- Home

- »

- Medical Devices

- »

-

U.S. House Call Market Size, Share & Trends Report, 2023GVR Report cover

![U.S. House Calls Market Size, Share & Trends Report]()

U.S. House Calls Market (2023 - 2030) Size, Share & Trends Analysis Report By Service (Primary Care, Urgent Care, Preventive Care, Mobile Clinical Testing, Chronic care Management) And Segment Forecasts

- Report ID: GVR-4-68039-208-0

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

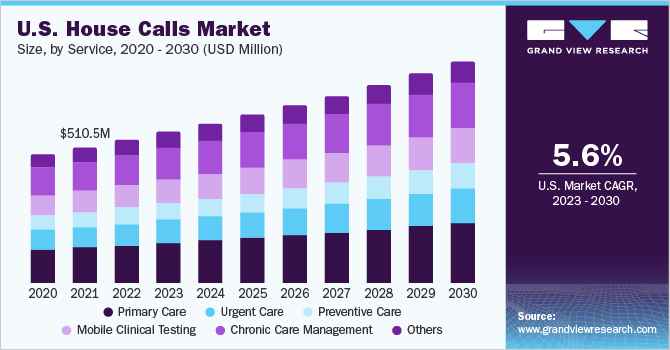

The U.S. house calls market size was valued at USD 537.7 million in 2022 and is expected to grow at a CAGR of 5.62% from 2023 - 2030. Increasing demand for cost-efficient, accessible, and convenient services for healthcare and wellness is expected to drive the industry growth during the forecast period. House call practices in the U.S. are expected to reduce the hospital expenditure for Medicare beneficiaries with chronic conditions. Thus, the house call market is expected to witness exponential growth in the coming years due to affordable, effective, and convenient on-demand healthcare services provided by these practices.

The Federal government has taken initiatives to support house call providers by relaxing the restrictions on telehealth in Medicare for providing better reimbursement to physicians. In July 2021, the Center for Medicare & Medicaid Services (CMS) proposed a physician payment rule involving an annual physician payment schedule for improving healthcare services by encouraging physicians to opt for house calls, e-consultation, and other similar services through better reimbursement.

Certain states in the U.S. with less than full-practice authority require nurse practitioners to work as part of a physician practice or enter into a contract with a physician to provide medical care, whether that care is in a hospital, doctor’s office, or a patient’s home. Minimizing restrictions on the range of services that practitioners can offer will in turn increase the availability of care providers.

App-based on-demand physician house call service is one of the technological advancements in healthcare that is trending. App-based on-demand house call services are attracting the U.S. population, being a convenient, timesaving, & cost-saving option, especially in case of acute health problems where home services are the best option. These services are reducing hospitalization time for patients, and saving costs for them, especially for long-term chronic care. The Med Star Hospital center, a leading healthcare center in the U.S., witnessed a 9% decrease in the hospitalization rate, indicating an impact of app-based house call services.

Impact of COVID-19 on U.S. House Calls Market: 0.76% decline in market growth from 2020 to 2021

Pandemic Impact

Post COVID Outlook

The COVID-19 pandemic has created a rapid shift in the U.S. healthcare system. Physician house call practices witnessed an exponential demand for chronic conditions management and urgent care during the ongoing COVID -19 pandemic

Post COVID-19, the demand for house call services has increased. Most of the multispecialty hospitals are extending house call services. Primary care, Urgent Care, and Chronic Care Management via house calls are expected to have importance due to the quality results in less time & cost via house calls

Restrictions during the pandemic have resulted in the development of web-based technology solutions in every sector to manage the crisis. Telemedicine app-based services are trending in the pandemic, enabling quality healthcare services with the convenience of being at home. Most of the hospitals in the U.S. have started app-based teleconsultation services as well as home treatment services. This new model of house call health care services has become an integral part of healthcare services

The recent lifting of restrictions on all sorts of healthcare services has not decreased the high demand for web-based house call services. Hence, telemedicine services will continue to be an integral part of the healthcare industry, creating the best experience for providers & receivers of the services, as teleconsultation will be opted for before a patient visits hospital

As per a report by the Commonwealth Development Fund, there is a need to reduce healthcare expenditure in the U.S., as excess healthcare expenditure is impacting the ability to meet critical public health needs and affecting the country's economic competitiveness. The emerging telemedicine & house call services in recent times are a great option for reducing healthcare expenditure, as telehealth saves healthcare costs in multiple ways. Home visits provided by mobile physician practices have eliminated wait-time for nonurgent or new cases in hospitals and have reduced healthcare expenditure.

