- Home

- »

- Medical Devices

- »

-

U.S. Guidewires Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. Guidewires Market Size, Share & Trends Report]()

U.S. Guidewires Market (2025 - 2033) Size, Share & Trends Analysis By Product (Coronary Guidewires, Peripheral Guidewires, Urology Guidewires, Neurovascular Guidewires), And Segment Forecasts

- Report ID: GVR-4-68040-232-5

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Guidewires Market Summary

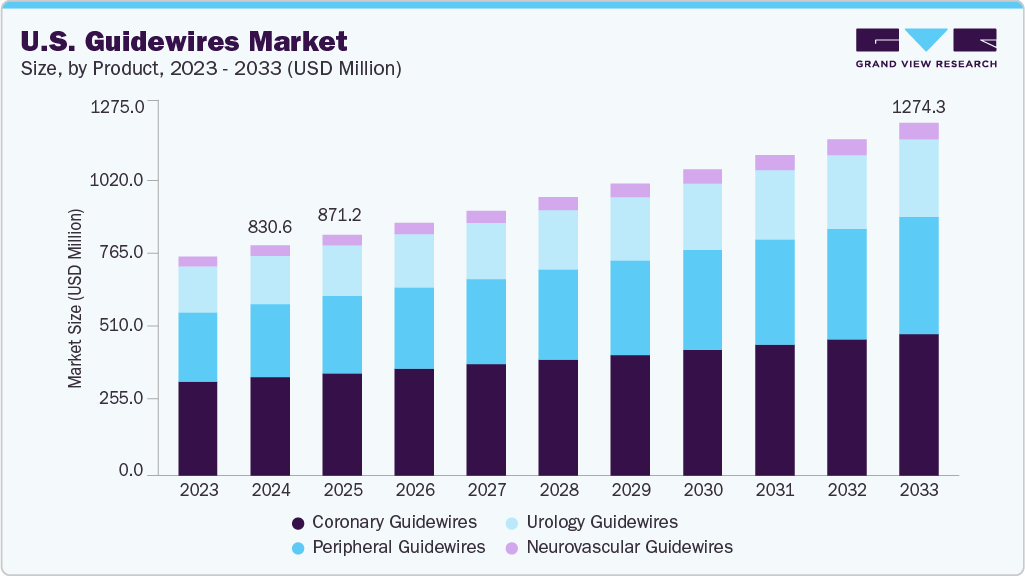

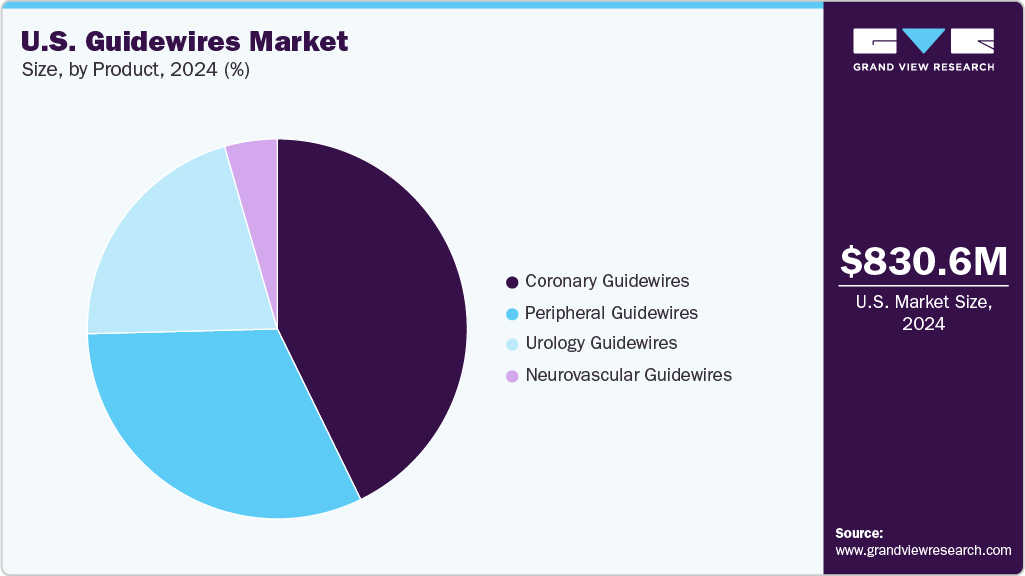

The U.S. guidewires market size was estimated at USD 830.6 million in 2024 and is projected to reach USD 1,274.3 million by 2033, growing at a CAGR of 4.87% from 2025 to 2033. The increasing prevalence of urological disorders, cardiovascular diseases, and Peripheral Artery Disease (PAD) is significantly driving the growth of the market.

