- Home

- »

- Advanced Interior Materials

- »

-

U.S. Hardfacing Welding Market Size & Share Report, 2030GVR Report cover

![U.S. Hardfacing Welding Market Size, Share & Trends Report]()

U.S. Hardfacing Welding Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (SAW, FCAW, SMAW), By Application (Metalworking, Shipbuilding, Mining), And Segment Forecasts

- Report ID: GVR-4-68040-058-6

- Number of Report Pages: 87

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

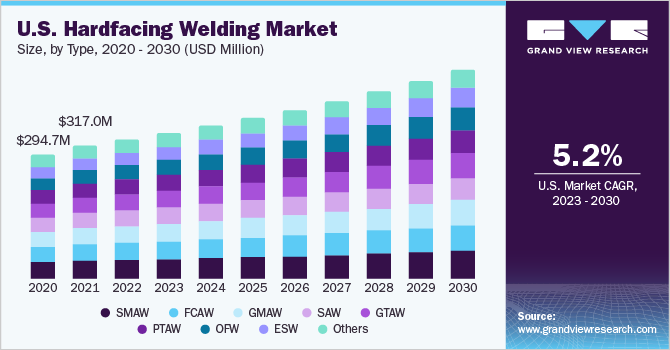

The U.S. hardfacing welding market size was estimated at USD 331.5 million in 2022 and is expected to grow a compound annual growth rate (CAGR) of 5.2% from 2023 - 2030. The market is expected to be driven by the growth of various industries, such as oil & gas, & mining, coupled with an increased need for saving costs.Hardfacing is a process of depositing a special alloy material on a base metal using various welding processes, such as Submerged Arc Welding (SAW), Flux Cored Arc Welding (FCAW), and Oxy-Fuel Welding (OFW). The process offers resistance to wear and corrosion, which helps reduce costs for companies and increases equipment life.

Technology is likely to play a vital role in the welding industry. Seamless integration of fabrication, design, and inspection of welding technology with information technology is likely to continue. Market players, such as Kennametal, Inc., develop new process technology in-house and focus on delivering innovative solutions to customers. They also provide solutions to address customers’ productivity requirements and manufacturing challenges.As per the american welding society (AWS), the number of qualified workers is not increasing in the U.S. welding industry. It is a challenge to reverse the trend and meet the needs of the industry.

There is a negative perception regarding the manufacturing industry, which influences qualified and skilled workers to prefer other streams. This, in turn, is negatively affecting the industry’s growth as the market requires a skilled workforce to meet the rising demand. The growth of this market is highly dependent on the growth of its end-use application areas. Hardfacing welding consumables find applications in various sectors, such as oil & gas, metalworking, mining, shipbuilding, agriculture, and others. In addition, the growth of the U.S. infrastructure and transportation industry is vital in driving the growth of the welding industry.

The market has only a few alternatives to hardfacing welding as hardfacing is an economical option and provides various advantages across industries. Several hardfacing processes and alloys are available for use as per the requirement and applications. The market players are also providing customized solutions to customers. Thus, the threat of substitutes is expected to remain low. Manufacturers in the U.S. focus on advancements and enhancements to their products to ensure that the products meet quality standards. The market is fragmented due to the presence of many large- and small-sized companies in the country.

Type Insights

The shielded metal arc welding (SMAW) segment dominated the market in 2022 with a revenue share of more than 13.65%. The segment is expected to grow further at a steady CAGR over the forecast period. The SAW type provides advantages like high deposition rates, uniform & high-quality welds, and lesser fumes emitted during the process. The SMAW technology can be used to weld carbon steel, high- and low-alloy steel, nickel alloys, and cast iron for shipbuilding, construction, and manufacturing industries. It can be used indoors and outdoors. The rise in construction activities in the U.S., coupled with a surge in renovation activities, is expected to drive the growth of this segment in the country over the forecast period. The electro-slag welding (ESW) type sub-segment is expected to grow at the fastest CAGR over the forecast period.

This is mainly because this technology produces less distortion, is faster, and welding heavy parts is possible using the process. Furthermore, it involves the use of resistance and arc welding techniques. It is helpful for welding materials that are thicker than 30 mm. Other types of welding technologies include electron-beam welding, induction welding, flow welding, and laser hybrid welding. These technologies are being employed for welding railway tracks. They are also used in shipbuilding applications, switchgear devices, heavy plate fabrication applications, and storage tanks. In addition, the ability to weld metals in different work environments and the cost efficiency offered by some other types of welding technologies are expected to boost the growth of other types of segment.

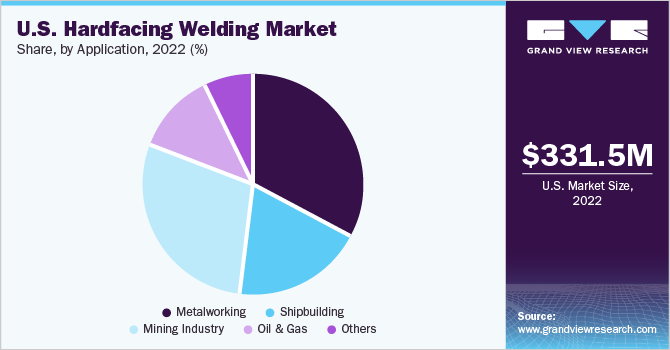

Application Insights

Based on applications, the market has been segmented into metalworking, shipbuilding, mining, oil & gas, and others. The metalworking segment led the industry in 2022 and accounted for the largest share of 33.2% of the overall revenue. Hardfacing welding techniques are widely employed in metalworking applications as they can help in extending the life of machine parts that undergo continuous wear and tear, as well as enable their reconditioning. The techniques are also becoming increasingly important in mines as they help in protecting the mining equipment that is exposed to abrasion and wear.

