- Home

- »

- Next Generation Technologies

- »

-

U.S. Healthcare ERP Market Size And Share Report, 2030GVR Report cover

![U.S. Healthcare ERP Market Size, Share & Trends Report]()

U.S. Healthcare ERP Market Size, Share & Trends Analysis Report By Function (Inventory And Material Management, Supply Chain And Logistics Management), By Deployment (On-premises, Cloud), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-816-9

- Number of Report Pages: 65

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

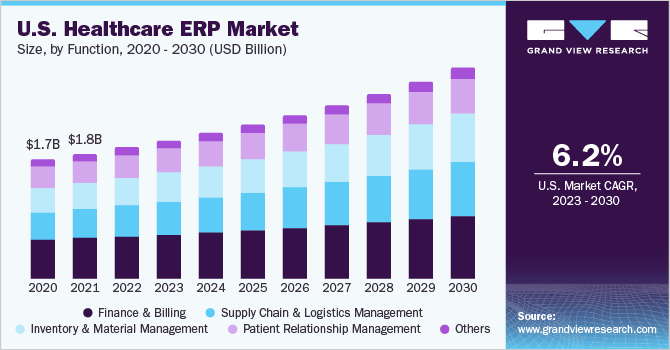

The U.S. healthcare ERP market size was estimated at USD 1.89 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030. The ease in breaking data silos across multiple business functions, automation of daily tasks, and streamlining information across various departments have triggered the adoption of ERP solutions in every industry, including healthcare, across the U.S. The adoption of ERP in the U.S. healthcare sector can be attributed to various advantages, such as an increase in caregiving efficiency and better utilization of resources, offered by ERP software.

Switching from legacy ERP systems to cloud-based ERP systems is benefitting the U.S. healthcare sector in the form of several functionalities and personalization features. Cloud-based ERP systems can provide healthcare organizations with universal access to data at any given time and from any location, thereby enhancing the efficiency of critical business functions. Given that all the information is centralized, the approach also brings healthcare providers, patients, and insurance providers in the U.S. under a single platform. Thus, the rise of cloud deployment services in the healthcare sector is expected to drive the growth of the market over the forecast period.

The healthcare sector generates large volumes of financial data and other information. Most of the information is related to the revenue generated from patients, insurance claims, and other expenses, among others. To eliminate this silo of data, healthcare administrators have started adopting ERP systems that provide disparate software for processing and storing data. Such systems can be typically beneficial because of their ability to increase efficiency, provide real-time data and analytical solutions, and data security due to the encryption of the database. These benefits are encouraging healthcare organizations in the U.S. to opt for ERP systems.

The integration of artificial intelligence (AI) in ERP solutions is benefitting the healthcare sector significantly. Healthcare providers in the U.S. have started integrating AI into the electronic healthcare record (EHR) management system to gain actionable insights and to help in providing personalized patient care at lower costs. The growing preference for healthcare ERP solutions featuring AI capabilities is opening new opportunities for vendors offering various financial applications, business intelligence packages, and ERP systems. Integrating natural language processing (NLP) programs and machine learning (ML) along with AI in healthcare ERP systems can also help in identifying patients proactively.Algorithms used by AI can be used to determine patterns among patients' clinical records and use the information to construct improved and augmented methods for therapy and even diagnosis.

The COVID-19 pandemic had both positive and negative impacts on the growth of the U.S. healthcare ERP market. The COVID-19 pandemic severely impacted the medical supply chain in the U.S. The shortages in supply prompted by the COVID-19 pandemic have only aggravated these issues, making it increasingly difficult for clinicians to obtain the commodities that are necessary in order to provide quality treatment at a fair cost. It put enormous pressure on this sector of the country's economy. On the positive side, the pandemic highlighted the importance of data-driven decision-making in managing public health emergencies. ERP systems provide healthcare organizations with robust data analytics and reporting capabilities, enabling them to track and analyze critical metrics, monitor resource utilization, manage supply chains, and make informed decisions. The need for real-time data and analytics during the pandemic has further emphasized the value of ERP solutions.

Function Insights

Based on function, the U.S. healthcare ERP market has been further segmented into inventory and material management, supply chain and logistics management, patient relationship management, finance and billing, and others. The finance and billing segment accounted for the largest market share of 32.3% in 2022. ERP systems offer robust reporting and analytics capabilities in the finance and billing segment. These features enable healthcare organizations to generate comprehensive financial reports, monitor key performance indicators, and gain actionable insights. The availability of accurate and timely financial data empowers healthcare providers to make informed decisions, identify revenue trends, and optimize financial performance.