Key Market Trends & Insights

- By product, the coronary guidewires segment led the U.S. guidewires market with the largest revenue share of 42.77% in 2024.

- By product, the neurovascular guidewires segment of the U.S. guidewires industry is anticipated to grow at the fastest CAGR from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 830.6 Million

- 2033 Projected Market Size: USD 1,274.3 Million

- CAGR (2025-2033): 4.87%

Moreover, a growing number of minimally invasive surgeries, paired with a rising geriatric population, presents an opportunity for increased product demand. Factors such as a rising number of coronary & peripheral intervention procedures and an increase in the geriatric population are resulting in high demand for minimally invasive surgeries in the country. This is expected to have a positive impact on the market in the years to come. A majority of people in the U.S. are inclined towards noninvasive surgeries owing to the probability of high infection associated with invasive procedures. According to data published by Yale Medicine, approximately 900,000 percutaneous coronary interventions (PCIs) are performed in the U.S. every year. Thus, such a high procedural volume is anticipated to support the nationwide demand for guidewires.

Moreover, the rising number of clinical trials and research studies aimed at expanding the applications of guidewires is expected to significantly support the country’s market growth. These trials are increasingly focused on assessing the safety and efficacy of guidewires across various procedures, as well as accelerating the development of novel and advanced products. Research institutions, academic centers, and industry players are actively collaborating on these investigations. Favorable clinical outcomes validate product performance, facilitating regulatory approvals, enhancing clinician adoption, and contributing to broader market expansion.

Some of the ongoing clinical trials are outlined below

Study Title

Conditions

Interventions

Sponsor

Enrollment

Completion Date

VasoStar Vibrational Guidewire System to Facilitate Crossing Coronary Artery Chronic Total Occlusions

Chronic Total Occlusion of Coronary Artery|Chronic Angina

DEVICE: VasoStar guidewire system

VasoStar, LLC

10

12/31/2026

The DISCOVER INOCA Prospective Multi-center Registry

Ischemia and No Obstructive Coronary Artery Disease|Coronary Microvascular Dysfunction|Coronary Vasospasm|Endothelial Dysfunction|Microvascular Angina|Chest Pain With Normal Coronary Angiography

DIAGNOSTIC_TEST: Coroventis Coroflow Cardiovascular System and PressureWireâ„ X Guidewire

Yale University

500

12/31/2032

A Single Center Diagnostic, Cross-Sectional Study of Coronary Microvascular Dysfunction

Coronary Microvascular Disease|Ischemic Heart Disease|Myocardial Ischemia

DRUG: Bivalirudin|DRUG: Adenosine|DRUG: Heparin|DEVICE: Pressure-Temperature Sensor Guidewire|DEVICE: Guiding Catheter

NYU Langone Health

175

6/30/2026

Evaluating the Role of the Guidewire in Peripheral Intravenous Access: A Randomized Controlled Trial of Ultrasound-Guided Catheter Survival

Peripheral Intravenous Vein Catheter Phlebitis|Intravenous Infection

DEVICE: B. Braun 6.35cm 20 gauge ultralong intravenous catheter|DEVICE: BD 5.71 cm 20 gauge Accucath

William Beaumont Hospitals

360

2026-05

Paclitaxel Coated Balloon for the Treatment of Chronic Benign Stricture- Bowel

Bowel; Stricture

COMBINATION_PRODUCT: GIE Medical ProTractX3 TTS DCB|OTHER: Control

GIE Medical

171

6/1/2032

NHLBI Transmural Electrosurgery LeafLet Traversal And Laceration Evaluation (TELLTALE) BASILICA-TAVR Trial

Valvular Heart Disease|Aortic Valve Failure

DEVICE: TELLTALE BASILICA procedure

National Heart, Lung, and Blood Institute (NHLBI)

139

5/14/2025

Paclitaxel Coated Balloon for the Treatment of Chronic Benign Stricture- Esophagus

Esophageal Stricture

COMBINATION_PRODUCT: GIE Medical ProTractX3 TTS DCB|OTHER: Control

GIE Medical

198

2031-04

Optilume PoST AppRoval Clinical Evaluation of Andrology ParaMeters

Urethral Stricture

COMBINATION_PRODUCT: Optilume Urethral DCB

Urotronic Inc.

