- Home

- »

- Medical Devices

- »

-

Fusion Biopsy Market Size, Share & Growth Report, 2030GVR Report cover

![Fusion Biopsy Market Size, Share & Trends Report]()

Fusion Biopsy Market (2025 - 2030) Size, Share & Trends Analysis Report By Biopsy Route (Transrectal, Transperineal), By End Use (Hospitals, Diagnostic Centers, Ambulatory Care Centers), By Region (North America, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68038-844-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fusion Biopsy Market Size & Trends

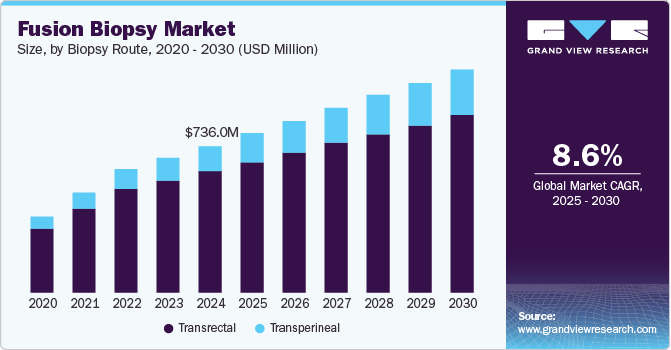

The global fusion biopsy market size was valued at USD 736.6 million in 2024 and is expected to grow at a CAGR of 8.6% from 2025 to 2030. The increasing prevalence of prostate cancer, raising awareness about the importance of regular clinical interventions, and developing reimbursement policies are factors likely to boost the demand for targeted fusion biopsy systems over the forecast period. Targeted MR/Ultrasound fusion biopsy systems are being used more frequently due to more radiologists becoming skilled with interpreting prostate MRI and adopting industry-standard image grading systems such as PI-RADS and Gleason score.

According to a study published in GLOBOCAN 2020 estimates of cancer incidence and mortality by the International Agency for Research on Cancer (IARC), in 2020, there were approximately 10.0 million cancer-related deaths and 19.3 million new cases worldwide. In 2040, 28.4 million new cancer cases are anticipated worldwide, a 47.0% increase from 2020. Additionally, the World Health Organization (WHO) predicts that by 2025, there will be over 167 million obese people worldwide, including both adults and children. The rising prevalence of these chronic conditions is anticipated to increase demand for fusion biopsy methods for early diagnosis and treatment, which will likely drive the market's growth. The market limitations could be the risk of infection or bleeding during the process, which could prove fatal in certain cases, and the procedure cost, which patients may not always be able to afford.

The primary diagnostic for prostate cancer includes prostate-specific antigen and digital rectal examination. Further ultrasound imaging is recommended if this preliminary test shows abnormal results. However, ultrasound scans have a high possibility of missing significant tumors, especially those that are smaller in size and may cause clinical complications in the future. Therefore, urologists refrain from taking risks and try to make a diagnosis as promptly and accurately as possible. This has led to the growing demand for prostate biopsy procedures contemplating its safety, reliability, and sensitivity in prostate cancer diagnosis.

Government and private bodies are committed to improving the health outcomes for men with prostate cancer by making significant investments in R&D for early and accurate diagnostic tools. For instance, since 2013, the government of Australia has spent over USD 84 million on prostate cancer treatment and diagnostic research through Cancer Australia, Prostate Cancer Research Foundation Australia, and National Health Medical Research Council Australia. Also, in December 2022, Novartis announced that the European Commission (EC) had granted approval for the targeted radioligand therapy Pluvicto. For those with advanced prostate cancer, Pluvicto is now the first targeted radioligand therapy that is commercially accessible, fulfilling an unmet need for a new therapeutic alternative.

Biopsy Route Insights

Based on the biopsy route, the transrectal segment dominated the market with a share of 85.62% in 2024. Many commercially available fusion biopsy systems are designed for the transrectal approach, contributing to its leading market share. However, the segment's growth has slowed due to complications such as fever, sepsis, hematuria, and rectal bleeding following transrectal biopsies. The fusion biopsy market is segmented into transperineal and transrectal biopsy routes, with transperineal gaining traction due to lower infection risks.

