- Home

- »

- Medical Devices

- »

-

U.S. Home Healthcare Services Market Report, 2028GVR Report cover

![U.S. Home Healthcare Services Market Size, Share & Trends Report]()

U.S. Home Healthcare Services Market Size, Share & Trends Analysis Report By Type (Skilled, Unskilled), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-595-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Healthcare

Report Overview

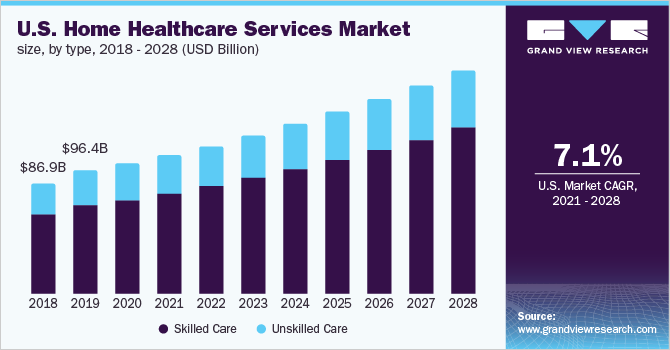

The U.S. home healthcare services market size was valued at USD 101.8 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 7.1% from 2021 to 2028. Major factors driving the market growth are increasing demand for home healthcare, the high prevalence of chronic diseases, and the launch of innovative payment models by the government. Home healthcare services are currently in demand due to major factors such as the high geriatric population and their preference to stay at home as they age, instead of a medical facility. According to the U.S. Census Bureau, as of 2020 56 million Americans were 65 years or older and their number is expected to reach 84 million by 2040. Moreover, patients who opt for home healthcare services following hospital discharge experience fewer instances of readmission, higher satisfaction, better outcomes, fewer emergency room visits, and lower costs, which prove to be important contributors, apart from high demand, for the growth of home healthcare industry.

The concern of multiple chronic conditions (MCC) among the U.S. population is a major medical and public health challenge. MCCs include a broad array of physical illnesses, such as heart disease, diabetes, respiratory illness, asthma, and arthritis. One of the major contributors to the requirement of home healthcare services in the U.S. is Alzheimer's disease (AD). According to the Alzheimer's Association, the prevalence of individuals aged 65 and older living with Alzheimer's dementia is expected to be around 6.2 million during 2021. Patients with dementias require more annual home health care visits than other older people, making the disease severity a decisive factor for the market growth.

COVID-19 U.S. home healthcare services market impact: 5.4% decline in growth rate from 2019 to 2020

Pandemic Impact

Post COVID-19 Outlook

The onset of the COVID-19 pandemic negatively affected the number of patients visiting the inpatient center.

Home health providers might focus on care programs such as hospital-at-home and SNF-at-home

Due to the increasing demand for telehealth services, reimbursement policies were modified to include new technologies.

Several additional CPT codes that were allowed telehealth coverage by CMS in the 2021 physician fee schedule, may return to pre-COVID-19 state after the pandemic is declared to have expired.

Expansion of the Home Health Value-Based Purchasing (HHVBP) model, declared by CMS in June 2021 in its proposed payment rule for 2022, is a significant change in the home health industry. Initially implemented in 2016 to create financial incentives to improve the quality of care, HHVBP has saved an average of around USD 141 million annually for Medicare since its inception. In addition, CMS has announced the increase of Medicare payments by 1.7% to home health agencies from 2022, which equates to an increase of around USD 310 million, and is expected to increase the affordability of care.

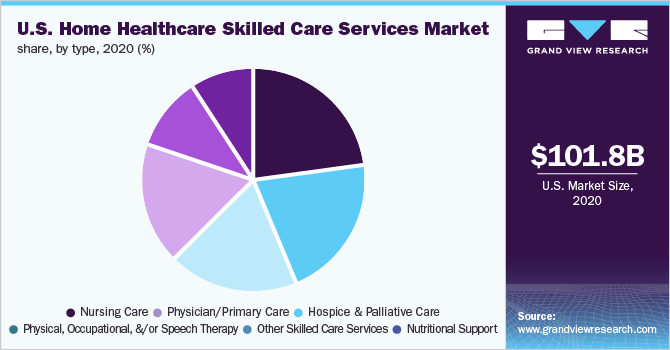

Type Insights

The type segment is categorized into skilled care and unskilled care. In 2020, the skilled care segment held the largest market share in terms of revenue and is expected to register the fastest growth over the forecast period. The nursing care sub-segment of skilled care is benefiting from the introduction of innovative programs such as SNF-at-home by key players, which provides quality care to the patients at the comfort of their homes.