34

12/30/2026

Endovascular vs Surgical Arteriovenous Fistula Outcomes

Dialysis Fistula Creation|Endo-vascular AVFs

PROCEDURE: Surgical AVF|PROCEDURE: Endo-vascular AVF

University of Alabama at Birmingham

21

6/30/2026

EUS-GE vs ES for Palliation of Gastric Outlet Obstruction

Gastric Outlet Obstruction

DEVICE: Lumen-apposing metal stent|DEVICE: Self-expandable metal stent

Johns Hopkins University

112

3/14/2026

NHLBI DIR Transcatheter Mitral Cerclage Annuloplasty Early Feasibility Study

Functional Mitral Regurgitation

DEVICE: Transmural Systems Transcatheter Mitral Cerclage Annuloplasty (TMCA)

National Heart, Lung, and Blood Institute (NHLBI)

19

12/31/2025

ROBUST III- Re-Establishing Flow Via Drug Coated Balloon For The Treatment Of Urethral Stricture Disease

Urethral Stricture

DEVICE: Optilume Drug Coated Balloon (DCB)|DEVICE: Control Treatment

Urotronic Inc.

127

2026-03

Chronic Venous Thrombosis: Relief With Adjunctive Catheter-Directed Therapy (The C-TRACT Trial)

Deep Vein Thrombosis|Venous Stasis|Venous Insufficiency|Venous Leg Ulcer|Venous Reflux|Post Thrombotic Syndrome

DEVICE: Stents

Washington University School of Medicine

250

4/27/2026

Intravascular Ultrasound in Patients With End-stage Renal Disease on Dialysis

End Stage Renal Disease

DIAGNOSTIC_TEST: Venography|DIAGNOSTIC_TEST: Intravascular ultrasound (IVUS)|OTHER: Image processing

Boston Medical Center

50

2026-09

Comparing Efficiency and Stone-Free Rates Mini PCNL vs Flex URS

Kidney Stones|Nephrolithiasis|Urolithiasis

DEVICE: ClearPETRA suction access sheath|DEVICE: ClearPETRA suction access sheath

Northwestern University

80

2026-11

Source: ClinicalTrials.gov

Technological advancements and the introduction of innovative products that enhance procedural safety, efficiency, and cost-effectiveness are key drivers of market growth. For example, in April 2024, Teleflex Incorporated launched the Wattson Temporary Pacing Guidewire, initially introduced at Columbia University Irving Medical Center. Designed to streamline workflows, the device supports both valve delivery and ventricular bipolar pacing in structural heart procedures such as balloon aortic valvuloplasty (BAV) and transcatheter aortic valve replacement (TAVR). Its flexible distal pigtail and multi-electrode bipolar configuration help reduce the risk of ventricular perforation while ensuring reliable, rapid pacing. Such advancements, along with growing adoption among clinicians, are expected to further propel the expansion of the U.S. guidewires industry.

“We are thrilled that our team at Columbia University Irving Medical Center was selected for the Wattson Temporary Pacing Guidewire limited market release and are proud to have completed the first TAVR procedures with this important new device. The Wattson Temporary Pacing Guidewire facilitated minimalist TAVR procedures with safe and reliable LV pacing throughout our first two days of cases, and we are eager to continue to use it moving forward.”said Dr. Tamim Nazif, Director of Clinical Research for Columbia Interventional Cardiovascular Care, Director of the Interventional Cardiology Fellowship Program, and assistant professor in medicine at Columbia University Irving Medical Center.

