- Home

- »

- Medical Devices

- »

-

U.S. Home Infusion Therapy Market, Industry Report, 2033GVR Report cover

![U.S. Home Infusion Therapy Market Size, Share & Trends Report]()

U.S. Home Infusion Therapy Market (2025 - 2033 ) Size, Share & Trends Analysis Report By Type (Product, Services), By Application (Anti-infective, Endocrinology, Hydration Therapy, Chemotherapy, Enteral Nutrition, Parenteral Nutrition), And Segment Forecasts

- Report ID: GVR-3-68038-956-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Home Infusion Therapy Market Summary

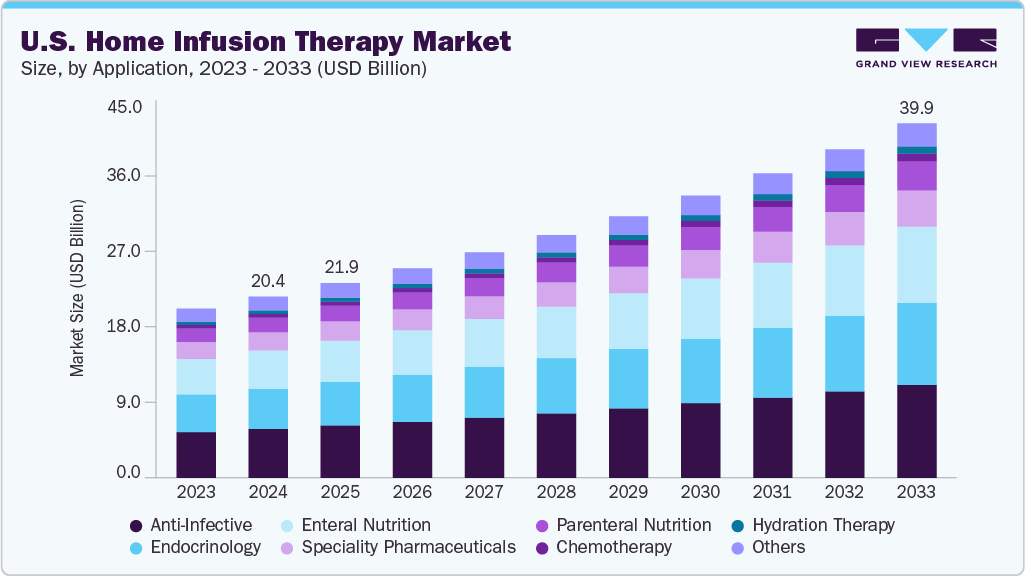

The U.S. home infusion therapy market size was estimated at USD 20.42 billion in 2024 and is expected to reach USD 39.96 billion by 2033, growing at a CAGR of 7.78% from 2025 to 2033. The increasing elderly population susceptible to severe health conditions is a significant factor driving market growth.

Key Market Trends & Insights

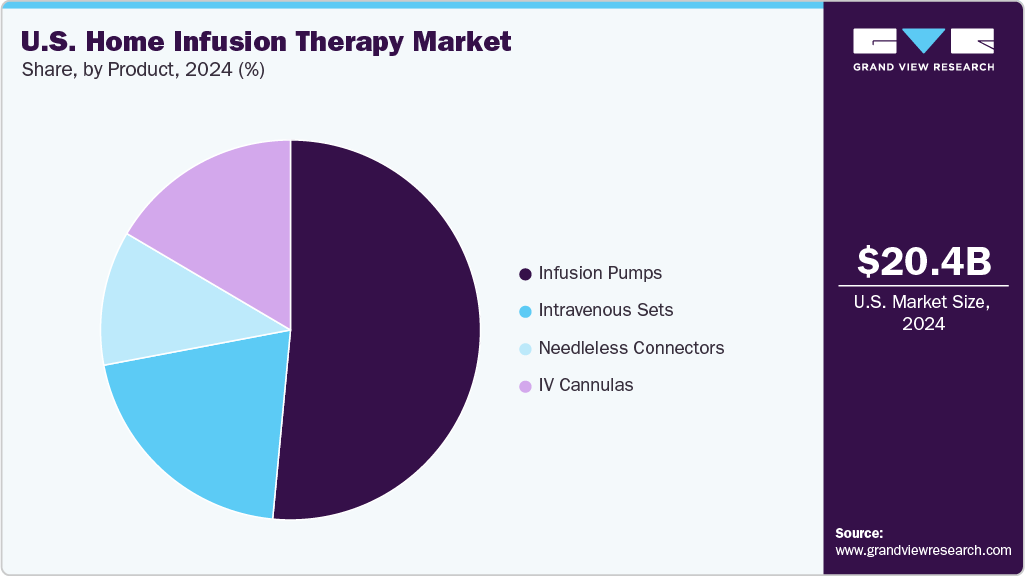

- Based on product, the infusion pumps segment held the highest market share of 51.50% in 2024.

