- Home

- »

- Organic Chemicals

- »

-

U.S. Higher Alpha Olefins Market Size, Industry Report, 2033GVR Report cover

![U.S. Higher Alpha Olefins Market Size, Share & Trends Report]()

U.S. Higher Alpha Olefins Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (C6-C8, C10-C14, C16), By Application (Polyethylene Comonomers, Lubricants & Synthetic Oils, Detergents & Surfactants, Synthetic Drilling Fluids), And Segment Forecasts

- Report ID: GVR-4-68040-614-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Higher Alpha Olefins Market Summary

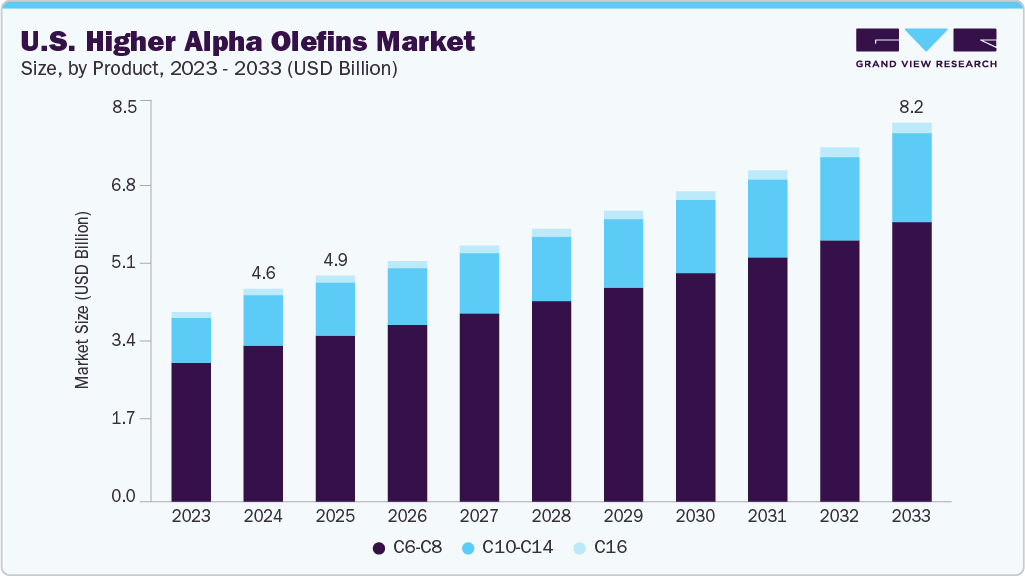

The U.S. higher alpha olefins market size was estimated at USD 4,601.5 million in 2024 and is projected to reach USD 8,196.9 million by 2033, growing at a CAGR of 6.7% from 2025 to 2033. The industry is experiencing steady growth due to increasing demand in polyethylene production and specialty chemicals.

Key Market Trends & Insights

- Based on product, the C6-C8 segment dominated the market and accounted for the largest revenue share of 73.4% in 2024.

- Based on applications, detergents & surfactants are expected to grow at a CAGR of 6.9% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 4,601.5 Million

- 2033 Projected Market Size: USD 8,196.9 Million

- CAGR (2025-2033): 6.7%

These olefins are essential as co-monomers for linear low-density polyethylene and as intermediates in surfactants, lubricants, and plasticizers. Rising consumption in packaging, automotive, and consumer goods supports market expansion.Demand fluctuations in end-use industries influence HAO market performance. Pricing of raw materials such as ethylene, availability of feedstock, and production capacities of major manufacturers affect supply dynamics. Environmental regulations and sustainability concerns also shape production processes and investment decisions. Seasonal demand cycles for detergents and lubricants can create temporary shifts in consumption patterns.

Opportunities for growth exist through the development of higher-purity and longer-chain alpha olefins for specialized applications. Expanding markets for biodegradable detergents and synthetic lubricants present new applications for HAOs. Emerging economies with growing plastics and chemical industries may further increase demand, while innovations in polymer blends and functional chemicals could extend their industrial relevance.

