- Home

- »

- Renewable Energy

- »

-

U.S. Geothermal Heat Pump Market Size Share Report, 2030GVR Report cover

![U.S. Geothermal Heat Pump Market Size, Share & Trends Report]()

U.S. Geothermal Heat Pump Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Closed Loop, Open Loop, Hybrid), By Application, And Segment Forecasts

- Report ID: GVR-4-68040-079-9

- Number of Report Pages: 89

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

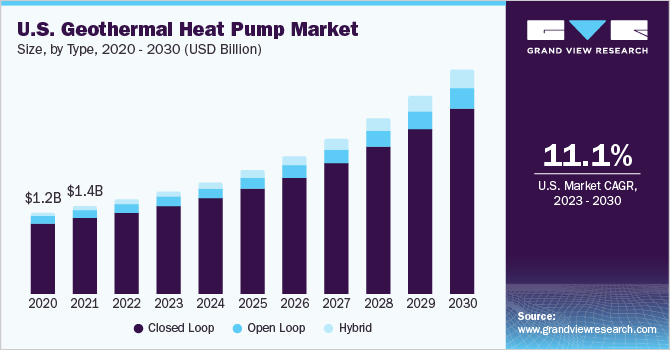

The U.S. geothermal heat pump market size was estimated at USD 1.52 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 11.1% from 2023 to 2030. The growth is expected to be driven by favorable government policies regarding the tax incentive schemes for the installation of geothermal heat pumps. Geothermal heat pumps (GHPs) are a type of renewable energy technology that can be used for heating and cooling applications in residential and commercial buildings. GHPs utilize the earth’s constant temperature as a source of thermal energy to provide a highly efficient and cost-effective heating and cooling solution.Thus, increasing demand for energy-efficient solutions and the growing global carbon footprint are expected to drive the geothermal heat pump market in the U.S. over the forecast period.

The market is expected to witness significant growth over the forecast period. The U.S. government has been promoting environmentally friendly construction practices and reduction of the amount of carbon emissions caused by newly constructed buildings. As the construction sector accounted for more than 25% of the greenhouse emissions in 2022, a number of guidelines are now being enforced to reduce the environmental footprint of construction activities. Regulatory requirements in the U.S. related to the construction industry include voluntary certifications for LEED and EDGE and NYC emissions reduction law.

The growing consumption of fossil fuels, such as coal, oil, and natural gas, to meet heating needs has a significant harmful impact on the environment. Most building furnaces or boilers run on fossil fuels, accounting for 42% of the total greenhouse gas emissions. Growing awareness regarding climate change and greenhouse gas emissions is expected to boost the demand for energy-efficient products and technologies in the coming years.

Government regulations and emission standards are also projected to positively influence the preference for energy-saving products in the industrial and residential sectors. Each KW of energy consumed by a heat pump produces 4 KW of thermal energy, which resembles 300% efficiency. According to IEA, heat pumps across the EU help reduce CO2 emissions amounting to an annual reduction of 9.16 Billion tons of CO2. Thus, increasing demand for energy-efficient solutions and growing carbon footprint across the globe are predicted to drive the geothermal heat pump market over the coming years.

Geothermal heat pumps consume less electricity as compared to traditional units, which helps in reducing utility costs. These systems are also eco-friendlier in comparison to other heat pumps as they do not burn fossil fuels. Moreover, geothermal heat pumps can efficiently operate in any climate, because of the earth’s constant temperature. These factors are expected to drive the demand for geothermal heat pumps over the forecast period.

Type Insights

The closed loop type segment led the market and accounted for 86.40% of the revenue share in 2022. Closed-loop geothermal heat pumps are popular in the U.S. as they are highly efficient and reliable. They have minimal maintenance requirements. These pumps also have a long lifespan with some of them lasting up to 50 years or more.

Closed-loop geothermal heat pumps are preferred as a result of both significant improvements in closed-loop technology and environmental concerns in the U.S. The use of open loops that inject water underground is likely to continue to be legal despite the U.S. Environmental Protection Agency's mention of banning "pump and dump" systems.

Moreover, to increase the number of pipes in a shorter trench and reduce installation costs, the pipe is looped. This allows for horizontal installation in locations where conventional vertical applications are impractical. Vertical systems are frequently used in large commercial buildings and schools because horizontal loops require vast land. These factors are expected to drive the demand for closed-loop systems over the forecast period.

