- Home

- »

- Medical Devices

- »

-

U.S. Hormone Therapy Market Size, Industry Report, 2033GVR Report cover

![U.S. Hormone Therapy (Retail Side) Market Size, Share & Trends Report]()

U.S. Hormone Therapy (Retail Side) Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Sex Hormones, Thyroid Hormones), By Indication, By Route of Administration (Oral, Parenteral), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-700-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

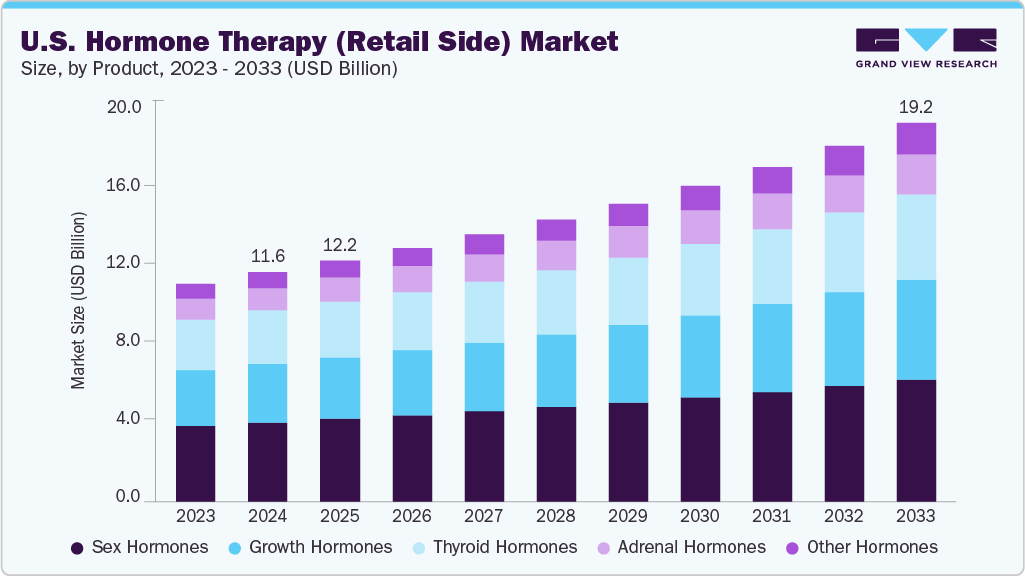

The U.S. hormone therapy (retail side) market size was estimated at USD 11.63 billion in 2024 and is projected to reach USD 19.22 billion by 2033, growing at a CAGR of 5.83% from 2025 to 2033. This growth is driven by an increasing aging population and rising hormonal disorder prevalence. In addition, advances in delivery technologies, including oral pills, transdermal patches, subcutaneous pellets, and injectables, have enhanced efficacy, convenience, and adherence.

Moreover, the pharmacies now offer convenient dispensing and counseling, and platforms such as Ro, Noom, and Midi Health bundle telemedicine, online prescribing, and at-home delivery of hormones, with some combining GLP‑1 weight-loss treatments, driving sales upward.

Rising Incidence of Hormone-Sensitive Cancers

The rising incidence of hormone-sensitive cancers, such as breast, prostate, and endometrial cancers, is a significant driver for the hormone therapy market in the U.S. Hormone therapies such as anti-estrogens, aromatase inhibitors, and androgen deprivation therapies are integral to cancer treatment regimens, often prescribed for long-term use. According to a study published in October 2024 by Springer Nature Limited, hormone receptor-positive breast cancer (BC) is the most common subtype and is typically associated with a relatively favorable prognosis. Globally, breast cancer is the most frequently diagnosed cancer, accounting for nearly 30% of all cancers among women. In the U.S., estimates indicated that approximately 13% of women will develop breast cancer during their lifetime, with around 287,850 new cases projected in 2022.

Growing Policy And Investment Support in Menopause Care

The market is experiencing significant growth, driven by the expanding policy support and significant private-sector investment in menopause care, positioning retail pharmacies as critical beneficiaries and facilitators of this momentum. As state and federal governments introduce laws mandating insurance coverage, clinical training, and workplace equity in menopause care, pharmacies are becoming frontline access points for millions of women seeking hormone replacement therapies (HRT).

