- Home

- »

- Medical Devices

- »

-

U.S. Fusion Biopsy Market Size, Industry Report, 2030GVR Report cover

![U.S. Fusion Biopsy Market Size, Share & Trends Report]()

U.S. Fusion Biopsy Market Size, Share & Trends Analysis Report By Biopsy Route (Transrectal, Transperineal), By End-use (Hospitals, Diagnostic Centers, Ambulatory Care Centers), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-239-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Fusion Biopsy Market Size & Trends

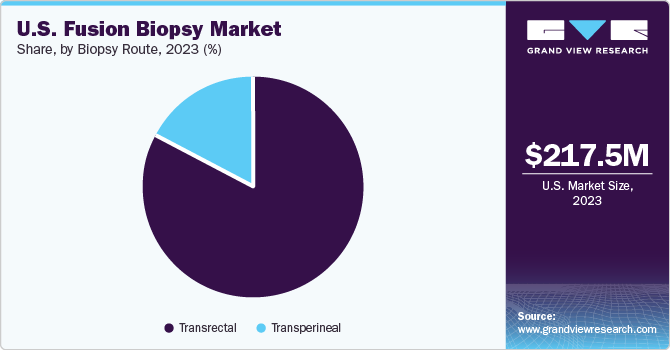

The U.S. fusion biopsy market size was estimated at USD 217.5 million in 2023 and is estimated to grow at a CAGR of 7.1% from 2024 to 2030. The market growth of is primarily driven by factors such as the high prevalence of prostate cancer in the population, the increasing importance of regular clinical interventions, and favorable government reimbursement programs.

In 2023, The U.S. accounted for over 30% in the global fusion biopsy market. Prostate cancer is one of the most prevalent and deadly cancers affecting men. According to the American Cancer Society, about 1 out of every 8 men will be diagnosed with prostate cancer during their lifetime. Nearly 280,000 prostate cancers are diagnosed annually in the U.S, and 69% of these cases are determined to be localized cancers that require either active surveillance or treatment decision. There are approximately 3 million prostate cancer screenings conducted in the U.S. which show elevated PSA results. Approximately 500,000 men undergo biopsies annually, but 60% of biopsies do not reveal cancer and may lead to increased complications and hospitalization. Moreover, approximately 30% of cancer-negative biopsies are false negatives, meaning these patients have cancer.

Technological advancements in fusion biopsy systems are propelling market growth. These advancements focus on improving portability, effectiveness, and safety. Additionally, software enhancements include advanced image measurement, multiplanar image reconstruction, patient data management, and image registration tools. These features optimize the operational workflow of prostate biopsies, leading to increased precision and efficiency. The progress in cancer detection through these innovations is expected to drive market growth in the near future.

The anticipated market growth for fusion biopsy is driven by streamlined reimbursement policies from Medicare, Medicaid, and private organizations, which cover the costs of fusion biopsy and MRIs, fostering market expansion over the forecast period. For instance, Cigna broadens its commercial and Medicare Advantage coverage to encompass Mdxhealth's Select mdx for Prostate Cancer Test. Under this scheme, Cigna expands its insurance coverage to include Mdxhealth's full range of precision diagnostic cancer tests, incorporating Confirm mdx and Genomic Prostate Score (GPS) tests.

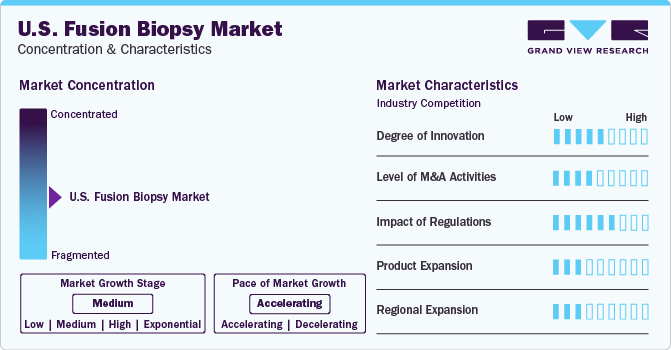

Market Concentration & Characteristics

The U.S. fusion biopsy market is moderately fragmented due to the presence of many companies that hold significant industry shares. The industry is characterized by intense competition, with major companies focusing on innovation and technology advancements to strengthen their market presence. For instance, in July 2022, miR Scientific announced the miR Sentinel™ Prostate Cancer Test in the United States. This test assesses the risk of chronic prostate cancer and helps in the clinical management of men who are at risk of prostate cancer.

Acquiring other companies or part of the companies in the industry is a strategic move that allows companies to enhance their market position by boosting their capabilities, expanding product offerings, and strengthening competencies. For instance, in August 2022, MDxHealth announced the acquisition of the Oncotype DX GPS test of Exact Sciences, providing prediction of prostate cancer chronicity. The acquisition deal closed at USD 30 million.

Regulatory bodies such as the US FDA impact the approvals of biopsies and further support the innovation and product expansion strategies undertaken by key industries of the market. For instance, in April 2023, Lantheus Holdings, Inc. announced the U.S. FDA approval for 177Lu-PNT2002 which treats metastatic castration-resistant prostate cancer (mCRPC).

Several key companies focusing on product as well as regional expansion initiatives to expand their product portfolio, and geographic exposure to fulfill the needs of consumers in that region. For instance, In January 2024, PanGIA Biotech announced an expansion of multi-cancer early-detection liquid biopsy. Through this expansion, the company would substantially broaden its platform by initiating follow-up studies in ten more cancer types.

