- Home

- »

- Medical Devices

- »

-

U.S. Funeral Homes Market Size, Industry Report, 2030GVR Report cover

![U.S. Funeral Homes Market Size, Share & Trends Report]()

U.S. Funeral Homes Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Traditional Funeral Services, Cremation Services), By Payment Model (Pre-paid Funeral Plans, At-need Funeral Services), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-514-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Funeral Homes Market Size & Trends

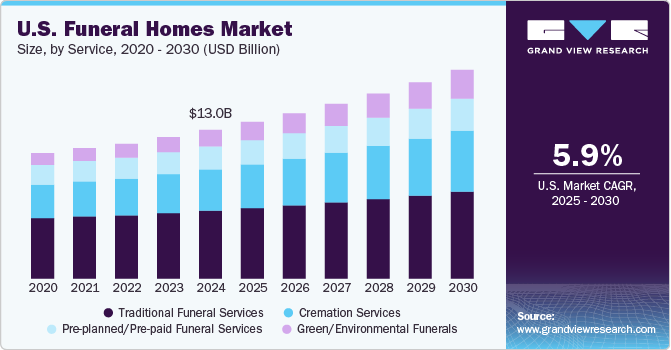

The U.S. funeral homes market size was valued at USD 13.03 billion in 2024 and is projected to grow at a CAGR of 5.92% from 2025 to 2030. The increasing elderly population in the U.S. is a primary driver, as aging directly correlates with higher death rates. In addition, increasing demand for unique, customized memorials and sustainable burial options (e.g., biodegradable urns, and natural burials) is expected to drive the growth of the market during the forecast period.

The market is undergoing significant transformation due to evolving preferences and societal trends. Cremation is increasingly favored, driven by lower costs, environmental concerns, and fewer religious prohibitions. The National Funeral Directors Association’s (NFDA) 2023 Cremation and Burial Report highlights significant shifts in funeral and cremation services in the United States, reflecting evolving consumer preferences and regional trends. By 2045, the US cremation rate is projected to rise to 81.4% from 60.5% in 2023, driven by factors such as cost-effectiveness, environmental concerns, and changing religious and cultural attitudes. Western states such as Washington, Nevada, and Oregon are leading this transition, with cremation rates expected to exceed 80% by 2035. Other regions, including the Southeast, Great Lakes, and Mid-Atlantic, are also witnessing a notable rise in crematory facilities, with a 5.2% increase in the number of crematories from 2021 to 2023, signaling broader acceptance.

Furthermore, the rise of digital solutions is transforming how memorial services are planned and conducted. Virtual funerals, live-streamed ceremonies, and online obituary platforms have gained popularity, particularly post-COVID-19. Tribute Technology recently launched the inaugural Tech-Enabled Funeral Home Awards to recognize innovative funeral homes that leverage technology for better service delivery. Thus, key players are entering into strategic partnerships in the industry and are enhancing service offerings. For instance, in May 2023, Carriage Services formed partnerships to improve pre-arranged funeral services and operational efficiency through technology. Innovations such as AI-driven service customization and virtual memorials present new investment opportunities within the sector.

"We are excited to announce this transformative national agreement and partnership between NGL, Precoa, and Carriage Services, By combining the expertise and heritage of NGL, the innovative and industry-leading preneed solutions of Precoa and the customer-centric approach of Carriage Services, we are elevating our pre-arranged funeral offering across all Carriage locations and ensuring families receive personalized support and peace of mind as they plan for their end-of-life celebration. In addition, this transformative partnership will enable Carriage to reach new audiences, forge deeper customer relationships, and grow market share, ultimately creating value for our shareholders.

- Carlos Quezada, Vice Chairman, President, and Chief Operating Officer of Carriage Services.

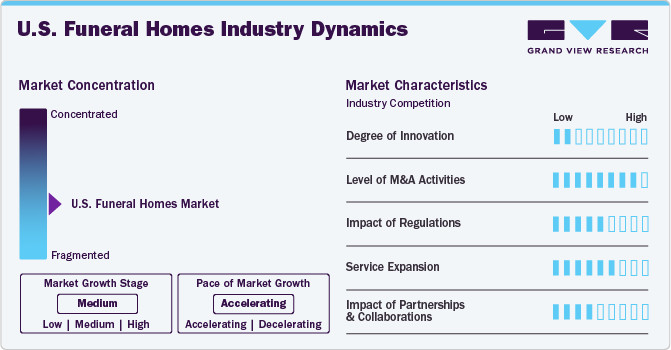

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, characteristics, and participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various characteristics, including a degree of innovation, level of M&A activities, impact of regulations, service expansion, and impact of partnerships & collaborations. For instance, the market is fragmented, with many small players entering and launching new innovative services. The degree of innovation is high, the level of M&A activities is moderate, the impact of regulations is medium, service expansion is medium, and the impact of partnerships & collaborations is also medium.

