- Home

- »

- Medical Devices

- »

-

U.S. Group 2 Powered Mobility Devices Market Report, 2030GVR Report cover

![U.S. Group 2 Powered Mobility Devices Market Size, Share, & Trend Report]()

U.S. Group 2 Powered Mobility Devices Market (2023 - 2030) Size, Share, & Trend Analysis Report By Product Type, By Sales Channel, By Payment Type, By End-use, By Price-range, And Segment Forecasts

- Report ID: GVR-2-68038-306-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

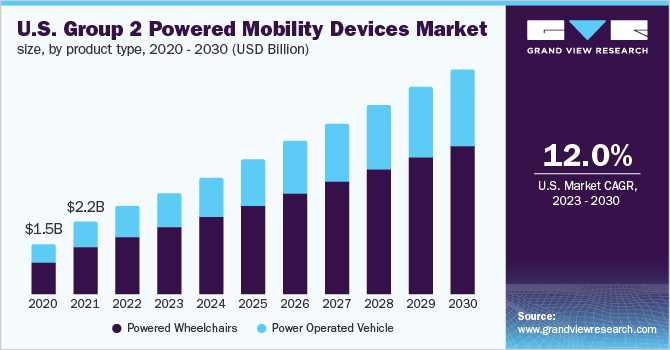

The U.S. group 2 powered mobility devices market size was valued at USD 2.6 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 12.0% from 2023 to 2030. There was a fall in the U.S. group 2 powered mobility devices market in 2020 due to the COVID-19 outbreak. However, the increasing geriatric population and rising acceptance of powered mobility devices for various outdoor activities are anticipated to provide a boost to the market. The pandemic has negatively impacted the mobility devices market. COVID-19 had a significant impact on the medical industry in terms of conducting medical procedures and therapy. The pandemic also contributed to a shipping and logistics crisis in the country. The shortage in the availability of logistics and shipping services caused delays in providing products and services to customers.

In the U.S., it is estimated that around 2.7 million people use wheelchairs for their day-to-day mobility needs. Spiraling demand from organizations such as the U.S. Department of Veterans Affairs and advancements in powered mobility devices are poised to augment the market. Supportive government initiatives are helping in streamlining overall reimbursement procedures based on patients’ medical criteria. This may aid in an increasing number of customers covered under the group 2 categories, which is expected to propel the market.

Surging demand for these devices among long-term and home care patients and increasing incidences of rheumatoid arthritis & osteoporosis are also expected to drive the market during the forecast period. According to the U.S. Census Bureau, in 2019, there were more than 54.1 million people above 65 years of age in the U.S., which accounted for 15.0% of the total population. Demand for powered mobility devices is growing due to the rising geriatric population.

Elderly individuals with limited mobility prefer battery-operated wheelchairs or scooters over manual vehicles as the former gives them the freedom to move independently, without any external support. Acceptance of mobility devices among patients and physicians is on the rise as they have proved to be exceptional in improving quality of life. Thus, due to the increasing awareness and rising acceptance, demand for battery-operated vehicles is poised to increase in the U.S.

Product Type Insights

The powered wheelchairs segment accounted for the leading share of more than 65.5% of the U.S. market in 2022. As of 2022, the high commercial availability of group 2 powered wheelchairs and the higher average selling price of these products as compared to scooters are contributing to the growth of the segment. Moreover, the growing popularity of battery-operated wheelchairs in the U.S. and rising consumer awareness about the advantages of these products over scooters will further support the growth of the segment during the forecast period.

Powered wheelchairs are motorized vehicles designed for patients with weak upper extremities caused by a neurological or muscular condition. These wheelchairs are necessary for patients who cannot perform mobility-related daily activities with walkers, canes, or manually operated vehicles. Powered scooters are designed for use in homes and improve the ability of people with chronic disabilities to cope with basic mobility activities. These patients require sufficient strength and postural stability to operate powered scooters effectively.

Payment Type Insights

The out-of-pocket payment type segment dominated the U.S. group 2 powered mobility devices market with a share of 83.2% in 2022. The reimbursement segment accounted for a smaller market share in 2022 due to the stringent policies and documentation requirements. However, the segment is projected to witness a strong growth rate primarily due to government initiatives to streamline reimbursement procedures, which may increase the number of patients being covered.

Reimbursement is provided for power-operated vehicles and wheelchairs through federal insurance as well as private insurance. Medicare classifies mobility devices into different groups, which have separate eligibility criteria for reimbursement. In general, Medicare reimburses 80.0% of the device cost, while the remaining 20.0% is paid for by patients along with any remaining deductible, copayment, or premium payments. The reimbursement also depends on whether the device supplier is enrolled in Medicare or not and prescribed an order by a qualified doctor for the necessity of the devices for the patient.

Sales Channel Insights

In 2022, the direct sales channel was the highest revenue generator. The segment will also exhibit the highest CAGR during the forecast period and will, therefore, retain its position through 2030. The presence of a large customer base, which includes customer groups (Physiotherapy Associates, U.S. Physical Therapy, and others), independent online channels, and third-party distributors, is one of the key factors anticipated to boost the sales of powered mobility devices in the U.S. during the forecast period. Direct sales can be done through catalogs, presentations, or through a company’s website. The profit margin is higher in direct sales as compared to other sales channels.

