- Home

- »

- Consumer F&B

- »

-

U.S. Ice Cream Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. Ice Cream Market Size, Share & Trends Report]()

U.S. Ice Cream Market (2026 - 2033) Size, Share & Trends Analysis By Product (Cartons, Tubs, Cups, Cones, Bars), By Type (Dairy & Water-based, Vegan), By Flavor (Chocolate, Vanilla, Fruit), By Distribution Channel (Foodservice, Retail), And Segment Forecasts

- Report ID: GVR-4-68040-846-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Ice Cream Market Summary

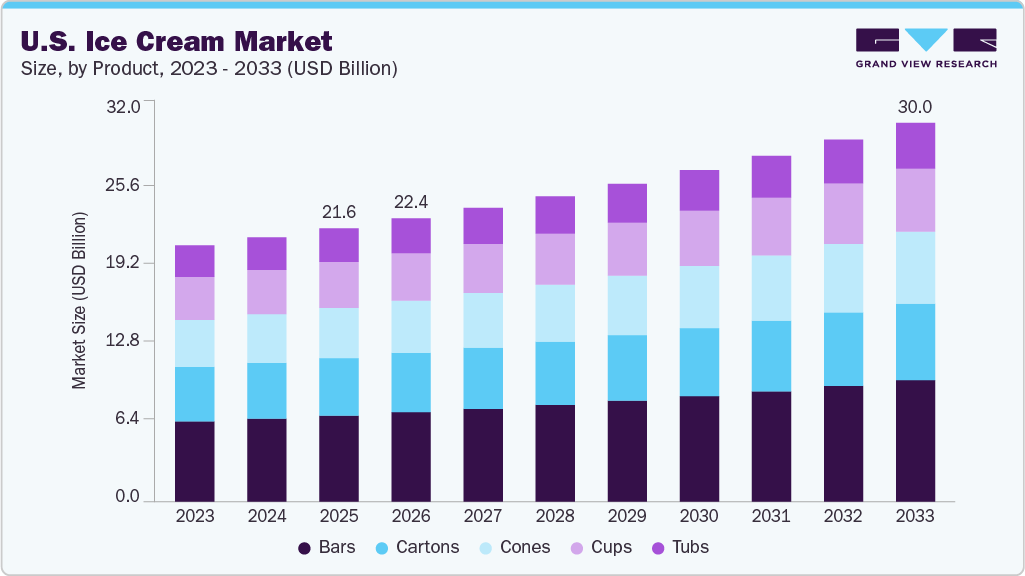

The U.S. ice cream market size was estimated at USD 21.64 billion in 2025 and is expected to reach USD 30.00 billion by 2033, growing at a CAGR of 4.2% from 2026 to 2033. The U.S. market is poised for steady growth driven by rising demand for premium products, expanding flavor options, and a growing shift toward healthier and specialty alternatives.

Key Market Trends & Insights

- By product, bars led the U.S. ice cream market and accounted for a share of 31.44% in 2025.

- By type, dairy & water-based led the U.S. ice cream market and accounted for a share of 94.59% in 2025.

- By flavor, chocolate led the U.S. ice cream market and accounted for a share of 35.10% in 2025.

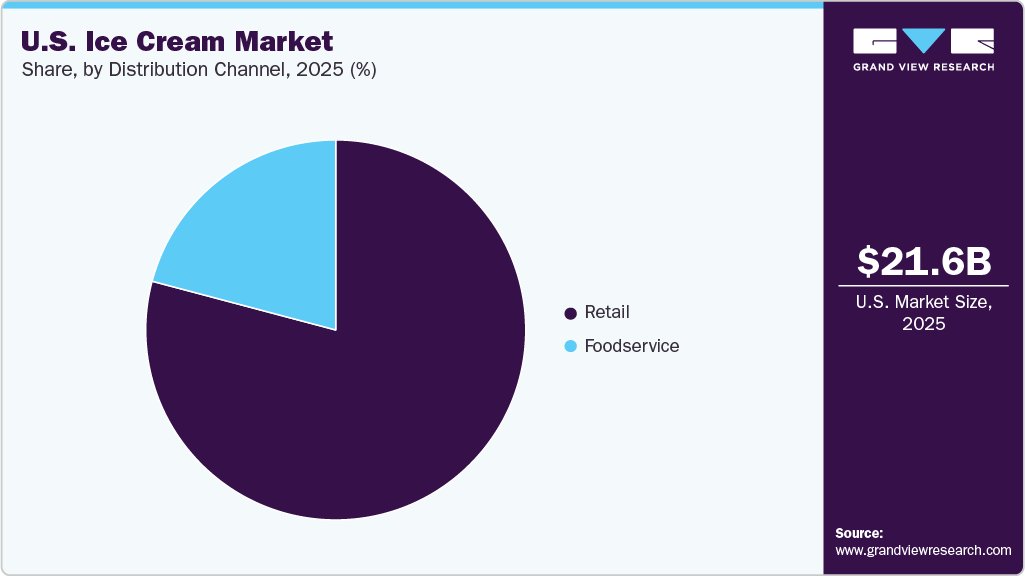

- By distribution channel, retail channels led the U.S. ice cream market and accounted for a share of 79.13% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 21.64 Billion

