- Home

- »

- Next Generation Technologies

- »

-

U.S. Greenhouse Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. Greenhouse Market Size, Share & Trends Report]()

U.S. Greenhouse Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Glass Greenhouse, Plastic Greenhouse), By Component (Hardware, Software, Services), By Crop Type, By End-user, And Segment Forecasts

- Report ID: GVR-4-68040-230-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Greenhouse Market Size & Trends

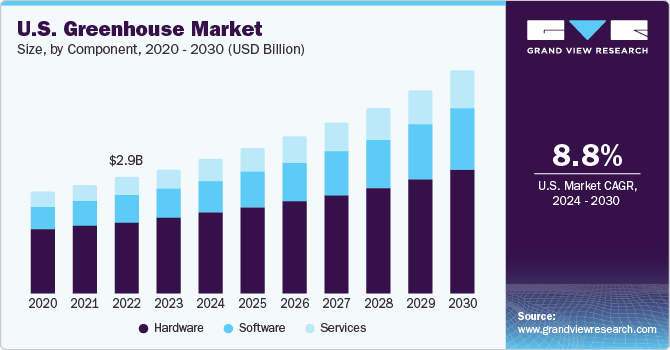

The U.S. greenhouse market size was estimated at USD 2910.7 million in 2023 and is projected to grow at a CAGR of 8.8% from 2024 to 2030. With rapid urbanization and increasing population, the arable land is shrinking, which is causing a shift in agricultural practices. The increasing environmental problems, such as groundwater depletion and soil degradation are affecting the agriculture and food production systems. Greenhouse provides ways to grow crops year-round, reduce water wastage, and also minimize the use of pesticides. The above-mentioned advantages of greenhouse are projected to fuel the market growth.

The U.S. market accounted for approximately 10.52% share of the global greenhouse market. Greenhouse farming offers protection to crops from severe weather conditions by using techniques such as controlled environment agriculture technology, where the facilities use climate control systems. It offers numerous benefits which include increased production with fewer risks. Greenhouse farming can be used in the large-scale production of organic crops. The controlled growing technology eliminates or at least minimizes the use of chemical pesticides. Crops are grown under selected and well-monitored conditions that ensure optimal growth year-round. Compared to open-field agriculture and other farming practices, such as vertical farm systems provide more crop rotation. The growth rate is controlled with the help of a computer database that manages optimum growing conditions for various varieties such as baby spinach, lettuces, baby rocket, Tatsoi, and basil.

Continued urbanization, growing population, climate change, and depleting water resources are causing the arable land per person to shrink continuously. As a result, policymakers are confronting a major challenge of ensuring adequate food supply for the growing population while ensuring sustainability. Food production can be particularly enhanced by leveraging the advances in technology and automation and adopting innovative farming techniques, including greenhouse farming, urban indoor farming, and vertical farming. Greenhouse farming can potentially help optimize the use of the available land, augment productivity, and increase yield while reducing the environmental footprint. Eventually, greenhouse farming can potentially emerge as a greener and cleaner farming technique while curbing the use of fossil fuels and ensuring biosecurity, which is expected to fuel market growth.

Operating costs associated with greenhouse farming are also quite high, as aggressive monitoring is required to ensure optimum growing conditions. Greenhouse farms tend to consume high amounts of energy, and most of the energy is still generated from burning fossil fuels, which are blamed for greenhouse gas emissions. Hence, the environmental footprint of greenhouse farms is also being questioned. As such, the high operational costs, maintenance costs, and energy costs associated with greenhouse farms are expected to hinder the growth of the market over the forecast period.

Market Concentration & Characteristics

The growth stage for the U.S. Greenhouse industry is medium and the rate is accelerating. The degree of innovation is high as numerous greenhouse farming companies are considering vertical farming techniques such as aeroponics and hydroponics as the future of greenhouse farming. Aeroponics technology facilitates faster plant growth, effectively allowing the cultivation of more seeds and plants in less time. Moreover, aeroponics can be controlled externally using timers or computers for the release of moist air at regular intervals. It also annuls the need for frequent use of weeding, pesticides, and other maintenance processes as compared to conventional farming.

