotal factors influencing the expansion of FSEDs. Operating 24/7, about 70% of these facilities enable patients, especially in underserved rural areas, to receive timely urgent care without the protracted wait times of hospital emergency departments. This immediate access to care is crucial for addressing health emergencies, particularly as the incidence of injuries and acute conditions such as chest pain or strokes rises, necessitating swift medical attention to improve survival rates and patient outcomes.

The country’s favorable regulatory environment further boosts FSED market growth, as higher reimbursement rates than traditional urgent care centers enhance their financial viability. Federal support and consumer-driven health plans are anticipated to foster the establishment of more FSEDs in 2024, presenting an appealing investment opportunity for healthcare providers. This supportive landscape enables FSEDs to effectively respond to the increasing demand for accessible emergency care, thereby strengthening their role in the healthcare ecosystem.

Innovations such as telemedicine and enhanced diagnostic tools optimize operational efficiency and significantly improve patient outcomes. As patients increasingly seek immediate care coupled with high-quality treatment, the integration of such technologies becomes essential in meeting these expectations. Collectively, these drivers position the U.S. FSED market for continued growth, addressing critical gaps in emergency care delivery and reshaping the healthcare landscape.

Ownership Insights

The Off-campus Emergency Department (OCED) dominated the market and accounted for a share of 64.8% in 2024 due to its strategic locations that facilitate emergency care closer to patients’ residences. With approximately 70% of FSEDs operating 24/7, they ensure prompt access to emergency services, particularly benefiting underserved communities where traditional healthcare options may be limited, thus fulfilling an essential need for immediate medical assistance.

The Independent Freestanding Emergency Department (IFSED) is expected to grow rapidly over the forecast period. IFSEDs are increasingly sought after for their operational flexibility and alignment with local community needs, independent of hospital affiliations. As of 2023, more than 200 independent FSEDs were reported nationwide, offering a wider range of services while ensuring shorter wait times. This responsiveness to urgent care demands enhances their appeal among patients prioritizing immediate treatment.

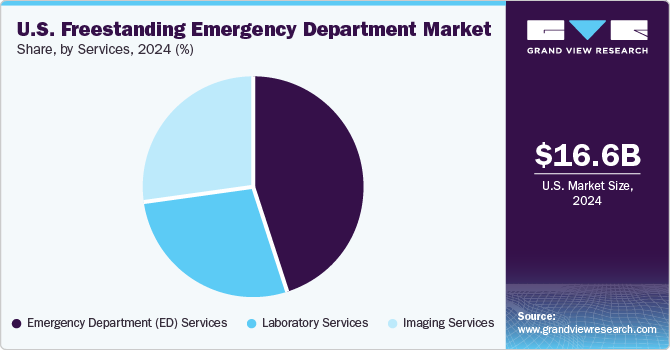

Services Insights

Emergency Department (ED) services led the market with a revenue share of 44.6% in 2024, fueled by the rise in emergency visits in the country. This surge in demand for immediate and comprehensive care compels FSEDs to deliver efficient services, effectively reducing congestion in traditional hospital EDs and significantly improving patient care outcomes.

Imaging services are expected to register the fastest CAGR of 6.3% over the forecast period, owing to their essential role in the rapid and accurate diagnosis of medical conditions. In 2023, over 30% of FSEDs reported the provision of imaging capabilities, enabling timely assessments vital for effective treatment planning. This integration of imaging services enhances overall patient care and attracts individuals seeking urgent medical attention at these facilities.

Key U.S. Freestanding Emergency Department Company Insights

Some key companies operating in the market include TH Medical, Universal Health Services, Inc., CHSPSC, LLC., C-HCA, Inc., and Lifepoint Health, Inc., among others. Key players are actively seeking strategic partnerships and acquisitions to broaden their geographic presence, while regulatory support and reimbursement policies are continuously evolving.

-

TH Medical specializes in the development and management of freestanding emergency facilities that deliver comprehensive emergency care. Their focus is improving patient access to urgent medical services, particularly in underserved regions, utilizing advanced technology and experienced emergency professionals.

