- Home

- »

- Medical Devices

- »

-

U.S. Hemodialysis And Peritoneal Dialysis Market Report 2030GVR Report cover

![U.S. Hemodialysis And Peritoneal Dialysis Market Size, Share & Trends Report]()

U.S. Hemodialysis And Peritoneal Dialysis Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Hemodialysis, Peritoneal Dialysis), By Product (Devices, Consumables, Service), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-022-2

- Number of Report Pages: 141

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

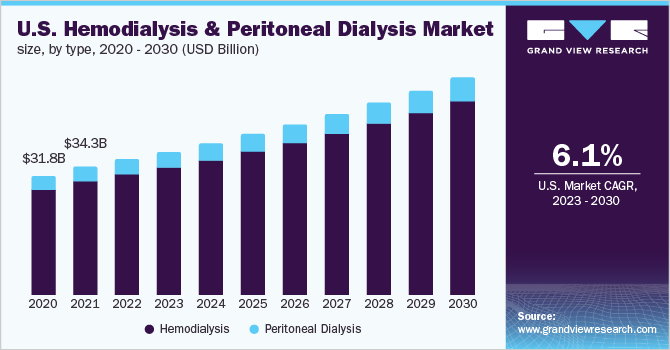

The U.S. hemodialysis and peritoneal dialysis market size was valued at USD 36.21 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 6.10% from 2023 to 2030. Rising incidence of Acute Kidney Injury (AKI), risks associated with transplants, shortage of organ donors, technological advancements, as well as initiatives by leading players to introduce advanced products & services are a few factors driving the demand for hemodialysis and peritoneal dialysis in the U.S., thereby propelling the market growth. For instance, Baxter has set up two training facilities in the U.S. that support self-care and help patients manage their home dialysis. Additionally, the outbreak of COVID-19 in the year 2020 has resulted in significant demand for dialysis across the country. Owing to this, the market has witnessed regulatory support from government authorities and a rise in financial incentives. These factors contribute to the positive growth of the U.S. hemodialysis and peritoneal dialysis market during the forecast period.

The COVID-19 pandemic had considerably impacted the dialysis care market globally. The pandemic had led to a sudden increase in demand for dialysis devices and consumables, due to high hospitalization rates. For instance, as per CDC statistics of 2021, CKD affected an estimated 37 million U.S. individuals, that is, 1 in 7 U.S. adults. This was mainly owing to the higher prevalence of comorbid conditions, such as CKD, diabetes, and hypertension. In addition, the pandemic led to major interruptions in the supply chain, which created challenges for manufacturers in keeping up with supply. Moreover, rising medical needs deriving from the geriatric populace, stronger demand for innovative products and therapies, and advancements in medical technologies are expected to further add to market growth post-COVID-19. In addition, rising efforts by public and private organizations to encourage home HD/PD can further create profitable opportunities for the market post-COVID-19.

The rising incidence of AKIs is a key factor expected to drive the demand for hemodialysis and peritoneal dialysis. For instance, the National Kidney Foundation, Inc., projected more than one in seven adults is affected by kidney disease. The following figure depicts the percentage of U.S. adults aged 18 years or older and gender-wise affected by Chronic Kidney Disease (CKD). According to CDC, more than approximately 37 million people are estimated to have CKD. Furthermore, according to the same source, CKD is more common in people over the age of 65 years and can lead to dialysis.

Moreover, in the past few years, the requirement for dialysis has increased. For instance, according to National Kidney Foundation in 2018, 785,883 U.S. residents faced kidney failure, of which, 554,038 received dialysis. Likewise, according to data published by FDA, about 10,000 children in the U.S. develop acute AKI. These children have a survival rate of around 38% to 43%. The death rate for neonates with AKI is around 60%. Fluid overload is prevalent in critically ill neonates and children, especially after procedures such as cardiac surgery. Such factors are likely to drive the demand for neonatal hemodialysis, thereby propelling the market growth.

The increasing prevalence of chronic kidney disease and healthcare spending by Medicare is contributing to the growth of the market in the country. As per the National Kidney Foundation, in 2019, more than 500,000 patients have undergone dialysis and more than 200,000 people are living with a kidney transplant. Moreover, the Medicare cost for people with all the stages of CKD in 2017 was around USD 120 billion. In 2017, Medicare spent USD 84 billion on people with CKD and USD 36 billion on people with End Stage Kidney Disease (ESKD).

