- Home

- »

- Healthcare IT

- »

-

U.S. Healthcare Staffing & Scheduling Software Market, 2033GVR Report cover

![U.S. Healthcare Staffing And Scheduling Software Market Size, Share & Trends Report]()

U.S. Healthcare Staffing And Scheduling Software Market (2025 - 2033) Size, Share & Trends Analysis Report By Deployment Mode (Web-Based, Cloud-based, On-Premises, Mobile Installed), By Application (Time & Attendance, Scheduling), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-695-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The U.S. healthcare staffing and scheduling software market size was estimated at USD 1.14 billion in 2024 and is projected to reach USD 3.12 billion by 2033, growing at a CAGR of 11.86% from 2025 to 2033. Growing demand for operational efficiency and cost containment, and rise of predictive and AI-drive scheduling are factors contributing to market growth. In addition, growing emphasis on compliance & credentialing and integration with core health IT systems are other factors propelling market growth further.

The ongoing nursing shortage in the U.S. is a significant driver of the growth of the healthcare staffing and scheduling software market. This shortage-driven by an aging population, rising patient volumes, and clinician burnout is creating widespread pressure on healthcare facilities to manage limited staff resources better while maintaining care quality and compliance. For instance, according to the data published by the American Association of Colleges of Nursing (AACN), federal authorities project a shortage of 78,610 full-time registered nurses (RNs) in 2025 and 63,720 in 2030.

Healthcare providers are constantly under pressure to deliver enhanced patient care. Efficient workforce scheduling significantly reduces labor costs, minimizes overtime, and limits the use of expensive staffing agencies. Software solutions that improve staffing accuracy, automate scheduling, verify licensure and credentials, and ensure compliance with labor laws help healthcare organizations cope with the limited nurse availability. Such systems reduce manual administrative burdens and enable dynamic scheduling that reduces overtime and prevents nurse fatigue, which is critical in retaining nurses and sustaining care standards. For instance, in April 2022, BookJane partnered with the Ohio Healthcare Association to address staffing shortages and improve care quality in Ohio.

Automated shift assignment and self-scheduling functionalities-now offered by the majority of leading vendors-enable administrators to optimize workforce deployment while ensuring shift coverage continuity. For instance, in March 2023, Connecteam introduced its all-in-one workforce management app, focusing on enhancing operations for deskless employees. The app features tools for time and attendance management, scheduling, and checklists, aiming to streamline communication and improve efficiency in workforce management for care organizations.

Moreover, there is a substantial market shift toward AI-enabled platforms capable of forecasting staffing needs based on historical trends, census data, and workload intensity. Companies such as Medecipher (a Snapcare company), Oracle HCM, Aya Healthcare, Inc., and OnShift stand out for their predictive analytics and workload-based staffing models. These capabilities improve planning accuracy and reduce last-minute staffing gaps, a significant cost and safety concern in healthcare settings.

Furthermore, seamless integration with existing hospital systems-such as EHRs, HRIS, payroll, and time-tracking tools-is a key factor in purchasing decisions. Vendors like Oracle, QGenda, and Symplr set themselves apart by providing strong integration features that allow real-time data exchange across platforms. This guarantees workforce decisions are based on current clinical and administrative data.

The following comparative benchmarking study evaluates market players to identify leaders, innovators, and emerging players based on key areas such as: AI and predictive analytics for smarter scheduling, mobile accessibility for staff convenience, integration with HR, EHR, and payroll systems, and real-time communication and compliance support.

Category

Companies

Analyst Key Takeaways

Leaders

UKG, AMN Healthcare, Oracle, Aya Healthcare, ShiftMed, QGenda, RLDatix, Bullhorn Inc., SmartLinx, Infor, eSchedule, Sling, Connecteam, Amergis

These companies demonstrate consistent performance across nearly all critical features. They possess advanced scheduling automation, compliance integration, credentialing, predictive staffing, and workforce analytics. They support multi-site deployment and have robust partner integrations.

Innovators

Upgrade license to gain access to the complete analysis.

Emerging Players

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaboration activities, degree of innovation, impact of regulations, and regional expansion. The U.S. healthcare staffing & scheduling software market is highly fragmented, with the presence of several workforce management providers dominating the market. The degree of innovation is high, and the level of merger & acquisition activities, the impact of regulations, and the regional expansion of the industry is moderate.

The U.S. healthcare staffing & scheduling software market experiences a high degree of innovation driven by technological advancements. Integrating artificial intelligence in healthcare staffing & scheduling platforms leverage real-time data to anticipate staffing needs based on census trends, workload fluctuations, or workforce availability deliver measurable value to providers. For instance, in May 2024, In-House Health raised USD 4 million in seed funding to develop an AI-driven scheduling platform that improves staffing efficiency for nursing teams. This innovative solution addresses the nurse shortage by optimizing shift management and reducing scheduling time and costs.

