- Home

- »

- Consumer F&B

- »

-

U.S. Frozen Food Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. Frozen Food Market Size, Share & Trends Report]()

U.S. Frozen Food Market Size, Share & Trends Analysis Report By Product (Frozen Meals, Meat/Poultry/Seafood, Desserts, Fruits & Vegetables, Snacks, Baked Goods), By Distribution Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-247-1

- Number of Report Pages: 107

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

U.S. Frozen Food Market Size & Trends

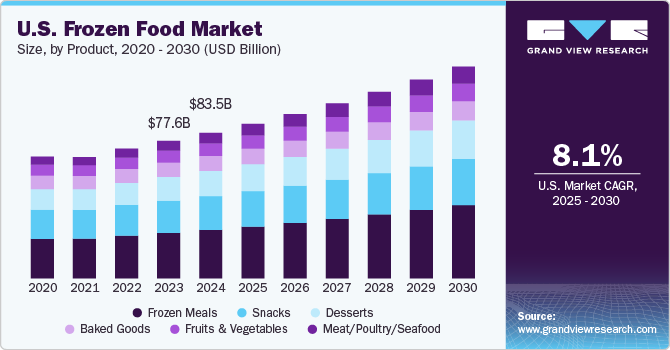

The U.S. frozen food market size was estimated at USD 83.50 billion in 2024 and is expected to grow at a CAGR of 8.1% from 2025 to 2030. The rise in dual-income households and busier lifestyles in the U.S. has fueled the demand for frozen, ready-to-eat, and ready-to-cook meals, making them a popular choice among consumers who seek quick, nutritious, and easy meal solutions. Frozen food products are also valued for their long shelf life, offering flexibility and reducing food waste, which resonates with environmentally conscious buyers.

Consumers are increasingly looking for clean-label, organic, and plant-based frozen foods, which has prompted manufacturers to innovate and offer healthier alternatives. Products such as plant-based frozen meals, snacks, and desserts are growing in popularity as they cater to both health-conscious and sustainability-driven consumers. Technological advancements in freezing techniques have also enhanced the quality of frozen products, maintaining their nutritional value, texture, and taste, which has helped elevate consumer perception of frozen food.

The rising prevalence of gluten-free dietary lifestyles among consumers owing to various health benefits offered by these products will boost the market for gluten-free frozen ready meals. For instance, in March 2022, Halo Top, an ice cream brand from Wells Enterprises, Inc., launched a line of fruity frozen desserts with new sorbet pints. These products are available in three flavors-raspberry, mango, and strawberry. In addition, these products are made from real fruits, with less sugar & calories, and are vegan-certified and gluten-free. A rise in the trend of healthy eating among buyers will further drive the market growth.

The growing penetration of online platforms is one of the major market strategies of frozen food companies. For instance, in September 2023, Yelloh, formerly known as Schwan’s Home Delivery, launched a new website and mobile app to enhance customer experience in ordering frozen meals and treats. This transformation marks a significant step in the company's evolution, maintaining its commitment to delivering high-quality frozen foods that customers have enjoyed for over 70 years. Customers can retain their existing accounts but will need to sign in on the new platform.

Product Insights

Frozen meals accounted for a revenue share of 34.6% in 2024. The U.S. frozen meal market is growing rapidly due to increasing demand for convenient, ready-to-eat meal options, lifestyle changes, dietary preferences, and rising disposable incomes. With a growing working population, many individuals have less time to prepare meals from scratch, contributing to market growth. Frozen meals offer a quick and easy alternative, requiring minimal preparation time. Consumers are also becoming more aware of the environmental impact of food waste, which encourages them to choose frozen meal options. For instance, according to data published by The Investor’s Podcast Network in August 2023, nearly 40% of all food in the U.S. is wasted. Frozen meals can help address these concerns by reducing food waste.

Frozen snacks market is expected to grow at a CAGR of 11.6% from 2025 to 2030. Busy schedules, convenience, the expansion of e-commerce, and changing lifestyles are driving the demand for frozen snacks. As more people move into urban areas seeking career growth opportunities, fast-paced lifestyles are increasing the need for convenient food alternatives like frozen snacks. Moreover, the rise of social media platforms and the sharing of new recipes have attracted consumers to frozen snacks, which can be prepared with minimal effort. With a growing number of health-conscious consumers, many frozen snack companies are now offering healthier options that cater to those seeking nutritious and convenient food alternatives.

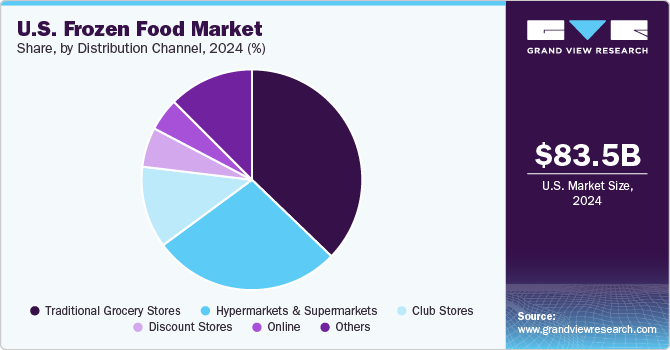

Distribution Channel Insights

Sales through traditional grocery stores accounted for a revenue share of 36.8% in 2024 in the U.S. frozen food market. The frozen food category in traditional grocery stores is growing due to factors such as their close proximity to residential areas and the convenience frozen foods offer, including time-saving meal options. These stores provide a wide array of products for consumers to choose from.

In addition to frozen food options, traditional grocery stores stock goods required for day-to-day convenience, which appeals to U.S. households as they can purchase items in bulk. Their extensive frozen food selections include a variety of products such as frozen snacks, desserts, prepared meals, and more. This range allows consumers to meet their dietary needs and preferences all in one place.

