- Home

- »

- Medical Devices

- »

-

U.S. Hemostasis Valve Market Size, Industry Report, 2033GVR Report cover

![U.S. Hemostasis Valve Market Size, Share & Trends Report]()

U.S. Hemostasis Valve Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Hemostasis Valve Y-Connectors, Double Y-Connector Hemostasis Valves), By Application, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-662-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021- 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Hemostasis Valve Market Size & Trends

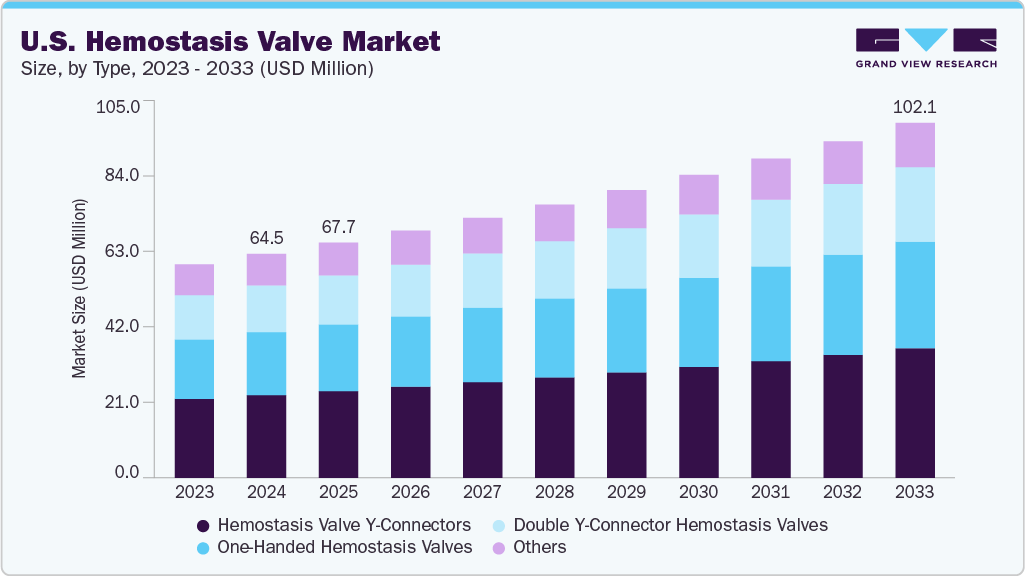

The U.S. hemostasis valve market size was estimated at USD 64.47 million in 2024 and is projected to grow at a CAGR of 5.4% from 2025 to 2033.The market is experiencing significant growth due to several key factors, including the rising incidence of cardiovascular diseases, favorable regulatory support, an aging population, and ongoing technological advancements. A notable driver is the increasing preference for minimally invasive procedures, which offer advantages such as less pain, shorter hospital stays, quicker recovery, and a reduced risk of complications compared to traditional open surgeries.

This shift is fueling the demand for medical devices that support these techniques. Hemostasis valves play a critical role in minimally invasive catheter-based procedures by ensuring controlled blood flow and preventing leakage during interventions.

Air pollution is increasingly recognized as a major contributor to the rise in cardiovascular diseases. Both chronic and short-term exposures significantly raise the risk of cardiovascular emergencies and mortality in the U.S. The World Heart Report 2024 highlights that air pollution worsens all major cardiovascular diseases (CVDs). In 2019, nearly 70% of the 4.2 million deaths linked to ambient air pollution were due to cardiovascular issues, particularly ischemic heart disease (1.9 million deaths) and stroke (900,000 deaths). As a result, there is an increased need for diagnostic and therapeutic procedures such as angiography and angioplasty, where hemostasis valves play a crucial role in maintaining patient safety by regulating blood flow during catheter-based interventions.

Technological advancements in medical devices are pivotal in driving the market growth. Ongoing technological advancements are playing a key role in improving the performance and reliability of hemostasis valves. Manufacturers are continuously innovating to enhance valve design, material quality, and compatibility with a variety of catheter sizes and interventional tools. These improvements help reduce the risk of blood leakage, improve ease of use for clinicians, and enhance patient safety during minimally invasive procedures. For example, Merit Medical Systems offers advanced hemostasis valves such as the Merit AccessPLUS and Honor Hemostasis Valves, which are designed with ergonomic features, superior sealing mechanisms, and robust hemostatic control. These innovations reflect the industry's focus on optimizing procedural efficiency and reducing complications in catheter-based interventions.