Policy Mandates And Market Innovation Driving Hormone Therapy Adoption

In addition, states such as California, Illinois, and Louisiana have already passed groundbreaking legislation requiring insurers to cover medically necessary hormone therapies and mandating improved menopause education for healthcare providers. Such mandates increase prescription volumes and drive insured demand through retail channels. Simultaneously, innovative offerings from startups such as Evernow and established players, including CVS Health, is reshaping public perception and encouraging more women to seek treatment.

Enhanced Diagnostics And Awareness

Advancements in diagnostic tools and screening protocols are enabling earlier and more accurate identification of conditions such as hypogonadism, hypothyroidism, and gender dysphoria, which were previously underdiagnosed. This shift is particularly visible in the rising number of people pursuing gender-affirming hormone therapy as social acceptance and clinical support grow. As more individuals become informed about the availability and benefits of hormone therapy, pharmacies are increasingly positioned as convenient, accessible points of care where patients can fill prescriptions, receive pharmacist guidance, and access affordability programs.

Retail Pharmacies Advancing Hormone Therapy Awareness Through Workplace Initiatives

Several pharmacies are engaged in awareness programs and initiatives intended to raise awareness about such therapies. For instance, in March 2025, CVS Health highlights that it has become the first organization in the U.S. to earn the Menopause Friendly Accreditation from MiDOViA, a leading organization committed to advancing menopause education, advocacy, and support in the workplace. This recognition is awarded to companies that move beyond basic awareness, demonstrating a genuine commitment to creating impactful and lasting improvements in how menopause care is addressed and supported within their workplace culture and policies.

Growing Expansion of Insurance Coverage

The expansion of insurance coverage for menopausal and endocrine therapies is emerging as a significant driver in the hormone therapy market in the U.S., particularly from the perspective of pharmacies as key distribution and patient engagement channels. Traditionally, hormone replacement therapy (HRT) for menopausal symptoms and endocrine disorders such as hypothyroidism or hypogonadism had varying degrees of insurance coverage, often leading to out-of-pocket expenses that deterred consistent use. Recent policy shifts and payer strategies are increasingly recognizing the clinical necessity and long-term cost-effectiveness of these therapies, thereby improving accessibility and stimulating market growth at the retail level.

Expansion of Value-Added Services And Insurance Coverage in BTC Pharmacies

Moreover, integrated health networks and BTCpharmacies are investing in value-added services, such as hormone level monitoring, pharmacist-led counseling, and AI-driven adherence tools, all of which are reimbursable under expanded insurance coverage in some states. For instance, CVS’ MinuteClinic has begun offering menopause consultations, some of which are covered by commercial insurers, making the pharmacy a hub for both diagnosis and treatment.

Pricing Analysis in Online vs. Offline Channels

Branded vs. Generic Price Variation Across Channels

Example: Bijuva (estradiol + progesterone)

-

BTC pharmacy (offline): Up to USD 265/month for 30 capsules (~USD 8.80/capsule), typically without insurance or discounts.

-

Online/DTC platforms: Subscription packages range from USD 85-USD 130/month, often including virtual consults and delivery, but frequently not insurance-integrated.

-

Observation: DTC providers lower upfront costs by bundling care, while retail pharmacies tend to have higher sticker prices unless supported by insurance or manufacturer coupons.

Form-Wise Pricing Benchmarks

HRT Form

Price Range - Online

Price Range - BTC (Offline)

Notable Discounts

Creams

Generic Estrace: USD 25-USD 40 (GoodRx)

Estrace: ~USD 127.90 / Premarin: ~USD 400 ; USD25 w/ coupon

AbbVie PAP (Estrace), Pfizer discount cards

Gels

Divigel: ~USD 40/month online

EstroGel: USD162.31-USD199.98 (GoodRx)

PAN Foundation, insurance copay cards

Patches

Estradiol Patch: <USD 40/month (GoodRx)