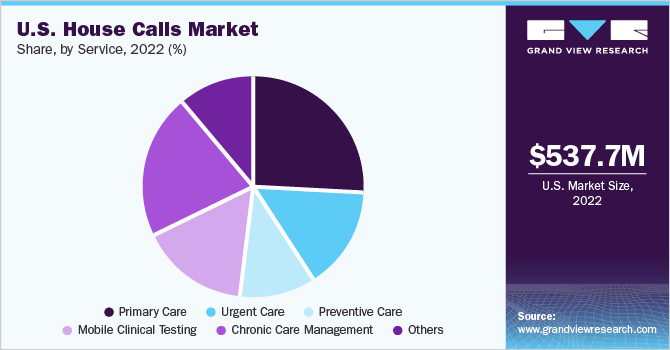

Service Insights

The service segment is categorized into primary care, urgent care, preventive care, mobile clinical testing, chronic care management, and others. In 2022, the primary care segment held the largest market share of 26.45% in terms of revenue and is expected to witness the highest growth with a CAGR of 6.04% during the forecast period. Availability of medical care in the comfort of home and increased preference for opting for in-home care due to the COVID-19 pandemic are some factors positively impacting the market growth.

Patients with chronic medical conditions - such as diabetes, Parkinson’s disease, Alzheimer’s disease, and Chronic Obstructive Pulmonary Disease (COPD) among others - require medical care regularly. Such people might not always be able to visit medical centers and may require frequent care which is leading to the high demand for house call services for chronic care management. Although high demand benefits providers, a simultaneous increase in cost might negatively impact payers. Thus, undertaking initiatives such as mergers & acquisitions of providers may help address this issue.

Mobile Clinical Testing includes mobile diagnostic services, both radiological- and laboratory-based services. Analyzing clinical tests plays an important role in disease diagnosis; for instance, according to the CDC, 70% of medical decisions are dependent on laboratory test results. factors such as busy schedules and difficulties in maintaining work-life balance, new care providers are making house call services available for clinical testing. For instance, Evera Technologies, established in November 2020, allows individuals to schedule on-demand, at-home blood draw by a mobile phlebotomist. Moreover, the COVID-19 pandemic is contributing to the high demand for mobile clinical testing services.

Key Companies & Market Share Insights

The U.S. house calls market is highly competitive. The top players are adopting various strategies, such as market expansion, mergers & acquisitions, and partnerships to strengthen their presence in the market. For Instance, in March 2021, Heal announced a partnership with Medley Pharmacy to help patients access critical prescriptions and medication without leaving home. Some of the prominent players in the U.S. house call market include:

-

SOS Doctors House Calls, Inc

-

Heal

-

Doctor on Demand, Inc

-

Resurgia Health Solutions LLC

-

MDLIVE, Inc

-

House Call Doctors Loss Angeles

-

Mount Sinai Visiting Doctors

-

Visiting Physician Association

-

Urgent Med Housecalls

-

House Call Doctors Medical Group

U.S. House Calls Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 566.8 million

Revenue forecast in 2030

USD 831.2 million

Growth Rate

CAGR of 5.62 % from 2022 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service

Country scope

U.S.

Key companies profiled

SOS Doctors House Calls, Inc; Heal; Doctor on Demand, Inc; Resurgia Health Solutions LLC; MDLIVE, Inc; House Call Doctors Loss Angeles; Mount Sinai Visiting Doctors; Visiting Physician Association; Urgent Med Housecalls; House Call Doctors Medical Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at country level and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. house calls market report based on service:

-

Service Outlook (Revenue, USD Million, 2017 - 2030)

-

Primary Care

-

Urgent Care

-

Preventive Care

-

Mobile Clinical Testing

-

Chronic Care Management

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. house calls market size was estimated at around USD 537.7 million in 2022 and is expected to reach around USD 566.8 million in 2023.

b. The U.S. house calls market is expected to grow at a compound annual growth rate of 5.62% from 2023 to 2030 to reach around USD 831.2 million by 2030.

b. Primary care dominated the U.S. house calls market with a share of 26.5% in 2022. This is attributed to the rising demand for primary care services from home-bound patients in the U.S.

b. Some key players operating in the house calls market include Heal; SOS Doctor House Call, Inc.; Urgent Med Housecalls, House Call Doctor Los Angeles, Housecall Doctors Medical Group; Doctor On Demand, Inc., Resurgia Health Solutions LLC., MDLIVE Inc., Mount Sinai Visiting Doctors; VISITING PHYSICIANS ASSOCIATION.

b. Key factors driving the U.S. house call market growth include rising demand for value-based healthcare services and increasing demand from the geriatric population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.