- Home

- »

- Medical Devices

- »

-

U.S. Hearing Aid Dispensers Market, Industry Report, 2030GVR Report cover

![U.S. Hearing Aid Dispensers Market Size, Share & Trends Report]()

U.S. Hearing Aid Dispensers Market Size, Share & Trends Analysis Report By Ownership (Independent, Manufacturer-Owned, Retail Chains), By Gender (Male, Female), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-216-3

- Number of Report Pages: 84

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Hearing Aid Dispensers Market Trends

The U.S. hearing aid dispensers market size was estimated at USD 650.2 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.36% from 2024 to 2030. A Hearing Aid Dispenser (HAD) refers to any individual involved in the fitting, selection, renting, adaptation, or servicing of aids or any other instrument designed to compensate for hearing impairment. This also includes performing testing and fitting procedures. As the Baby Boomer generation ages, the need for accessible audiology is growing due to research linking untreated audiology disorders with dementia. This is expected to contribute to the market’s growth.

Moreover, the increasing geriatric population suffering from audiology disorders in the U.S. and higher demand for the hearing aid industry is expected to drive the growth of the market over the forecast period. According to the National Institute on Deafness and Other Communication Disorders (NIDCD) statistics of March 2023, around 15% of the adults aged 18 years and above in the U.S. have trouble listening, and one in three adults aged 65 to 74 years are suffering from hearing loss. In addition, around 50% of people aged 75 years and above suffer from difficulty in the ability to hear.

Dispensers offer services to individuals, families, and communities by improving communication and providing access to health care services. They work as part of a hearing healthcare team, contributing their knowledge and skills to provide optimal patient care. Through a cooperative effort, the team aims to provide the best possible care to patients. Rapidly changing technology and the ability to hear impaired patients require more professionals on the healthcare team. With this dynamic, more formal education is required for hearing instrument specialists and is now mandated by the State of Missouri.

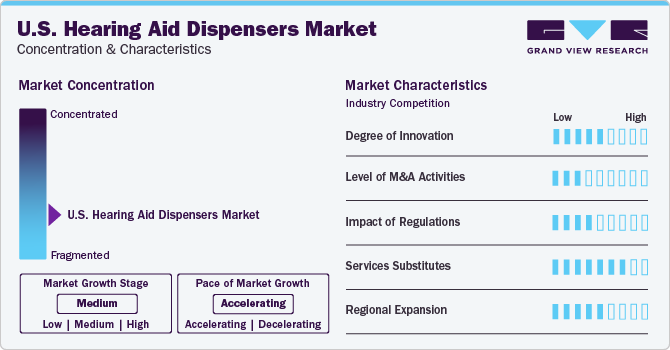

Market Concentration & Characteristics

The degree of innovation in the market has been increasing gradually. With advancements in technology and increasing demand for hearing aids, dispensers are constantly exploring new ways to improve their products and services. Additionally, there has been a rise in digital listening devices, which offer better sound quality and can be customized to the specific needs of users. The market is shifting toward more innovative and technologically advanced solutions.

The impact of regulations on the market has been significant. Every state in the U.S. has different sets of rules and regulations for licensing requirements. For instance, the District of Columbia, Iowa, Kansas, Kentucky, New Hampshire, New York, Pennsylvania, and Virginia require separate aid specialist licenses for dispensing audiologists. Moreover, HADs must have a high school diploma or a GED and should receive on-the-job training from audiologists.

The level of mergers & acquisitions in the market is low and moderate as major manufacturers are acquiring retail units to offer their products to customers and expand their reach with quality dispensing services. For instance, in July 2021, HearUSA acquired My Hearing Centers based in Utah. The company will add more than 100 offices in different states in the U.S. Such initiatives is expected to boost the growth of the market over the forecast period.

