- Home

- »

- Advanced Interior Materials

- »

-

U.S. Granite Market Size And Share, Industry Report, 2033GVR Report cover

![U.S. Granite Market Size, Share & Trends Report]()

U.S. Granite Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Granite Slabs, Granite Tiles), By Application (Countertops, Flooring & Wall Cladding, Monuments & Memorials, Infrastructure & Construction), And Segment Forecasts

- Report ID: GVR-4-68040-638-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Granite Market Summary

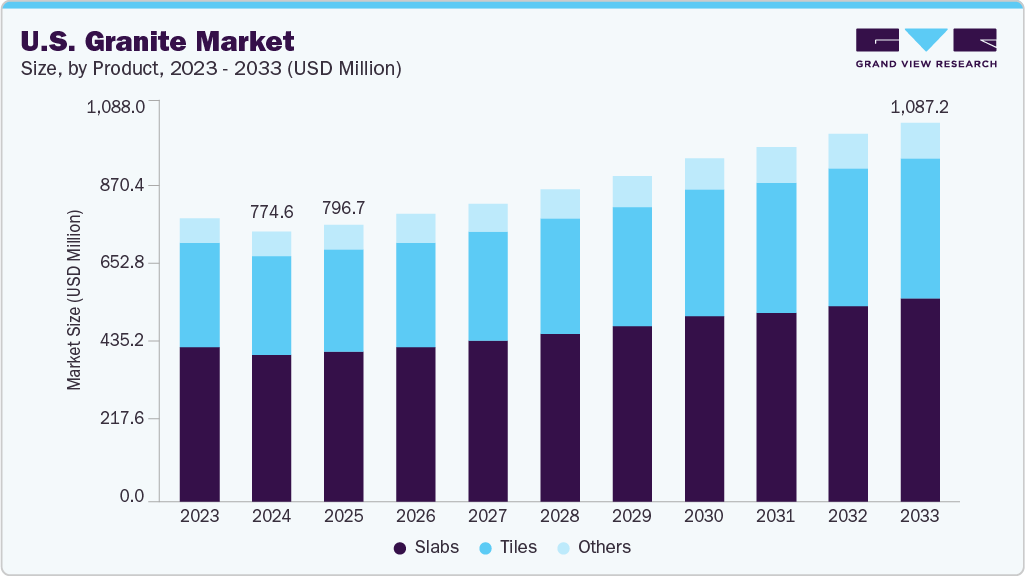

The U.S. granite market size was estimated at USD 774.6 million in 2024 and is projected to reach USD 1,087.2 million by 2033, growing at a CAGR of 4.0% from 2025 to 2033. The market is poised for steady growth, driven by increased investments in infrastructure development and the construction sector's ongoing expansion.

Key Market Trends & Insights

- The U.S. granite market is expected to grow at a substantial CAGR of 4.0% from 2025 to 2033.

- By product, granite slabs dominated the market with a revenue share of over 54.2% in 2024.

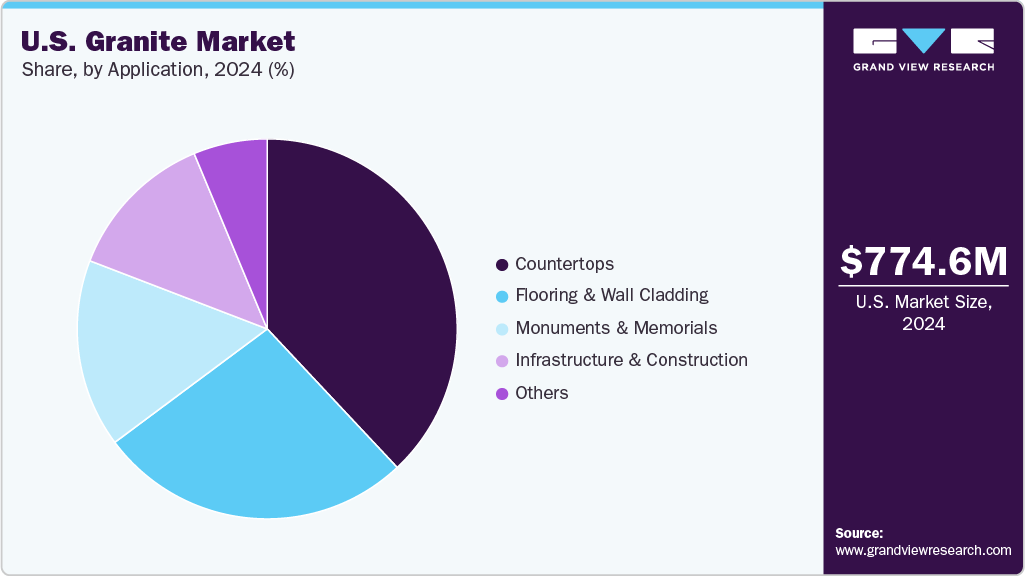

- By application, the countertops segment held the largest share of over 37.8% of granite revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 774.6 Million

