- Home

- »

- Energy & Power

- »

-

U.S. Grid Analytics Market Size, Share, Industry Report, 2033GVR Report cover

![U.S. Grid Analytics Market Size, Share & Trends Report]()

U.S. Grid Analytics Market (2025 - 2033) Size, Share & Trends Analysis Report By Component Type (Software, Services, Hardware), By Application, And Segment Forecasts

- Report ID: GVR-4-68040-832-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Research

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Grid Analytics Market Summary

The U.S. grid analytics market size valued at USD 1.77 billion in 2024 and is projected to reach USD 3.75 billion by 2033, at a CAGR of 8.6% from 2025 to 2033. The market is driven by utilities’ increasing reliance on data intelligence to modernize grid operations. The growing deployment of smart meters, sensors, and digital substations is generating massive datasets that require advanced analytics for real-time monitoring, load forecasting, outage prediction, and asset optimization.

Key Market Trends & Insights

- By component type, software held the highest market share of 55% in 2024.

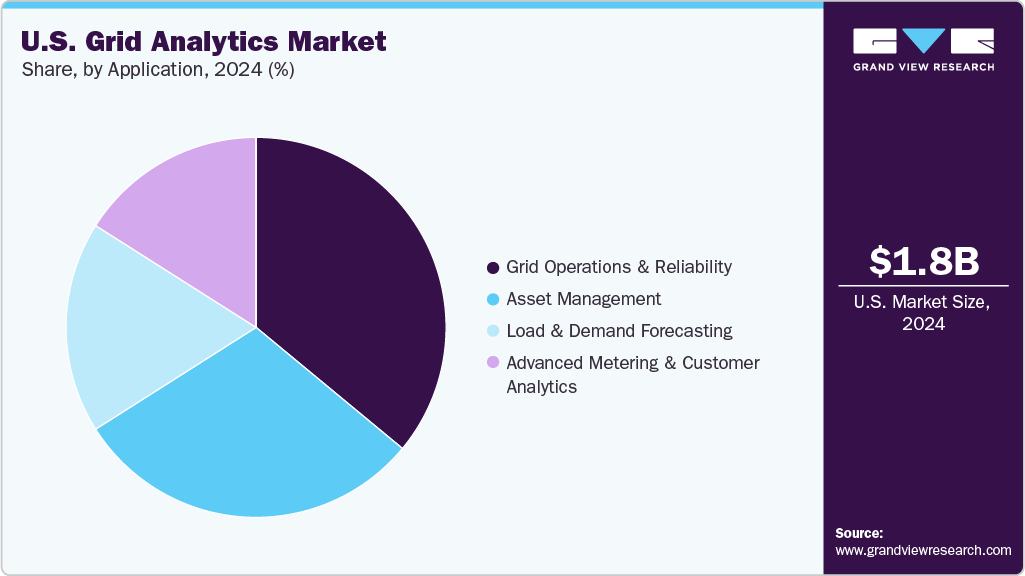

- Based on the application, the grid operations & reliability segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.77 Billion

- 2033 Projected Market Size: USD 3.75 Billion

- CAGR (2025-2033): 8.6%

As utilities face rising operational complexity due to EV adoption, extreme weather events, and stricter reliability metrics, grid analytics solutions are helping to enhance situational awareness, reduce downtime, and optimize investment decisions across both transmission and distribution networks.At the same time, the ongoing transition toward cleaner and more decentralized energy systems is intensifying the need for platforms that can manage diverse distributed energy resources (DERs) and two-way power flows. Federal and state-level funding for grid modernization, combined with initiatives promoting resilience, wildfire mitigation, and cybersecurity, is accelerating the adoption of cloud-based and AI-driven analytics architectures.

Increasing involvement of software vendors, cloud providers, and engineering firms is further strengthening the technological landscape, enabling utilities to move beyond traditional grid planning toward predictive, automated, and data-centric operational models.

Drivers, Opportunities & Restraints

The U.S. grid analytics market is primarily driven by the increasing need for data-driven grid modernization, enhanced operational visibility, and improved reliability across aging transmission and distribution networks. As utilities integrate larger volumes of renewable energy, EV charging loads, and distributed energy resources, they face challenges related to load variability, asset strain, and real-time decision-making. Grid analytics platforms allow operators to leverage data from AMI systems, sensors, and SCADA networks to predict failures, optimize asset lifecycles, and reduce downtime through predictive maintenance. Additionally, federal and state initiatives focused on resilience, wildfire mitigation, outage management, and climate-driven storm preparedness are prompting utilities to adopt advanced analytics to meet increasingly stringent reliability and performance standards.