“Saving manager time on scheduling is a huge win and relieves burnout among nursing leaders, but the real prize is improved staffing outcomes. When hospitals fail to properly predict the future, it costs money in overtime pay and agency use. We can reduce both through precision staffing.”

- Ari Brenner ex- co-founder and COO of Stellar Health

The industry is experiencing a moderate level of merger and acquisition activities undertaken by several key players. This is due to the desire to gain a competitive advantage in the industry, enhance technological capabilities, and consolidate in a rapidly growing market

The regulatory framework for the U.S. healthcare staffing and scheduling software market is shaped by a combination of federal, state, and industry-specific regulations that govern data privacy, labor compliance, interoperability, and software functionality. At the federal level, the Health Insurance Portability and Accountability Act (HIPAA) is a central regulation affecting software platforms that manage healthcare staff. Although these tools are typically used for internal workforce operations, they often interact with systems containing protected health information (PHI), especially when integrated with electronic health records (EHR), payroll, or clinical workflow systems. As a result, vendors must implement HIPAA-compliant security protocols, including access controls, encryption, and audit trails.

The industry is witnessing moderate regional expansion, driven by an increasing customer base for healthcare staffing & scheduling software and solutions. Healthcare providers are aligning with technology providers for workforce optimization. For instance, in May 2024, Children's Minnesota partnered with the Virginia-based staffing platform ShiftMed to address scheduling gaps within its pediatric healthcare system.

Case Study: Schlegel Villages Achieves 10X ROI and Dramatically Improves Shift Fulfillment with BookJane

Introduction

Schlegel Villages, a leading senior care provider with 19 long-term care and retirement facilities across Southern Ontario, faced critical staffing challenges amid industry-wide labor shortages. To optimize workforce management and improve shift fulfillment, they implemented the BookJane J360 platform. This case study explores how Schlegel Villages transformed their staffing approach to enhance operational efficiency, reduce overtime, and achieve a tenfold return on investment.

Challenge

Schlegel Villages struggled with filling open shifts due to a labor shortage in the senior living sector. Management spent 40-50% of their time managing shift callouts, relying heavily on overtime hours and third-party agencies to cover staffing gaps. This approach was unsustainable as workforce shortages were projected to worsen, leading to inefficient use of management time and inconsistent shift coverage.

Solution

Schlegel Villages deployed the BookJane J360 platform at five facilities after a brief 2-3 week implementation. The platform enabled internal staff to view and select from all available shifts across the Villages, providing greater flexibility and empowering workers to choose shifts that best suited their schedules. This digital tool also served as an effective recruitment mechanism for casual and part-time staff. The solution streamlined shift posting and acceptance processes, reducing administrative time from hours to minutes, and significantly decreased dependency on external agencies and overtime.

Results/Outcome

-

Shift fulfillment by internal staff rose substantially, reaching 70-80% within 12 months of full deployment.

-

Overtime hours and third-party agency reliance were significantly reduced, easing financial and operational pressures.

-

Administration time for shift management dropped from 30-60 minutes per shift to approximately 30 seconds for posting and acceptance.

-

Overall shift fulfillment rates on open shifts increased from 40-50% to over 90%.

-

After 15 months, Schlegel Villages realized a remarkable 10X return on their BookJane investment.

-

The platform became integral to daily staffing operations, improving workforce satisfaction and operational consistency even during the challenging COVID-19 pandemic.

This case underscores how adopting innovative digital workforce management technology can overcome labor shortage challenges, optimize resource use, and deliver substantial financial and operational benefits for senior care providers.

Deployment Mode Insights

Based on deployment, the cloud-based segment held the largest market share of 35.08% in 2024 due to its scalability, cost-effectiveness, and accessibility. In addition, this segment is expected to register growth at the fastest CAGR from 2025 to 2033. Cloud solutions eliminate the need for heavy upfront IT infrastructure investment and reduce ongoing maintenance expenses, making them attractive for healthcare providers of all sizes, including hospitals, clinics, and staffing agencies. In addition, cloud platforms enable real-time data access and seamless integration with other healthcare systems, such as EHRs, improving coordination and workforce management efficiency.

Moreover, the web-based and mobile-installed segments are expected to grow significantly over the forecast period. Mobile accessibility has transitioned from convenience to an industry standard. Solutions designed around seamless mobile workflows, real-time shift updates, communication tools, availability sharing, and self-scheduling consistently outperform traditional interfaces in clinician adoption and operational efficiency. A streamlined mobile experience enhances workforce engagement and loyalty.