- Based on applications, the anti-infective segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 20.42 Billion

- 2033 Projected Market Size: USD 39.96 Billion

- CAGR (2025-2033): 7.78%

In addition, the rising prevalence of disorders such as cancer, diabetes, chronic pain, and gastrointestinal diseases is anticipated to further stimulate growth in the U.S. market. Home infusion therapy provides various advantages for patients, including cost-effectiveness, improved health outcomes, enhanced convenience, and elevated safety standards.Aging is one of the leading risk factors for developing infections and associated complications. Thus, the rapidly aging U.S. population is anticipated to drive market growth. For instance, according to the Population Reference Bureau, the number of people aged 65 and older is projected to increase from 58 million in 2022 to 82 million by 2050. Increasing patients’ preference for home therapy is also driving the market growth. Home healthcare supports the daily life activities of patients and provides better access to skilled medical care. As compared to hospital treatment, home infusion therapy is cost-effective since it eliminates hospital stays and ultimately saves the patient’s money. Home infusion therapy also allows the patient to maintain higher safety due to less risk of hospital-acquired infections at home. This augments the demand for home treatment, thereby driving the market growth.

This country’s high prevalence of cancer, diabetes, and other chronic diseases propels market growth further. According to the American Cancer Society, nearly 1.9 million new cancer cases were expected to be diagnosed with 609,360 cancer deaths in 2022. The prevalence of diabetes in the U.S is also quite significant, which can be attributed to negative lifestyle choices and a stressful work environment. Moreover, there has been a constant surge in the prevalence of cardiovascular and chronic respiratory diseases in the country. In addition, factors such as a growing geriatric population and increasing volume of surgical procedures are expected to propel the country’s demand for intravenous infusion pumps in the forecast period.

Moreover, the government is expected to introduce stricter regulations and adopt new standards for safer & efficient practices. This progress is being achieved by improving national standards of care via the Infusion Therapy Standards of Practice and the Policies and Procedures for Infusion Nursing, along with upgrading policies of individual care providers. Moreover, new product launches and FDA approvals significantly contribute to market growth. For instance, in April 2024, Baxter received U.S. FDA clearance for its Novum IQ large volume infusion pump and Dose IQ safety software. This advancement enhances connected and intelligent infusion therapy, improving patient safety and care efficiency.

Market Characteristics & Concentration

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaboration activities, degree of innovation, impact of regulations, and regional expansion. The U.S. home infusion therapy market is fragmented, with the presence of several software and solution providers dominating the market. The impact of regulations on industry is high. Moreover, the degree of innovation, the level of merger & acquisition activities and the regional expansion of industry are moderate.

The industry experiences a moderate degree of innovation driven by technological advancements. Market players are launching new products to enhance their market presence. For instance, in April 2025, ICU Medical received FDA clearance for new additions to its infusion pump portfolio, including the Plum Solo single-channel and updated Plum Duo dual-channel precision IV pumps.

The industry is also characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to the desire to gain a competitive advantage in the industry, enhance product offerings, and consolidate in a rapidly growing market. For instance, in May 2022, Fresenius Kabi acquired Ivenix, Inc. This acquisition helped Fresenius to leverage its product portfolio by adding premium infusion therapy products.

“With us expanding in MedTech we will provide state-of-the-art and industry leading offerings in infusion therapy for the U.S. market. All for the long-term benefit of patients and our customers along the continuum of critical and chronical care. The acquisition is an ideal fit both in market offerings as well as competencies as we welcome an outstanding and truly dedicated healthcare and technology team to our global Fresenius Kabi family.”- Michael Sen, Chief Executive Officer, Fresenius Kabi.

The regulatory framework for the U.S. home infusion therapy market is primarily governed by the Centers for Medicare & Medicaid Services (CMS). Providers must comply with strict guidelines governing drug administration, patient safety, and reimbursement protocols. The U.S. Food and Drug Administration (FDA) regulates infusion devices and software to ensure safety and efficacy, while reimbursement policies influence market accessibility and growth.

The industry experiences moderate regional expansion. Moreover, key players are partnering with healthcare providers to integrate their infusion pump systems with the software platforms.

Type Insights

Based on product, the infusion pumps segment held the largest revenue share of 51.50% in 2024. The infusion pumps segment is further categorized into ambulatory infusion pumps, elastomeric pumps, syringe pumps, insulin pumps, patient-controlled analgesics (PCA), and volumetric pumps. This growth is attributed to their increasing use and efficiency in delivering nutrition, medications, and other required fluids in required amounts. In addition, modernized infusion pumps are equipped with alert systems to avoid the risk of adverse drug interaction or when the pump parameters are incorrectly set. These factors are expected to drive segment growth in the forthcoming years, thus driving market growth.