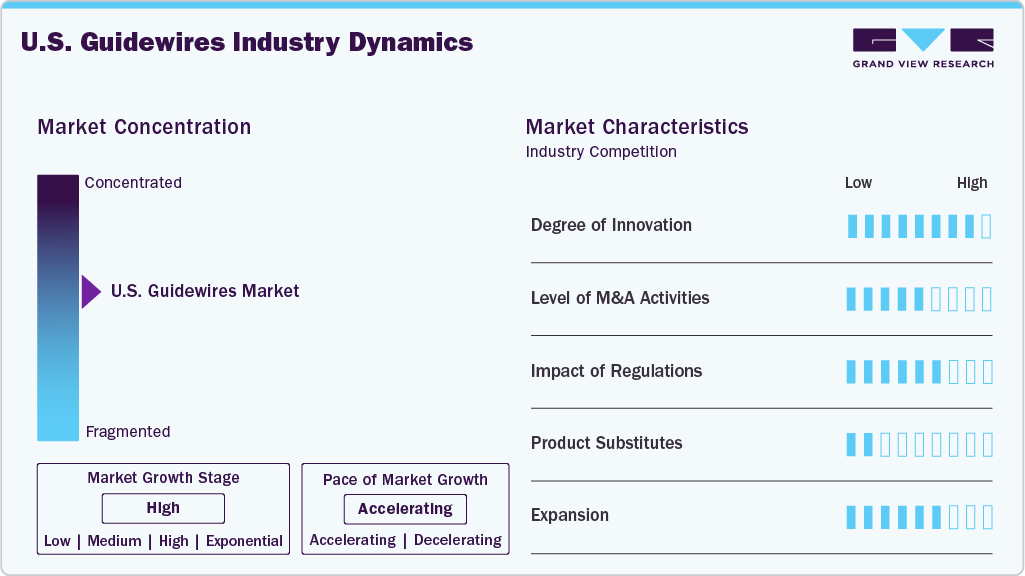

Market Concentration & Characteristics

The market growth stage is moderate, with an accelerating pace of growth. The U.S. guidewires market is characterized by moderate growth due to the rising burden of chronic diseases, supportive government and regulatory initiatives, and the growing research activities.

Industry players, researchers, and academic institutions are actively working to advance guidewire technologies for use in a wide range of surgical procedures. Efforts include exploring new coating materials and integrating cutting-edge technologies to enhance performance and safety. For example, in October 2024, researchers at the Georgia Institute of Technology unveiled the smallest robotic guidewire, the Coaxially Aligned Steerable Guidewire Robot (COAST). This remotely controlled device enhances navigational precision within complex vascular pathways and reduces procedural risks due to its micro-tendon actuation system, which enables smooth, kink-free movement. Such technological innovations are expected to significantly support market growth.

The U.S. Food and Drug Administration (FDA) regulates guidewires as medical devices under regulation number 870.1330. Classified as Class II devices, they require appropriate premarket oversight, which is managed by the Office of Neurological and Physical Medicine Devices.

Industry players in the guidewires market are increasingly entering distribution collaborations to enhance product visibility, broaden market reach, and strengthen their presence in the U.S. For example, in July 2025, Medtronic announced an exclusive U.S. distribution collaboration with Future Medical Design Co., Ltd. (FMD), a Japan-based company, to market FMD’s workhorse and specialty peripheral guidewires. The arrangement expands Medtronic’s portfolio for transradial access in the treatment of peripheral artery disease. Under the agreement, Medtronic becomes the sole distributor of selected peripheral stainless-steel guidewires.

Product Insights

The coronary guidewires segment dominated the U.S. guidewires industry, accounting for 42.77% of the total revenue in 2024. This dominance is attributable to high usage rates and increasing preference for minimally invasive coronary procedures. Increased public awareness of cardiovascular diseases and minimally invasive treatment options will likely lead to more people seeking these procedures, thereby increasing demand for coronary guidewires. Continuous technological advancements and increasing healthcare accessibility are expected to drive a larger market share for the coronary guidewire segment over the forecast period.

The neurovascular guidewires segment is expected to register the fastest CAGR over the forecast period, driven by increasing industry efforts to develop advanced solutions for neurovascular procedures and supportive regulatory pathways. For example, in May 2023, Artiria Medical, based in Switzerland, received 510(k) clearance from the U.S. FDA for its real-time, deflectable neurovascular guidewire. The device provides enhanced navigation within the brain’s complex arterial network by allowing physicians to shape the distal tip in real time without removing it from the patient, while also enabling adjustments to the wire’s support profile throughout the procedure. Such regulatory approvals are anticipated to further accelerate segment growth.

