- Home

- »

- Consumer F&B

- »

-

U.S. Gelato Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. Gelato Market Size, Share & Trends Report]()

U.S. Gelato Market (2025 - 2033) Size, Share & Trends Analysis Report By Source (Dairy, Plant), By Flavor (Vanilla, Chocolate, Fruits & Berries), By Production Method, By Packaging, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-828-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Gelato Market Summary

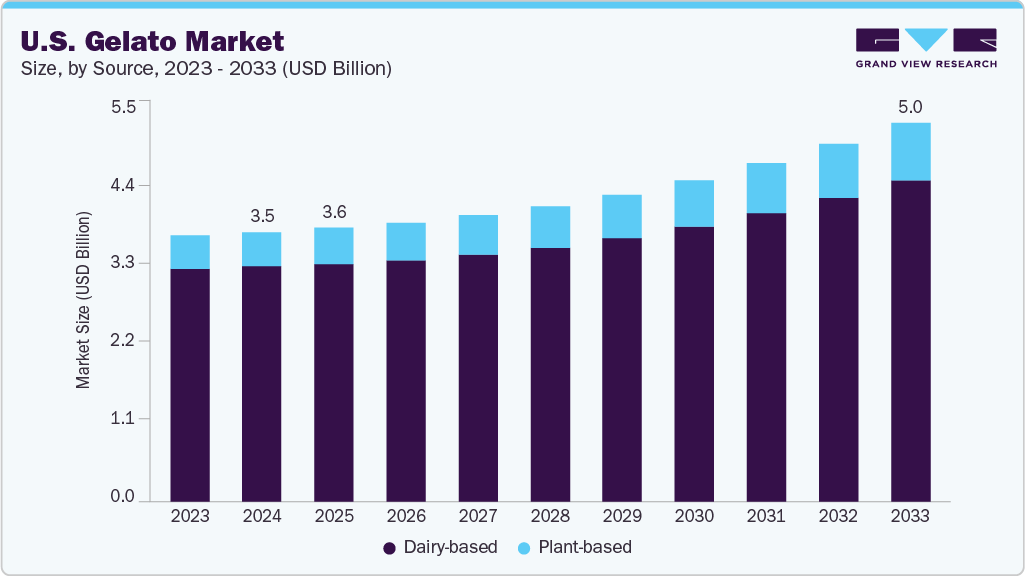

The U.S. gelato market was valued at approximately USD 3.58 billion in 2024 and is projected to reach USD 5.04 billion by 2033, growing at a compound annual growth rate CAGR of 4.2% from 2025 to 2033. The growth of the market is driven by a growing preference for artisanal and premium desserts that highlight authentic Italian recipes, natural ingredients, and rich textures.

Key Market Trends & Insights

- By source, the dairy-based segment dominated the market with an 87.2% share in 2024.

- By flavor, the vanilla segment dominated the market with a 27.0% share in 2024.