Market Concentration & Characteristics

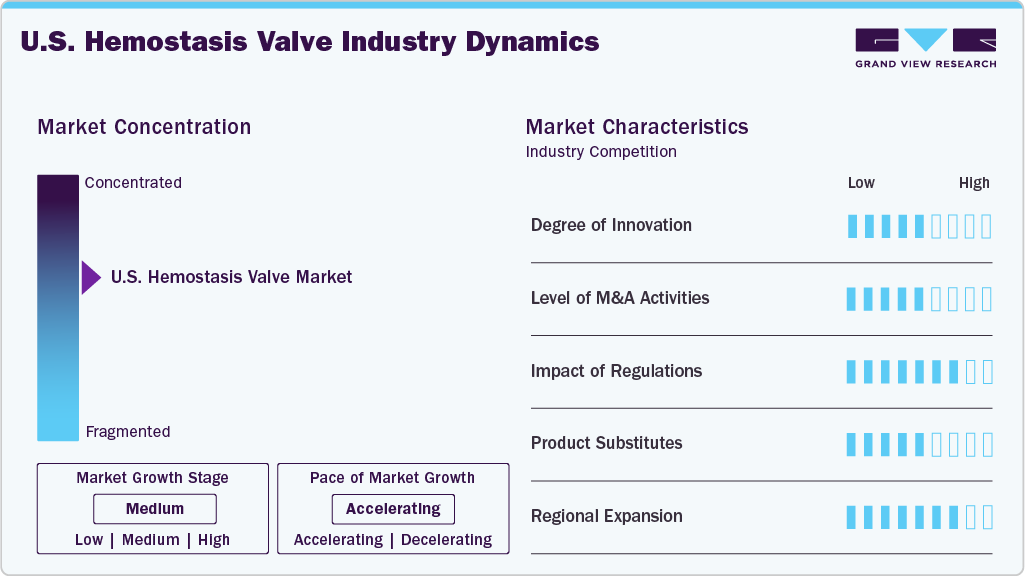

The degree of innovation in the market is moderate to high, driven by the increasing demand for safer and more efficient minimally invasive procedures. As interventional cardiology, radiology, and vascular surgeries become more advanced, the need for precision devices like hemostasis valves grows, pushing manufacturers to invest in product development and R&D.

The U.S. hemostasis valve industry experiences a moderate level of mergers and acquisitions (M&A). While major medical device companies do acquire smaller firms to enhance their product offerings and access emerging technologies, the market is not undergoing significant consolidation. Instead, M&A activity is generally targeted toward companies that produce complementary medical devices or offer specialized, niche products within the broader fields of hemostasis management and surgical interventions.

The U.S. regulatory frameworks exert a profound influence on the hemostasis valve industry. While regulatory demands can increase costs and entry barriers, they also ensure high-quality, reliable devices that support the expanding use of minimally invasive procedures. This regulatory environment promotes steady innovation, market growth, and patient safety.

Product expansion in the U.S. hemostasis valve industry is medium, as companies are continuously improving and expanding their product offerings to cater to different types of interventional procedures. However, the market's focus remains on refining existing products rather than launching entirely new categories of devices. Manufacturers are introducing new features such as user-friendly designs, improved durability, and compatibility with a wider range of surgical applications to meet evolving healthcare needs.

Type Insights

Hemostasis valve Y-connectors segment held the largest share of 37.0% in 2024. Hemostasis valve Y-connectors currently lead the market due to their versatility and ability to provide multiple access points during minimally invasive procedures. Their growing adoption is driven by the increasing demand for complex cardiovascular and interventional procedures that require enhanced catheter management and precise hemostasis.Furthermore, the ongoing innovations ensure their dominant position in the global market. For instance, OKAY II by Nipro is a hemostatic connector designed to minimize blood loss during medical procedures effectively. Its spacious 3.33mm inner diameter accommodates a wide range of Percutaneous Coronary Intervention (PCI) devices and techniques, ensuring versatility and compatibility in clinical settings. As the demand for minimally invasive cardiovascular interventions continues to rise, the importance and utilization of Y-connectors are expected to grow, further reinforcing their market leadership.