- 2033 Projected Market Size: USD 1,087.2 Million

- CAGR (2025-2033): 4.0%

Government initiatives to upgrade transportation networks, public buildings, and urban spaces contribute to rising demand for durable and aesthetically appealing materials. It is known for its strength and resistance to environmental wear, and is widely used in constructing bridges, pavements, and monuments across the country. Slabs dominate the U.S. granite industry due to their superior strength, enduring quality, and visually rich appearance. Their availability in various textures, colors, and finishes makes them a top choice for architectural applications. From residential interiors to commercial developments, slabs are widely used for premium installations such as countertops, flooring, facades, and commemorative structures, spaces where durability and design are equally critical.The rising complexity of modern construction, particularly in high-rise urban projects and luxury developments, continues to drive demand. Their natural resistance to environmental stressors, weather fluctuations, heavy foot traffic, and mechanical wear makes them ideal for infrastructure such as bridges, transit stations, and high-traffic public spaces. As sustainable building practices gain momentum, natural materials with long service lives and low maintenance needs are becoming more popular than synthetic alternatives.

Simultaneously, ongoing advancements in cutting, polishing, and surface treatments have greatly increased design flexibility. These innovations allow for seamless integration into contemporary architectural styles, enhancing both form and function. As the construction sector shifts towards high-performance and visually striking materials, slabs remain a cornerstone in modern building aesthetics and structural design.

Drivers, Opportunities & Restraints

Increased consumer preference for premium, long-lasting building materials pushes demand across the residential and hospitality sectors. Many homeowners and developers opt for high-end finishes with durability and timeless visual appeal. Additionally, government-led infrastructure funding, primarily through initiatives like the Bipartisan Infrastructure Law, creates strong demand for natural stone in roads, transit systems, and public spaces. Rapid urban redevelopment in major cities also plays a role, with older structures being replaced or renovated using higher-spec materials to meet modern building codes and design trends.

Rising trend of home renovation and remodeling, especially in the premium housing segment. As homeowners increasingly seek to upgrade kitchens, bathrooms, and outdoor living spaces, natural stone surfaces such as granite slabs and tiles have become preferred due to their durability, upscale appearance, and value addition to properties. This trend is further supported by rising disposable income, increased home equity, and a strong focus on personalized, long-lasting design solutions. The demand is also fueled by real estate investors and developers prioritizing high-end finishes to attract discerning buyers and renters.

The rise of smart cities and sustainable urban planning provides opportunities to integrate natural stone into large-scale, environmentally conscious construction. Granite’s long lifespan and low maintenance make it an ideal choice for these initiatives. There’s increasing demand in outdoor landscaping and hardscaping applications, such as walkways, retaining walls, and decorative facades, as public and private outdoor spaces are being reimagined for both functionality and aesthetics. Additionally, digital templating, CNC cutting, and water-jet technologies have enhanced fabrication efficiency, reducing waste and enabling highly customized installations that cater to design-forward projects.

Fluctuations in global supply chains and the reliance on imports for specific varieties can result in pricing volatility and supply delays, affecting project timelines and budgets. Labor shortages in the construction and stone fabrication industries are another limiting factor, as skilled craftsmanship is crucial for installation and finishing. At times, consumer preferences are shifting toward lighter, engineered options that replicate the appearance of stone but provide easier handling and installation, presenting a challenge to traditional natural stone segments.

Product Insights

By product, granite slabs dominated the market with a revenue share of over 54.0% in 2024. Slabs is the most significant product category in the U.S. granite industry, driven by their widespread use in upscale architectural and interior applications. These large, polished surfaces are prominently featured in kitchen countertops, bathroom vanities, expansive flooring, and seamless wall cladding. Their popularity stems from visual elegance, functional resilience, superior heat and scratch resistance, and a properly sealed non-porous surface. Creating continuous, grout-free surfaces enhances hygiene and aesthetic appeal, making it the material of choice for luxury residences, hospitality venues, and executive office spaces.

Although secondary in market share, tiles offer a flexible, cost-effective alternative suited to various construction needs. Their compact size facilitates easier handling, transport, and installation, making them ideal for projects with logistical constraints or tighter budgets. Commonly used in residential bathrooms, kitchens, and commercial flooring, tiles come in a range of textures from polished and honed to flamed finishes. Their anti-slip properties and durability render them a dependable choice for high-traffic areas such as building lobbies, corridors, and service zones. This product segment is particularly appealing to mid-tier developers and homeowners who aim to balance performance, aesthetics, and cost-efficiency.

Application Insights

The countertops segment held the largest share of over 37.0% of granite revenue in 2024. Countertops remain a dominant application area, particularly in premium kitchen and bathroom designs. Their appeal lies in the combination of aesthetics and practicality-delivering strong resistance to heat, stains, scratches, and low porosity when appropriately sealed. This makes them especially suitable for high-use, moisture-prone areas such as food preparation zones. The availability of varied patterns, colors, and surface finishes also allows for seamless integration into modern and traditional interiors, supporting functional use and elevated design preferences.