Transperineal fusion biopsy is an emerging trend and is expected to experience the fastest compounded annual growth rate of 11.0% during the forecast period. In terms of accuracy, research suggests that transperineal biopsies are highly effective in sampling the entire prostate, including the anterior regions, which are often under-sampled in transrectal procedures. A study published in the Journal of Urology 2020 suggests that transperineal fusion biopsies detected 30.0% more clinically significant cancers in the anterior and apical regions than transrectal biopsies. This makes it especially valuable for patients with prior negative biopsies but persistent elevated PSA levels.

A lower sepsis rate and risk of rectal bleeding compared to the traditional approach is expected to contribute towards the segment growth. Moreover, the transperineal approach efficiently assesses the ventral prostate areas typically omitted with transrectal fusion biopsy. Market players such as Koelis and BiopSee offer transrectal and transperineal accessories with their fusion biopsy system, giving urologists the flexibility to provide personalized patient care.

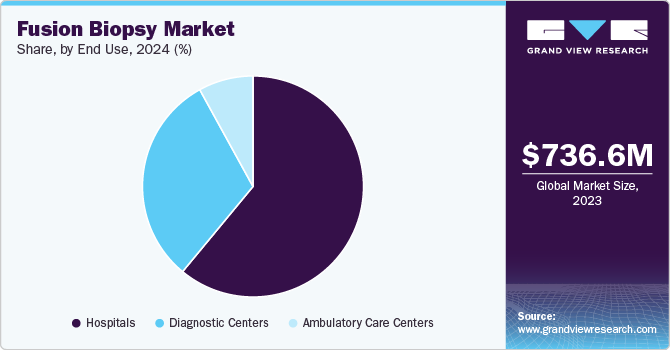

End Use Insights

The hospitals segment held the largest market share, approximately 60.9% in 2024, due to their high purchasing power. The average unit price of a fusion biopsy system is expensive, making it unaffordable for private diagnostic centers. However, the adoption of these systems in ambulatory care centers is reported to be increasing with the growing demand for prostate cancer care in rural areas.

The availability of skilled personnel & resources in hospitals, such as MRI scanners, anesthesiologists, radiologists, and urologists, allows them to perform fusion biopsies on demand. There is an increase in participation by private sector players in the hospital industry, making patient comfort a primary outcome. A transperineal fusion biopsy system is adopted to gain greater hospital acceptance, boosting the market.

Diagnostics centers are expected to grow significantly over the forecast period. Shorter wait times, cost efficiency, and a developing reimbursement paradigm are the factors expected to drive the growth of this segment. As targeted MR/Ultrasound biopsy system is an emerging technology, the high cost is a major barrier to its implementation in diagnostic centers. However, it is observed that two diagnostic centers are partnering to purchase an MR/Ultrasound fusion biopsy system, contemplating its quick ROI and surging demand for fusion biopsy.

Ambulatory care centers are expected to grow at the fastest rate of 9.6% during the forecast period. The rising prevalence of prostate cancer in rural areas having limited access to healthcare services is the factor expected to drive the growth of the segment. Moreover, introducing highly portable and low-cost MRI is expected to enhance the adoption rate of targeted MR/Ultrasound biopsy in ambulatory care centers. Thus, it is expected to boost the overall market growth.

Regional Insights

North America fusion biopsy market accounted for the largest revenue share of over 40.80% in 2024 and is expected to retain its dominance during the forecast period. The rising prostate cancer cases, increased adoption of advanced diagnostic technologies, and growing awareness of early detection.

U.S. Fusion Biopsy Market Trends

The fusion biopsy market in the U.S. is experiencing significant growth, driven by several key factors that enhance its adoption and effectiveness in prostate cancer detection. In recent years, the increasing prevalence of prostate cancer has heightened the demand for more precise diagnostic techniques in the country. This has led several organizations and institutes to invest in R&D and enhance innovation in fusion biopsy procedures.