Recent innovations in U.S. funeral homes are transforming the industry by integrating technology and enhancing the overall experience for families. For instance, in October 2024, Batesville introduced the Family Choices digital and physical showrooms, designed to simplify the selection process for families during difficult times. This innovative showroom features 360-degree digital imaging, allowing families to explore burial and cremation options interactively. This approach respects traditional values while modernizing the experience, making it more comfortable and accessible for grieving families. These advancements indicate a significant shift in how funeral services are approached, focusing on personalization, technology integration, and enhanced customer experiences during challenging times.

The past years saw a slowdown in M&A activity as firms awaited regulatory outcomes related to pre-paid funerals and adjusted to post-COVID market conditions. However, as these uncertainties diminish, M&A activity is expected to ramp up again. Major strategic acquirers included Service Corporation International (SCI), Park Lawn Corporation, and Carriage Services. Private equity firms also played a significant role, with companies such as Foundation Partners Group and Axar Capital Management actively pursuing acquisitions.

The funeral industry in the U.S. is governed by a mix of federal and state regulations aimed at consumer protection and ethical practices. Key federal regulations include the FTC's Funeral Rule, which requires transparency in pricing and service options, and OSHA standards for workplace safety. State regulations vary widely, covering licensing, burial permits, and embalming practices. These rules impact funeral costs and consumer choices, with stricter regulations often leading to higher expenses. Overall, these regulations ensure that funeral homes operate with respect and professionalism while safeguarding consumer rights.

Service expansion within the market is medium, with many providers actively exploring opportunities to broaden their offerings. There is a growing trend towards integrating technology into funeral services. Innovations such as virtual memorials and AI-driven service customization are becoming popular, catering to consumer preferences for personalized and convenient options. For instance, in December 2024, Foundation Partners Group introduced Afterall, a digital platform designed to assist families in finding suitable funeral services tailored to their needs. This platform integrates various resources and services, allowing families to access over 250 affiliated funeral homes, cemeteries, and cremation services from a single website. The initiative aims to modernize the end-of-life planning process by simplifying the search for local providers and enhancing the overall user experience.

The impact of partnerships and collaborations within the market is medium, reflecting a growing trend among providers to enhance their offerings through strategic alliances. For instance, in January 2025, companies such as Tribute Technology formed strategic partnerships with the industry's top providers through their Partnership Program to enhance service delivery in the funeral profession. These collaborations bring together technology providers and funeral homes, enabling access to advanced management software and personalized memorialization tools. Such partnerships aim to streamline operations and improve the overall experience for families.

Service Insights

The traditional funeral services segment held the largest revenue share of 45.63% in 2024 due to funeral practices in the U.S. being significantly shaped by cultural and religious traditions. Families can choose traditional services that include viewings, formal services, and burials, reflecting their values and beliefs. This often leads to a preference for full-service funerals that provide comprehensive experience, including transportation and embalming services. Furthermore, the integration of technology into funeral services has transformed how families plan and conduct memorials. Virtual memorials and livestreaming of services have become more common, especially following the COVID-19 pandemic. This adaptation not only meets consumer needs for convenience but also expands access to traditional funeral services.

The green/environmental funerals segment is expected to grow at the fastest CAGR over the forecast period. Green/environmental funerals focus on eco-friendly practices that minimize the carbon footprint associated with traditional burial and cremation methods. Sustainable funerals emphasize eco-friendly practices, including biodegradable caskets, natural burial sites, and minimal chemical use in embalming. The growing demand for these options is driven mainly by a shift in consumer values towards sustainability and ethical considerations in death care. Furthermore, the 2024 Survey on Alternative Burial Options & Preferences Across America showcased that 6,000 Americans assessed their preferences for eco-friendly and alternative burial methods compared to traditional options. The findings indicate that in 2024, 19% of respondents preferred a ‘Green Burial’ over traditional burial practices. This is expected to drive the growth of the segment during the forecast period.

Payment Model Insights

The at-need funeral services segment held the largest revenue share in 2024. The growth of the segment is attributed to demographic shifts, including an aging population and increasing mortality rates, increasing the demand for funeral services. In addition, cultural changes regarding death and funerals have led to more personalized and diverse service offerings. Families increasingly seek unique memorial experiences reflecting the deceased’s life and values, prompting funeral homes to adapt their service models accordingly.

The pre-paid funeral plans segment is expected to witness significant growth over the forecast period. Pre-paid funeral plans enable individuals to pre-arrange and finance their funerals, ensuring their preferences are honored and reducing the financial strain on their families. The growth of this segment is driven by increased consumer awareness regarding the advantages of planning, such as securing current service prices and minimizing stress for relatives during difficult times. For instance, Everdays offers a straightforward approach to prepaid funeral planning, allowing users to select and pay for their funeral arrangements online. They work with various funeral homes across the nation and have assisted over 3 million families.

