- Home

- »

- Nutraceuticals & Functional Foods

- »

-

U.S. Functional Shots Market Size, Industry Report, 2033GVR Report cover

![U.S. Functional Shots Market Size, Share & Trends Report]()

U.S. Functional Shots Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Energy, Immunity, Detox), By Distribution Channel (Hypermarkets & Supermarkets, Convenience Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-804-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Functional Shots Market Summary

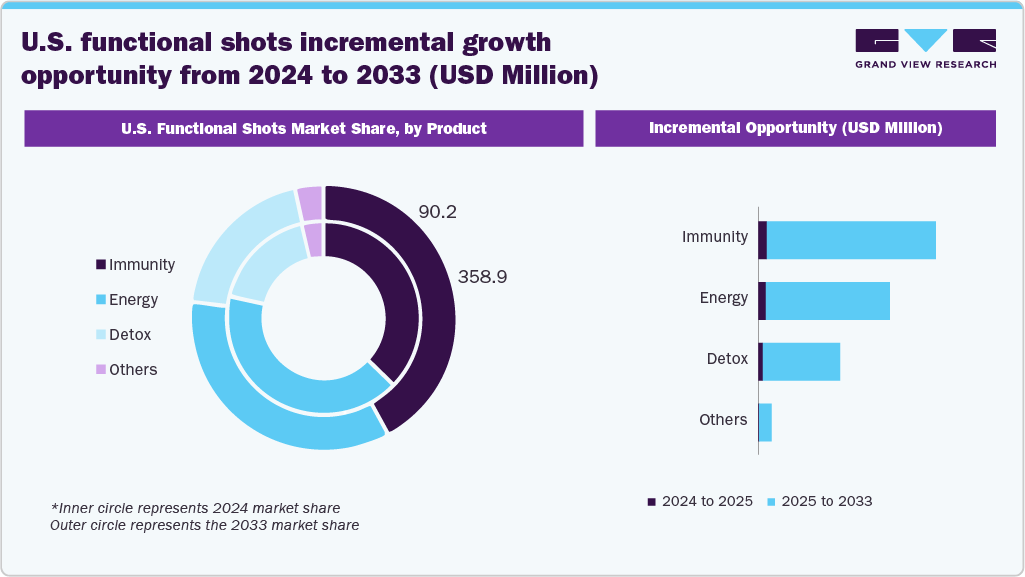

The U.S. functional shots market size was estimated at USD 243.0 million in 2024 and is projected to reach USD 855.7 million by 2033, growing at a CAGR of 15.2% from 2025 to 2033. The market is fueled by rising consumer emphasis on proactive health management, growing demand for convenient wellness formats, and elevated focus on immunity, energy, gut health, and stress relief solutions.

Key Market Trends & Insights

- By product, energy functional shots accounted for a market share of 41.6% in 2024.