Sales of U.S. frozen food through online channels are expected to grow with a CAGR of 12.3% from 2025 to 2030. The frozen food market in the U.S. is growing, driven by lifestyle changes and a rising number of working professionals seeking convenient and delicious meals. Online stores offer a significant advantage to these busy consumers, allowing them to place orders with just a click of a button. Moreover, the increase in internet connectivity across the nation further accelerated online shopping, providing consumers with access to a wide range of products

Region Insights

The market for frozen food in Southeast U.S. is accounted for a revenue share of 16.2% in 2024 in the U.S. frozen food market. The frozen food market in the Southeast U.S. has seen significant growth, driven by increasing demand for convenient, ready-to-eat meals, particularly among busy households and working professionals. Factors such as urbanization, shifting consumer preferences for quick meal solutions, and improvements in freezing technology that enhance product quality and nutrition have all contributed to rising consumption.

The market for frozen food in South Central U.S. is expected to grow with a CAGR of 10.6% from 2025 to 2030. As more households prioritize easy-to-prepare options, frozen foods have become a staple, particularly for budget-conscious families and younger demographics. Retailers in the South Central U.S. are expanding their frozen food offerings, including organic and culturally inspired products, to meet evolving consumer preferences, further boosting consumption across the region.

Key U.S. Frozen Food Company Insights

The U.S. frozen food market is characterized by numerous well-established and emerging players. Manufacturers in the U.S. frozen food market are engaging in a variety of strategic initiatives to keep pace with evolving consumer demands and market trends. For instance, in June 2024, Nestlé S.A. introduced a diverse array of innovations, adding over 50 new products to grocery store shelves. The new range included notable choices in both single-serve and multi-serve frozen meals, as well as frozen vegetables and snacks. These launches further strengthened Conagra's robust portfolio of industry-leading brands.

Key U.S. Frozen Food Companies:

- Unilever PLC

- Nestlé S.A.

- General Mills, Inc.

- Nomad Foods Ltd.

- Tyson Foods Inc.

- Conagra Brands Inc.

- Wawona Frozen Foods

- Bellisio Parent, LLC

- McCain Foods

- The Kraft Heinz Company

Recent Developments

-

In October 2024, Nestlé S.A. launched Mexican and Asian frozen meals in the U.S. It will market frozen products sold under the Mings and Tapatío brands. The Mings brand was created by celebrity chef Ming Tsai and combines a “fusion of East-West flavors,” while Tapatío will feature Mexican frozen meals.

-

In September 2024, Authentic Asia, a brand under Bellisio Foods, introduced a new line of single-serve frozen meals. These meals showcase the regional flavors of Asia with restaurant-quality ingredients and the convenience of at-home preparation. Designed to offer a takeout-style experience, the meals featured a unique two-tray package that allowed rice and noodles to cook separately from the protein, sauce, and vegetables. This packaging ensured that each dish preserved its authentic taste and texture after just a few minutes in the microwave.

U.S. Frozen Food Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 83.50 billion

Revenue forecast in 2030

USD 132.67 billion

Growth rate

CAGR of 8.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/ billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Country scope

U.S.

State scope

Southeast; Northeast; Great Lakes; Mid-South; South Central; West; California; Plains

Key companies profiled

Unilever PLC; Nestlé S.A.; General Mills, Inc.; Nomad Foods Ltd.; Tyson Foods Inc.; Conagra Brands Inc.; Wawona Frozen Foods; Bellisio Parent, LLC; McCain Foods; The Kraft Heinz Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. Frozen Food Market Report Segmentation

This report forecasts revenue growth at the regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. frozen food market report on the basis of product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Frozen Meals

-

Breakfast Food

-

Dinners/Entrees

-

Pizza

-

-

Meat/Poultry/Seafood

-

Seafood

-

Processed Poultry

-

Poultry

-

Meat

-

-

Desserts

-

Ice Cream/Sherbet

-

Novelties

-

Desserts/Toppings

-

-

Fruits & Vegetables

-

Fruits

-

Strawberries

-

Raspberries

-

Blueberries

-

Blackberries

-

Peaches

-

Cherries

-

Apricots

-

Apples

-

Others

-

-

Vegetables

-

Mixed Vegetables

-

Broccoli

-

Beans

-

Corn

-

Peas

-

Prepared Vegetables

-

Corn on the Cob

-

Spinach

-

Onion Rings

-

Zucchini

-

Carrots

-

Onions

-

-

Snacks

-

Baked Goods

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Traditional Grocery Stores

-

Hypermarkets & Supermarkets

-

Club Stores

-

Discount Stores

-

Online

-

Others

-

-

State Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Southeast

-

Northeast

-

Great Lakes

-

Mid-South

-

South Central

-

West

-

California

-

Plains

-

-

Frequently Asked Questions About This Report

b. The U.S. frozen food market size was estimated at USD 83.50 billion in 2024 and is expected to reach USD 89.94 billion in 2025.

b. The U.S. frozen food market is expected to grow at a compounded growth rate of 8.1% from 2025 to 2030 to reach USD 132.67 billion by 2030.

b. U.S. frozen snacks is expected to growth with a CAGR of 11.6% from 2025 to 2030. Busy schedules, convenience, the expansion of e-commerce, and changing lifestyles are driving the demand for frozen snacks. As more people move into urban areas seeking career growth opportunities, fast-paced lifestyles are increasing the need for convenient food alternatives like frozen snacks.

b. Some key players operating in U.S. frozen food market include Unilever PLC, Nestlé S.A., General Mills, Inc., Nomad Foods Ltd., Tyson Foods Inc., and others.

b. Key factors that are driving the market growth include rising ready-to-eat food products and increasing snacking culture

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."