- Home

- »

- Advanced Interior Materials

- »

-

U.S. Gypsum Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. Gypsum Market Size, Share & Trends Report]()

U.S. Gypsum Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Natural Gypsum), By Application (Gypsum Board, Cement Additive, Plaster of Paris, Agriculture), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-651-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Gypsum Market Summary

The U.S. gypsum market size was estimated at USD 8.76 billion in 2024 and is projected to reach USD 18.96 billion by 2033, growing at a CAGR of 9.3% from 2025 to 2033. The market is experiencing stable growth, supported by sustained residential and commercial construction activity.

Key Market Trends & Insights

- The gypsum market in the U.S. is expected to grow at a substantial CAGR of 9.3% from 2025 to 2033.

- By type, synthetic gypsum dominated the market with a revenue share of over 51.0% in 2024.

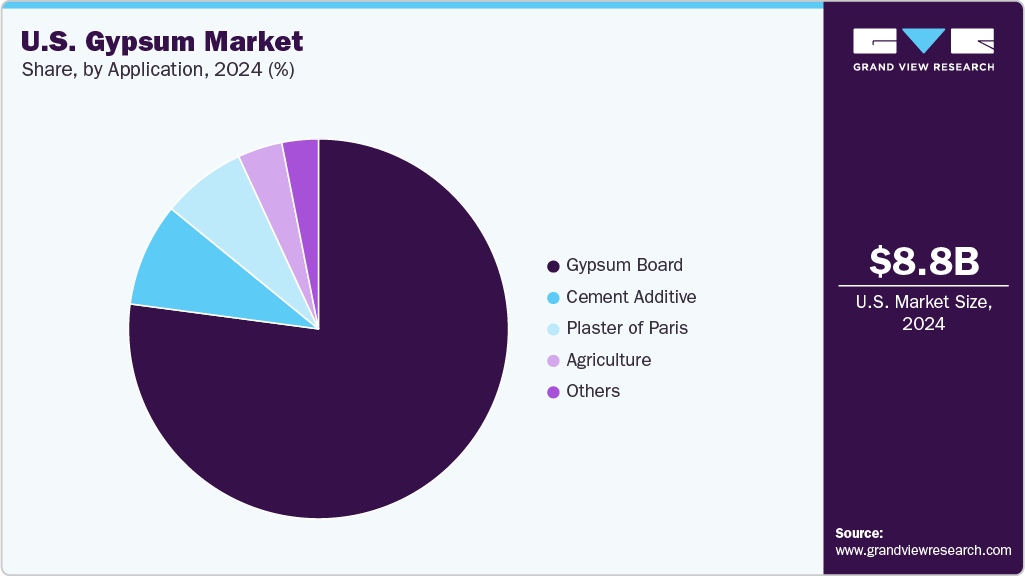

- The gypsum board segment held the largest share of over 77.0% of gypsum revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.76 Billion

- 2033 Projected Market Size: USD 18.96 Billion

- CAGR (2025-2033): 9.3%

There is a growing shift toward environmentally responsible and energy-efficient building materials, positioning gypsum as a preferred choice due to its lightweight, fire-resistant, and sound-insulating properties. Its use in drywall systems, interior partitions, and ceiling applications continues to expand, driven by evolving architectural preferences and stricter building standards. In addition, the rising adoption of synthetic and recycled gypsum aligns with national sustainability goals, further reinforcing the material’s importance in the U.S. construction landscape.Technological advancements in prefabricated construction and modular building systems drive increased demand for gypsum products in the region. The focus on lightweight, fire-resistant, and thermally efficient materials aligns with the growing adoption of advanced drywall systems and precision-engineered gypsum boards. These innovations facilitate faster installation, improved acoustic performance, and greater design versatility, meeting the evolving needs of modern architecture and sustainable building practices. As a result, the integration of gypsum in energy-efficient and environmentally conscious construction solutions is expanding rapidly across the region.

With the increasing focus on sustainable construction and net-zero energy targets, the adoption of advanced building materials to enhance insulation and reduce environmental impact is being accelerated. These materials are incorporated into high-performance ceiling systems, partition walls, and eco-friendly interior finishes in alignment with evolving architectural and regulatory standards.

