- Home

- »

- Distribution & Utilities

- »

-

U.S. HVDC Converter Station Market, Industry Report, 2033GVR Report cover

![U.S. HVDC Converter Station Market Size, Share & Trends Report]()

U.S. HVDC Converter Station Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Bi-Polar, Monopolar, Back-to-Back, Multi Terminal), By Technology (Line Commutated Converter (LCC) and Voltage Source Converter (VSC)), And Segment Forecasts

- Report ID: GVR-4-68040-690-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. HVDC Converter Station Market Summary

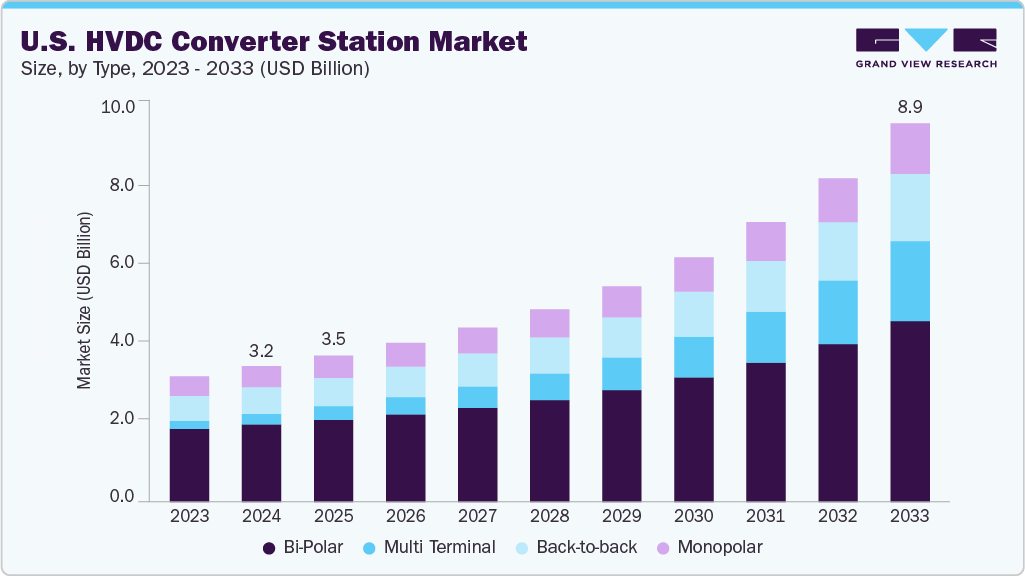

The U.S. HVDC converter station market size was estimated at USD 3.20 billion in 2024 and is projected to reach USD 8.92 billion by 2033, growing at a CAGR of 11.8% from 2025 to 2033. This growth is primarily driven by rising investments in long-distance high-voltage transmission infrastructure, grid modernization initiatives, and increasing integration of renewable energy sources such as solar and wind.

As the U.S. energy sector transitions towards a more sustainable and interconnected grid, deploying HVDC (High Voltage Direct Current) converter stations is critical for efficient power transfer, reduced line losses, and enhanced grid stability across vast geographies.

HVDC converter stations enable point-to-point bulk power transmission and link asynchronous grids. Their use is especially prominent in cross-country transmission, offshore wind integration, and interconnection of renewable-rich remote regions with high-demand urban centers. Compared to AC systems, HVDC offers lower transmission losses and better control over power flow, making it a strategic choice for grid operators. In the U.S., growing offshore wind capacity in the Northeast, energy exchange between the Eastern and Western Interconnections, and the federal focus on grid resilience contribute to robust market demand. Furthermore, technological advancements in Voltage Source Converter (VSC) systems and public-private investments in clean energy infrastructure are expected to support steady market expansion through 2033.

Drivers, Opportunities & Restraints

The U.S. HVDC converter station industry is gaining strong traction due to the surging demand for long-distance, high-capacity, and energy-efficient power transmission solutions. As utilities, transmission system operators, and renewable developers aim to enhance grid stability and interconnectivity, HVDC converter stations offer a proven method to reduce transmission losses and control power flow more precisely. The rising integration of offshore wind, solar farms, and interregional power links accelerates HVDC deployment. At the same time, government-led grid modernization programs and decarbonization targets further reinforce market momentum across the United States.