“We are excited about receiving the FDA clearance on a cutting-edge, Swiss-made technology. We are looking forward to starting our clinical activities in the U.S. very soon.” Said Guillaume Petit-Pierre, co-founder and CEO of Artiria.

Key U.S. Guidewires Company Insights

Market participants are advancing product offerings, prioritizing regulatory clearances, and enhancing growth opportunities through strategic partnerships and collaborative initiatives.

Key U.S. Guidewires Companies:

- Boston Scientific Corporation

- Medtronic

- Cook

- Terumo Medical Corporation

- Abbott

- Stryker

- Teleflex Incorporated

- BD

- ASAHI INTECC USA, INC.

- Olympus America

- Dornier MedTech.

- Koninklijke Philips N.V.

Recent Developments

-

In October 2024, researchers at the Georgia Institute of Technology unveiled the smallest robotic guidewire, the Coaxially Aligned Steerable Guidewire Robot (COAST). This remotely controlled device enhances navigational precision within complex vascular pathways and reduces procedural risks due to its micro-tendon actuation system, which enables smooth, kink-free movement.

-

In October 2024, In October 2024, Baylis Medical Technologies announced the U.S. commercial launch of the PowerWire Pulse radiofrequency (RF) guidewire. As the latest addition to the PowerWire family, this 0.035-inch RF guidewire is designed to create a controlled pathway through soft tissues using precision RF puncture technology. It features a torquable, stiff proximal shaft for enhanced control and a smooth transition to a flexible distal tip for safe navigation in complex anatomies. The PowerWire Pulse has been utilized across multiple clinical applications, including soft-tissue cutting within the cardiovascular, portal venous, biliary, urinary, and gastrointestinal systems.

-

In September 2024, Philips announced FDA approval for its enhanced LumiGuide guidewire, coinciding with the milestone of treating the 1,000th patient using its breakthrough 3D device-guidance technology. The updated, longer LumiGuide Navigation Wire now allows U.S. clinicians to visualize a wider range of catheters, further advancing procedural precision. This achievement also marks the 1,000th procedure supported by Philips’ Fiber Optic RealShape (FORS) technology, underscoring its growing adoption in clinical practice.

-

In April 2024, Teleflex Incorporated launched the Wattson Temporary Pacing Guidewire, initially introduced at Columbia University Irving Medical Center. Designed to streamline workflows, the device supports both valve delivery and ventricular bipolar pacing in structural heart procedures such as balloon aortic valvuloplasty (BAV) and transcatheter aortic valve replacement (TAVR). Its flexible distal pigtail and multi-electrode bipolar configuration help reduce the risk of ventricular perforation while ensuring reliable, rapid pacing.

U.S. Guidewires Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 871.2 million

Revenue forecast in 2033

USD 1.27 billion

Growth rate

CAGR of 4.87% from 2025 to 2033

Base year for estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, country

Country scope

U.S.

Key companies profiled

Boston Scientific Corporation; Medtronic; Cook; Terumo Medical Corporation; Abbott; Stryker; Teleflex Incorporated; ASAHI INTECC USA, INC.; Dornier MedTech; Koninklijke Philips N.V.; Olympus America; BD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. Guidewires Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. guidewires market report based on product:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Coronary Guidewires

-

Peripheral Guidewires

-

Urology Guidewires

-

Neurovascular Guidewires

-

Frequently Asked Questions About This Report

b. The U.S. guidewire market size was estimated at USD 830.6 million in 2024 and is expected to reach USD 871.2 million in 2025.

b. The U.S. guidewire market is expected to grow at a compound annual growth rate of 4.87% from 2025 to 2033 to reach USD 1,274.3 million by 2033.

b. Based on product, the coronary guidewires segment held the largest market share, accounting for 42.77% in 2024, primarily due to the rising prevalence of cardiac disorders.

b. Some key players operating in the U.S. guidewire market include Boston Scientific Corporation and Medtronic. Cook, Terumo Medical Corporation, Abbott, Stryker, Teleflex Incorporated, ASAHI INTECC USA, INC., Koninklijke Philips N.V., Dornier MedTech, Olympus America, and BD.

b. Key factors that are driving the market growth include increasing prevalence of urological disorders, cardiovascular diseases, and Peripheral Artery Disease (PAD)

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.