-

C-HCA, Inc., as a subsidiary of HCA Healthcare, establishes freestanding emergency departments that operate 24/7. Their facilities aim to reduce congestion in hospital emergency rooms while providing high-quality, immediate care to diverse communities nationwide.

Key U.S. Freestanding Emergency Department Companies:

- TH Medical

- Universal Health Services, Inc.

- CHSPSC, LLC.

- C-HCA, Inc.

- Lifepoint Health, Inc.

- Ardent Health Management Services (AHS Management Company, Inc.)

- Ascension

- Deerfield (Adeptus Health, Inc.)

- Emerus Hospital Partners, LLC

Recent Developments

-

In December 2024, Baptist Health inaugurated a new freestanding emergency room in West Boca, providing comprehensive, round-the-clock services as part of Boca Raton Regional Hospital’s network of care.

-

In September 2024, HCA Florida Kendall Hospital announced a new 10,000-square-foot freestanding emergency room in Homestead, set to open in late 2025, enhancing access to comprehensive medical services.

-

In August 2024, Ascension Sacred Heart announced plans for a new freestanding emergency room in Perdido Key, enhancing emergency services and expanding healthcare access in southwest Escambia County by summer 2025.

-

In May 2024, HCA Florida Englewood Hospital broke ground on a USD 31 million free-standing emergency room in Wellen Park, enhancing access to emergency services in south Sarasota County, expected to open in spring 2025.

-

In April 2024, Orlando Health initiated construction of a freestanding emergency room in Longwood, targeting a 2025 opening concurrent with the new Lake Mary Hospital.

-

In March 2024, Micro-hospitals gained traction in the U.S. healthcare sector, exemplified by Sila Realty Trust’s USD 85.5 million acquisition of a portfolio featuring four micro-hospitals and a freestanding emergency department, highlighting the potential for medical real estate investment.

U.S. Freestanding Emergency Department Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.51 billion

Revenue forecast in 2030

USD 23.35 billion

Growth rate

CAGR of 5.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Ownership, services

Country scope

U.S.

Key companies profiled

TH Medical; Universal Health Services, Inc.; CHSPSC, LLC.; C-HCA, Inc.; Lifepoint Health, Inc.; Ardent Health Management Services (AHS Management Company, Inc.); Ascension; Deerfield (Adeptus Health, Inc.); Emerus Hospital Partners, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Freestanding Emergency Department Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. freestanding emergency department market report based on ownership and services:

-

Ownership Outlook (Revenue, USD Million, 2018 - 2030)

-

Off-campus Emergency Department (OCED)

-

Independent Freestanding Emergency Department (IFSED)

-

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Emergency Department (ED) Services

-

Laboratory Services

-

Imaging Services

-

Frequently Asked Questions About This Report

b. The U.S. freestanding emergency department market was estimated at USD 16.55 billion in 2024 and is expected to reach USD 17.51 billion in 2025.

b. The U.S. freestanding emergency department market is expected to grow at a compound annual growth rate of 5.93% from 2025 to 2030 to reach USD 23.35 billion by 2030.

b. The Off-campus emergency department (OCED) dominated the ownership segment in 2024. This is attributable to the overcrowding of the hospital emergency department, and availability of high reimbursement for the treatment at OCED when compared with independent freestanding emergency department (IFSED).

b. Some key players operating in the U.S. freestanding emergency department market include Adeptus Health Inc.; Tenet Healthcare Corporation; Universal Health Services, Inc.; HCA Healthcare, Inc.; Community Health Systems, Inc.; Ascension Health; Legacy Lifepoint Health, Inc.; Ardent Health Services; and Emerus

b. Key factors that are driving the U.S. freestanding emergency department market growth include overcrowding of the emergency departments at the hospitals, a growing number of patients opting for immediate treatment options, advanced healthcare infrastructure of the country, rising number of injuries due to accidents, and rising incidence of chest pain or disease like epilepsy and stroke, which require immediate attention.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.