Opportunities in the U.S. grid analytics market continue to expand as utilities transition toward digital substations, cloud-based infrastructure, and AI-driven operational models. Advancements in machine learning, edge analytics, and digital twins are enabling real-time grid simulations, faster outage restoration, and more accurate load and demand forecasting. The increasing deployment of DERs, battery storage, community solar, and microgrids presents a significant growth avenue, as analytics solutions are essential for managing bidirectional power flows and maintaining network stability. Utilities, RTOs, and ISOs such as PJM, CAISO, ERCOT, and MISO are also investing in analytics tools to address congestion, optimize dispatch, and evaluate grid performance under high renewable penetration. Growing utility spending on cybersecurity analytics, vegetation management insights, and AMI 2.0 upgrades further strengthens market opportunities for software vendors and engineering service providers.

However, the market faces notable restraints, including high investment requirements for analytics platforms, data management complexities, and interoperability challenges across diverse utility systems. Many utilities struggle with legacy infrastructure that was not designed to support real-time data flows, making integration costly and time-consuming. Regulatory fragmentation across states and slow approval processes for modernization budgets can also hinder rapid adoption. Additionally, concerns related to data privacy, cybersecurity, and workforce skill gaps, particularly in handling AI, cloud systems, and big data pipelines, pose challenges to full-scale deployment. Competing priorities such as transmission upgrades, wildfire mitigation projects, and grid hardening efforts may delay analytics investments for smaller utilities. Overcoming these barriers will require coordinated regulatory support, targeted digital workforce development, and increased standardization in data and software frameworks across the U.S. grid ecosystem.

Component Type Insights

The software segment accounted for the largest revenue share of over 55% in 2024, solidifying its dominance in the U.S. grid analytics market. This leadership is driven by utilities’ increasing dependence on advanced data platforms, AI-driven analytics tools, and cloud-based applications to manage the growing complexity of grid operations. As datasets from AMI systems, digital substations, sensors, and DERs continue to expand, software solutions enable real-time monitoring, predictive asset management, load forecasting, outage detection, and grid optimization. Their ability to integrate seamlessly with utility IT/OT systems and provide high scalability makes them indispensable for utilities transitioning toward digitalized and automated grid environments. Additionally, state-level mandates concerning reliability reporting, wildfire risk modeling, and resilience planning further reinforce the adoption of analytics software across transmission and distribution networks operated by utilities such as PG&E, Duke Energy, Exelon, and NextEra Energy.

The services segment is expected to register the fastest CAGR of 10.2% during the forecast period, reflecting the growing demand for implementation support, system integration, data management, and ongoing analytics consultancy. As utilities upgrade to advanced, AI-enabled platforms and migrate toward cloud-native architectures, they increasingly rely on specialized service providers to configure solutions, build custom analytics models, and ensure interoperability across legacy infrastructures. The rising need for training, cybersecurity monitoring, and continuous platform optimization is further boosting service adoption. Moreover, utilities are increasingly outsourcing tasks such as data cleansing, DER impact assessment, load modeling, and digital twin development to reduce internal resource burdens.

Application Insights

The grid operations & reliability segment held the largest revenue share of over 36% in 2024 in the U.S. grid analytics market, driven by utilities’ increasing need to enhance situational awareness, minimize outages, and maintain stable grid performance amid rising operational complexity. With aging infrastructure, increasing electrification, and higher penetration of distributed energy resources, utilities rely heavily on analytics platforms to monitor system conditions in real-time, detect anomalies, predict failures, and automate response strategies. These solutions support key operational functions such as load balancing, voltage monitoring, fault localization, and restoration planning, helping utilities improve SAIDI and SAIFI scores while strengthening resilience against extreme weather events. Major operators, including PJM, CAISO, ERCOT, and large investor-owned utilities, are prioritizing investments in advanced grid monitoring, asset health analytics, and digital control systems, reinforcing the dominance of this application segment across both transmission and distribution networks.