Climara Pro: ~USD 250 (discounted), Avg. cash: USD 317.81

Bayer assistance & co-pay savings

Tablets

Estrace generic: <USD 10 for 90-day supply (GoodRx)

Premarin: USD 200-USD 273.22/month (cash)

Pfizer savings cards

Injections

Delestrogen: <USD 50 (generic, GoodRx)

Depo-Estradiol: ~USD 180-USD 269.93 cash

Pfizer Rx Pathways

Market Concentration & Characteristics

The market is fragmented, with many small players entering the market and launching new innovative products. The degree of innovation is medium, the level of mergers & acquisitions activities is medium, and the threat of substitutes is low. The impact of regulations on the market is high, and the regional expansion of players is low.

Innovations include the rise of telemedicine platforms and specialty pharmacies have improved access to hormone therapy, making distribution more convenient and enhancing patient adherence. Innovations such as long-acting growth hormone formulations, such as Novo Nordisk’s Sogroya, have also increased patient compliance, further boosting demand. Companies such as Pfizer (with Genotropin) and Ascendis Pharma have reported growing U.S. sales, indicating intense market penetration.

The market saw notable consolidations as larger companies aim to expand their reach and capabilities. For instance, in October 2021, 23andMe acquired telehealth provider Lemonaid Health for approximately USD 400 million. This acquisition marks a significant shift as 23andMe integrates personalized genomic insights with on-demand medical services and digital pharmacy capabilities. By leveraging Lemonaid’s telehealth platform, 23andMe aims to offer a more comprehensive, end-to-end healthcare experience from genetic risk assessment to diagnosis, prescription, and treatment delivery.

The continuous policy changes and upgradation of regulations are expected to hinder market growth. RCM is relatively low due to changes in regulatory frameworks, specific demands of healthcare organizations, and varying reimbursement policies across the U.S. However, with the growing adoption of digital healthcare solutions and the increasing need for efficient RCM, the market is expected to witness significant growth in the coming years.

The hormone therapy landscape has evolved, with treatments such as menopause HRT and testosterone replacement now available through retail pharmacies and online platforms. Major drugstore chains, including CVS, Walgreens, and Walmart, are dispensing these therapies alongside trusted pharmacist support. Online services such as Hims & Hers, Ro, and Melo Health offer hormone testing, virtual consultations, and home delivery, often integrating HRT with weight-loss medications in subscription models. This direct-to-consumer approach has increased accessibility for patients seeking menopause care and testosterone therapy.

Product Insights

The sex hormones segment dominated the market in 2024 with a market share of over 34.71%. This growth is driven by an aging population, increased awareness of hormonal imbalances, and a rising demand for gender-affirming care. Key factors contributing to this growth include the increasing prevalence of menopause-related symptoms in women and andropause in men, leading to greater demand for estrogen, progesterone, and testosterone therapies. The rise of direct-to-consumer telehealth platforms, such as Everlywell and Hims & Hers, has also improved access to hormone treatments by offering convenient testing and prescription services. In addition, there is a growing utilization of compounded bioidentical hormone replacement therapies (BHRT) in retail pharmacies, as patients seek personalized and perceived "natural" options.

The adrenal hormones segment is anticipated to grow at a significant CAGR during the forecast period, owing to increasing consumer awareness of adrenal fatigue, hormonal imbalances associated with aging, and the rising popularity of bioidentical hormone replacement therapies (BHRT). Adrenal hormones such as DHEA (dehydroepiandrosterone) and cortisol modulators are often marketed as supplements to enhance energy, mood, and stress resilience, particularly for middle-aged and older adults. This retail growth is further supported by an increase in online health platforms, wellness stores, and integrative clinics that offer over-the-counter adrenal support supplements. For instance, DHEA supplements are commonly available in chains such as GNC and CVS, online through platforms such as Amazon, and on specialty sites like Life Extension.