The one-handed hemostasis valve segment is projected to experience the fastest CAGR of 6.1% during the forecast period. This growth is fueled by ergonomic designs, continuous technological improvements, and an expanding variety of clinical applications. Unlike conventional hemostasis valves that need two hands to operate-often making procedures more complex and slower-one-handed valves allow clinicians to manage blood flow and catheter control with a single hand, freeing the other hand to perform additional critical tasks. For instance, Merit Medical Honor Hemostasis Valve is a leading example of this innovation. It features a single-handed operation design with a dual-seal system that ensures effective hemostasis while providing ease of use and improved procedural efficiency.

End Use Insights

The hospitals segment held the largest revenue share of 56.6% in 2024. This dominance can be attributed to its advanced medical infrastructure, high volume of procedures, role in emergency and critical care, comprehensive patient care approach, adoption of technological advancements, and regulatory and reimbursement support. Hospitals have advanced medical infrastructure and state-of-the-art facilities for performing diagnostic and therapeutic procedures. These factors collectively highlight the pivotal role of hospitals in utilizing hemostasis valves for a wide range of medical interventions, ensuring patient safety and improving clinical outcomes.

The outpatient facilities segment is anticipated to register the fastest CAGR over the forecast period. Outpatient facilities such as ambulatory surgical centers (ASCs) and specialized vascular clinics are increasingly equipped with modern imaging tools and endovascular equipment, allowing them to perform effective interventions for a growing patient base. Outpatient centers are more accessible regarding location and scheduling flexibility, which helps reduce care delays. Furthermore, many healthcare systems and insurance providers recognize the cost-efficiency of ASCs and are more willing to reimburse procedures conducted in these settings. This financial support encourages more healthcare providers to adopt ASCs for various medical interventions, including those requiring hemostasis valves.

Application Insights

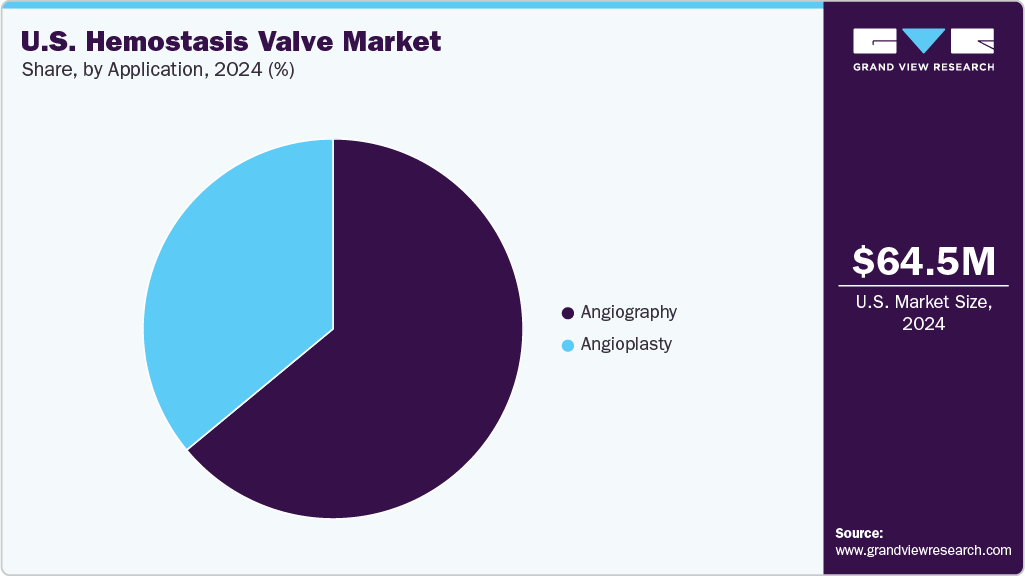

The angiography segment, categorized by application, held the largest market share of 64.0% in 2024 and is expected to grow at the fastest CAGR of 5.6% during the forecast period. Angiography procedures are steadily increasing in the U.S., driven by a combination of clinical demand, aging demographics, and advancements in medical technology. This rise reflects broader trends in cardiovascular care and minimally invasive diagnostics. According to the article published by the National Library of Medicine in September 2023, coronary angiography (CAG) is the gold standard for diagnosing obstructive coronary artery disease (CAD). Angiographies are among the most common interventional procedures in the U.S. healthcare, with volumes in the millions.