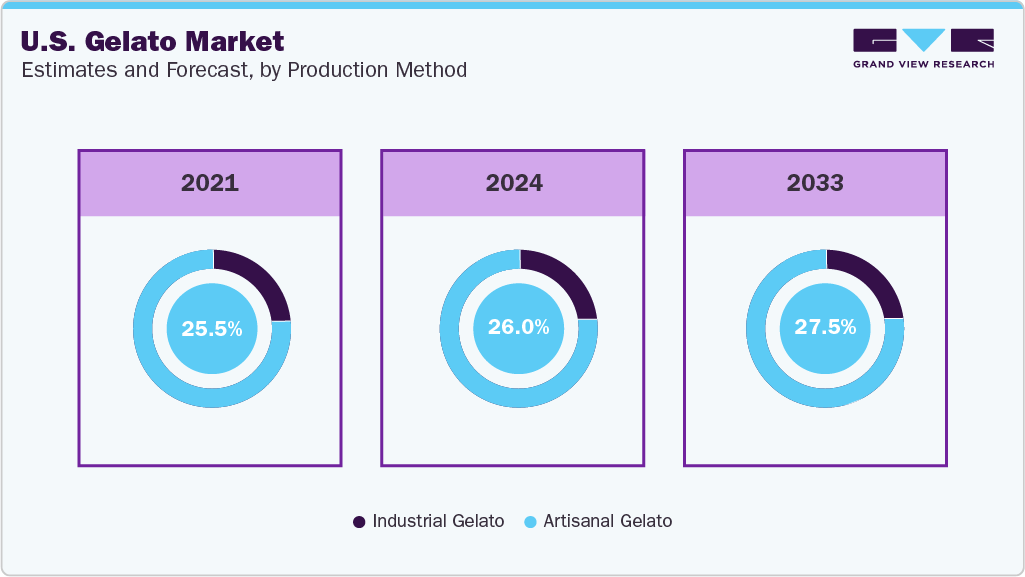

- By production method, the artisanal gelato segment dominated the market with a 26.0% share in 2024.

- By packaging, the take-home packaging segment dominated the market and accounted for 54.1% in 2024.

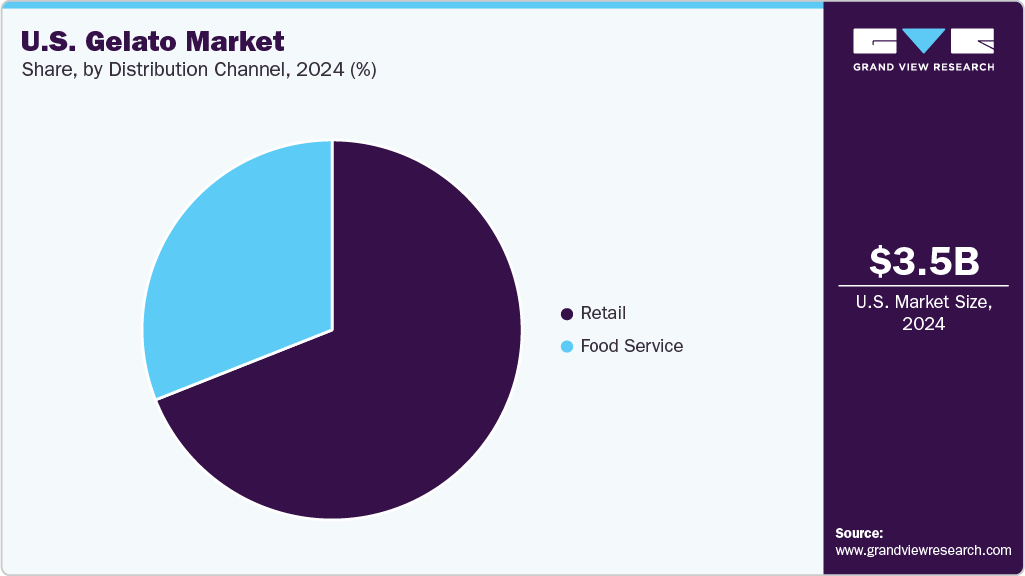

- By distribution channel, the retail segment dominated the gelato market, with a share of 69.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.58 Billion

- 2033 Projected Market Size: USD 5.04 Billion

- CAGR (2025-2033): 4.2%

As consumers seek indulgent and high-quality dessert options, gelato has gained strong appeal across retail and foodservice channels. Its smoother texture, denser composition, and perceived authenticity position as a sophisticated alternative to traditional ice cream among health-conscious and experience-driven buyers. The rising focus on health and wellness has further reshaped market dynamics and prompted a gradual shift in consumer preferences toward more nutritious indulgences. Consumers opt for low-sugar, dairy-free, and vegan gelato alternatives that align with balanced and sustainable lifestyles. This trend is particularly evident among younger and urban populations, who actively seek desserts that combine taste with health benefits.

To meet evolving expectations, producers reformulate their offerings with natural sweeteners, reduced sugar, and clean-label ingredients without compromising taste or texture. Innovation in dairy-free and vegan gelato variants targets younger urban consumers who prioritize sustainability and functional nutrition. The expansion of boutique gelato parlors and franchise cafes across major U.S. cities has increased product accessibility and strengthened brand visibility. These developments collectively reinforce gelato’s position as a modern and premium dessert option in the evolving gelato industry.