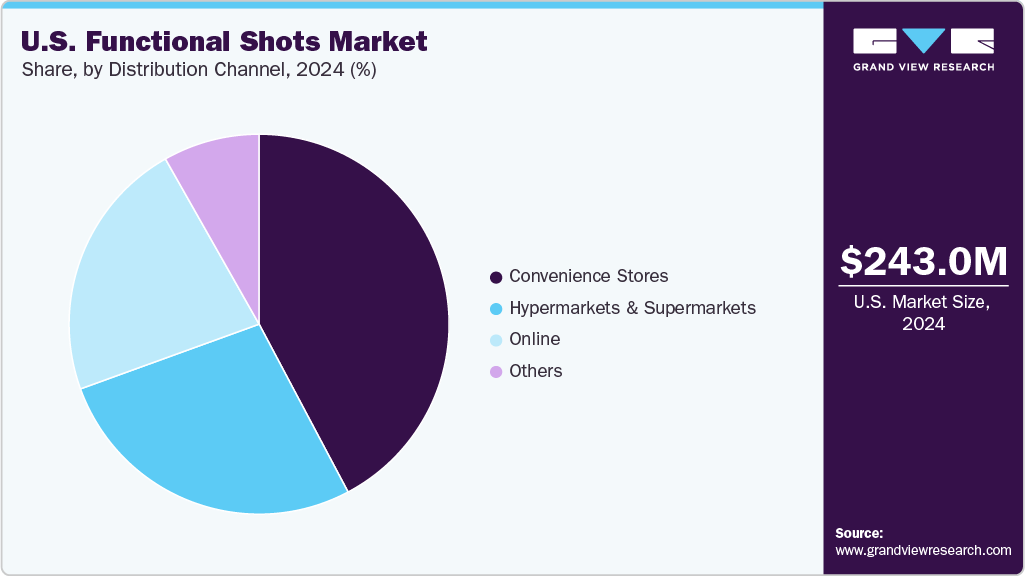

- By distribution channel, convenience stores accounted for a market share of 42.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 243.0 Million

- 2033 Projected Market Size: USD 855.7 Million

- CAGR (2025-2033): 15.2%

Increasing adoption of clean label ingredients, natural formulations, and functional botanicals supports category expansion. Furthermore, robust fitness culture, expanding supplement habits, and strong interest in nootropics and adaptogens continue to accelerate functional shot consumption in the U.S. across key demographic cohorts. A key growth catalyst in the U.S. is the pronounced shift toward immediate, targeted nutrition that offers measurable functional benefits. Functional shots serve consumers seeking compact, ready to consume solutions delivering high potency ingredients such as vitamins, probiotics, caffeine, and plant extracts. Moreover, heightened awareness surrounding immune resilience, cognitive performance, metabolic health, and digestive support reinforces consistent demand, supported by a mature wellness and fitness infrastructure.Innovation within product formulation and branding remains a critical driver of market advancement. Leading brands prioritize clinically supported ingredients, reduced sugar content, organic certifications, and transparent labeling to strengthen consumer confidence and premium positioning. In addition, advancements in bioavailability, expanded flavor portfolios, and specialized blends for mood support, cognitive endurance, hydration, and detoxification drive adoption. Broader retail penetration across grocery, pharmacy, convenience, and specialty channels, combined with direct-to-consumer strategies, enhances accessibility and consumer reach.

Demographic and cultural dynamics further reinforce market growth. Younger consumers, particularly Millennials and Gen Z, demonstrate high receptivity to functional beverages aligned with fast paced lifestyles, wellness routines, and digital influence. Rising disposable incomes and increasing prioritization of holistic health continue to strengthen purchase motivation. Furthermore, supportive regulatory frameworks emphasizing natural ingredients and quality assurance increase consumer trust, while influencer partnerships, digital marketing, and educational content amplify awareness and trial momentum across the U.S. functional shots landscape.