Drivers, Opportunities & Restraints

The robust growth in residential and commercial construction activities primarily drives the market in the U.S. Increasing urbanization and renovation projects fuel demand for gypsum-based products such as drywall, plaster, and ceiling systems. In addition, stricter building codes emphasizing fire resistance, acoustic insulation, and energy efficiency further promote the use of gypsum materials. The rising focus on sustainable construction practices and the availability of synthetic gypsum from industrial by-products also contribute to market growth by offering eco-friendly alternatives to natural gypsum.

Significant opportunities for the country's market arise from advancements in prefabrication and modular construction techniques. These methods require precision-engineered gypsum products that enable faster installation and design flexibility. Growing investment in infrastructure modernization, green building initiatives, and smart buildings presents further potential for expanding gypsum applications. Developing innovative gypsum composites with enhanced moisture resistance and durability opens avenues in specialized sectors such as healthcare, education, and commercial real estate.

Despite favorable conditions, the market in the region faces challenges, including raw material supply constraints and fluctuations in mining output, which can impact pricing and availability. Competition from alternative materials such as cement boards and fiber cement panels also poses a restraint, especially in markets seeking cost-effective or highly durable solutions. Furthermore, stringent environmental regulations related to mining and manufacturing processes can increase operational costs for producers. Finally, economic uncertainties and shifts in construction spending patterns may intermittently affect overall demand for gypsum products.

Type Insights & Trends

Synthetic gypsum is experiencing growing demand in the U.S., particularly within the construction industry. It primarily produces drywall, plasterboard, cement, and finishing materials, offering consistent quality and cost advantages over natural gypsum. A key driver behind its adoption is its origin as a by-product of flue-gas desulfurization in coal-fired power plants, aligning well with the U.S. industry's increasing focus on sustainability and waste reduction. With the rise in green building practices and energy-efficient construction, synthetic gypsum is preferred for its environmental benefits and reliability in large-scale manufacturing.

It remains a critical material in both the construction and agricultural sectors in the U.S. It is widely used in plaster production, ceiling tiles, decorative moldings, and as a setting retarder in cement, valued for its purity and fire-resistant properties. In agriculture, natural gypsum is applied as a soil amendment to improve structure, drainage, and nutrient availability, especially in clay-heavy soils. Despite the rise of synthetic alternatives, natural gypsum is still favored in specialty applications that require higher mineral quality or where local availability supports cost-effective sourcing.

Application Insights & Trends

Gypsum board, also known as drywall or plasterboard, holds the largest market share in the U.S. market due to its versatility, performance benefits, and cost-effectiveness across a broad range of construction applications. It is the material of choice for interior walls, ceilings, and partitions in residential, commercial, and institutional buildings. This dominance is primarily driven by its superior fire resistance, which helps meet stringent fire safety regulations in both residential and commercial structures. Gypsum board contains chemically combined water that is released as steam when exposed to fire, helping to slow the spread of flames and reduce structural damage.

In addition to fire resistance, it offers excellent sound insulation, making it ideal for applications where acoustic control is essential, such as in schools, hospitals, offices, and multi-family housing. Its affordability and ease of installation are also significant factors. Gypsum boards are lightweight and can be quickly cut, fitted, and secured with minimal labor and equipment, allowing for faster project timelines and lower overall costs. This ease of handling makes it a preferred choice for both new construction and renovation projects.

The material’s lightweight nature simplifies transportation and reduces structural loads, which is particularly beneficial in high-rise construction and remodeling work. Moreover, the boards provide a smooth surface ready for painting or wallpaper application, enabling quick finishing and customization.

Other applications, such as cement additives, plaster of Paris, and agricultural use, play essential roles but cater to more specialized or secondary market needs. While cement additives support setting time control and strength in construction, and agrarian gypsum improves soil structure and fertility, these segments are smaller than the sheer volume and frequency of gypsum board use across the U.S. building sector.

Key U.S. Gypsum Company Insights

Some of the key players operating in the market include USG Corporation, Georgia-Pacific LLC, and CertainTeed.