Biopsy Route Insights

Based on product, the transrectal biopsy route dominated the market with the largest share of 83% in 2023. This growth can be attributed to the high preference for transrectal biopsies to detect prostate cancer in the U.S. The transrectal approach is commonly used for fusion biopsy due to its proximity to the prostate and the familiarity among urologists. It is known as a provider-centric method for prostate biopsy, being quick and convenient to perform. These applications of transrectal biopsies further fuel the market growth.

The transperineal biopsy segment is expected to grow at the fastest rate at 10.1% CAGR from 2024 to 2030. This biopsy is patient-centric and often considered a clean procedure, with minimal risk of sepsis. It eliminates the necessity for prophylactic antibiotics required in the transrectal approach. These benefits of this biopsy will likely escalate the growth opportunities in the market over the forecast years.

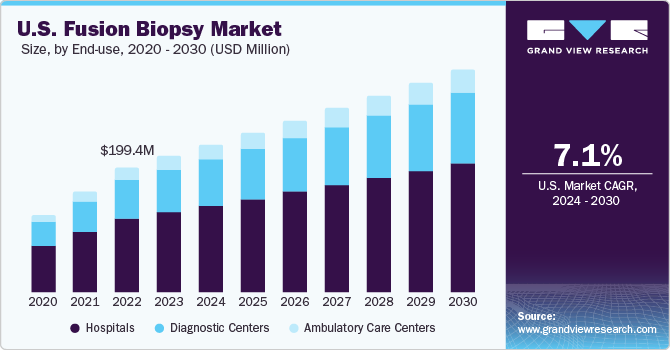

End-use Insights

Based on end-use, hospitals held the largest share of 59% in 2023 owing to the high installation of fusion biopsy settings in the hospitals. These installations help in providing hands-on training experience with advanced technology to young urologists. Moreover, hospitals are comprised of skilled personnel and relevant resources such as MRI scanners, radiology wards, and medical equipment, contributing to the accelerating growth of the market. Moreover, growing awareness about preclinical tests among individuals is likely to boost the segment’s growth.

The ambulatory care centers segment is projected to expand at the fastest CAGR from 2024 to 2030 owing to cost-effectiveness and better patient accessibility. The rise in patient preference for undergoing examinations in cost-effective medical settings has been the primary driver behind the development of ambulatory surgical centers (ASCs). Moreover, the launch of specialized ambulatory care centers for treating urological disorders is expected to accelerate the growth opportunity in the market over the forecast period. For instance, in April 2023, The University of Arkansas for Medical Sciences (UAMS) announced the launch of a new Urology Center in West Little Rock. This center offers specialized treatment for complex kidney stones, urinary system reconstruction, erectile dysfunction, and high-quality routine urology services.

Key U.S. Fusion Biopsy Company Insights

Key U.S. fusion biopsy companies include Artemis, Koelis, Eigen Health, and Focal Healthcare among others.

There is intense competition in the U.S. fusion biopsy market. The adoption of competitive strategies such as mergers & acquisitions, strategic alliances, collaborative agreements, and partnerships helps to sustain the competition.

Key U.S. Fusion Biopsy Companies:

- Artemis

- Koelis

- Eigen Health

- MedCom

- Focal Healthcare

- BK Medical

- Agiliti Health

- Penn Medicine

- Cleveland Diagnostics

- PanGIA Biotech

- miR Scientific, Inc.

Recent Developments

-

In January 2024, Cleveland Diagnostics received USD75 million from Novo Holdings to Advance its early-detection oncology testing platform. The funding will speed up the commercial strategy for its IsoPSA prostate cancer test and broaden its range of non-invasive tests.

-

In July 2023, Quest Diagnostics launched a novel prostate cancer test that aims to meet the urgent clinical demand for tests that can assist in identifying and distinguishing potentially aggressive cases of prostate cancer in men.

U.S. Fusion Biopsy Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 217.5 million

The revenue forecast for 2030

USD 357.2 million

Growth Rate

CAGR of 7.1% from 2024 to 2030

Actual estimates

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion & CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Biopsy route, end-use

Country Scope

U.S.

Key companies profiled

ARTEMIS; KOELIS; Philips; Eigen Health; MedCom; Focal Healthcare; BK Medical; Agiliti Health; Penn Medicine; Cleveland Diagnostics; PanGIA Biotech; miR Scientific, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Fusion Biopsy Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. fusion biopsy market based on biopsy route and end-use:

-

Route Outlook (Revenue, USD Million, 2018 - 2030)

-

Transrectal

-

Transperineal

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Centers

-

Ambulatory care Centers

-

Frequently Asked Questions About This Report

b. The U.S. fusion biopsy market size was estimated at USD 217.5 million in 2023 and is expected to reach USD 236.3 million in 2024.

b. The U.S. fusion biopsy market is expected to grow at a compound annual growth rate of 7.1% from 2024 to 2030 to reach USD 357.2 million by 2030.

b. The transrectal segment lead the U.S. fusion biopsy market share by capturing over 75% in 2023 since it has been considered the gold standard in performing prostate biopsies globally for many years. Most of the commercially available fusion biopsy techniques are limited to the transrectal approach, contributing to its dominant market share.

b. Some key players operating in the U.S. fusion biopsy market include Eigen Health; Koninklijke Philips N.V.; Hitachi, Ltd.; MedCom; ESAOTE SpA; KOELIS; Focal Healthcare; UC-Care Medical Systems Ltd.; GeoScan Medical

b. Key factors that are driving the market growth include increasing prevalence of prostate cancer, growing awareness about the importance of regular clinical interventions, and developing reimbursement policies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."