U.S. Hydrochloric Acid Market Size & Trends

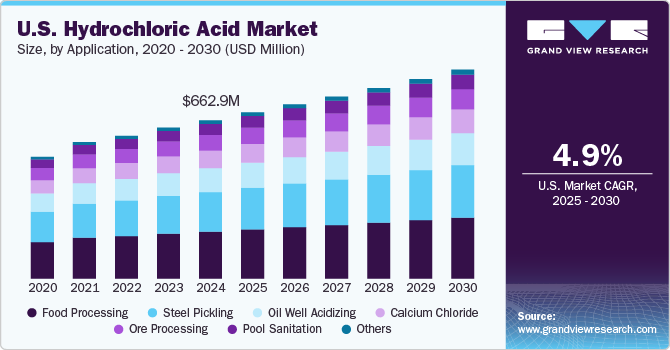

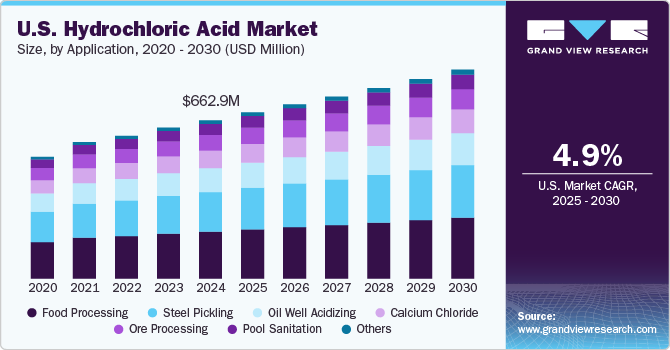

The U.S. hydrochloric acid market size was valued at USD 662.9 million in 2024 and is expected to grow at a CAGR of 4.9% from 2025 to 2030. This growth is attributed to the increasing industrial activities, particularly in water treatment and food processing, which significantly boost demand for hydrochloric acid. In addition, the construction sector's expansion also contributes to this trend, as HCl is essential for various applications such as concrete cleaning. Furthermore, rising environmental awareness encourages industries to adopt sustainable practices, enhancing the use of hydrochloric acid in eco-friendly processes.

Hydrochloric acid is a strong inorganic acid that is widely used in various industrial processes. In the U.S., the market for hydrochloric acid is expected to grow significantly due to the increasing demand for water and wastewater treatment. This process aims to improve water quality for safe consumption and environmental compliance. Hydrochloric acid is particularly effective in neutralizing alkaline substances, making it a valuable resource in treating wastewater and ensuring that effluent meets regulatory standards.

In addition, growth opportunities are driven by rising demand from multiple end-use industries. The food and beverage sector frequently employs hydrochloric acid as an acidity regulator, recognized by the designation E507. It is integral in producing numerous items, including baby food, cheese, and syrups. In the pharmaceutical industry, hydrochloric acid is essential for synthesizing active ingredients in medications and maintaining the appropriate pH levels in products such as eye drops.

Furthermore, as environmental regulations become more stringent, industries are motivated to adopt effective water treatment solutions, further boosting hydrochloric acid demand. Hydrochloric acid's versatility across different applications highlights its importance and underscores its potential to drive market expansion within the U.S. economy. Moreover, with ongoing technological advancements and increased awareness of water quality issues, the hydrochloric acid market is well-positioned for sustained growth in the coming years.

Application Insights

The food processing application segment dominated the U.S. hydrochloric acid industry and accounted for the largest revenue share of 29.7% in 2024. This growth is attributed to its extensive use as an acidifier in various food products. Hydrochloric acid is vital for producing corn syrup, soy sauce, and hydrolyzed vegetable protein. In addition, as consumer preferences shift towards processed foods, the demand for hydrochloric acid in this sector is expected to rise. Furthermore, stringent food safety regulations and the need for quality control further enhance its utilization in food processing applications.

The calcium chloride segment is expected to grow at a CAGR of 5.2% over the forecast period, owing to its role in producing calcium chloride, which is widely used for de-icing roads and as a desiccant. In addition, the increasing need for effective winter maintenance solutions and moisture control in various industries boosts the demand for calcium chloride. Furthermore, as construction activities grow, the requirement for calcium chloride in concrete production and soil stabilization also contributes to the rising consumption of hydrochloric acid.