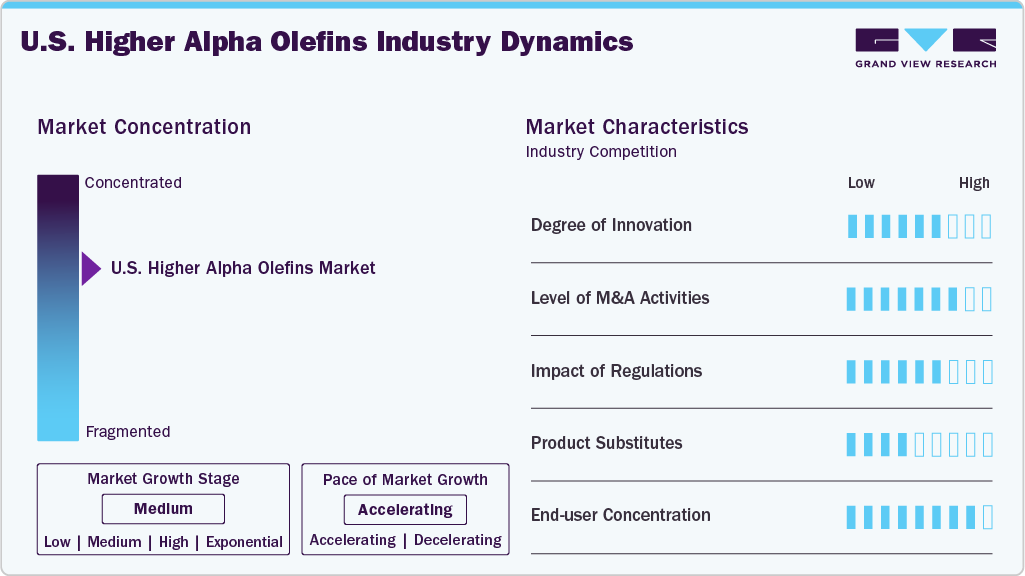

Market Concentration & Characteristics

The higher alpha olefins (HAO) market is characterized by a relatively limited number of established producers who maintain significant influence over global supply. Production requires advanced technology and specialized catalysts, which creates high entry barriers for new competitors. This concentration allows established players to shape pricing and availability while maintaining consistent quality standards to meet the diverse needs of end-use industries.

The market also shows a strong focus on performance and application-specific requirements. Manufacturers often tailor products to meet demands in polyethylene production, surfactants, lubricants, and other specialty chemicals. Relationships with downstream industries are critical, as long-term contracts and partnerships ensure steady demand. The market is responsive to shifts in raw material availability and changing industrial requirements, emphasizing innovation and flexibility as central characteristics for maintaining competitiveness and sustaining growth.

Product Insights

The C6-C8 segment dominated the market and accounted for the largest revenue share of 73.4% in 2024, due to its extensive use as co-monomers in linear low-density polyethylene (LLDPE) production and in the manufacture of detergents and plasticizers. Their chain length provides an optimal balance of reactivity and physical properties, making them highly versatile for a wide range of applications. This broad applicability across packaging, consumer goods, and industrial products has sustained strong demand and contributed to significant revenue generation in 2024.

The C10-C14 segment is expected to grow at a faster rate with a CAGR of 6.6% from 2025 to 2033, due to rising demand for specialty chemicals and synthetic lubricants that require longer-chain alpha olefins. These compounds offer superior performance in applications like surfactants, emulsifiers, and plastic additives, where higher chain length enhances stability and efficiency. Expansion in emerging markets, coupled with innovations in biodegradable and high-performance chemical formulations, is expected to accelerate adoption and drive sustained growth in this segment over the forecast period.