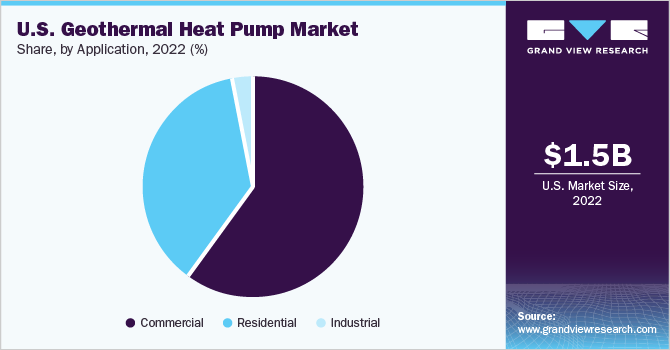

Application Insights

The application segment consists of residential, commercial, and industrial. The commercial segment led the market and accounted for 59.91% of the revenue share in 2022. The growth of the commercial application segment of the U.S. geothermal heat pump market is driven by rising energy costs and increasing awareness about the benefits of geothermal heating and cooling systems of geothermal heat pumps, along with the presence of government incentives and tax credits given by the government for geothermal heat pump installations.

Geothermal heat pumps provide significant energy savings and can be installed in a wide range of commercial facilities, including office buildings, medical facilities, schools, courthouses, and training facilities. Increasing usage of large geothermal heat pumps in commercial buildings for space heating or cooling is expected to be one of the major factors influencing the growth of the market. Vertical closed-loop systems are typically ideal for large commercial buildings.

Moreover, the residential application segment of the U.S. geothermal heat pump industry has been experiencing steady growth in recent years owing to a surge in the implementation of various energy efficiency standards, the presence of different government incentives and tax credits, and the rise in awareness among homeowners about the benefits of geothermal heat pumps.

Key Companies & Market Share Insights

The U.S. geothermal heat pump industry is a highly competitive market owing to the presence of major industries across the region as these companies are fairly concentrated and highly competitive.For instance, in April 2023, Carrier Corporation announced the acquisition of the Germany-based Viessmann Climate Solutions heat pump business for USD 13.27 billion with the objective of expansion in the geothermal heat pump market in Europe. Some prominent players in the U.S. geothermal heat pump market include:

-

Bard HVAC

-

Carrier

-

ClimateMaster, Inc

-

Daikin Industries, Ltd

-

Dandelion

-

Encon Heating & A/C

-

Glen Dimplex

-

Ingersoll Rand (Trane)

-

Maritime Geothermal

-

NIBE

U.S. Geothermal Heat Pump Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.54 billion

Growth rate

CAGR of 11.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in thousand units, revenue in USD million and CAGR from 2023 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application

Country scope

U.S.

Key companies profiled

Bard HVAC; Carrier; ClimateMaster, Inc.; Daikin Industries, Ltd.; Dandelion; Encon Heating & A/C; Glen Dimplex; Ingersoll Rand (Trane); Maritime Geothermal; NIBE; Robert Bosch LLC; Stiebel Eltron; Vaillant Group; Viessmann; Spectrum Manufacturing

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Geothermal Heat Pump Market Report Segmentation

This report forecasts volume and revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. geothermal heat pump market report based on type and application:

-

Type Outlook (Volume, Thousand Units, Revenue, USD Million, 2018 - 2030)

-

Closed Loop

-

Horizontal

-

Vertical

-

-

Open Loop

-

Hybrid

-

-

Application Outlook (Volume, Thousand Units, Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Frequently Asked Questions About This Report

b. The U.S. Geothermal Heat Pumps market was estimated at USD 1.52 billion in 2022 and is projected to reach USD 1.69 billion in 2023.

b. The U.S. Geothermal Heat Pumps market is expected to witness a compound annual growth rate of 11.1% from 2023 to 2030 to reach USD 3.54 billion by 2030.

b. Closed loop emerged as the largest type segment and accounted for 86.40% of the market in 2022 owing to its long lifespan of the product, which can last up to 50 years.

b. Some of the key players operating in the U.S. Geothermal Heat Pumps market include Bard HVAC, Carrier, ClimateMaster, Inc, Daikin, and Dandelion, among others.

b. The demand for U.S. geothermal heat pumps has been increasing in recent years due to a number of factors, such as favorable government policies regarding the tax incentive schemes for the installation of geothermal heat pumps.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.