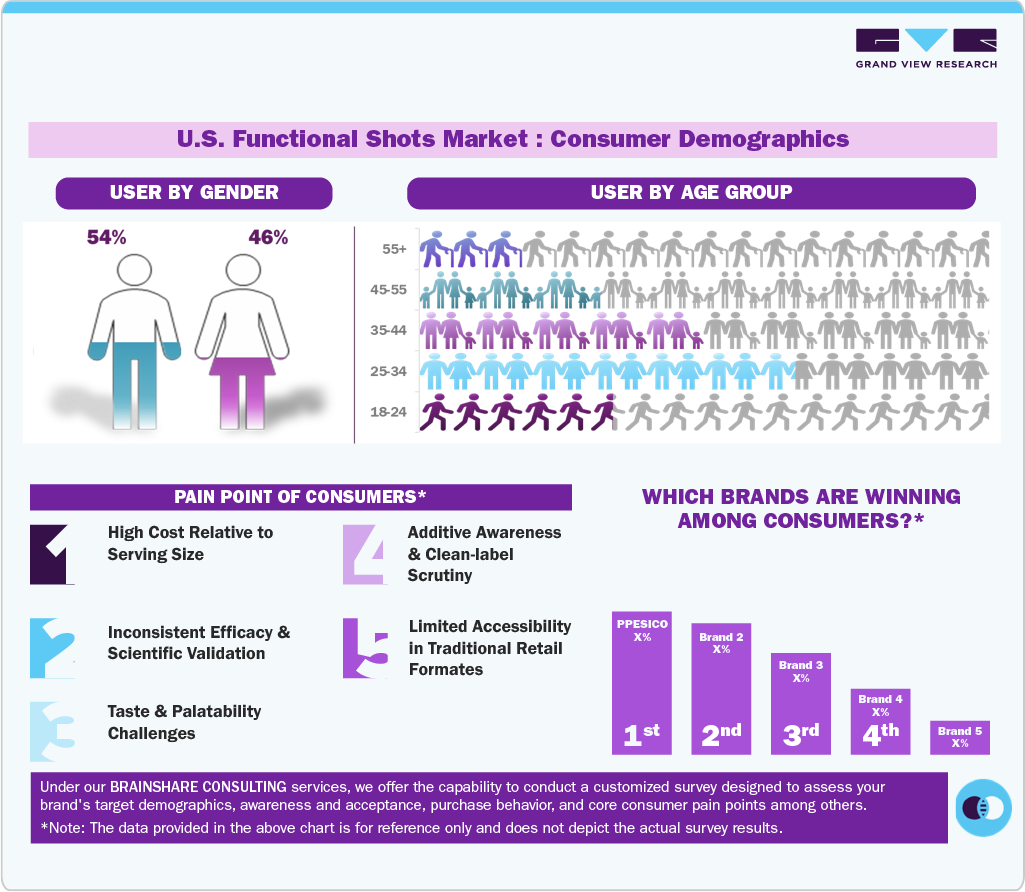

Consumer Demographic Insights

U.S. consumers are increasingly gravitating toward functional shots due to their concentrated wellness benefits, ease of use, and capacity to address specific health priorities, including immunity support, sustained energy, digestive balance, stress reduction, and cognitive enhancement. Demand continues to rise as individuals seek efficient, science-backed solutions that align with modern health and performance objectives.

Millennials and Gen Z remain the primary drivers of this trend in the U.S., propelled by a strong focus on preventive wellness, athletic engagement, and a preference for clean-label, naturally formulated products. These cohorts place significant value on transparency, ingredient clarity, and formulations that reflect evidence-based nutritional practices and holistic lifestyle choices. This consumer base embraces functional shots for their portability and rapid delivery format, which seamlessly aligns with demanding daily schedules, commuting patterns, travel routines, and hybrid work environments.

Product Insights

The energy functional shots accounted for a market share of 41.6% of the revenue in 2024. The the energy shots segment growth is driven by rising demand for quick, portable energy solutions, a shift toward natural and clean-label stimulants such as adaptogens and plant-based caffeine, and increased adoption among fitness enthusiasts, office professionals, and students. A heightened focus on sustained energy, cognitive performance, and reduced sugar content further accelerates the preference for premium, science-backed energy shots that align with active, fast-paced lifestyles.

The immunity functional shots segment is projected to grow at a CAGR of 16.8% from 2025 to 2033. The market is expanding due to heightened consumer focus on preventive wellness, increased awareness of immune resilience, and sustained post-pandemic health consciousness. Demand is reinforced by strong interest in vitamins, antioxidants, probiotics, and herbal botanicals that support daily immunity. Furthermore, busy lifestyles and seasonal illness patterns encourage consumers to adopt convenient, fast-acting immunity shots as part of routine self-care and holistic health maintenance.

Distribution Channel Insights

The sales of functional shots through convenience stores accounted for a share of 42.2% of the revenue in 2024. The market is driven by rising demand for immediate, grab-and-go wellness solutions aligned with busy consumer lifestyles. These stores offer high visibility and impulse-purchase opportunities near checkout counters, reinforcing trial and repeat usage. Furthermore, an increased assortment of premium health-focused beverages, expanded chilled sections, and partnerships with emerging functional brands strengthen accessibility. In addition, convenience stores benefit from commuter traffic, urbanization, and extended operating hours, making them ideal points for rapid functional shot purchases.