The competitive rivalry in the greenhouse industry is high owing to the fragmented nature of the market. The level of mergers and acquisitions (M&A) activities in the industry is moderate. To increase their market share, companies are using various growth tactics such as M&As, partnerships & collaborations, joint ventures, and product development.

The U.S. market is subject to increasing regulatory scrutiny. The Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) monitors the loading, mixing, and application of pesticides and other tasks that involve exposure to pesticides. Worker Protection Standard regulations of environmental protection agencies urged employers to take steps to prevent employees from risk of exposure to pesticides in nurseries, greenhouses, and farms. As per the regulation, the employer must train their workers regarding pesticide safety and must provide them with appropriate personal protective equipment.

The threat of substitutes is low in the market. Traditional and building-based or container-based soilless farming techniques are substitutes for greenhouse farming. However, the amount of food produced from the traditional approach is lower compared to greenhouse farming. Although the food produced in building-based soilless farming is more in volume, greenhouses are cost-effective compared to building-based farming techniques. Thus, the overall threat of substitutes is low.

Type Insights

Based on type, the market is bifurcated into glass and plastic greenhouse segments. The plastic segment held the largest market in 2023 with a market revenue share of 57.63%. One of the major benefits of the plastic greenhouse over glass greenhouse is the low installation costs. The plastic greenhouse segment is further classified into polyethylene, polycarbonate, and polymethyl-methacrylate subsegments. The polycarbonate segment held the largest market share in 2023 as polycarbonate materials are more durable and shatter-resistant compared to regular glass. In addition, the durable panels can easily withstand hard impacts from stones, wind, rain, and snow, among others without any damage. Polycarbonate greenhouses come in different shapes and designs are highly flexible and can be bent without any breakage.

The glass greenhouse is anticipated to witness the fastest CAGR of 9.2% from 2024 to 2030. Glass greenhouse is one of the strongest of all greenhouse materials due to its weight, high durability, and strength leading to significant years of service. One of the major reasons for their popularity is the clarity of the glass which can be maintained for years if cleaned regularly. The glass greenhouse segment is further classified into horticulture glass and others. Others include float glass, tempered glass, laminated glass, and frosted/hammered glass.

Component Insights

Based on component, the market is categorized into hardware, software, and services. The hardware segment dominated the market in 2023 with a market share of 61.16%. The growth of the segment can be attributed to the increasing demand for hardware among farmers for maintaining a suitable environment in greenhouse farming. A suitable environment is being maintained by using climate control systems. The hardware plays a significant role in maintaining the environment in greenhouses. Farmers are increasingly adopting contemporary smart agriculture and innovative technology.

The hardware segment is further categorized into climate control systems, lighting systems, sensors, and irrigation systems, which enable the cultivation of indoor-grown crops. The sensors subsegment is anticipated to witness the fastest CAGR from 224 to 2030 as greenhouse farming is inclined towards the usage of sensors to store information in the cloud for analyzing the information. The use of sensors enables monitoring of growth conditions, identifying anomalies, and identifying issues at the earliest. Early detection of issues paves the way for undertaking proactive, rather than reactive, actions. Furthermore, smart sensors are more effective and are used to deliver regular readings for undertaking necessary remedial actions. Thus, these benefits are driving the segment’s growth.

The software segment is anticipated to witness the fastest CAGR of 11.0% from 2024 to 2030. Greenhouse management software is a software tool that helps businesses and farmers manage the cultivation, tracking, and distribution of plants in a greenhouse environment. It provides features such as crop planning, inventory management, pest and disease control, labor tracking, and sales analysis. By automating and streamlining processes, greenhouse management software can help businesses save time, reduce costs, increase yield, and improve quality. The software segment is further bifurcated into web-based and cloud-based.

The web-based segment held the largest market share. The growth can be attributed to the target set by AgriTech 4.0 to support the development of technology through innovations and research in the agriculture sector. AgriTech 4.0 aims to construct and design web-based control systems that provide secure and safe services for greenhouse farming. The web-based services integrate multiple heterogeneous devices for optimizing the growing process of plants.