Indication Insights

The menopause & andropause management segment dominated the market in 2024 with a market share of over 21.15%. This is attributed to the increased awareness, an aging population, and a wider availability of over-the-counter (OTC) and direct-to-consumer (DTC) hormone-based solutions. For menopause, demand is fueled by approximately 1.3 million American women entering menopause each year, leading to greater interest in alleviating symptoms such as hot flashes, mood changes, and sleep disturbances. Products such as bioidentical hormone creams, vaginal estrogen rings, and patches from brands such as Estroven and Amberen have become popular due to their non-prescription accessibility.

The gender affirming therapy segment is anticipated to grow at a significant CAGR during the forecast period, owing to the increasing societal acceptance of transgender and non-binary individuals, expanded insurance coverage, and greater awareness among healthcare providers. Pharmacies, such as CVS Health and Walgreens, have played a crucial role in improving access to hormone replacement therapy (HRT) by offering more inclusive services and employing trained pharmacists. A major factor contributing to this growth is the expansion of state-level and private insurance policies that cover gender-affirming treatments, particularly following the non-discrimination provisions of the Affordable Care Act.

Route of Administration Insights

The transdermal segment dominated the market in 2024 with a market share of over 31.77%. This growth is primarily due to patient preference for non-invasive, convenient, and consistent delivery systems. This method, which includes patches, gels, and creams, provides uniform hormone absorption through the skin, minimizing the peaks and troughs often associated with oral delivery.

The oral segment is anticipated to grow at a significant CAGR during the forecast perioddue to its convenience, high patient compliance, and the availability of both generic and branded formulations. Oral hormone therapies, such as estrogen and progestin pills for managing menopausal symptoms, as well as testosterone undecanoate for male hypogonadism, are preferred by both prescribers and patients because of their ease of use and non-invasive nature.

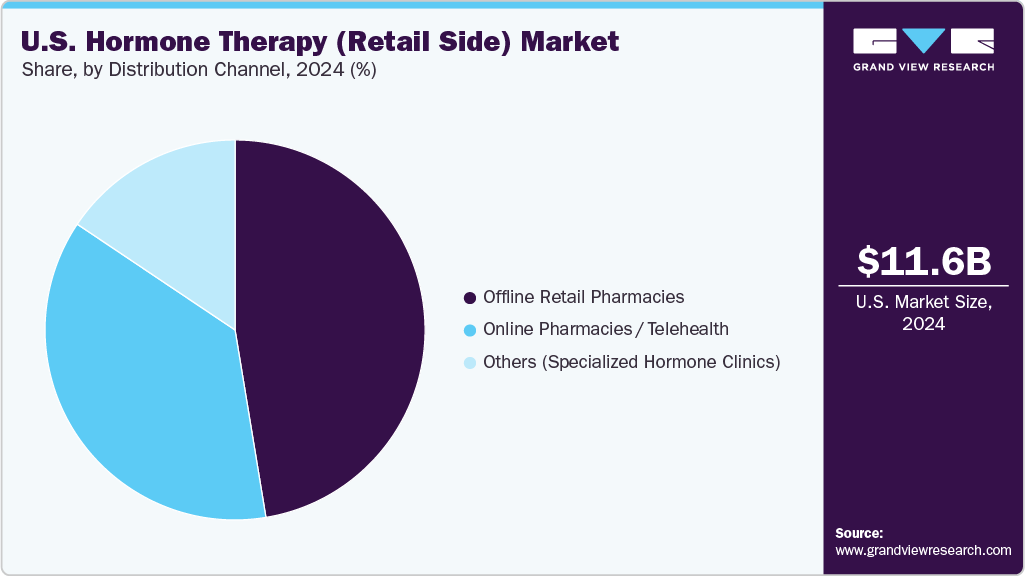

Distribution Channel Insights

The offline retail pharmacies segment held a significant share of 47.40% in 2024. This growth is driven by increasing demand for personalized treatment, an aging population, and rising awareness of hormonal imbalances, especially among menopausal women and older men. Offline pharmacies continue to flourish because they offer trust and immediacy, which is particularly important for patients who prefer face-to-face consultations with pharmacists for sensitive treatments like hormone replacement therapy (HRT).