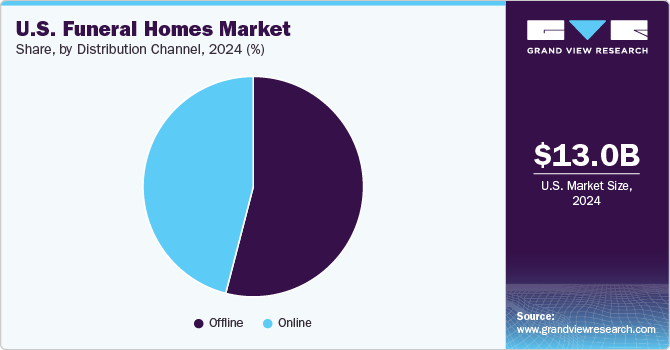

Distribution Channel Insights

The offline segment held the largest revenue share in 2024. Offline funeral homes offer immediate service availability, which is crucial for families facing sudden losses. This immediacy allows for quick coordination of necessary arrangements, making offline services a preferred choice during urgent times. As disposable incomes rise, families are increasingly willing to spend on high-quality funeral services that meet their specific needs, further boosting the offline segment's growth.

The online segment represented a significant market share over the forecast period. The segment growth is attributed to the increasing digital adoption and shifting consumer preferences. This trend is fueled by convenience, transparency, and the demand for personalized services, especially among tech-savvy millennials and Gen Z. Online platforms enable users to compare service providers, access pricing details, and customize arrangements efficiently. For instance, in October 2024, Foundation Partners Group, located in Winter Park, Florida, and backed by Colpatria Capital and Access Holdings, launched Afterall, a digital platform to assist families in finding and selecting local funeral homes. Furthermore, the company has acquired Cake, a provider of online tools and resources focused on end-of-life planning in the U.S.

"The launch of Afterall, combined with the acquisition of Cake, marks an important step in simplifying and improving the end-of-life experience. We work with families facing end-of-life situations every day, and many express a desire for better preparation and easier processes. We believe this is just the beginning of transforming the end-of-life industry for the better."

- Chris Blackwell, interim CEO of Foundation Partners Group

Key U.S. Funeral Homes Company Insights

Facility expansion, strategic partnerships, and a focus on inorganic growth initiatives are indeed pivotal strategies for companies in the funeral services industry aiming to solidify their market presence. Notable emerging players actively pursuing these strategies to enhance their competitive edge are Titan Casket, Solace Cremation, and Past Post.

Key U.S. Funeral Homes Companies:

- Service Corporation International

- StoneMor

- Carriage Services, Inc.

- Foundation Partners Group, LLC

- Everstory Partners

- NorthStar Memorial Group

- Sollon Funeral and Cremation Services Ltd.

- Wilbert Funeral Services

- Dignity Memorial

- Neptune Society

Recent Developments

-

In December 2024, Foundation Partners Group launched Afterall, a digital hub designed to streamline the end-of-life planning process. This platform integrates over 250 funeral homes and cemeteries, offering resources like free digital obituary services and a memorial store. The initiative follows the acquisition of Cake, an online end-of-life planning tool, marking a significant step towards modernizing funeral services.

-

In October 2024, Service Corporation International introduced a two-story mausoleum at Arlington Memorial Park, a property under the Dignity Memorial brand in Sandy Springs, Georgia.

-

In August 2024, Johnson-Romito and Busch Funeral Homes, these two respected funeral homes in Cleveland, announced their merger to enhance service offerings across 12 locations. This partnership aims to maintain community-focused services while expanding their reach

U.S. Funeral Homes Market Report Scope

Report Attribute

Details

Revenue Forecast in 2030

USD 18.29 billion

Growth Rate

CAGR of 5.92% from 2025 to 2030

Actual data

2018 - 2023

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Service, payment model, distribution channel

Country scope

U.S.

Key companies profiled

Service Corporation International; StoneMor; Carriage Services, Inc.; Foundation Partners Group, LLC; Everstory Partners; NorthStar Memorial Group; Sollon Funeral and Cremation Services Ltd.; Wilbert Funeral Services; Dignity Memorial; and Neptune Society

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Funeral Homes Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. funeral homes market report based on service, payment model, and distribution channel.

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Traditional Funeral Services

-

Cremation Services

-

Green/Environmental Funerals

-

Pre-planned/Pre-paid Funeral Services

-

-

Payment Model Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pre-paid Funeral Plans

-

At-need Funeral Services

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The U.S. funeral homes market size was established at USD 13.03 billion in 2024 and is expected to reach USD 13.72 billion in 2025.

b. The U.S. funeral homes market is expected to grow at a compound annual growth rate of 5.92% from 2025 to 2030 to reach USD 18.29 billion by 2030.

b. The traditional funeral services segment held the largest revenue share of 45.63% in 2024 due to funeral practices in the U.S. are significantly shaped by cultural and religious traditions. Families could choose traditional services, including viewings, formal services, and burials, reflecting their values and beliefs. This often leads to a preference for full-service funerals that provide comprehensive experience, including transportation and embalming services.

b. Some key players operating in the U.S. funeral homes market include Service Corporation International; StoneMor; Carriage Services, Inc.; Foundation Partners Group, LLC; Everstory Partners; NorthStar Memorial Group; Sollon Funeral and Cremation Services Ltd.; Wilbert Funeral Services; Dignity Memorial; and Neptune Society

b. Key factors driving market growth include the increasing elderly population in the U.S., which is a primary driver, as aging directly correlates with higher death rates. In addition, increasing demand for unique, customized memorials and sustainable burial options (e.g., biodegradable urns, and natural burials) is expected to drive the growth of the market during the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.