The nursing care provided at home includes disease management, IV medication management, and wound care among others. Considering the benefits of providing nursing at home, service providers are taking initiatives to grow at-home skilled nursing programs, along with acute care models. For instance, South Carolina-based Prisma Health in July 2021 expanded its home recovery care program to its post-acute facility. Implementation of such programs helps patients reduce their hospital stay and in turn reduces the stress on hospital staff.

Primary care refers to healthcare services provided by a physician, generally by the most frequently contacted physician and is beneficial as the care providers are aware of the ongoing history with patients. Providing comprehensive primary care at home has proven to be highly effective in improving patient experience and reducing healthcare costs and encourages providers to establish home health dedicated programs. For instance, Home Based Primary Care (HBPC) is operated by the U.S. Department of Veterans Affairs (VA) to cater increasing veteran population with chronic disabling diseases. Such programs prove effective in reducing inpatient hospital stays and emergency room visits, thus reducing cost.

Key Companies & Market Share Insights

The U.S. home healthcare services market is highly fragmented with the presence of a few major players and a large number of small and medium-sized care providers. One of the major changes witnessed by the industry is the increasing utilization of technology, such as remote health monitoring (RPM) and teleconferencing with the care provider. Technology startups are launching innovative products to facilitate technology integration in-home healthcare services. In July 2021, Home Health Community Organization (HHCO) launched a technology platform to provide tools and other training resources for the skill development of its employees. Some of the prominent players operating in the U.S. home healthcare services market are:

-

Kindred Healthcare, LLC

-

Brookdale Senior Living Inc.

-

Sunrise Senior Living, LLC

-

Genesis Healthcare, Inc.

-

Capital Senior Living Corporation

-

Diversicare Healthcare Services, Inc.

-

Senior Care Center

-

Atria Senior Living, Inc.

-

Amedisys, Inc.

-

Home Instead, Inc.

U.S. Home Healthcare Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 108.5 billion

Revenue forecast in 2028

USD 175.7 billion

Growth Rate

CAGR of 7.1% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD Billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type

Country scope

U.S.

Key companies profiled

Kindred Healthcare, LLC; Brookdale Senior Living Inc.; Sunrise Senior Living, LLC; Genesis Healthcare, Inc.; Capital Senior Living Corporation; Diversicare Healthcare Services, Inc.; Senior Care Center; Atria Senior Living, Inc.; Amedisys, Inc.; Home Instead, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For this study, Grand View Research has segmented the U.S. home healthcare services market report based on type:

-

Type Outlook (Revenue, USD Billion, 2016 - 2028)

-

Skilled Care

-

Physician/primary care

-

Nursing Care

-

Physical, Occupational, and/or Speech Therapy

-

Nutritional Support

-

Hospice & Palliative Care

-

Other Skilled Care Services

-

-

Unskilled Care

-

Frequently Asked Questions About This Report

b. The U.S. home healthcare service market size was estimated at USD 101.8 billion in 2020 and is expected to reach USD 108.5 billion in 2021.

b. The U.S. home healthcare service market is expected to grow at a compound annual growth rate of 7.13% from 2021 to 2028 to reach USD 175.7 billion by 2028.

b. Skilled care dominated the U.S. home healthcare service market with a share of 73% in 2020. This is attributable to the introduction of innovative programs such as SNF-at-home by key players, which provides quality care to the patients at the comfort of their homes.

b. Some key players operating in the U.S. home healthcare service market include Kindred Healthcare, LLC, Brookdale Senior Living Inc., Sunrise Senior Living, LLC, Genesis Healthcare, Inc., Capital Senior Living Corporation, Diversicare Healthcare Services, Inc., Senior Care Center, Atria Senior Living, Inc., Amedisys, Inc., and Home Instead, Inc.

b. Key factors that are driving the U.S. home healthcare service market growth include increasing demand for cost-effective healthcare alternatives, the high prevalence of chronic diseases, and the launch of innovative payment models by the government.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."