Canada fusion biopsy market is driven by the increasing adoption of advanced medical technology and the rising prevalence of prostate cancer. Prostate cancer has a significantly high prevalence in Canada, which has increased the need for advanced diagnosis and screening tools in the country. According to the Canadian Cancer Society, prostate cancer is the 3rd leading cause of death in Canadian men, with an estimated 27,900 men getting diagnosed with this cancer in 2024, representing 22% of all cancer types.

Europe Fusion Biopsy Market Trends

The fusion biopsy market in Europe held the second-largest global market share in 2024. Developed economies and favorable regulatory procedures create enormous opportunities for major regional market players. Thus, the market is expected to exhibit lucrative growth during the forecast period.

The UK fusion biopsy market has experienced significant growth driven by increasing government initiatives and rising emphasis on accurate prostate cancer diagnosis. The introduction of MRI fusion biopsy techniques has transformed the diagnostic landscape, allowing for more precise targeting of suspicious lesions. Furthermore, the increasing efforts by various organizations to increase the access of such technologies to a more extensive population base are further expected to drive market growth.

The fusion biopsy market in Germany is driven by advanced healthcare infrastructure, strong government support, and increasing prostate cancer awareness. Germany’s healthcare system, known for its high standards and widespread access to cutting-edge medical technology, has played a pivotal role in adopting fusion biopsy. Moreover, guidelines from the German Society of Urology (DGU) have emphasized the need for more accurate diagnostic procedures, contributing to a shift from conventional biopsy methods toward fusion biopsy.

Asia Pacific Fusion Biopsy Market Trends

The fusion biopsy market in Asia Pacific is witnessing growth, driven by the developing healthcare infrastructure and increasing awareness about prostate cancer. As countries such as China, India, Japan, and South Korea enhance their medical capabilities, healthcare providers have increasingly adopted fusion biopsy technologies. Particularly in countries such as Japan and South Korea, where aging populations contribute to higher incidences of prostate-related diseases, the demand for advanced diagnostic solutions has significantly increased.

Japan fusion biopsy market has seen considerable growth, propelled by the country’s rapidly aging population and rising incidence of prostate cancer. The declining birth rates and increasing life expectancy of the country are significantly growing the geriatric population in Japan, making it one of the fastest aging populations in the world, which substantially increases the threat of prostate cancer in the country.

The fusion biopsy market in China has experienced rapid expansion, driven by the country’s increasing focus on enhancing healthcare services and addressing the growing burden of prostate cancer. As China’s population continues to age, the incidence of prostate cancer has risen, prompting healthcare providers to adopt more precise diagnostic technologies. According to the WCRF International, China had the 2nd highest prevalence of prostate cancer globally, with 134,156 cancer incidents in 2022.

Latin America Fusion Biopsy Market Trends

The fusion biopsy market in Latin America has grown significantly due to increasing awareness and adoption of advanced diagnostic technologies, particularly in Brazil and Argentina. In recent years, healthcare systems in these countries have prioritized the modernization of medical procedures, with fusion biopsy becoming a critical component of prostate cancer diagnostics. Latin America's growing middle class, coupled with improved access to healthcare, has increased the demand for more accurate and minimally invasive diagnostic tools.

Brazil fusion biopsy market is driven by the country's increasing focus on modernizing its healthcare infrastructure and addressing the rising incidence of prostate cancer. As the second-largest economy in the Americas, Brazil has invested heavily in medical research and healthcare modernization, with a growing emphasis on precision medicine, leading Brazilian healthcare institutions to adopt advanced diagnostic technologies, including MRI-ultrasound fusion biopsy, which offers more accurate cancer detection than traditional methods.