The use of hardfacing welding processes is considered an improved alternative to recover components that have undergone abrasion in mines. For instance, according to the Universidad Nacional de Colombia, the coatings deposited by the SMAW technique can be used to repair worn components of mining equipment. Oil & gas application is expected to witness the highest CAGR over the forecast period. Oil & gas plants involve the use of complex infrastructures, such as pipelines, rigs, and platforms.

This leads to the increased requirement of hardfacing welding techniques for the maintenance of existing plants and the construction of new ones. Several welding technologies can be utilized in oil & gas plants to improve the efficiency of machinery and reduce costs. The use of automation equipment in oil & gas plants can improve their productivity by 40%. According to the Independent Petroleum Association of America (IPAA), there are approximately 9,000 oil & natural gas producers in the U.S. These manufacturers operate in 33 states of the country.

Regional Insights

The Southeastern region of the U.S. dominated the market with the largest revenue of share in 2022 and is also anticipated to witness the fastest CAGR of 6.3% over the forecasted period. The region includes Arkansas, Louisiana, Mississippi, Alabama, Tennessee, Kentucky, Florida, Georgia, South Carolina, North Carolina, Virginia, and West Virginia. The growing industrial development activities and arise in the number of investments in the steel manufacturing and automotive industries are expected to drive the growth of the market in the southeastern region of the U.S. In addition, industrial developments & business expansions and the presence of Fortune 500 companies support the growth of the market. For instance, in January 2022, U.S. Steel announced its plans of expanding in the state by launching its advanced steel mill in Arkansas.

The midwestern region of the U.S. is expected to grow at the second-highest CAGR from 2023 to 2030. The region comprises North Dakota, South Dakota, Nebraska, Kansas, Minnesota, Iowa, Wisconsin, Illinois, Indiana, Michigan, Ohio, and Missouri. The presence of advanced manufacturing units in this region is driving the demand for hardfacing welding techniques. Moreover, the growing fabricated metals and primary metals industry in Nebraska is expected to drive the employment rate in the state. This, in turn, fuels the demand for hardfacing welding techniques. Some of the major companies carrying out machinery and steel manufacturing in Nebraska include Nucor Corp., Lindsay Corp., T-L Irrigation, Reinke Irrigation, and Sidump’r Trailers.

Key Companies & Market Share Insights

Prominent players use various strategies including business expansion, new product launches, and acquisitions to enhance their market position. These players provide various products like electrodes, wires, powder, equipment, machines, and other hardfacing welding consumables. The products are used to reduce the wear & tear of equipment in industries, such as agriculture, power generation, iron & steel, mining, and crushing. Some of the prominent players in the U.S. hardfacing welding market include:

-

Illinois Tool Works Inc.

-

The Lincoln Electric Company

-

Kennametal Inc.

-

Arc Specialties

-

Welding Alloys Group

-

Waldun

-

ESAB Corp.

-

Kjellberg Group

-

DAIHEN Corp.

-

Polymet

-

Selectrode Industries, Inc.

-

F.W. Winter Inc. & Co.

U.S. Hardfacing Welding Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 495.9 million

Growth rate

CAGR of 5.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Country scope

U.S.

Key companies profiled

Illinois Tool Works Inc.; The Lincoln Electric Company; Kennametal Inc.; Arc Specialties; Welding Alloys Group; Waldun, ESAB Corp.; Kjellberg Group; DAIHEN Corp.; Polymet, Selectrode Industries, Inc.; F.W. Winter Inc. & Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Hardfacing Welding Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. hardfacing welding market report on the basis of type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Submerged Arc Welding (SAW)

-

Flux Cored Arc Welding (FCAW)

-

Shielded Metal Arc Welding (SMAW)

-

Gas Metal Arc Welding (GMAW)

-

Gas Tungsten Arc Welding (GTAW)

-

Plasma Transferred Arc Welding (PTAW)

-

Oxy-Fuel Welding (OFW)

-

Electro Slag Welding (ESW)

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Metalworking

-

Shipbuilding

-

Mining Industry

-

Oil & Gas

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Northwest

-

Midwest

-

West

-

Southwest

-

Southeast

-

Middle Atlantic

-

Northeast

-

-

Frequently Asked Questions About This Report

b. The global U.S. hardfacing welding market size was estimated at USD 331.5 million in 2022 and is expected to reach USD 346.8 million in 2023.

b. The U.S. hardfacing welding market is expected to grow at a compound annual growth rate of 5.2% from 2023 to 2030 to reach USD 495.9 million by 2030.

b. Metal working accounted for the largest segment of U.S. hardfacing welding market with the revenue share of 33.2% in 2022 owing to its increasing need to improve the wear resistance & lifespan of various equipment and to save costs.

b. Some of the key players operating in the U.S. hardfacing welding market include Illinois Tool Works Inc., The Lincoln Electric Company, Kennametal Inc., Arc Specialties, Welding Alloys Group, Waldun, ESAB Corporation, Kjellberg Group, DAIHEN Corporation, Polymet, and Selectrode Industries, Inc.

b. The key factors that are driving the U.S. hardfacing welding market includes the growth of its applications areas such as metalworking, shipbuilding, mining industry, oil & gas, construction and aerospace industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.