The angioplasty segment is also expected to grow at a significant CAGR during the forecast period. The increasing prevalence of cardiovascular diseases, technological advancements, a shift towards minimally invasive procedures, the expansion of healthcare infrastructure in emerging economies, and rising awareness about early diagnosis and treatment drive the market growth. The adoption of angioplasty, particularly percutaneous coronary intervention (PCI), is on the rise in the United States, reflecting broader healthcare trends toward less invasive, faster-recovery cardiac procedures. More than 18.2 million adults in the U.S. are affected by coronary artery disease, driving strong demand for related medical interventions, one of the most frequently performed being angioplasty. Each year, over 965,000 angioplasty procedures are conducted across the country to restore blood flow and manage coronary blockages.

Key U.S. Hemostasis Valve Company Insights

Some of the key market players operating in the hemostasis valve market include Boston Scientific Corporation, Teleflex Incorporated, Merit Medical Systems, B. Braun SE, TERUMO CORPORATION, and Abbott. These companies are making significant infrastructure investments, which enable them to develop, manufacture, and commercialize a high volume of valves worldwide. In addition, to increasing their presence globally, companies engage in several strategic partnerships with distributors and other companies.

Key U.S. Hemostasis Valve Companies:

- Boston Scientific Corporation

- Teleflex Incorporated

- Merit Medical Systems

- B. Braun Melsungen AG

- TERUMO CORPORATION

- Abbott

- Argon Medical Devices

- Freudenberg Medical

- DeRoyal Industries, Inc.

- Antmed Corporation

Recent Developments

-

In November 2024, BioCardia, Inc. launched its Morph DNA steerable introducer family, improving control in biotherapeutic delivery with a swiveling side port in the hemostasis valve to reduce tangling. The company continues to focus on its CardiAMP Heart Failure trials, expecting significant results by early 2025.

In October 2024, a recall was issued for the Monarch Inflation Device and the Access-9 Large Bore Hemostasis Valve Metal Insertion Tool. These devices are used for inflating and deflating balloon angioplasty catheters, injecting fluids, and monitoring pressure, and are classified as angiographic injectors and syringes.

U.S. Hemostasis Valve Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 67.71 million

Revenue forecast in 2033

USD 102.14 million

Growth rate

CAGR of 5.4% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use

Key companies profiled

Boston Scientific Corporation; Teleflex Incorporated; Merit Medical Systems; B. Braun Melsungen AG; TERUMO CORPORATION; Abbott; Argon Medical Devices; Freudenberg Medical; DeRoyal Industries, Inc.; Antmed Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Hemostasis Valve Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. hemostasis valve market report based on type, application, and end use:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Hemostasis Valve Y- Connectors

-

Double Y- Y-Connector Hemostasis Valves

-

One-Handed Hemostasis Valves

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Angiography

-

Angioplasty

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. hemostasis valve market size was estimated at USD 64.47 million in 2024 and is expected to reach USD 67.71 million in 2025.

b. The U.S. hemostasis valve market is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2033 to reach USD 102.14 million by 2033.

b. Hemostasis valve Y-connectors segment held the largest share of 37.0% in 2024. Hemostasis valve Y-connectors currently lead the market due to their versatility and ability to provide multiple access points during minimally invasive procedures.

b. The U.S. Hemostasis Valve market is dominated by key industry players such as Boston Scientific Corporation; Teleflex Incorporated; Merit Medical Systems; B. Braun Melsungen AG; TERUMO CORPORATION; Abbott; Argon Medical Devices; Freudenberg Medical; DeRoyal Industries, Inc.; Antmed Corporation

b. The market is experiencing significant growth due to several key factors, including the rising incidence of cardiovascular diseases, favorable regulatory support, an aging population, and ongoing technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.