Demand for large-scale construction and infrastructure projects continues to grow, fueled by investments in public spaces and civic amenities. Due to its exceptional load-bearing capacity and resistance to environmental wear, the material is frequently used in bridges, transit platforms, curbstones, and exterior facades of commercial buildings. Its long service life and low upkeep costs offset the higher upfront installation expense. These attributes make it a preferred choice for projects with critical durability, safety, and visual impact, such as transportation hubs and municipal structures.

Flooring and wall cladding contribute significantly to usage across both residential and commercial sectors. High-traffic areas like hotel lobbies, airport terminals, corporate offices, and shopping centers benefit from the material’s hard-wearing properties and timeless appearance. It offers a polished yet practical solution that balances durability with luxury. When used in wall treatments, it enhances spatial depth and aesthetic value, often serving as a focal point in executive interiors, cultural institutions, and upscale retail environments. Its versatility across applications continues to support its leading position in the building materials segment.

Key U.S. Granite Company Insights

Some of the key players operating in the market include Cambria and Arizona Tile.

-

Cambria is a leading American manufacturer of natural stone surfaces, specializing in quartz and natural stone-based products. Known for its superior quality, Cambria blends advanced technology with timeless design, offering countertops, tiles, and slabs suitable for residential and commercial spaces. The company operates a vertically integrated model, managing its production, distribution, and retail operations across the U.S.

-

Established in 1977, Arizona Tile is a major importer and distributor of granite and natural stones, including quartzite, marble, and quartz. The company serves residential and commercial markets with over 25 locations across the Western U.S. Arizona Tile is known for its extensive inventory, customer service, and customized surface solutions.

-

Founded in 1925 in South Dakota, Dakota Granite Company is a leading quarrier and manufacturer of natural granite products. It specializes in American-sourced granite blocks, slabs, memorials, and architectural stone. The company maintains strict quality control with its quarries and fabrication plants and supports sustainable stone sourcing.

-

Precision Countertops is a well-established fabricator and installer of granite, quartz, and solid surface countertops, headquartered in Oregon. It operates extensively across the Pacific Northwest, catering to builders, designers, and homeowners with customized surface solutions.

Key U.S. Granite Companies:

- American Marazzi Tile Inc.

- Arizona Tile

- Cambria

- Craig Baker Marble Co., Inc.

- Dakota Granite Company

- Granite Tops

- Levantina USA

- MSI Surfaces

- Precision Countertops

- Vangura Surfacing Products

Recent Developments

-

In February 2024, Cambria introduced six new quartz designs and two innovative finishes during the Las Vegas Kitchen & Bath Industry Show (KBIS). This launch underscored the company’s commitment to blending aesthetic appeal with performance by expanding its design portfolio. Later in November 2024, Cambria expanded its premium offerings at the High Point Market in North Carolina, unveiling four new quartz surfaces: Inverness Stonestreet, Avalene, Inverness Blakeley, and Everleigh Warm. These were launched with two distinctive finish options, Luxe and Satin, allowing greater design flexibility for residential and commercial interiors.

-

Meanwhile, Arizona Tile announced the opening of a new 60,000-square-foot showroom and warehouse in Roseville, California, on June 19, 2025. This strategic expansion is aimed at enhancing service capabilities in Northern California. The facility features an extensive collection of over 130 types of natural stone, including granite, and over 40 series of porcelain and ceramic tiles. The new location supports the company’s mission to provide high-quality materials and improved accessibility to the region's architects, designers, and contractors.

U.S. Granite Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 796.7 million

Revenue forecast in 2033

USD 1,087.2 million

Growth rate

CAGR of 4.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

U.S.

Key companies profiled

American Marazzi Tile Inc.; Arizona Tile; Cambria; Craig Baker Marble Co. Inc.; Dakota Granite Company; Granite Tops; Levantina USA; MSI Surfaces; Precision Countertops; Vangura Surfacing Products

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Granite Market Report Segmentation

This report forecasts the volume & revenue growth at the country level and analyzes the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the U.S. granite market report based on product and application:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Granite Slabs

-

Granite Tiles

-

Other

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Countertops

-

Flooring & Wall Cladding

-

Monuments & Memorials

-

Infrastructure & Construction

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. granite market size was estimated at USD 774.6 million in 2024 and is expected to reach USD 796.7 million in 2025.

b. The U.S. granite market is expected to grow at a compound annual growth rate of 4.0% from 2025 to 2033, reaching USD 1,087.2 million by 2033.

b. By product, granite slabs dominated the market with a revenue share of over 54.0% in 2024.

b. Some key vendors in the U.S. granite market are American Marazzi Tile Inc., Arizona Tile, Cambria, Craig Baker Marble Co. Inc., and Dakota Granite Company, Granite Tops, Levantina USA, MSI Surfaces, Precision Countertops, Vangura Surfacing Products.

b. The growth of the U.S. granite market is primarily driven by increased consumer preference for premium, long-lasting building materials, pushing demand across the residential and hospitality sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.