Application Insights

Based on application, time and attendance segment dominated the market in 2024 and accounted for the largest revenue share of 28.06%. Healthcare organizations precisely track employee working hours, shift attendance, overtime, and absenteeism. Time and attendance software automates these tasks, eliminating manual tracking, enabling real-time monitoring, and providing reliable data for payroll and compliance. For instance, in August 2024, Nebraska Methodist Health System selected QGenda for healthcare workforce management. This selection is expected to enhance system-wide scheduling, time, and attendance for all 650 physicians and over 8,000 nurses, aiming to improve operational efficiency and streamline processes.

The staff scheduling segment is expected to grow at the fastest CAGR from 2025 to 2033 due to increasing complexity in healthcare operations, rising demand for workforce flexibility, and growing pressure on hospitals to optimize labor costs while ensuring high-quality patient care. Healthcare facilities such as hospitals, ambulatory centers, and long-term care institutions are dealing with chronic staffing shortages, increasing patient volumes, and variable skill requirements across units. As a result, administrators need intelligent scheduling tools that go beyond static templates. Modern staff scheduling solutions address these needs by offering real-time, rules-based scheduling, dynamic shift swaps, and predictive algorithms that anticipate demand fluctuations and staffing gaps.

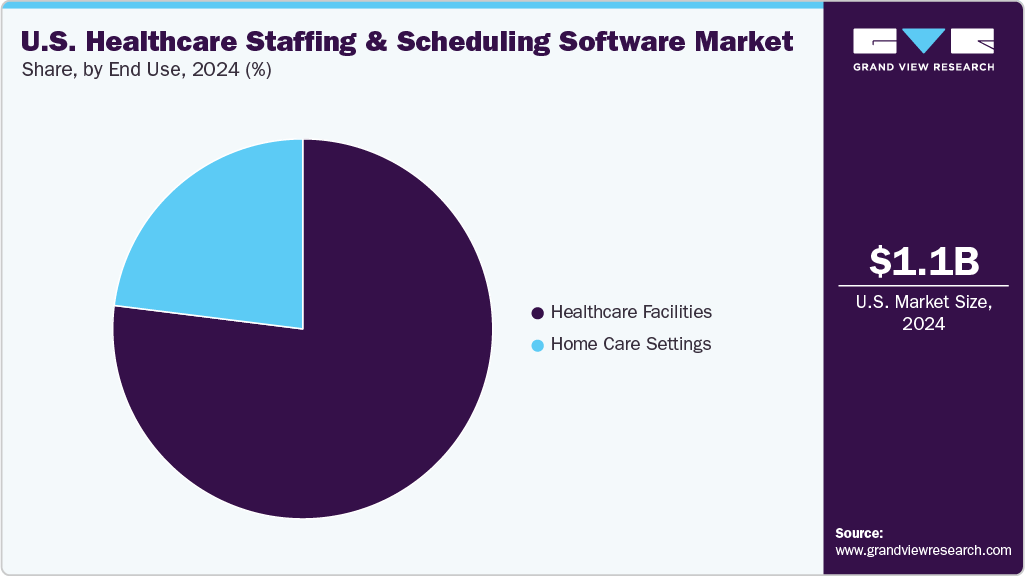

End Use Insights

Based on end use, the healthcare facilities segment held the largest market share of 76.97% in 2024. Hospitals, health systems, outpatient centers, and long-term care facilities face continuous pressure to ensure round-the-clock staffing coverage, comply with labor regulations, manage workforce costs, and deliver safe, high-quality patient care, which are some challenges that make robust staffing and scheduling tools indispensable.

Managing shift assignments manually or using outdated systems often leads to inefficiencies such as overstaffing, understaffing, or non-compliance with credential requirements. This has driven widespread adoption of scheduling software that automates these processes, optimizes resource utilization, and supports real-time changes. For instance, in April 2022, BookJane partnered with One Human Service Network, OneHSN, to support 450 childcare providers in the District of Columbia..

The home care settings segment is anticipated to grow at the fastest CAGR over the forecast period. The aging U.S. population, combined with an increase in chronic diseases and a growing preference for receiving care at home rather than in hospitals or nursing facilities, is driving strong growth in home healthcare. More patients and families seek convenient, personalized, and cost-effective care delivered in the home environment, which fuels demand for specialized staffing and scheduling solutions tailored to this setting. For instance, in August 2022, BeeHive Homes, an assisted living facility partnered with BookJane to improve employee engagement and retention at BeeHive Franchisee of 34 Communities across Texas and New Mexico. They used BookJane’s shift fulfillment platform to streamline scheduling, empower staff with flexible shifts, reduce last-minute vacancies, and improve communication.