Consumer Insights

Consumer behavior in the U.S. gelato market reflects a shift toward premium, authentic, and health-aligned dessert choices. Consumers perceive gelato as a sophisticated alternative to conventional ice cream, associated with craftsmanship, dense texture, and authentic flavor. Urban, high-income groups drive demand, viewing gelato as an indulgence that combines quality with sensory appeal. The expansion of boutique gelaterias and quick-service outlets has strengthened visibility, while social media continues to influence purchasing decisions by promoting gelato as part of an aspirational lifestyle.

Health awareness has become a decisive factor shaping consumer preferences in the U.S. gelato market. The focus on balanced indulgence has encouraged buyers to seek desserts that offer satisfaction without excessive sweetness. According to an article published in IFT in September 2024, 65% of U.S. consumers now prefer products that are less sweet, reflecting a widespread shift toward lower sugar consumption and a more mindful approach to eating. This behavior has accelerated demand for clean-label and plant-based gelato prepared with almond, oat, or coconut milk bases. Consumers now prioritize transparency, sustainable sourcing, and nutritional balance, driving brands to innovate with formulations that deliver indulgence without compromising wellness. These behavioral trends continue to redefine the market, positioning gelato as a premium yet mindful dessert choice in the United States.

Source Insights

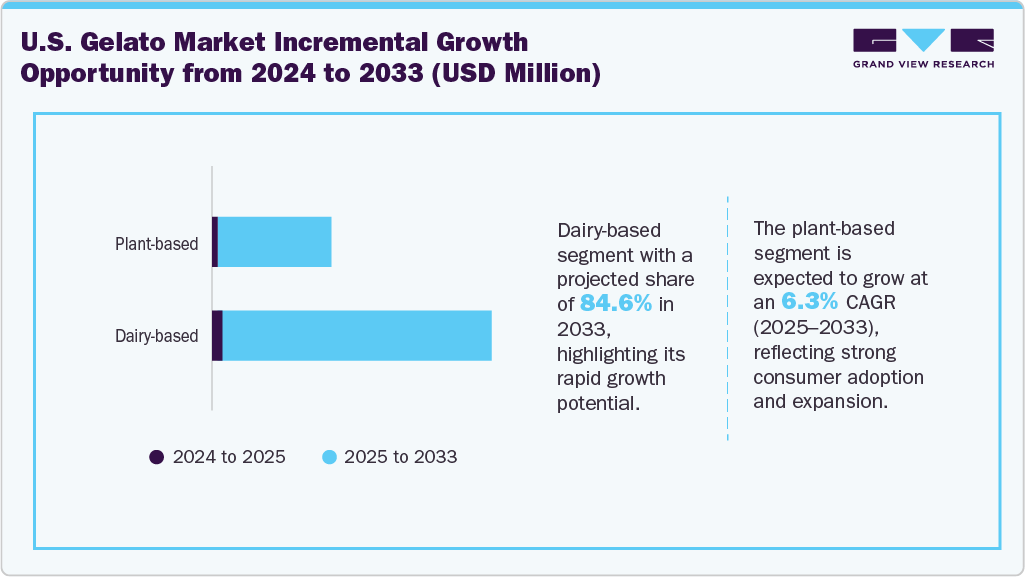

The dairy-based segment accounted for the largest share of 87.2% in 2024. This is driven by a strong consumer preference for authentic Italian-style gelato, made with milk and cream, which offers rich flavor, smooth texture, and superior indulgence. Consumers associate traditional dairy formulations with genuine craftsmanship and premium quality, making them the preferred choice in the U.S. gelato market. The availability of high-quality ingredients and advanced production capabilities further supports consistent taste and texture across brands. Producers emphasize authenticity and sensory appeal to attract buyers seeking indulgence combined with quality.