Opportunities in the U.S. market are expanding as HVDC converter stations become integral to multi-gigawatt transmission projects, cross-border interconnections, and large-scale renewable energy corridors. Advances in Voltage Source Converter (VSC) technologies enable more compact, modular, and flexible station designs, making HVDC systems viable for urban and offshore applications. However, several restraints persist. The high upfront capital costs associated with station construction, equipment procurement, and permitting can delay project implementation. Moreover, complex regulatory approvals and the need for specialized technical expertise may limit faster adoption. Despite these challenges, the long-term outlook remains optimistic, backed by the market’s critical role in enabling a cleaner, more resilient U.S. power grid.

Type Insights

The Bi-Polar HVDC converter station segment led the market with the largest revenue share of 57.59% in 2024. This dominant position is largely attributed to the segment’s capability to support high-voltage, long-distance power transmission while maintaining cost and energy efficiency. Bi-polar systems are widely preferred for their enhanced fault tolerance and ability to continue partial operation even in a conductor failure, making them highly suitable for the U.S. grid’s evolving needs. Their adoption is particularly strong across utility-scale power transmission projects, renewable energy corridors, and remote installations in mining, oil & gas sectors, and offshore wind development.

The widespread use of bi-polar converter stations is further driven by their operational reliability and economic advantages in high-capacity transmission environments. These systems offer a balanced load across positive and negative poles, minimizing transmission losses and improving overall system efficiency. In the U.S., growing investments in interregional grid connections, cross-border transmission infrastructure, and clean energy projects continue to support demand for bi-polar HVDC solutions. Their proven ability to support stable, long-range transmission with minimal environmental footprint positions this segment for sustained growth through 2033, particularly as utilities and grid operators pursue grid expansion and modernization objectives.

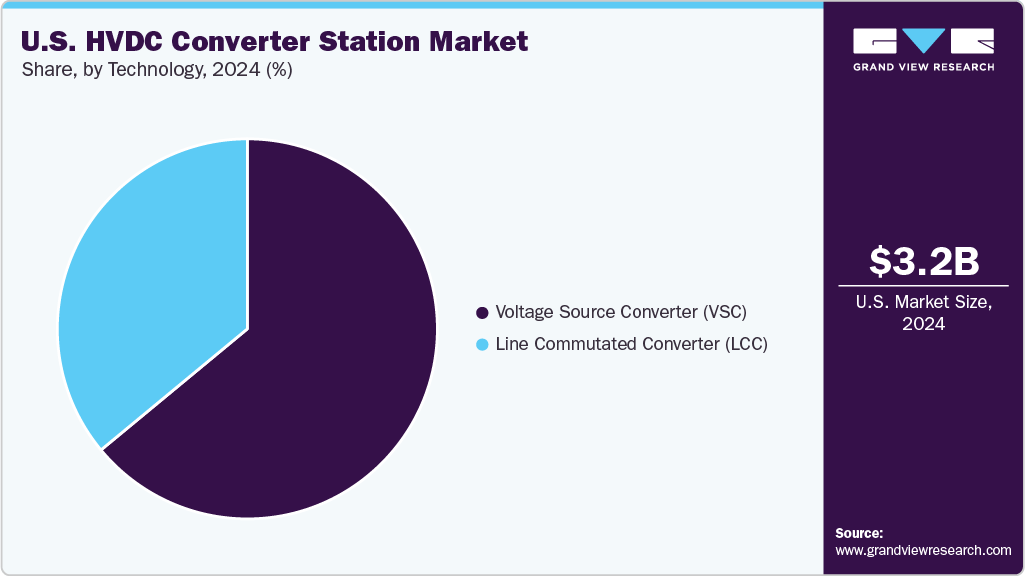

Technology Insights

The voltage source converter (VSC) technology segment led the market with the largest revenue share of 53.17% in 2024. This leading position is supported by the segment’s flexibility and strong performance in complex, space-constrained, or remote environments. VSC-based HVDC Converter Stations are increasingly deployed in sectors such as oil & gas, mining, renewable energy, and transportation infrastructure due to their compact footprint, ease of installation, and ability to provide stable power under dynamic load conditions. With voltage ratings typically ranging from 1 kV to 35 kV, these systems are well-suited for both onshore and offshore applications requiring efficient and modular power delivery.