Complex Rehab Technology (CRT) products are sold through various retail outlets. These retail outlets stock mobility devices manufactured by various manufacturers and have trained professionals. Retail stores have the advantage of personal touch and provide customization of products. In recent times, a large number of e-commerce players have entered the powered mobility devices market. Online channels facilitate direct communication with the manufacturers. However, some consumers find it difficult to make a decision of purchasing a wheelchair without physically inspecting it.

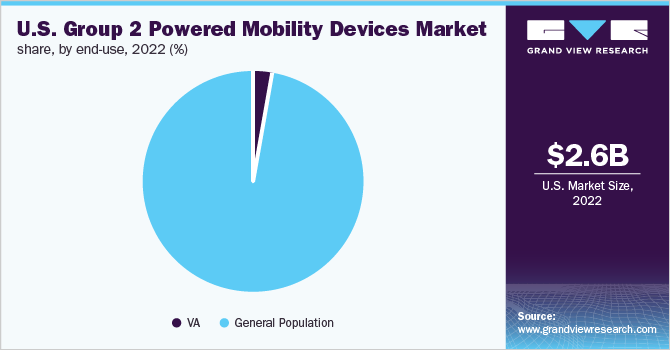

End-use Insights

The general population segment dominated the U.S. group 2 powered mobility devices market with a share of 97.5% in 2022. According to a report by WHO, around 15.0% of the global population lives with disabilities, which is the world’s largest minority. Adoption of home care is growing globally, mainly due to the rising geriatric population. With aging, the baby boomer population is increasing, which is driving demand for home health services. According to Everyday Health, 90.0% of American individuals above the age of 65 prefer staying at home for care.

The VA segment is also expected to witness a lucrative growth rate of 8.8% during the forecast period. According to an article on Military Medicine, more than 250,000 veterans use wheelchairs and they are usually covered by the VA, as technology has improved and the advancements in technology can benefit veterans. A wheelchair, scooter, or any mobility transportation can be allotted to the veterans, according to their physical condition and requirements.

Price-range Insights

In 2022, the USD 5,000-9,000 segment was the highest revenue generator and accounted for 76.3% of the market share. The segment will also exhibit the highest CAGR during the forecast period and will, therefore, retain its position through 2030. This price range includes both the affordable cost of the wheelchair as well as advanced features. The buyers in this price range do not need to sacrifice for their needs.

The group 2 powered mobility devices will also incur significant maintenance costs, mainly for children and patients who require rehabilitation with expected progress, whose growth means they will outgrow their assistive devices for personal growth and comfort. Assistive device users usually prefer these price range products due to factors such as reliability, efficiency, simplicity, comfort, safety, and aesthetics, which should be taken into account to ensure better and independent movement for the users.

Key Companies & Market Share Insights

Companies are continuously focusing on initiatives such as mergers & acquisitions, regional expansions, and novel product developments. For instance, in August 2021, Pride Mobility Products Corporation launched Jazzy EVO 613 group 2 chairs, which offer 25.0% less charging time and 25.0% more range. Some of the key companies in the U.S. group 2 powered mobility devices market include:

-

Golden Technologies

-

Pride Mobility Products Corporation

-

Invacare Corporation

-

National Seating & Mobility

-

Numotion

-

1800wheelchair.com

-

EZ Lite Cruiser

-

Shoprider Mobility Products, Inc.

-

Medical Depot, Inc. (Drive DeVilbiss Healthcare).

U.S. Group 2 Powered Mobility Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.0 billion

Revenue forecast in 2030

USD 6.7 billion

Growth rate

CAGR of 12.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Market representation

Revenue in USD million/billion, CAGR from 2023 to 2030

Country scope

U.S.

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product type, payment type, sales channel, end-use, price-range

Key companies profiled

Golden Technologies; Pride Mobility Products Corporation; Invacare Corporation; National Seating & Mobility; Numotion; 1800wheelchair.com; EZ Lite Cruiser; Shoprider Mobility Products, Inc.; Medical Depot, Inc. (Drive DeVilbiss Healthcare)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Group 2 Powered Mobility Devices Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. group 2 powered mobility devices market based on the product type, payment type, sales channel, end-use, and price range:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Powered Wheelchairs

-

Power Operated Vehicle

-

-

Payment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Reimbursement

-

Out-of-Pocket

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

E-commerce

-

Direct Sales (excluding VA)

-

Veteran Affairs

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

VA

-

General Population

-

-

Price-range Outlook (Revenue, USD Million, 2018 - 2030)

-

1,000-4,999

-

5,000-9,000

-

9,000 and above

-

Frequently Asked Questions About This Report

b. The U.S. group 2 powered mobility devices market size was estimated at USD 2.6 billion in 2022 and is expected to reach USD 3.0 billion in 2023.

b. The U.S. group 2 powered mobility devices market is expected to grow at a compound annual growth rate of 12.0% from 2023 to 2030 to reach USD 6.7 billion by 2030.

b. Powered wheelchairs dominated the U.S. group 2 powered mobility devices market with a share of 65.5% in 2022. This is attributable to the high commercial availability of group 2 powered wheelchairs and the higher average selling price of these products.

b. Some key players operating in the U.S. group 2 powered mobility devices market include Golden Technologies; Pride Mobility Products Corporation; Invacare Corporation; National Seating & Mobility; Numotion; 1800wheelchair.com; EZ Lite Cruiser; Shoprider Mobility Products, Inc.; and Medical Depot, Inc. (Drive DeVilbiss Healthcare).

b. Key factors that are driving the U.S. group 2 powered mobility devices market growth include the growing number of people living with disabilities, the increasing geriatric population, and the rising acceptance of powered mobility devices for various outdoor activities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.