The plant-based segment of the U.S. gelato market is expected to grow at a CAGR of 6.3% during the forecast period due to rising consumer demand for healthier, sustainable, and allergen-free dessert options. Increasing awareness of lactose intolerance, vegan lifestyles, and environmental concerns has prompted consumers to shift toward non-dairy alternatives made from almond, oat, coconut, or soy-based ingredients. These formulations appeal to health-conscious buyers seeking clean-label, low-fat, and cholesterol-free desserts that do not compromise on taste or texture. This growing interest in plant-based indulgence has prompted leading manufacturers to expand their vegan gelato offerings. For instance, in January 2024, Unilever launched dairy-free gelato under its Talenti brand in the United States, expanding its plant-based dessert portfolio with formulations featuring cashew butter and oat milk. Continuous innovation in plant-based ingredients and advanced production techniques that replicate the creaminess of traditional gelato further support the segment’s expansion.

Flavor Insights

The vanilla segment dominated the market in 2024 This growth is driven by strong consumer preference for classic and familiar flavors that combine indulgence with authenticity, with vanilla emerging as the leading choice in the U.S. gelato market. The flavor is regarded as a classic option that strikes a balance between familiarity and richness, appealing to both traditional and modern consumers. Its smooth and creamy profile complements various inclusions, toppings, and mix-ins, making it a preferred base flavor for standalone offerings and creative combinations. Consumers often view vanilla gelato as a benchmark for quality and authenticity, prompting producers to focus on real vanilla beans and natural extracts to enhance flavor depth. Firms are expanding their presence in the market to strengthen accessibility and promote authentic Italian gelato experiences. For instance, in October 2024, Amorino expanded its presence in the United States with the opening of a new gelato boutique in Downtown St. Petersburg, Florida, strengthening its footprint in the U.S. gelato industry.

The fruits and berries segment is projected to register the fastest CAGR over the forecast period. This growth is driven by the rising preference for fruit and berry flavors, which are gaining momentum as consumers seek refreshing, naturally flavored, and lower-fat dessert options that align with clean-label and health-conscious trends. Varieties such as strawberry, mango, lemon, and mixed berry attract buyers seeking vibrant flavors crafted with real fruit purees and minimal artificial ingredients. These options are perceived as lighter and more natural compared to chocolate or nut-based varieties, appealing to both indulgent and wellness-oriented consumers. In addition, brands are introducing seasonal and exotic fruit blends to broaden flavor diversity and capture growing interest across retail and foodservice channels.

Production Method Insights

The industrial gelato segment accounted for the largest revenue share in 2024. The growth is driven by large-scale production efficiency, consistent quality, and extensive retail distribution networks that make industrial gelato widely accessible across the United States. Industrial producers benefit from economies of scale, which enable them to maintain competitive pricing while ensuring consistent flavor, texture, and quality standards. Leading brands continue to expand their manufacturing capabilities and invest in automation to improve output and distribution efficiency. For instance, in June 2025, Sammontana Italia introduced its gelato products to the U.S. market, debuting at Eataly locations in New York City with flavors such as Salted Caramel and Pistachio. This expansion reflects the increasing demand for high-quality, mass-produced gelato in the U.S. market, reinforcing the dominance of industrial producers in meeting large-scale consumer needs and sustaining their leadership in the gelato industry.

The artisanal gelato segment is projected to grow at the fastest CAGR over the forecast period. The growth is driven by rising consumer preference for authentic Italian flavors and premium frozen desserts that emphasize craftsmanship, freshness, and quality. Consumers value products made with natural ingredients, minimal additives, and small-batch preparation methods that deliver a richer texture and more authentic taste. Artisanal gelato producers in the country are focusing on innovation through the creation of limited-edition, locally inspired, and seasonal flavors to attract experience-driven buyers. This growing demand for handcrafted, high-quality gelato reflects the strong appeal of premium desserts, continuing to position artisanal gelato as a key driver of growth in the U.S. gelato market.