Furthermore, the demand for homecare dialysis services has increased over the years and is expected to increase further. Patients suffering from acute and chronic kidney diseases are treated at home or at outpatient facilities. Hence, the demand for renal home therapies has increased. Moreover, according to NCBI, as of 2017, 10.8% of U.S. residents are dialyzed at home, which is a 30% increase in home dialysis over the past decade. In 2019, Advancing Kidney Health Initiative proposed to increase the number of patients with renal failure to be treated at home by hemodialysis or peritoneal dialysis. Additionally, CMS proposed a goal where 80% of dialysis patients are to be treated with the help of a home dialysis setting. With such initiatives undertaken by governments and organizations, the demand for home care dialysis services is expected to increase over the forecast period.

Type Insights

Based on type, the hemodialysis and peritoneal dialysis market is segmented into hemodialysis, and peritoneal dialysis. In 2022, hemodialysis segment dominated the market in terms of value with a share of 88.70% and is expected to attain the highest CAGR of 6.19% during the forecast period. In addition, hemodialysis segment is further fragmented into conventional, short daily hemodialysis, nocturnal hemodialysis. Whereas peritoneal dialysis is further sub segmented into Continuous Ambulatory Peritoneal Dialysis (CAPD), and Ambulatory Peritoneal Dialysis (APD).

The rising number of ESRD patients, surge in the geriatric population suffering from kidney diseases, as well as the rising prevalence of diabetes and hypertension, are significant factors driving the segment growth. Elderly people (aged ≥65) are currently the fastest-growing group of the general population in the U.S. According to the U.S. Census Bureau’s 2017 National Population Projections, by 2060, nearly one in four U.S. citizens is likely to be an older adult. An aging population and a rising risk of CKD are projected to significantly boost segment growth.

Hemodialysis involves the use of a hemodialyzer to remove extra and waste fluids & chemicals from the body. The blood comes into contact with dialysate as it passes through the filter, which is similar to bodily fluid except for the presence of impurities. This is a relatively complicated type of dialysis with a rigorous treatment framework and restricted flexibility in terms of patients' time, mobility, and transportation. In addition, it entails the establishment and maintenance of vascular access, such as a dialysis catheter or the formation of an AV fistula or graft in either the arm or the groin to access the high blood flows required for dialysis.

Product Insights

Based on product, the hemodialysis and peritoneal dialysis market is segmented into devices, consumables, and service. In 2022, service segment dominated the market with a share of 68.0%. This can be attributed to an increase in the number of dialysis service providers, as well as the increase in the prevalence of ESRD. In addition, several key dialysis service providers are looking to expand their service offerings by opening and purchasing new dialysis centers throughout the country, which is expected to boost segment growth. Technological advancements and initiatives undertaken by various manufacturers are expected to further boost the market. For instance, in February 2021, DaVita incorporated a secure telehealth technology, DaVita Care Connect, into its home dialysis sector. It was one of the many connective technologies in its suite of services aimed at improving treatment and outcomes for patients who choose to treat themselves at home.

However, consumables segment is expected to exhibit the highest CAGR of 6.42% during the forecast period. Significant investments from the governments to enhance patient safety, patient-centered care, and efficacy is expected to support the segment growth in the forecast period. Companies are creating catheters made of sophisticated materials resistant to chemicals such as peroxides, iodine, and alcohol. This can help extend the life of catheters and lower the chances of malfunctioning. Furthermore, demand for antimicrobial-coated catheters is increasing, which minimizes rate of bloodstream infections. Similarly, new dialyzer manufacturing technologies, such as improved surface contact and cutoff membrane dialyzers for greater diffusion, have a beneficial impact on the consumable segment's growth.The Consumables market has been further segmented into bloodlines, concentrates, catheters, and others.

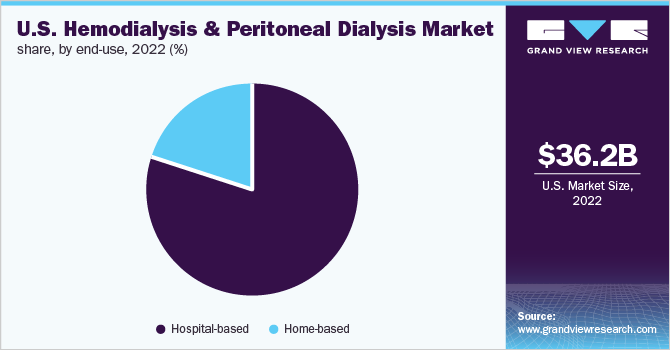

End-use Insights

End-use scope of the hemodialysis and peritoneal dialysis market includes home-based, and hospital based. In 2022, and hospital-based segment dominated the market with a share of 79.39%. The segmental dominance is likely to continue to be robust in the coming years because of the significant availability of highly qualified and experienced healthcare personnel in the hospitals. The presence of a professional and experienced renal care team ensures optimal treatment and enhanced dialysis results in healthcare settings such as dialysis centers and hospitals.