Middle East and Africa (MEA) Fusion Biopsy Market Trends

The fusion biopsy market in the Middle East and Africa (MEA) is witnessing significant growth due to the increasing prevalence of prostate cancer and the region's push towards adopting advanced medical technologies. Countries like the UAE, Saudi Arabia, and South Africa are at the forefront of this trend, investing in state-of-the-art healthcare facilities and innovative diagnostic techniques. The introduction of MRI-ultrasound fusion biopsy in these nations has been driven by government initiatives to improve cancer care and the rising awareness of the importance of early detection.

Saudi Arabia fusion biopsy market is driven by the government's commitment to enhancing healthcare services and addressing the rising incidence of prostate cancer. Saudi Arabia's healthcare spending is projected to grow by an average of 3% annually from 2022 to 2025, aligning with the Vision 2030 objectives. This increase will facilitate the establishment of more public hospitals, clinical laboratories, and upgraded healthcare facilities across the kingdom. Investment in both public and private sectors is anticipated to enhance diagnostic IVD testing, focusing on infectious diseases and cancer. This modernization of the country’s healthcare sector is expected to increase healthcare access and the adoption of advanced healthcare technologies, including fusion biopsy.Key Fusion Biopsy Company Insights

The market is fragmented, with the top few players holding a significant market share. However, increasing demand for efficient diagnostic tools in prostate cancer management creates growth opportunities for new players to enter the market. The market players are adopting various strategies such as mergers and acquisitions, product launches, collaborations, reinforcing distribution networks, and entering untapped markets, especially developing economies, to strengthen their market presence. For instance, in August 2022, Promaxo, Inc., a supplier of medical imaging, robotics, and AI technology, announced that it had signed research partnerships for developing regulatory pathways as well as for MR-guided prostate interventions with Imperial College London and University Hospital Tuebingen Germany, two of the top university hospitals in Europe.

Key Fusion Biopsy Companies:

The following are the leading companies in the fusion biopsy market. These companies collectively hold the largest market share and dictate industry trends.

- Eigen

- Koninklijke Philips N.V.

- Hitachi Ltd.

- MedCom

- ESAOTE SPA

- KOELIS

- Focal Healthcare

- BK Medical Holding Company, Inc.

- Exact Imaging

- Biobot Surgical Pte Ltd.

- UC-Care Medical Systems Ltd.

Fusion Biopsy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 798.4 million

Revenue Forecast in 2030

USD 1.2 billion

Growth rate

CAGR of 8.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Biopsy route, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, Denmark, Sweden, Norway, India, Japan, China, Thailand, South Korea, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Eigen; Koninklijke Philips N.V.; Hitachi, Ltd.; MedCom; ESAOTE SPA; KOELIS; Focal Helathcare; UC-Care Medical Systems Ltd.; GeoScan Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fusion Biopsy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fusion biopsy market report based on biopsy route, end-use, and region:

-

Biopsy Route Outlook (Revenue, USD Million, 2018 - 2030)

-

Transrectal

-

Transperineal

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Centers

-

Ambulatory Care Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global fusion biopsy market size was estimated at USD 736.6 million in 2024 and is expected to reach USD 798.4 million in 2025.

b. The global fusion biopsy market is expected to grow at a compound annual growth rate of 8.6% from 2025 to 2030 to reach USD 1.2 billion by 2030.

b. North America dominated the fusion biopsy market with a share of 40.8% in 2024. This is attributable to the rising prevalence of prostate cancer in the U.S. and Canada, the presence of a large installed base of fusion biopsy units, increasing research activities related to prostate cancer treatment, and the presence of effective screening programs.

b. Some key players operating in the fusion biopsy market include Eigen; Koninklijke Philips N.V.; Hitachi, Ltd., MedCom; ESAOTE SPA; KOELIS; Focal Healthcare; UC-Care Medical Systems Ltd.; and GeoScan Medical.

b. Key factors that are driving the fusion biopsy market growth include the growing demand for targeted biopsy, the development of efficient reimbursement policies in several countries, and the launch of intuitive and attractive fusion biopsy software systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.