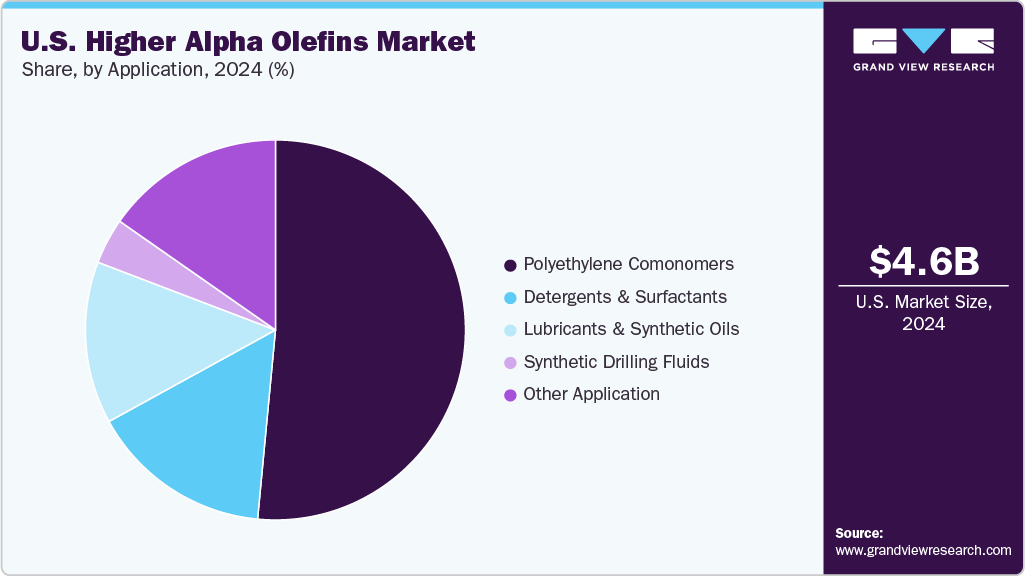

Application Insights

The Polyethylene Comonomers segment dominated the market and accounted for the largest revenue share of 51.5% in 2024, due to its critical role in producing linear low-density polyethylene (LLDPE) and high-density polyethylene (HDPE). These co-monomers enhance polymer properties such as flexibility, tensile strength, and clarity, which are essential for packaging, automotive, and consumer goods applications. The consistent demand from the plastics industry, driven by ongoing requirements for high-performance materials, has maintained this segment’s strong revenue contribution in 2024.

The detergents & surfactants segment is expected to grow fastest with a CAGR of 6.9% from 2025 to 2033. The segment is projected to grow rapidly as higher alpha olefins are increasingly used to produce linear alkylbenzene, a key intermediate in biodegradable and efficient cleaning products. Rising consumer demand for household and industrial cleaning solutions, along with a shift toward eco-friendly formulations, is expected to boost adoption. Expanding chemical manufacturing capabilities in emerging regions will support sustained growth, making this segment one of the fastest-growing applications in the HAO market.

Key U.S. Higher Alpha Olefins Companies Insights

Key players operating in the U.S. higher alpha olefins market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Two dominant manufacturers in the market are Chevron Phillips Chemical and Exxon Mobil Corporation.

-

Chevron Phillips Chemical is recognized for its advanced petrochemical operations, producing a wide range of alpha olefins and co-monomers. The company focuses on innovation in polymer and specialty chemical solutions, serving industries from plastics to lubricants. Its integrated approach allows efficient production of high-purity products that meet stringent performance standards.

-

Exxon Mobil Corporation operates as a leading energy and chemical company with significant involvement in alpha olefins production. It leverages large-scale chemical manufacturing capabilities to provide consistent, high-quality olefins for polyethylene and specialty chemical applications. The company integrates cutting-edge technology into its operations to enhance product performance and operational reliability.

Key U.S. Higher Alpha Olefins Companies:

- Chevron Phillips Chemical (CP Chem)

- Exxon Mobil Corporation

- SABIC

- Shell Chemicals

- INEOS Group Holdings S.A

- Sasol

- Dow

- NOVVI, LLC

- Braskem

- Idemitsu Kosan Co., Ltd.

Recent Developments

-

In September 2023, ExxonMobil Corporation expanded its Baytown, Texas, manufacturing facility in the U.S. Gulf Coast with a USD 2 billion investment, starting two new chemical units. The project added a 400,000-ton polymers line and a 350,000-ton linear alpha olefins unit, strengthening ExxonMobil’s portfolio, entering new markets, and supporting economic development while ensuring safe, on-schedule execution.

U.S. Higher Alpha Olefins Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4,890.9 million

Revenue forecast in 2033

USD 8,196.9 billion

Growth rate

CAGR of 6.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Key companies profiled

Chevron Phillips Chemical (CP Chem); Exxon Mobil Corporation; SABIC; Shell Chemicals; INEOS Group Holdings S.A; Sasol; Dow; NOVVI, LLC; Braskem; Idemitsu Kosan Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Higher Alpha Olefins Market Report Segmentation

This report forecasts volume & revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the U.S. higher alpha olefins market report based on product and application.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

C6-C8

-

C10-C14

-

C16

-

-

Application Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Polyethylene Comonomers

-

Lubricants & Synthetic Oils

-

Detergents & Surfactants

-

Synthetic Drilling Fluids

-

Other Application

-

Frequently Asked Questions About This Report

b. The U.S. higher alpha olefins market size was estimated at USD 4,601.5 million in 2024 and is expected to reach USD 4,890.9 million in 2025.

b. The U.S. higher alpha olefins market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2033 to reach USD 8,196.9 million by 2033.

b. C6–C8 higher alpha olefins accounted for over 74.8% of the market in 2024. Their dominance is attributed to their widespread use as comonomers in LLDPE and HDPE, where they impart flexibility, tensile strength, and processability.

b. Some key players operating in the U.S. higher alpha olefins market include Chevron Phillips Chemical Company LP, Shell Chemical Company, Westlake Chemical Corporation, TPC Group, LyondellBasell Industries, Huntsman Corporation, INEOS, Eastman Chemical Company, and Sasol.

b. Key factors that are driving the market growth include ongoing industrial demand for cleaner, low-volatility, and high-performance formulations across sectors such as automotive, packaging, electronics, and personal care. , reducing emergency room visits and hospitalization rate, and technological innovation in communication technology across the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.