The inventory and material management segment is expected to grow at the fastest CAGR of 7.5% during the forecast period. This is owing to the timely need for medical devices to ensure effective therapy and diagnosis of the patients, storing the inventory, assuring on-time ordering of material, and minimizing wastage and storage expenses by maintaining an adequate inventory level. ERP enables automated inventory management, ensuring its accuracy, tracking supply, and refining the overall operation, which has a favorable impact on the U.S. healthcare company's overall development and efficiency.

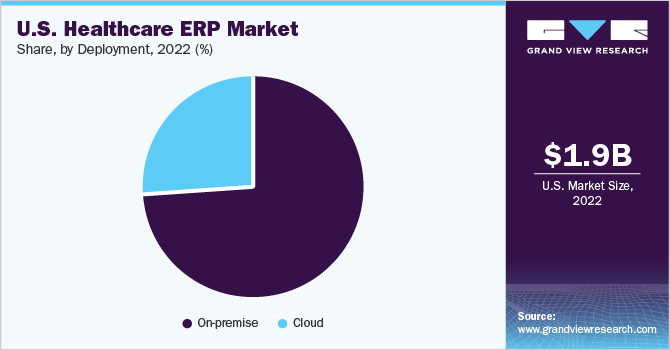

Deployment Insights

The on-premisessegment accounted for the largest revenue share of around 73.9% in 2022. This segment offers benefits such as centralized inventory control, optimization, and the integration of financial and human resource systems, as well as the capacity to adapt and customize the software for different needs and requirements and data security. It enhances patient care, and improves supply chain, inventory management, and financial analysis.

The cloud segment is expected to register the fastest CAGR of 9.2% over the forecast period. Cloud computing is allowing enterprises to store their data on a remote server and access it using the internet. Technological advancement in cloud computing is facilitating agility, scalability, reliability, and flexibility, thereby encouraging the adoption of cloud computing in the healthcare industry. ERP solutions enable operational improvements in the overall business process and benefit in terms of profitability, productivity, and growth.

The dynamics of the healthcare system in the U.S. are changing rapidly as automation continues to proliferate in the healthcare sector. At this juncture, cloud computing is allowing vendors to cater to the needs of their clients through various delivery models, including software as a service (SaaS), infrastructure as a service (IaaS), and platform as a service (PaaS). These models allow customers to pay according to usage and reduce their IT infrastructure costs. Cloud-based ERP systems can provide healthcare organizations with universal access to data at any given time and from any location, thereby enhancing the efficiency of critical business functions.

Key Companies & Market Share Insights

The market is highly competitive and to meet the changing customer requirements and identify cost-saving opportunities, ERP systems providers are focusing on adopting new technologies. For instance, in October 2022, Oracle introduced a planning system for the healthcare industry. With the help of the new industry-specific planning tool, healthcare organizations can more easily simulate potential outcomes, predict demand in the future, make resource optimization, and improve their workforce management, and patient care decisions. Some prominent participants in the U.S. healthcare ERP market include:

-

Epic Systems Corporation

-

Cerner Corporation

-

McKesson Corporation

-

Oracle Corporation

-

Microsoft Corporation

-

Sage Software Solution Pvt. Ltd.

-

QAD Inc.

-

Medical Information Technology, Inc.

-

SAP SE

U.S. Healthcare ERP Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.03 billion

Growth Rate

CAGR of 6.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Function, deployment

Country scope

U.S.

Key companies profiled

Epic Systems Corporation.; Cerner Corporation; McKesson Corporation; Oracle Corporation; Microsoft Corporation; Sage Software Solution; Pvt. Ltd.; QAD Inc.; Medical Information Technology, Inc.; SAP SE

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Healthcare ERP Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. healthcare ERP market report based on function and deployment:

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Inventory and material management

-

Supply chain and logistics management

-

Patient relationship management

-

Finance and billing

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

Frequently Asked Questions About This Report

b. The U.S. healthcare ERP market size was estimated at USD 1.89 billion in 2022.

b. The U.S. healthcare ERP market is expected to grow at a compound annual growth rate of 6.2% from 2023 to 2030 to reach USD 3.03 billion by 2025.

b. The finance and billing segment dominated the U.S. healthcare ERP market with a share of 32.3% in 2022. This is attributable enable healthcare organizations to generate comprehensive financial reports, monitor key performance indicators, and gain actionable insights

b. Some key players operating in the U.S. healthcare ERP market include Epic Systems Corporation.; Cerner Corporation; McKesson Corporation; Oracle Corporation; Microsoft Corporation; Sage Software Solution; Pvt. Ltd.; QAD Inc.; Medical Information Technology, Inc.; SAP SE

b. Key factors that are driving the market growth include the development of cloud-based ERP and the integration of artificial intelligence in ERP.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."