- Home

- »

- Homecare & Decor

- »

-

U.S. Home And Garden Fungicides Market Size Report, 2030GVR Report cover

![U.S. Home And Garden Fungicides Market Size, Share & Trends Report]()

U.S. Home And Garden Fungicides Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Organic, Inorganic), By Form (Dry, Liquid), By Application (Home Garden, Turf & Ornamentals), And Segment Forecasts

- Report ID: GVR-4-68039-403-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

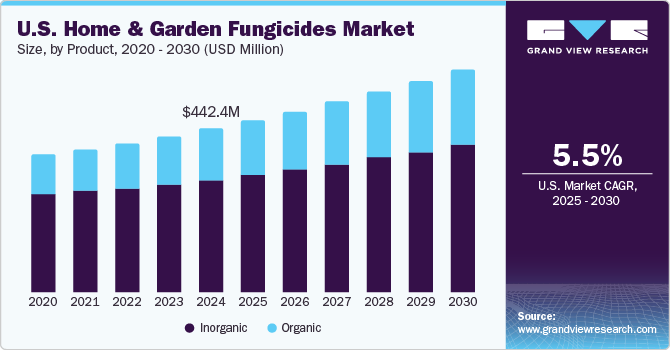

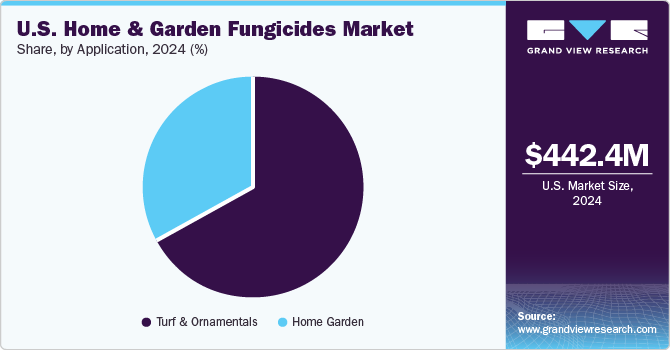

The U.S. home and garden fungicides market size was valued at USD 442.4 million in 2024 and is projected to grow at a CAGR of 5.5% from 2025 to 2030. The rising demand for landscaping projects such as water fountains, plant beds, and gazebos and an increase in gardening activities have highlighted the need to maintain plant health among households in the country. Fungicides are a primary solution to prevent or kill the growth of fungi and their spores that can damage plants. Furthermore, the conversion of residential and commercial outdoor spaces into lawns, outdoor kitchens, and party areas for entertainment and leisure purposes necessitates proper maintenance of flowers and plants, boosting market demand.

Consumers in the U.S. prefer the presence of larger and more varied vegetation in their lawns and gardens, driving the use of fungicides to maintain their healthy growth. The COVID-19 pandemic led to a surge in home gardening activities as people spent more time at home. Many turned to gardening as a hobby or a way to grow their own food, enabling substantial sales of products that could manage plant diseases. A report by Raleigh Realty published in August 2024 stated that around 55% (72 million) of American households have a garden, with the country being one of the leaders in terms of gardening activities. Moreover, according to the 2023 National Gardening Survey report, 80% of the country’s households took a strong interest in gardening activities in 2022, witnessing an average spending of USD 616 in this area. This showcases the significant efforts being taken by individuals to maintain plant health, leading to strong sales of fungicides.

Fungicides are increasingly available in easy-to-use formats, such as ready-to-spray bottles or granules. It makes them more accessible for casual gardeners who may not have experience with complex pest management solutions. The availability of organic solutions, such as those based on neem oil, sulfur, or copper, has grown substantially in recent years, catering to the increasing consumer demand for non-toxic and environmentally friendly alternatives. Fungicides are regulated by federal and state agencies in the U.S. to ensure they are safe for use in agriculture, home gardens, and landscaping. Home gardeners are required to follow label instructions for fungicide use, with the label indicating whether a product is safe for application in home gardens and the precautions needed during its usage. Regulatory bodies further monitor the effectiveness and safety of fungicides through continued research. This includes evaluating new products, emerging resistance to fungal pathogens, and reviewing existing chemicals’ environmental and health impacts. These factors shape the growth of the U.S. home and garden fungicides industry.

Product Insights

The inorganic segment accounted for a larger revenue share of 69.4% in the U.S. home and garden fungicides industry in 2024. The steadily rising consumption of fruits and vegetables in the country and the increasing adoption of advanced gardening techniques are driving the demand for inorganic fungicides. Home gardening of fruits and vegetables has become increasingly popular in recent years, driven by factors such as sustainability, food security, and the desire for fresh, home-grown produce. These consumers often face challenges such as fungal infections in their plants or crops that require effective treatment, creating demand for inorganic fungicides. Copper-based and sulfur solutions are very popular due to their efficacy and long shelf life.

On the other hand, the organic segment is expected to grow at the highest CAGR from 2025 to 2030. Increasing concerns regarding the environmental and health impacts of inorganic chemicals have been influencing gardeners across the country to seek safer alternatives, aiding segment expansion. Natural fungicides that use ingredients such as neem oil and baking soda mixtures are increasingly becoming popular among home gardeners. Advances in microbial and botanical technologies are expected to lead to the emergence of more effective and affordable organic fungicide products. These solutions are extensively available in mainstream gardening stores and online platforms, expanding their reach among eco-conscious homeowners and gardeners.