Packaging Insights

The take-home packaging accounted for the largest revenue share in 2024, driven by increasing consumer demand for convenient and premium frozen desserts suitable for at-home consumption. Busy lifestyles and the growing trend of at-home indulgence have led consumers to purchase multi-serve gelato tubs, which offer flexibility, portion control, and better value for money. Producers focus on innovative and visually appealing packaging formats that enhance product freshness and strengthen brand recognition. For instance, in April 2022, Baskin-Robbins rebranded in the United States with a new visual identity, logo, and packaging design to modernize its image and enhance consumer engagement across retail channels. Such initiatives demonstrate that packaging innovation and design play a crucial role in improving brand appeal and maintaining the dominance of the take-home segment in the U.S. gelato industry.

The impulse packaging segment is projected to grow at the fastest CAGR of XX% from 2025 to 2033, driven by rising demand for on-the-go and single-serve dessert options that offer convenience and instant indulgence. Small-format gelato options such as cups, cones, and bars appeal to younger consumers who prefer quick, portable treats during travel, leisure, or social occasions. The expansion of modern retail outlets, quick-service restaurants, and convenience stores enhances product accessibility and facilitates spontaneous purchases. The premiumization trend in the gelato industry encourages brands to introduce impulse products with high-quality ingredients, visually appealing packaging, and artisanal presentation. These premium impulse packs highlight product quality and attract higher per-unit packaging investment due to their design complexity and smaller production runs. A wider range of flavors, plant-based options, and healthier formulations broadens impulse consumption occasions beyond traditional desserts. Limited-edition launches and visually distinctive packaging designs enhance shelf appeal and consumer engagement, positioning the impulse packaging segment for the fastest growth in the U.S. gelato market.

Distribution Channel Insights

The retail segment accounted for the largest revenue share in 2024. The growth is driven by strong consumer preference for in-store gelato experiences that emphasize freshness, customization, and authenticity. Offline outlets enable customers to explore a wide variety of freshly prepared flavors and premium textures, enhancing the overall perception of quality and indulgence. Leading brands are actively expanding their retail presence across major U.S. cities to strengthen customer engagement and improve accessibility. For instance, in February 2022, Gelatissimo opened its first U.S. store in Houston, Texas. This reflects the expanding international participation in the market, driven by rising consumer interest in authentic, premium frozen desserts. In addition, the growth is driven by the increasing adoption of e-commerce platforms and delivery apps that offer consumers convenient access to premium frozen desserts. Rising digitalization, improved cold-chain logistics, and the availability of same-day delivery services have made it easier for consumers to enjoy gelato at home without compromising freshness or quality.

The food service segment is expected to witness significant growth during the forecast period. Cafes, boutique dessert bars, and upscale restaurants are growing quickly across the U.S., leading to more gelatos being served in the food-service industry. Gelato’s premium and artisanal image help these businesses attract urban millennials and Gen Z customers who look for unique dining and eye-catching desserts. Cities such as New York, Los Angeles, Chicago, and Miami now have more specialty cafes offering both imported and locally made gelato. Creative options such as seasonal flavors, affogatos, and gelato sandwiches keep customers coming back and spending more. Social media also drives demand by making gelato look trendy and part of a modern lifestyle.