The online pharmacies/telehealth is anticipated to grow at a significant CAGR during the forecast period. This increase is driven by changing consumer behaviors, technological advancements, and a greater need for accessible healthcare. A large part of this growth is linked to a rising awareness and demand for hormone replacement therapy (HRT), especially for issues such as menopause, low testosterone (Low T), and gender-affirming care.

Key U.S. Hormone Therapy (Retail Side) Companies:

- CVS Health

- Walgreens Boots Alliance, Inc.

- Walmart Pharmacy

- The Kroger Co.

- Albertsons

- Costco Wholesale Corporation

- Hims & Hers Health, Inc

- Lemonaid Health, Inc. (acquired by 23andMe in November 2021)

- Amazon.com, Inc.

- GoodRx, Inc.

Recent Developments

-

In October 2021, 23andMe acquired telehealth provider Lemonaid Health for approximately USD 400 million, combining its consumer-genetics platform with Lemonaid’s on-demand medical and digital pharmacy services.

-

In August 2021, T Clinics USA opened a new men’s health clinic in Naples, Florida, offering testosterone replacement therapy (TRT) and a range of peptide treatments such as CJC-1295, Ipamorelin, BPC-157, AOD-9604, and semaglutide to support male vitality, metabolism, muscle growth, and healing.

U.S. Hormone Therapy (Retail Side) Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.21 billion

Revenue forecast in 2033

USD 19.22 billion

Growth rate

CAGR of 5.83% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, indication, route of administration, distribution channel

Country scope

U.S.

Key companies profiled

CVS Health; Walgreens Boots Alliance, Inc.; Walmart Pharmacy; The Kroger Co.; Albertsons; Costco Wholesale Corporation; Hims & Hers Health, Inc.; Lemonaid Health, Inc. (acquired by 23andMe in November 2021); Amazon.com, Inc.; GoodRx, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Hormone Therapy (Retail Side) Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. hormone therapy (retail side) market report based on product, indication, route of administration, and distribution channel:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Sex Hormones

-

Estrogen Replacement Therapy (ERT)

-

Testosterone Replacement Therapy (TRT)

-

Progesterone Therapy

-

Combined Hormone Therapy

-

-

Thyroid Hormones

-

Growth Hormones

-

Adrenal Hormones

-

Other Hormones

-

-

Indication Outlook (Revenue, USD Billion, 2021 - 2033)

-

Menopause & Andropause Management

-

Hypothyroidism

-

Hypogonadism

-

Growth Hormone Deficiency

-

Gender Affirming Therapy

-

Fertility Treatment

-

Cosmetic Applications

-

Other Indications

-

-

Route of Administration Outlook (Revenue, USD Billion, 2021 - 2033)

-

Oral

-

Parenteral

-

Transdermal

-

Other Route of Administration

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Offline Retail Pharmacies

-

Large chains

-

Independent pharmacies

-

-

Online Pharmacies / Telehealth

-

Pure-play online pharmacies

-

Telehealth & subscription-based DTC brands

-

-

Others (Specialized Hormone Clinics)

-

Frequently Asked Questions About This Report

b. The U.S. hormone therapy (retail side) market size was estimated at USD 11.63 billion in 2024.

b. The U.S. hormone therapy (retail side) market is expected to grow at a compound annual growth rate of 5.83% from 2025 to 2033 to reach USD 19.22 billion by 2033.

b. The sex hormones segment dominated the U.S. hormone therapy (retail side) market with a market share of over 34.71%. This growth is driven by an aging population, increased awareness of hormonal imbalances, and a rising demand for gender-affirming care.

b. Some key players operating in the U.S. hormone therapy (retail side) market include CVS Health, Walgreens Boots Alliance, Inc., Walmart Pharmacy, The Kroger Co., Albertsons, Costco Wholesale Corporation, Hims & Hers Health, Inc., Lemonaid Health, Inc., Amazon.com, Inc., GoodRx, Inc.)

b. The market growth is driven by the increasing aging population and rising prevalence of hormonal disorders. In addition, advances in delivery technologies, including oral pills, transdermal patches, subcutaneous pellets, and injectables, have enhanced efficacy, convenience, and adherence.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.