The number of service substitutes available in the market is high and is expected to remain the same over the forecast period. The non-prescription audiology devices available in the market can be explored as a service substitute. These devices, such as over the counter (OTC) hearing aids and personal sound amplification products (PSAPs), can be easily purchased online or via mail order and do not require any professional help for fitting, hampering the hearing aid dispensers market. OTC hearing aids from reputable manufacturers are also available, offering virtual consultations with audiologists for personalized recommendations and adjustments, making alternatives more accessible and affordable. For instance, in October 2022, Sam’s Club launched Over-The-Counter (OTC) hearing aids, expanding its solutions portfolio at online and in-club hearing aid centers.

The market is expanding regionally with a strategic emphasis on reaching beyond urban areas. As awareness of ability to hear health rises across the nation, businesses in this market are actively extending their services to suburban and rural regions to address the growing demand for accessible audiology care. This expansion strategy includes setting up new clinics, collaborating with local healthcare providers, and utilizing digital platforms to reach a wider audience.

Gender Insights

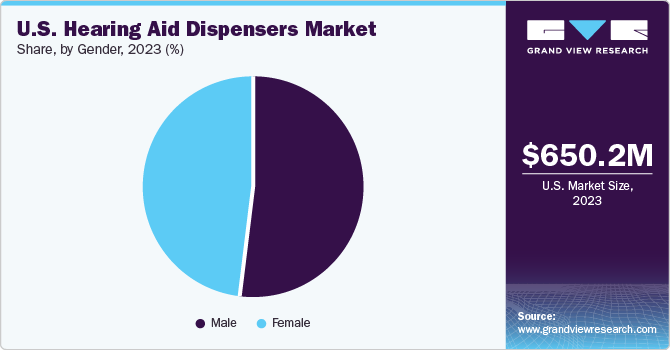

The male segment dominated the market in with the largest revenue share of 51.55% in 2023. The growth is attributed to several influential factors, such as specific industries or professions with higher noise exposure contributing to an increased demand for services, attracts more men to pursue careers in this field. Additionally, educational and awareness campaigns have enhanced male participation in the profession, fostered a better understanding of audiology health, and encouraged men to take up roles as dispensers. Shifts in societal attitudes, normalizing the act of seeking help for listening issues, further contribute to the rise of male professionals in this market.

The female segment is expected to witness the fastest CAGR over the forecast period. Growth of this segment is propelled by an increase in awareness and advocacy for gender diversity in healthcare. Educational campaigns emphasizing the significance of hearing health and efforts to break traditional gender roles contribute to a rising number of women entering the field. As societal attitudes evolve, providing equal opportunities for women in traditionally male-dominated professions, female professionals find appealing career paths in the market.

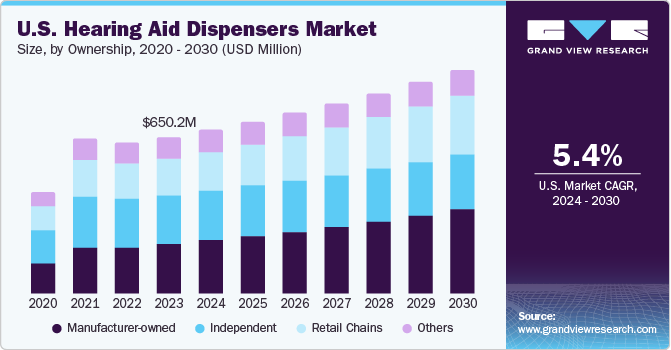

Ownership Insights

The manufacturer-owned segment dominated the market with a revenue share of 31.65% in 2023 and is expected to witness the fastest CAGR from 2024 to 2030. The growth can be attributed to the rising acquisition of stores and growing sales of products through various supplied stores. Companies such as Unitron; Phonak; Widex (WS Audiology A/S); Oticon; Starkey Laboratories, Inc.; Signia (WS Audiology A/S); and GN Resound use supplied stores for the sales of their products. Moreover, the rise in demand for dispensers due to an increase in awareness among the population about listening loss is expected to drive the segment growth.