Key U.S. Healthcare Staffing & Scheduling Software Company Insights

Key players operating in the U.S. healthcare staffing & scheduling software market are undertaking various initiatives to strengthen their market presence and increase the reach of their products. Strategies such as new product launches and partnerships are playing a key role in propelling the market growth.

Key U.S. Healthcare Staffing & Scheduling Software Companies:

- UKG

- BookJane

- AMN Healthcare

- Oracle

- Aya Healthcare

- ShiftMed

- QGenda, LLC

- RLDatix

- Bullhorn Inc.

- SmartLinx

- Infor

- eSchedule

- Sling

- Connecteam

- Amergis

- Medecipher (a Snapcare company)

Recent Developments

-

In February 2025, MyMichigan Health integrated QGenda, LLC's credentialing solutions. This integration helped MyMichigan Health significantly enhance operational efficiency and patient access. This unified platform reduces credentialing time and increases provider deployment efficiency.

-

In August 2024, Care Systems announced a partnership with Harris OnPoint, granting the company the right to distribute CareWare within the healthcare market.

-

In May 2024, QGenda announced a significant expansion of its provider credentialing services, driven by increased enterprise adoption as healthcare organizations transition from outdated systems. This move aims to streamline credentialing, enabling faster provider enrollment and improved operational efficiency.

-

In April 2024, Medecipher was acquired by SnapCare, integrating its AI-driven staff scheduling technology with SnapCare’s healthcare workforce marketplace. This acquisition aimed to improve healthcare staffing efficiency and safety outcomes by optimizing clinician-patient matching.

-

For instance, in September 2023, ShiftMed partnered with Hennepin Healthcare to implement on-demand W-2 workforce solutions, enhancing staffing efficiency and recruitment processes. This collaboration aims to optimize staffing ratios and provide flexible work opportunities for healthcare professionals in the Minneapolis area.

-

In July 2023, SSM Health partnered with ShiftMed to enhance its on-demand flexible labor solutions for nurses, providing access to a network of over 350,000 credentialed medical professionals.

-

In December 2022, QGenda announced a mobile-first Nurse and Staff Workforce Management solution designed to enhance the management of healthcare workforces. This innovative approach aims to improve the scheduling, engagement, and retention of nurses and staff while effectively controlling labor costs.

“Nurses want to be able to manage their own schedules, including the ability to set preferences or sign up for extra shifts and partial shifts when they want. QGenda offers a flexible scheduling solution that balances nurse independence with the ability to efficiently meet the needs of each nursing unit from a management perspective.”

-Jana Hill, director, care logistics, Piedmont Athens Regional Medical Center.

U.S. Healthcare Staffing And Scheduling Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.27 billion

Revenue forecast in 2033

USD 3.12 billion

Growth rate

CAGR of 11.86% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment mode, application, end use

Country scope

U.S.

Key companies profiled

UKG; BookJane; AMN Healthcare; Oracle; Aya Healthcare; ShiftMed; QGenda; RLDatix; Bullhorn Inc.; SmartLinx; Infor; eSchedule; Sling; Connecteam; Amergis; Medecipher (a Snapcare company)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Healthcare Staffing And Scheduling Software Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. healthcare staffing and scheduling market report based on deployment mode, application, and end use:

-

Deployment Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Web-Based

-

Cloud-Based

-

On-Premises

-

Mobile Installed

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Time and Attendance

-

HR and Payroll

-

Scheduling

-

Talent Management

-

Reporting & Analytics

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Healthcare Facilities

-

Home Care Settings

-

Frequently Asked Questions About This Report

b. Some prominent players in the U.S. healthcare staffing and scheduling software market are UKG; BookJane; AMN Healthcare; Oracle; Aya Healthcare; ShiftMed; QGenda; RLDatix; Bullhorn Inc.; SmartLinx; Infor; eSchedule; Sling; Connecteam; Amergis; and Medecipher (a Snapcare company)

b. The U.S. healthcare staffing and scheduling software market is substantially grow due to increasing healthcare staff shortage, growing demand for operational efficiency and cost containment and emphasis on compliance and credentialing, rise of predictive and AI-driven scheduling and integration with core

b. The U.S. healthcare staffing and scheduling software market size was estimated at USD 1.14 billion in 2024 and is expected to reach USD 1.27 billion in 2025

b. The U.S. healthcare staffing and scheduling software market is expected to grow at a compound annual growth rate of 11.86% from 2025 to 2033 to reach USD 3.12 billion by 2033.

b. Based on application, time and attendance segment dominated the market in 2024 and accounted for the largest revenue share of 28.06%. Healthcare organizations precisely track employee working hours, shift attendance, overtime, and absenteeism. Time and attendance software automates these tasks, eliminating manual tracking, enabling real-time monitoring, and providing reliable data for payroll and compliance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.