The advanced metering & customer analytics segment is projected to register the fastest CAGR of 10.6%, supported by the rapid expansion of AMI deployments, growing smart meter upgrades, and rising demand for customer-level energy insights. As AMI 2.0 rolls out across the country, utilities are leveraging high-resolution consumption data to improve billing accuracy, detect theft, manage demand response programs, and provide personalized energy efficiency recommendations to customers. Advanced analytics help uncover load patterns, forecast customer demand, and support dynamic pricing models that align consumption with grid conditions. Additionally, utilities are increasingly integrating customer analytics with DER management systems to enable behind-the-meter visibility and support programs such as EV charging optimization and rooftop solar forecasting. With federal resilience grants, state-level digitalization initiatives, and rising customer expectations for transparency and control, the advanced metering & customer analytics segment is expected to experience sustained growth and become one of the most transformative areas within the U.S. grid analytics landscape.

Key U.S. Grid Company Insights

Some of the key players operating in the U.S. Grid Analytics market Oracle and General Electric, among others.

-

Oracle is one of the most prominent players in the U.S. grid analytics market, offering a comprehensive suite of advanced grid management, meter data analytics, and utility operations software through its Oracle Utilities Analytics platform. From its strong U.S. base, the company provides utilities with cloud-driven solutions that support outage prediction, load forecasting, asset health monitoring, and customer energy usage insights. Oracle plays a crucial role in modernizing utility IT and OT environments by integrating AMI data, SCADA inputs, GIS systems, and IoT sensor networks into unified analytics dashboards.

-

General Electric, through GE Vernova’s Grid Solutions business, is another leading vendor shaping the U.S. grid analytics landscape. GE provides a broad portfolio of advanced analytics platforms, including its GridOS and Advanced Distribution Management Systems (ADMS), which help utilities enhance grid visibility, optimize network performance, and manage increasing renewable penetration. The company operates multiple engineering hubs, R&D centers, and field service teams across the U.S., supporting utilities with real-time grid modeling, predictive asset analytics, outage management, and distribution automation capabilities.

Key U.S. Grid Analytics Companies:

- ABB Ltd.

- AutoGrid Systems Inc.

- Capgemini SE

- General Electric (GE)

- Grid4C

- IBM Corporation

- Innowatts

- Itron, Inc.

- Oracle Corporation

- Siemens AG

Recent Developments

-

In February 2025, Oracle Utilities launched its next-generation Grid Analytics Cloud Platform in the United States, introducing advanced AI-driven forecasting, anomaly detection, and real-time grid state visualization capabilities. The new platform integrates high-frequency AMI data, DER outputs, weather intelligence, and substation sensors feed into a unified analytics environment designed to help utilities improve outage prediction accuracy and optimize load management during extreme weather events. Oracle also introduced an automated data governance module to streamline compliance with U.S. state regulatory reporting requirements.

U.S. Grid Analytics Market Report Scope

Report Attribute

Details

Market Definition

The U.S. Grid Analytics market estimate includes the total revenues generated from the development, deployment, and ongoing support of software, services, and analytical platforms used for grid monitoring, forecasting, asset management, outage detection, and operational optimization across transmission and distribution networks.

Market size value in 2025

USD 1.49 billion

Revenue forecast in 2033

USD 3.75 billion

Growth rate

CAGR of 8.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD Million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Component Type and Application

Country scope

U.S.

Key companies profiled

ABB Ltd.; AutoGrid Systems Inc.; Capgemini SE; General Electric (GE); Grid4C; IBM Corporation; Innowatts; Itron, Inc.; Oracle Corporation; Siemens AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Grid Analytics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the U.S. grid analytics market report on the basis of component type and application:

-

Component Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Services

-

Hardware

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Asset Management

-

Grid Operations & Reliability

-

Load & Demand Forecasting

-

Advanced Metering & Customer Analytics

-

Frequently Asked Questions About This Report

b. The U.S. grid analytics market size was estimated at USD 1.77 billion in 2024 and is expected to reach USD 1.94 billion in 2025.

b. The U.S. grid analytics market is expected to grow at a compound annual growth rate of 8.6% from 2025 to 2033 to reach USD 3.75 billion by 2033.

b. Based on the component type segment, software held the largest revenue share of more than 55% in 2024.

b. Some of the key players operating in the U.S. grid analytics market include Oracle Corporation, General Electric (GE), Siemens AG, IBM Corporation, Itron, Inc., Capgemini SE, AutoGrid Systems Inc., Innowatts, Grid4C, and ABB Ltd.

b. The key factors driving the U.S. grid analytics market include the growing demand for real-time grid visibility, the need to modernize aging transmission and distribution infrastructure, and the rising integration of distributed energy resources such as rooftop solar, battery storage, and electric vehicles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.