States Insights

California Hydrochloric Acid Market Trends

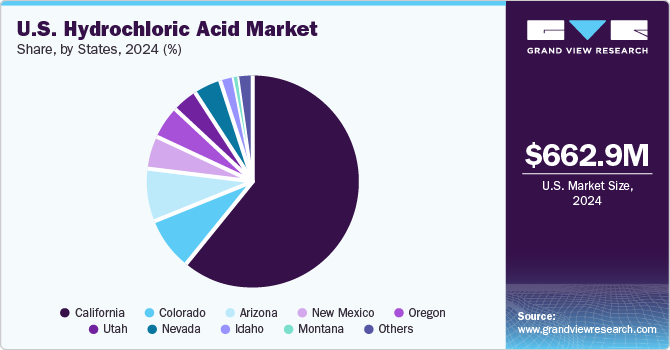

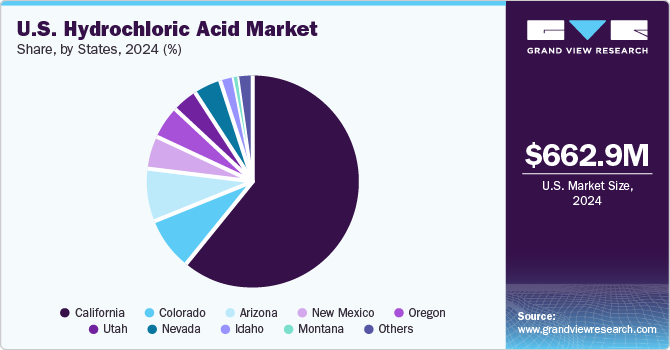

The California hydrochloric acid market dominated the U.S. market and accounted for the largest revenue share of 60.3% in 2024. This growth is attributed to the booming construction industry. As one of the largest states for construction activities, California's demand for hydrochloric acid is significant, particularly in steel pickling processes essential for preparing steel products. In addition, the state's stringent environmental regulations promote effective water treatment solutions, further increasing the utilization of hydrochloric acid in various applications.

New Mexico Hydrochloric Acid Market Trends

The hydrochloric acid market in New Mexico is expected to grow at a CAGR of 5.8% over the forecast period, owing to the rising oil and gas production activities. In addition, the state has seen an increase in oil well acidizing operations, where hydrochloric acid is crucial for enhancing oil extraction processes. This surge in hydrocarbon production not only boosts demand for hydrochloric acid but also attracts investments in related infrastructure. Furthermore, as New Mexico continues to develop its energy sector, the need for efficient chemical solutions such as hydrochloric acid is expected to expand, driving market growth in the region.

Key U.S. Hydrochloric Acid Company Insights

Key companies in the U.S. hydrochloric acid industry include Westlake Chemical Corporation, Tronox Holdings plc, Olin Corporation, and others. These companies are implementing strategies such as expanding production capacities, investing in advanced technologies, and focusing on sustainability. In addition, they pursue strategic partnerships and mergers to enhance supply chains and diversify product offerings, ensuring competitiveness in the evolving market landscape.

-

Continental Chemical Company manufactures hydrochloric acid in various concentrations and offers it for applications across multiple sectors, including oil and gas, food processing, and metal finishing. Operating primarily in the chemical supply segment, the company is well-equipped to meet both large-scale and smaller demands for hydrochloric acid, ensuring reliable service and competitive pricing for its diverse customer base.

-

Tronox Holdings plc specializes in the production of titanium dioxide pigments and also manufactures hydrochloric acid. The company operates within the chemical manufacturing segment, utilizing hydrochloric acid as a key component. By integrating hydrochloric acid into its production methods, the company supports various industries, including coatings, plastics, and paper, contributing to its comprehensive portfolio of chemical solutions.

Key U.S. Hydrochloric Acid Companies:

- Thermo Fisher Scientific Inc.

- Westlake Chemical Corporation

- ERCO Worldwide

- Continental Chemical Company

- Miles Chemical Company Inc.

- Tronox Holdings plc

- Jones-Hamilton Co.

- Olin Corporation

- Spectrum Chemical Manufacturing Corp.

- Detrex Corporation

- TRInternational

- Formosa Plastics Corporation, U.S.A.

Recent Developments

-

In January 2025, Jones-Hamilton Co. announced its acquisition of Nexchlor LLC, enhancing its position as a leading hydrochloric acid (HCl) producer. Based in Maumee, Ohio, Jones-Hamilton operates chemical manufacturing facilities and serves clients in over 20 countries. With this acquisition, Jon Cupps joins as Division Manager, overseeing the hydrochloric acid business. CEO Tim Poure highlighted the synergy between the companies to improve HCl supply capabilities and customer relationships.

-

In August 2024, Westlake Corporation held a public hearing regarding its application for a permit to install two hazardous waste-fired hydrochloric acid production furnaces. The meeting, attended by sixteen individuals, addressed community concerns about the project, which was expected to recover hydrochloric acid from waste streams. Environmental specialist Don Johnson emphasized the strict regulations under the Resource Conservation and Recovery Act and the need for 99.999% contaminant removal.

U.S. Hydrochloric Acid Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 697.1 million

|

|

Revenue forecast in 2030

|

USD 875.9 million

|

|

Growth Rate

|

CAGR of 4.9% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Application

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

Thermo Fisher Scientific Inc.; Westlake Chemical Corporation; ERCO Worldwide; Continental Chemical Company; Miles Chemical Company Inc.; Tronox Holdings plc; Jones-Hamilton Co.; Olin Corporation; Spectrum Chemical Manufacturing Corp.; Detrex Corporation; TRInternational; Formosa Plastics Corporation, U.S.A.

|

|

Customization scope

|

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Hydrochloric Acid Market Report Segmentation

This report forecasts revenue growth at country level and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. hydrochloric acid market report based on application.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Oil Well Acidizing

-

Food Processing

-

Steel Pickling

-

Ore Processing

-

Pool Sanitation

-

Calcium Chloride

-

Others

-

States Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Utah

-

Idaho

-

California

-

Arizona

-

Nevada

-

Colorado

-

Oregon

-

Wyoming

-

Montana

-

New Mexico

-

Rest of U.S.