In addition, the growing focus of players on building independent dialysis centers, and high adoption of patients for treatment in in-center dialysis are some of the factors projected to drive segment growth. Moreover, companies are focusing on the development of customized hemodialysis machines with a variety of interventions. This is likely to have an influence on the end-user experience.

However, home-based segment is expected to exhibit the highest CAGR of 7.17% during the forecast period.Home dialysis has various advantages, including increased quality of life, lower travel costs, flexibility, and easier patient mobility, which will enhance its adoption rate in the next years. Similarly, an increase in the choice for home dialysis therapy among the older population suffering from various renal dysfunctions will further boost segment revenue. The development of smaller dialysis machines that can be put on a nightstand, as well as easier blood tubing and dialyzer connections, have resulted in a growing number of patients preferring this mode of dialysis to maintain their independence and high functional status.

Key Companies & Market Share Insights

The key market players are focusing on the launch of innovative products, growth strategies, and technological advancements. For instance, in October 2019, Fresenius Medical Care has received a breakthrough device designation by the U.S. FDA for its new hemodialysis machine that aims to stop blood clotting without the use of any medication. Additionally, few key players are introducing technologically advanced products to achieve a competitive advantage in the industry. Advancements in the hemodialysis and peritoneal dialysis market are anticipated to boost market growth over the forecast period. For instance, in December 2020, Medtronic launched a dialysis machine for neonatal and pediatrics in the U.S. This launch helped the company to increase its market share in the renal segment. Some prominent players in the U.S. hemodialysis and peritoneal dialysis market include:

-

Baxter

-

B. Braun Melsungen AG

-

Fresenius Medical Care AG

-

Medtronic

-

Asahi Kasei Medical Co., Ltd.

-

Nipro Corp.

-

DaVita

-

BD

-

Nikkiso Co., Ltd.

-

Cantel Medical

U.S. Hemodialysis And Peritoneal Dialysis Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 38.27 billion

Revenue forecast in 2030

USD 57.93 billion

Growth rate

CAGR of 6.10% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, end-use

Country scope

U.S.

Key companies profiled

Baxter, B; Braun Melsungen AG; Fresenius Medical Care AG; Medtronic; Asahi Kasei Medical Co., Ltd.; Nipro Corp; DaVita; BD; Nikkiso Co., Ltd.; Cantel Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. Hemodialysis And Peritoneal Dialysis Market Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. hemodialysis and peritoneal dialysis market report based on product, type, and end-use:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hemodialysis

-

Conventional

-

Short Daily Hemodialysis

-

Nocturnal Hemodialysis

-

-

Peritoneal Dialysis

-

Continuous Ambulatory Peritoneal Dialysis (CAPD)

-

Automated Peritoneal Dialysis (APD)

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Device

-

Machine

-

Dialyzers

-

Water Treatment System

-

Others

-

-

Consumables

-

Bloodlines

-

Concentrates

-

Catheters

-

Others

-

-

Service

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Home-based

-

Hospital-based

-

Frequently Asked Questions About This Report

b. The U.S. hemodialysis and peritoneal dialysis market size was estimated at USD 36.21 billion in 2022 and is expected to reach USD 38.27 billion in 2023.

b. The U.S. hemodialysis and peritoneal dialysis market is expected to witness a compound annual growth rate of 6.10% from 2023 to 2030 to reach USD 57.93 billion by 2030.

b. Hemodialysis segment held the largest share of 88.70% in 2022 due to the presence of large number of dialysis centers, rising number of ESRD patients, surge in geriatric population suffering from kidney diseases, as well as the rising prevalence of diabetes and hypertension.

b. Some key players operating in the U.S. hemodialysis and peritoneal dialysis market include Baxter, B. Braun Melsungen AG, Fresenius Medical Care AG, Medtronic, Asahi Kasei Medical Co., Ltd., Nipro Corp., DaVita, BD, Nikkiso Co., Ltd., and Cantel Medical.

b. Increasing incidence of chronic kidney disease, the availability of advanced dialysis, machines disposables and replacement fluids, and rising government initiatives to increase the accessibility of dialysis treatment and growing adoption of home hemodialysis are expected to drive market growth in the coming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.