Crop Type Insights

Based on crop type, the market has been segmented into fruits, vegetables & herbs, flowers & ornamentals, and others. The fruits, vegetables & herbs segment held the largest market share of 52.15% in 2023. The segment's growth can be attributed to the increased production of frequently produced fruits and vegetables in greenhouses. Crops grown in greenhouses provide maximum profit to companies involved in their cultivation. At the same time, greenhouse farming improves biodiversity as it does not cause land disturbances. As a result, greenhouse farming is in high demand for growing various fruits, vegetables, and herbs.

Fruits, vegetables & herbs are further sub-segmented into tomato, lettuce, bell and chili pepper, strawberry, cucumber, Leafy Greens (excluding lettuce), herbs, and others. The tomato segment held the largest market share in 2023. Tomato crops are increasingly grown in greenhouses as it enables growers to maintain the temperature required for tomatoes. These crops require nearly 8 hours of sunlight, which greenhouses provide using LED lighting. Therefore, benefits such as sufficient lighting and stable temperature have increased the demand among tomato growers.

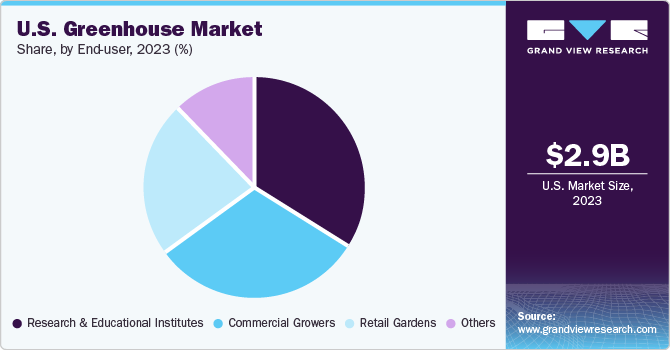

End-user Insights

In terms of end-user, the market has been segmented into commercial growers, retail gardens, research and educational institutes, and others. The research and educational institutes segment dominated the market in 2023 with a share of 34.09%. The segment growth is attributed to the use of greenhouses by research institutes to conduct experiments that require precise control of growing conditions, including temperature, humidity, light, and nutrient levels. Greenhouses allow researchers to manipulate these factors. By conducting these experiments in a controlled environment, researchers and educational institutes can eliminate the confounding effects of external factors and obtain more accurate and reproducible results.

The commercial grower’s segment is anticipated to witness the fastest CAGR of 9.8% from 2024 to 2030. Greenhouses are widely utilized by commercial growers as an essential tool for their horticultural operations. Commercial growers use greenhouses to produce a wide range of crops, including fruits, vegetables, flowers, and ornamental plants, year-round, regardless of the outdoor climate. Furthermore, government bodies are providing some financial assistance to the growers which are also considered to propel the market growth.

Key U.S. Greenhouse Company Insights

Some of the key companies in the U.S. target market include Berry Global, Poly-Tex, Inc., Argus Control Systems Ltd, and Agra Tech, Inc.

-

Berry Global, Inc. is a multinational corporation that offers a diverse selection of innovative and flexible packaging for greenhouse structures. The firm also offers a wide range of products, including packaging for personal care, food and beverage, pharmaceuticals, and industrial applications. Berry Global, Inc. operates through four business segments, namely consumer packaging international, consumer packaging North America, engineered materials, and other health & hygiene specialties.

-

Agra Tech, Inc. is a greenhouse manufacturing firm that specializes in the designing, manufacturing, and distribution of greenhouse systems and accessories. The company offers a wide range of products, including commercial greenhouses, retail greenhouses, and hobby greenhouses, as well as related accessories such as benches, shelving, ventilation systems, and heating systems.

Tortuga AgTech and Koidra are some of the emerging companies in the U.S. market.

-

Tortuga AgTech's system is integrated with advanced greenhouse growing methods and technology like robotics, automation and precision data analytics, and machine learning, enabling farmers to compete economically with traditional agriculture and preferable products. Tortuga Agriculture Technologies builds robotics that autonomously inventorizes, grades, picks, and packs soft produce like strawberries. It also provides inventory tracking, forecasting, and issue detection via advanced imaging systems utilized for harvesting.