-

Founded in 1901, USG Corporation is a pioneering leader in the gypsum industry. It is widely recognized for its innovation and extensive product portfolio, including drywall, joint compounds, and ceiling panels. Headquartered in Chicago, Illinois, USG has been critical in shaping modern construction practices by introducing lightweight, fire-resistant gypsum products.

-

Established in 1927, Georgia-Pacific LLC is one of the largest manufacturers of building products and gypsum materials in the U.S. The company’s gypsum division produces drywall and related products used extensively in residential and commercial construction.

-

CertainTeed, a subsidiary of the French multinational Saint-Gobain since its acquisition, was initially founded in 1904 and has since become a trusted name in gypsum and building materials. The company offers a broad range of gypsum boards, plasters, and related products designed for superior fire resistance, sound control, and ease of installation.

-

Knauf USA, part of the global German-based Knauf Group, founded in 1932, is a significant manufacturer and supplier of gypsum boards, cement boards, and other products. The company is recognized for its commitment to environmental responsibility and product innovation, offering high-performance gypsum solutions that cater to green building requirements and advanced construction techniques.

Key U.S. Gypsum Companies:

- American Gypsum Company

- CertainTeed (Saint-Gobain)

- Continental Building Products

- Etex Group

- Georgia-Pacific LLC

- Knauf USA

- LafargeHolcim (Holcim Group)

- National Gypsum Company

- PABCO Building Products

- USG Corporation

Recent Developments

-

In February 2025, National Gypsum Company secured a USD 4 million investment to modernize production lines at its U.S. wallboard plants. The upgrades focus on automation and output optimization to bolster efficiency and meet increasing demand in North American building markets

-

By the end of 2024, USG Corporation (through subsidiary CGC Inc.) initiated upgrades at its Washingtonville (Ohio) and Jacksonville (Florida) gypsum board facilities. These investments include enhanced automation, advanced quality control systems, and energy-saving measures, reinforcing USG’s platform for sustainable growth in the U.S. construction sector.

-

On July 6, 2023, Saint‑Gobain’s CertainTeed announced a USD 235 million investment to expand its gypsum facility in Palatka, Florida. The enhancement will double the plant's production capacity and boost energy efficiency through ultra-low energy dryers and heat-recovery mills, improving energy performance by up to 40%. The expansion will also create over 100 new jobs, supported by over USD 7 million in state and local incentives.

U.S. Gypsum Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.32 billion

Revenue forecast in 2033

USD 18.96 billion

Growth rate

CAGR of 9.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion, volume kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application

Regional scope

North America

Country scope

U.S.

Key companies profiled

American Gypsum Company; CertainTeed (Saint-Gobain); Continental Building Products; Etex Group; Georgia-Pacific LLC; Knauf USA; LafargeHolcim (Holcim Group); National Gypsum Company; PABCO Building Products; USG Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Gypsum Market Report Segmentation

This report forecasts regional revenue growth and analyzes the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the U.S. gypsum market report by type and application.

-

Type Outlook (Volume, Kilotons; Revenue, USD Billion, 2021 - 2033)

-

Natural Gypsum

-

Synthetic Gypsum

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2021 - 2033)

-

Gypsum Board

-

Cement Additive

-

Plaster of Paris

-

Agriculture

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. gypsum market size was estimated at USD 8.76 billion in 2024 and is expected to reach USD 9.32 billion in 2025.

b. The U.S. gypsum market is expected to grow at a compound annual growth rate of 9.3% from 2025 to 2033, reaching USD 18.96 billion by 2033.

b. By type, the synthetic gypsum segment dominated the market with a revenue share of over 51.0% in 2024.

b. Some of the key vendors in the U.S. gypsum market are American Gypsum Company, CertainTeed (Saint-Gobain), Continental Building Products, Etex Group, Georgia-Pacific LLC, Knauf USA, LafargeHolcim (Holcim Group), National Gypsum Company, PABCO Building Products, USG Corporation.

b. The robust growth in residential and commercial construction activities primarily drives the market in the U.S. Increasing urbanization and renovation projects fuel demand for gypsum-based products such as drywall, plaster, and ceiling systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.