Form Insights

The liquid form of fungicides accounted for the largest revenue share in the U.S. home and garden fungicides industry in 2024 and is further expected to advance at the fastest CAGR from 2025 to 2030. These products are highly popular in both home gardening and commercial agriculture due to their ease of application and versatility. They are available in different types based on their function, such as contact fungicides, systemic fungicides, and biological liquid fungicides. Systemic solutions are absorbed by the plant and provide internal protection by killing or inhibiting fungi within the plant tissue. Examples of this type include phosphonate-based fungicides and azoxystrobin. The liquid form ensures uniform distribution over leaves, stems, and fruits, enhancing plant and crop protection. Moreover, their concentration can be customized as per plant requirements, driving their appeal.

The dry segment is expected to advance at a significant CAGR during the forecast period in the U.S. home and garden fungicides market. These products are noted for their stability, ease of transport, and versatility in application methods. They are available in different forms, including powder, granules, and dust. Other options, such as Water-Dispersible Granules (WDG) and wettable powders, are also widely available, increasing their usage in home gardening activities. Additionally, their adoption has increased as they are resilient and difficult to wash off, resulting in higher product effectiveness and cost savings.

Application Insights

The turf & ornamentals segment accounted for a dominant revenue share in the U.S. home and garden fungicides industry in 2024. Moreover, this application area is expected to maintain its leading position during the forecast period. The increasing presence of golf courses, lawns, sports fields, and parks in the country has driven the use of fungicides, which are critical for maintaining healthy turfgrass in these settings. As per the National Golf Foundation, as of 2023, there are around 16,000 golf courses in the U.S. at approximately 14,000 golf facilities. The country is home to 43% of the global golf courses, highlighting the need for products to keep the surface healthy and disease-free, maintaining its appearance, durability, and playability. Golf courses, sports fields, and professionally maintained lawns have higher aesthetic and functional standards, boosting the demand for fungicides.

The demand for fungicides in home gardens is expected to grow at a significant CAGR from 2025 to 2030. Consumers in the U.S. have substantially picked up on gardening as a beneficial hobby, as it provides a relaxed atmosphere while also proving to be beneficial for the property in the long term. A well-maintained garden increases the value of homes and their demand among buyers, encouraging residents to look after their plants and crops regularly. The growth of container gardening, rooftop gardens, and houseplants further creates demand for small-scale and easy-to-use fungicide solutions. Homeowners are resorting to watching online gardening tutorials, reading gardening magazines, and joining

Key U.S. Home And Garden Fungicides Company Insights

Some of the notable companies involved in the U.S. home and garden fungicides industry include Bayer AG, Certis USA, and The Scotts Company, among others.

-

Bayer AG is a multinational life sciences company that operates through three divisions - Crop Science, Pharmaceuticals, and Consumer Health. The company offers several products under its crop protection segment, including Acceleron (seed treatment), Adengo (herbicides), Belt (insecticides), Confidor (insecticides), Flint (fungicides), Luna (fungicides), and Prosaro (fungicides), among others. Bayer fungicides address a wide range of fungal diseases, ensuring comprehensive crop and plant protection.

-

Certis Biologicals is a leading provider of biological products for pest and disease management in agriculture, horticulture, and gardening. The company provides a range of biopesticides, including bactericides, molluscicides, herbicides, insecticides, miticides, and fungicides. Under the fungicides segment, Certis offers various solutions such as CONVERGENCE, Cueva, Double Nickle 55, Howler EVO, Kocide 2000-O, LifeGard, OSO, SoilGard 12G, and Theia, among others. A majority of these products are certified for use in organic farming by the U.S. Department of Agriculture (USDA) and the Organic Materials Review Institute (OMRI).

Key U.S. Home And Garden Fungicides Companies:

- Bayer AG

- Syngenta

- BASF

- Corteva

- Certis USA L.L.C.

- Central Garden & Pet Company

- Nufarm US

- Spectrum Brands, Inc.

- The Scotts Company LLC

- Atticus LLC

Recent Developments

-

In May 2024, BASF announced the launch of the Aramax Intrinsic fungicide, which has been developed for application on golf course fairways. The product is a dual-active fungicide that utilizes triticonazole and pyraclostrobin as ingredients to offer broad-spectrum control for a number of warm- and cool-season turf diseases, including snow mold, brown patch, large patch, and dollar spot on. The fungicide is also EPA-approved to provide health benefits to plants, such as enhancing growth efficiency and improving turf stress tolerance, creating a healthier playing surface.

-

In March 2024, Certis Biologicals announced that it had acquired several assets from AgBiome, including the widely used fungicides Theia and Howler. These products would be added to the company’s pest, disease, and weed control solutions portfolio, which is indicated for high-value and large-acre commodity crops. The Howler fungicide (Pseudomonas chlororaphis strain AFS0) and the Theia fungicide (Bacillus subtilis strain AFS032321) are both OMRI-listed products.

U.S. Home And Garden Fungicides Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 464.9 million

Revenue forecast in 2030

USD 608.8 million

Growth Rate

CAGR of 5.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, application

Key companies profiled

Bayer AG; Syngenta; BASF; Corteva; Certis USA L.L.C.; Central Garden & Pet Company; Nufarm US; Spectrum Brands, Inc.; The Scotts Company LLC; Atticus LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Home And Garden Fungicides Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. home and garden fungicides market report based on product, form, and application:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Inorganic

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Dry

-

Liquid

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Home Garden

-

Turf & Ornamentals

-

Golf Course

-

Lawn & Landscape

-

Ornamentals

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.