-

Koidra is at the forefront of climate tech innovation, offering intelligent automation solutions that enable high-tech greenhouses, biomass energy facilities, and food processing plants to excel in both sustainability and production efficiency. Koidra is headquartered in Seattle.

Key U.S. Greenhouse Companies:

- Berry Global, Inc.

- Mastronardi Produce

- Stuppy Greenhouse, Inc.

- Logiqs B.V.

- Growspan

- Poly-Tex, Inc.

- Agra Tech Inc.

- DENSO CORPORATION

- Gotham Greens

- Windset Farms

Recent Developments

-

In September 2023, Mangrove Equity Partners acquired Atlas Greenhouse. Mangrove Equity Partners is a Tampa, Florida-based lower middle-market private equity firm. It invests in stable and profitable companies headquartered in the US and Canada. Atlas Greenhouse manufactures sells, and distributes a complete line of standard and custom greenhouse structures from its facility in Alapaha, Georgia. The company is a full product line manufacturer and supplier of greenhouse systems, components, and accessories, making it a one-stop shop for all growers’ needs.

-

In September 2023, Pure Flavor, announced that it had acquired MightyVine, a leading indoor tomato grower based in Rochelle, Illinois, to add to its expanding portfolio of greenhouses and distribution centers. Pure Flavor's facility in Georgia opened in late 2018. Pure Flavor growers tomatoes-on-the-vine at the facility for retail & food service partners in Georgia, Florida, North & South Carolina, Louisiana, Tennessee, and Alabama.

U.S. Greenhouse Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3135.6 million

Revenue forecast in 2030

USD 5204.6 million

Growth Rate

CAGR of 8.8% from 2024 to 2030

Historic data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, component, crop type, end-user

Country scope

U.S.

Key companies profiled

Berry Global, Inc.; Mastronardi Produce; Stuppy Greenhouse, Inc.; Logiqs B.V.; Growspan; Poly-Tex, Inc.; Agra Tech Inc.; DENSO CORPORATION; Gotham Greens; Windset Farms

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Greenhouse Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. greenhouse market report based on type, offering, crop type, and end-user:

-

Type Outlook (Revenue, USD Million; 2017 - 2030)

-

Glass Greenhouse

-

Horticulture Glass

-

Others

-

-

Plastic Greenhouse

-

Polyethylene

-

Polycarbonate

-

Polymethyl-methacrylate

-

-

-

Component Outlook (Revenue, USD Million; 2017 - 2030)

-

Hardware

-

Climate control systems

-

Lighting Systems

-

Irrigation Systems

-

Sensors

-

Others

-

-

Software

-

Cloud-based

-

Web-based

-

-

Services

-

System Integration & Consulting

-

Managed Services

-

Assisted Professional Services

-

-

-

Crop Type Outlook (Revenue, USD Million; 2017 - 2030)

-

Fruits, Vegetables & Herbs

-

Tomato

-

Lettuce

-

Bell and Chilli Pepper

-

Strawberry

-

Cucumber

-

Leafy Greens Leafy Greens (excluding lettuce)

-

Herbs

-

Others

-

-

Flowers & Ornamentals

-

Perennials

-

Annuals

-

Ornamentals

-

-

Others

-

-

End-user Outlook (Revenue, USD Million; 2017 - 2030)

-

Commercial Growers

-

Research and Educational Institutes

-

Retail Gardens

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. greenhouse market was estimated at USD 2910.7 million in 2023 and is expected to reach USD 3135.6 million in 2024.

b. The U.S. greenhouse market is expected to progress at a compound annual growth rate of 8.8% from 2024 to 2030 to reach USD 5204.6 million in 2030.

b. The plastic greenhouse segment accounted for the largest revenue share of more than 57% in 2023 in the U.S. greenhouse market. It will maintain its dominance over the forecast period owing to its low installation costs over the glass segment.

b. The key players operating in the U.S. greenhouse market include Berry Global, Poly-Tex, Inc., Argus Control Systems Ltd, and Agra Tech, Inc.

b. Key factors driving the U.S. greenhouse market include the rapid urbanization and increasing population, the arable land is shrinking, which is causing a shift in agricultural practices

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.