The dominance of the VSC segment is further reinforced by its operational advantages, including independent control of active and reactive power, fast response to grid fluctuations, and black start capability. These features are especially critical in renewable integration projects and modern grid architectures where stability and responsiveness are paramount. In the U.S., rising demand for decentralized power systems and federal and state-level investment in clean energy and transmission upgrades continue to bolster VSC adoption. As technological innovations further enhance VSC performance and reduce costs, this segment is expected to maintain its leadership in the HVDC Converter Station market over the forecast period.

U.S. HVDC Converter Station Company Insight

Some key players operating in the U.S. HVDC converter station industry include Hitachi Energy, Siemens Energy, GE Vernova, Mitsubishi Electric, Toshiba Energy Systems & Solutions, NR Electric, Schneider Electric, Prysmian Group, Quanta Services, and Alstom Grid. These companies are actively investing in advanced HVDC technologies, modular converter station designs, and digital control systems to meet the growing demand for reliable, scalable, and energy-efficient transmission infrastructure. Their expertise in both Voltage Source Converter (VSC) and Line Commutated Converter (LCC) technologies enables them to support a diverse range of utility, industrial, and renewable energy projects across the U.S.

Key U.S. HVDC Converter Station Companies:

- Hitachi Energy

- Siemens Energy

- GE Vernova

- NR Electric

- Toshiba Energy Systems & Solutions

- Mitsubishi Electric

- Alstom Grid

- Prysmian Group

- Schneider Electric

- Quanta Services

Recent Developments:

- In March 2025, Hitachi Energy was awarded a contract by a U.S. regional transmission operator to deliver a modular HVDC converter station supporting the integration of offshore wind energy into the onshore grid. The project aims to enhance long-distance power transmission efficiency and grid stability using advanced Voltage Source Converter (VSC) technology.

U.S. HVDC Converter Station Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.45 billion

Revenue forecast in 2033

USD 8.92 billion

Growth rate

CAGR of 11.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, technology

Country scope

U.S.

Key companies profiled

Hitachi Energy; Siemens Energy; GE Vernova; NR Electric; Toshiba Energy Systems & Solutions; Mitsubishi Electric; Alstom Grid; Prysmian Group; Schneider Electric; Quanta Services

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. HVDC Converter Station Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. HVDC converter station market report based on the type and technology

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Bi-Polar

-

Monopolar

-

Back-to-back

-

Multi Terminal

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Line Commutated Converter (LCC)

-

Voltage Source Converter (VSC)

-

Frequently Asked Questions About This Report

b. The U.S. HVDC converter station market size was estimated at USD 3.20 billion in 2024 and is expected to reach USD 3.45 billion in 2025.

b. The U.S. HVDC converter station market is expected to grow at a compound annual growth rate of 11.8% from 2025 to 2033 to reach USD 8.92 billion by 2033.

b. Based on the type segment, Bi-Polar held the largest revenue share of more than 57.59% in 2024 in the U.S. HVDC Converter Station market, driven by its high transmission efficiency, fault-tolerant operation, and suitability for long-distance, high-capacity power transfer.

b. Some of the key players in the U.S. HVDC converter station market include Hitachi Energy, Siemens Energy, GE Vernova, Schneider Electric, Mitsubishi Electric, Toshiba Energy Systems & Solutions, NR Electric, Prysmian Group, Alstom Grid, and Quanta Services, among others.

b. The key factors driving the U.S. HVDC converter station market include the increasing need for long-distance, high-capacity, and energy-efficient power transmission. HVDC technology enables the integration of renewable energy sources, enhances grid stability, and reduces transmission losses, making it essential for modernizing aging infrastructure and supporting the transition to a more resilient and sustainable power grid across the United States.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.