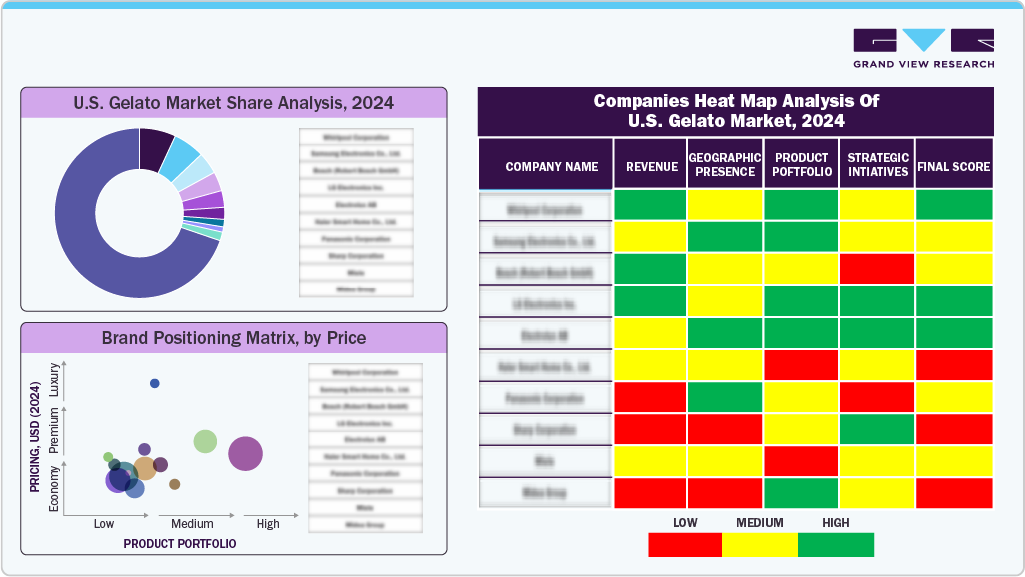

Key Companies & Market Share Insights

Domestic gelato producers employ targeted strategies to enhance their market position and adapt to evolving consumer preferences. Growth is driven by innovation in flavor development, product reformulation, and the expansion of health-oriented offerings such as plant-based, low-sugar, and dairy-free gelato. Producers focus on locally inspired and seasonal flavors to appeal to regional tastes and differentiate their brand. Companies expand their presence across supermarkets, cafes, and boutique outlets, investing in experiential marketing to emphasize authenticity and craftsmanship. Strategic partnerships with retailers and foodservice operators support wider distribution and visibility. By aligning with trends in wellness, sustainability, and premiumization, producers enhance consumer engagement and reinforce their competitive edge in the market.

-

Nestle S.A. is one of the largest global food and beverage companies with a strong presence across frozen desserts, including premium ice cream and gelato. Its broad distribution network, diversified brand portfolio, and continuous product innovation strengthen its position in both retail and foodservice channels.

-

Unilever PLC is a major multinational consumer goods company with leading ice cream brands under its portfolio. The company operates across mass-market and premium segments, supported by strong global reach, extensive manufacturing capabilities, and sustained investment in flavor innovation and cold-chain expansion.

Key U.S. Gelato Companies:

- Nestle S.A.

- Unilever PLC

- Baskin-Robbins, Inc.

- G.S. Gelato & Desserts, Inc.

- Uli’s Gelato

- Amorino

- Gelatissimo

Recent Developments

-

In July 2025, Amorino launched a gelato boutique in the Georgetown neighborhood of Washington, D.C., marking its entry into the U.S. capital’s retail arena. This expansion reflects the growing demand for premium artisanal gelato in the U.S. market, as consumers increasingly seek authentic European dessert experiences and natural ingredient formulations.

-

In June 2023, G.S. Gelato & Desserts, Inc. expanded its frozen-dessert manufacturing facility in Fort Walton Beach, Florida (USA), increasing capacity and workforce to meet rising U.S. demand.

U.S. Gelato Market Report Scope

Report Attribute

Details

Revenue Forecast in 2033

USD 5.04 billion

Growth Rate (Revenue)

CAGR of 4.2% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative (Revenue) units

Revenue in USD Million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, flavor, production method, packaging, distribution channel

Key companies profiled

Nestle S.A., Unilever PLC; Baskin-Robbins, Inc.; G.S. Gelato & Desserts, Inc.; Uli’s Gelato; Amorino; Gelatissimo

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Gelato Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the U.S. gelato market report on the basis of source, flavor, production method, packaging, and distribution channel.

-

Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Dairy-based

-

Plant-based

-

-

Flavor Outlook (Revenue, USD Million, 2021 - 2033)

-

Vanilla

-

Chocolate

-

Fruits & Berries

-

Nuts

-

Others

-

-

Production Method Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial Gelato

-

Artisanal Gelato

-

-

Packaging Outlook (Revenue, USD Million, 2021 - 2033)

-

Impulse packaging

-

Take-home packaging

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Retail

-

Online

-

Offline

-

-

Food service

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.