The needleless connectors segment is anticipated to grow at the fastest CAGR, owing to various benefits, such as less risk of bacterial contamination and higher protection against needlestick injuries. Moreover, needleless connectors reduce the risk of health-care associated bloodstream infections (HA-BSIs).

Application Insights

Based on application, the anti-infective segment held the largest market share of 26.94% in 2024 due to the rising incidence of bacterial, viral, and fungal infections. Patients with conditions such as sepsis, osteomyelitis, and complicated urinary tract infections often require prolonged intravenous antibiotic therapy, which is increasingly managed at home. The segment’s growth is also supported by technological innovations and favorable reimbursement policies. Portable infusion pumps and catheter-based delivery systems allow safe and efficient administration of antibiotics and antivirals in the home setting. Moreover, the CMS and private payers increasingly reimburse for outpatient and home-based anti-infective therapies, encouraging broader adoption, thereby fueling market growth.

The chemotherapy segment is anticipated to grow at the fastest CAGR from 2025 to 2033, owing to the rising prevalence of cancer and increasing demand for convenient treatment options. Home infusion enables patients to receive chemotherapy in a familiar environment, reducing the burden of frequent hospital visits. Growth in this segment is also driven by the cost advantages of home-based chemotherapy compared to inpatient treatment. Payers and healthcare providers are increasingly promoting home infusion to reduce hospital stays and optimize resource utilization.

Key U.S. Home Infusion Therapy Companies Insights

Key players operating in the U.S. home infusion therapy market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. Home Infusion Therapy Companies:

- B. Braun Melsungen

- Baxter International,

- Caesarea Medical Electronics Ltd.

- CareFusion

- Fresenius Kabi

- ICU Medical

- JMS CO., LTD.

- Smiths Medical, Inc.

- Terumo Corporation

- Coram LLC

- Option Care Enterprises, Inc.

- BioScrip, Inc.

- BriovaRx Infusion Services

- Paragon Healthcare

Recent Developments

-

In January 2025, ReGlow launched the Micro Infusion System, a 24K gold-plated microneedling skincare tool with an anti-aging serum designed for at-home use.

-

In December 2024, Baxter International announced five new injectable pharmaceutical product launches in the U.S. These include Micafungin, Cyclophosphamide, Pantoprazole Sodium, Cefazolin, and Vasopressin.

-

In November 2024, ICU Medical, Inc. and Otsuka Pharmaceutical Factory, Inc. partnered to enhance the manufacturing and innovation of IV solutions in the North American market. This collaboration aims to provide a valuable range of complementary infusion products, such as IV infusion pumps, for customers in North America.

-

In August 2023, Uptiv Health launched a hybrid infusion care model combining personalized in-person therapy with virtual care management through a consumer-friendly digital platform.

U.S. Home Infusion Therapy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21.95 billion

Revenue Forecast in 2033

USD 39.96 billion

Growth rate

CAGR of 7.78% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application

Country scope

U.S.

Key companies profiled

B. Braun Melsungen; Baxter International; Caesarea Medical Electronics Ltd.; CareFusion; Fresenius Kabi; ICU Medical; JMS CO., LTD.; Smiths Medical, Inc.; Terumo Corporation; Coram LLC; Option Care Enterprises, Inc.; BioScrip, Inc.; BriovaRx Infusion Services; Paragon Healthcare

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Home Infusion Therapy Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. home infusion therapy market report based on Type, and application.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Product

-

Infusion PumpsIntravenous Sets

-

Elastomeric

-

Electromechanical

-

Gravity

-

Others

-

-

Intravenous Sets

-

IV Cannulas

-

Needleless Connectors

-

- Services

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Anti-infective

-

Endocrinology

-

Diabetes

-

Others

-

-

Hydration Therapy

-

Athletes

-

Others

-

-

Chemotherapy

-

Enteral Nutrition

-

Parenteral Nutrition

-

Specialty Pharmaceuticals

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. home infusion therapy market size was estimated at USD 20.42 billion in 2024 and is expected to reach USD 21.95 billion in 2025.

b. The U.S. home infusion therapy market is expected to grow at a compound annual growth rate of 7.78% from 2025 to 2033 to reach USD 39.96 billion by 2033.

b. Anti-Infective segment dominated the U.S. home infusion therapy market with a share of 26.94% in 2024. This is attributable to extensive use as antifungal, antibiotics, and antiviral agent at-home care.

b. Some key players operating in the U.S. home infusion therapy market include B. Braun Melsungen; Baxter International; Caesarea Medical Electronics Ltd.; CareFusion; Fresenius Kabi; ICU Medical; JMS CO., LTD.; Smiths Medical, Inc.; Terumo Corporation

b. Key factors that are driving the market growth include rise in elderly population prone to various severe disorders and increasing preference for home therapy.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.