The sales of functional shots through online channels are anticipated to grow at a CAGR of 17.0% from 2025 to 2033. The shift in consumer preference toward the convenience and simplicity of online shopping is significantly accelerating the growth of this segment. Consumers value doorstep delivery, a wider product assortment, and easy access to niche wellness formulations that are unavailable in physical stores. Furthermore, subscription programs, bundle deals, and auto-replenishment models drive repeat purchases. In addition, targeted digital advertising, influencer recommendations, and user reviews enhance product discovery and trust, while mobile commerce adoption strengthens online purchasing behavior among health-focused audiences.

Key U.S. Functional Shots Company Insights

Established and emerging players in the U.S. market for functional shots operate in an intensively competitive environment, driven by targeted health positioning, advanced formulation science, and fast-paced product innovation. Brands are strategically investing in omnichannel retail expansion and digitally optimized marketing to engage health-driven American consumers and capitalize on the rising preference for convenient, on-the-go wellness solutions.

The nationwide shift toward clean-label, natural, and clinically substantiated ingredients is reshaping purchasing behavior, with growing emphasis on botanical actives, reduced artificial additives, transparent labeling, and eco-conscious packaging. In addition, heightened retailer focus on premium wellness assortments and increased consumer education around preventive health further reinforce market expansion in the U.S.

Key U.S. Functional Shots Companies:

- Living Essentials Marketing, LLC

- For Goodness Shakes Ltd

- Unrooted Drinks

- Beet It Sport

- PepsiCo (KeVita)

- Arizona Beverages USA

- Suja Life, LLC.

- Hawaiian OLA

- Pressed Juicery

- B.fresh

Recent Developments

-

In October 2025, Vive Organic broadened its energy-focused portfolio by introducing two functional shots, Energy + Focus and Energy Extra Strength. These plant-based, USDA-certified organic formulations are designed to provide sustained energy and sharpened concentration. Featuring caffeine, L-Theanine, and adaptogenic mushrooms, the shots offer a clean, steady performance lift without the common post-energy crash.

-

In October 2025, Moju strengthened its immunity shot lineup by launching a Honey Lemon variant, formulated with cold-pressed Peruvian ginger, lemon, and honey in a 420 ml dosing format. The product offers natural vitamin C along with NHS-recommended vitamin D3, delivering a gentler, more approachable flavor profile intended to support daily immune wellness.

-

In October 2025, Plenish introduced its “Ultra Ginger” functional shot, formulated with a potent concentration that equates to 29 g of fresh ginger root per serving. The product provides 100 percent of the recommended daily intake of vitamin C and includes zinc, delivering a powerful immunity and wellness boost in a compact, nutrient-dense format.

U.S. Functional Shots Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 275.9 million

Revenue forecast in 2033

USD 855.7 million

Growth rate

CAGR of 15.2% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Country scope

U.S.

Key companies profiled

Living Essentials Marketing, LLC; For Goodness Shakes Ltd; Unrooted Drinks; Beet It Sport; PepsiCo (KeVita); AriZona Beverages USA; Suja Life, LLC.; Hawaiian Ola; Pressed Juicery; B.fresh

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Functional Shots Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. functional shots market report based on product and distribution channel.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Energy

-

Immunity

-

Detox

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. functional shots market size was estimated at USD 243.0 million in 2024 and is expected to reach USD 275.9 million in 2025.

b. The U.S. functional shots market is expected to grow at a compound annual growth rate (CAGR) of 15.2% from 2025 to 2033 to reach USD 855.7 million by 2033.

b. Convenience stores accounted for a market share of 42.2% in 2024, driven by impulse purchases, expanding availability of on-the-go functional beverages, and consumers’ preference for quick, accessible health-boosting options during busy routines.

b. Some key players operating in the U.S. functional shots market include Living Essentials Marketing, LLC; For Goodness Shakes Ltd; Unrooted Drinks; Beet It Sport; PepsiCo (KeVita); AriZona Beverages USA; Suja Life, LLC.; Hawaiian Ola; Pressed Juicery; and B.fresh.

b. Key factors driving market growth include rising consumer awareness of health and wellness, increasing demand for energy and immunity-boosting products, growing popularity of natural and functional ingredients, and product innovation in convenient formats.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.