The independent segment held a significant market share in 2023 owing to the low entry barriers for new retail outlets, which facilitated their widespread presence and ease of accessibility to customers. Moreover, high profit margins that incentivize the operation of independent retail stores drive the growth of the market.

Key U.S. Hearing Aid Dispensers Company Insights

The market is still in its initial stages, with many companies entering the market. Moreover, the companies operating in the market are involved in various strategic decisions, including new service launches, mergers & acquisitions, and partnership & collaborations which better suit the changing market landscape.

Key U.S. Hearing Aid Dispensers Companies:

- Audio Hearing Aid Service, LLC

- Costco Wholesale Corporation

- Davidson Hearing Aid Centres

- Echo Hearing Center

- Elite Hearing Centers of America

- Family Hearing Center

- Hear Well Be Well

- Hearing Unlimited

- HearUSA

- Independent Hearing Services

- LUCID HEARING HOLDING COMPANY, LLC

- Miracle-Ear

- SoundPoint Hearing Centers

Recent Developments

-

In January 2024, HearUSA has announced plans to open 17 new Hearing Center of the future locations in Florida, California, Michigan, and Texas in 2024. These centers will provide an innovative, client-focused hearing care experience to even more people across the United States.

-

In January 2024, WS Audiology A/S launched the “Partners in Excellence for You” Program to elevate the expertise of HCPs. This program helps professionals gain the confidence, knowledge, and tools required to increase their skills in their respective fields. This program seems to reinforce the value of clinical expertise and outstanding care, which is essential in the ever-evolving world of audiology.

-

In December 2023, HearUSA opened a Hearing Center of the Future and HearAcademy Learning Center in Huntington Beach. The center features new engagement technologies, interactive displays, a solution wall, and expertise from licensed HCPs. Moreover, the HearAcademy Learning Center provides training opportunities for local HCPs to stay up to date with the latest advancements in hearing care.

U.S. Hearing Aid Dispensers Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 650.2 million

Revenue forecast in 2030

USD 932.3 million

Growth rate

CAGR of 5.36% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ownership, gender

Country scope

U.S.

Key companies profiled

SoundPoint Hearing Centers; Hearing Unlimited; Davidson Hearing Aid Centres; Hear Well Be Well; Independent Hearing Services; Echo Hearing Center; Family Hearing Center; Costco Wholesale Corporation; Miracle-Ear; Elite Hearing Centers of America; LUCID HEARING HOLDING COMPANY, LLC; Audio Hearing Aid Service, LLC; HearUSA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Hearing Aid Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. hearing aid dispensers market report based on ownership and gender.

-

Ownership Outlook (Revenue, USD Million, 2018 - 2030)

-

Independent

-

Manufacturer-owned

-

Retail chains

-

Others

-

-

Gender Outlook (Revenue, USD Million, 2018 - 2030)

-

Male

-

Female

-

Frequently Asked Questions About This Report

b. The U.S. hearing aid dispensers market size was estimated at USD 650.2 million in 2023 and is expected to reach USD 681.59 million in 2024.

b. The U.S. hearing aid dispensers market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.36% from 2024 to 2030 to reach USD 932.3 billion by 2030.

b. Manufacturer-owned segment dominated the U.S. hearing aid dispensers market with a share of 31.65% in 2023 owing to the increasing sales of products through supplied stores.

b. Some key players operating in the U.S. hearing aid dispensers market SoundPoint Hearing Centers, Hearing Unlimited, Davidson Hearing Aid Centres, Hear Well Be Well, Independent Hearing Services, Echo Hearing Center, Family Hearing Center, Costco Wholesale Corporation, Miracle-Ear, Elite Hearing Centers of America, LUCID HEARING HOLDING COMPANY, LLC, Audio Hearing Aid Service, LLC, HearUSA, and others

b. Key factors that are driving the U.S. hearing aid dispensers market growth include increasing prevalence of hearing loss, moderate regulations for hearing aid dispensers, and increasing female workforce participation in such profession.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."