- 2033 Projected Market Size: USD 30.00 Billion

- CAGR (2026-2033): 4.2%

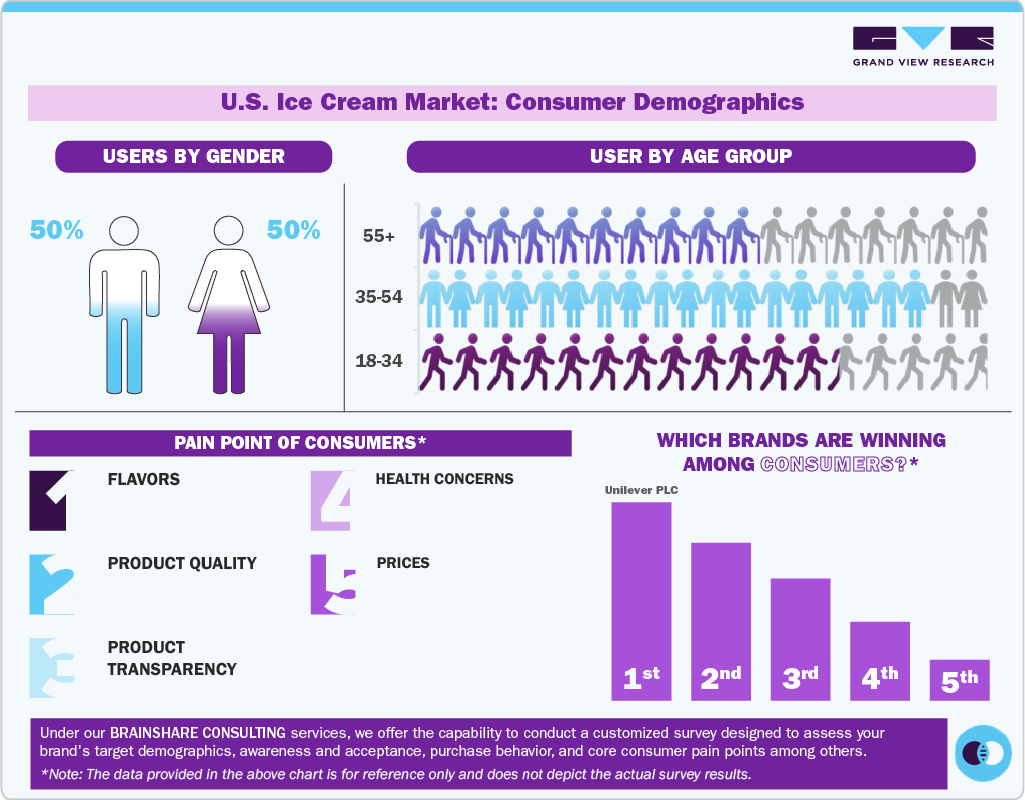

Consumers are increasingly seeking lactose-free, vegan, and plant-based options, prompting brands to accelerate innovation in these segments. Modern consumers, especially younger demographics, seek ice creams that feel indulgent and elevated, featuring layered textures, inclusions like brownies or cookie chunks, complex sauces, and visually appealing formats such as dipped cones or filled cores. This shift reflects a desire for experience-based indulgence, where the sensory richness of the product determines its premium value. As a result, brands are investing in sophisticated formulations and creative product architectures to meet this rising expectation for multi-layered, high-quality ice cream experiences.

Flavor innovation, including bold combinations, limited-edition releases, and seasonal offerings, is also shaping the U.S. ice cream landscape. Consumers are seeking novelty and variety, which has led brands to introduce adventurous blends, globally inspired flavors, and trending ingredients like pistachio, floral botanicals, and fusion desserts. Limited-time launches and exclusive drops create excitement and drive trial, particularly among Gen Z and millennials, who enjoy exploring new taste experiences.

Consumer Insights

Personalization is a key trend driving consumer preferences in the market. Brands are offering customizable options, allowing customers to create their own flavors by selecting mix-ins, toppings, and bases, enhancing the overall experience and catering to individual preferences. This trend aligns with the desire for unique and personalized food experiences, reflecting the growing importance of self-expression and customization among consumers.

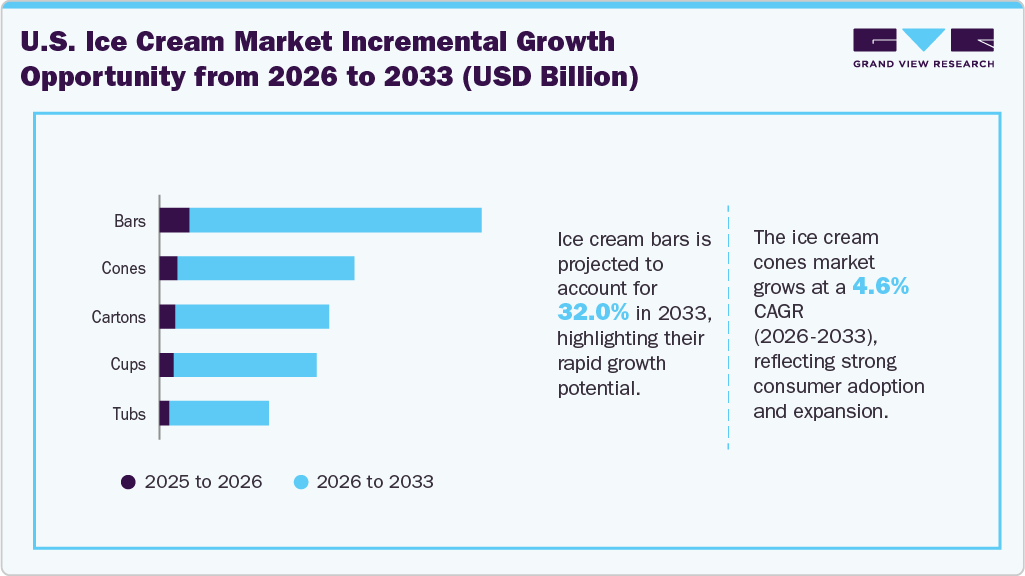

Product Insights

Ice cream bars held the largest revenue share of the U.S. ice cream industry in 2025, accounting for a share of 31.44%. They offer convenience, portability, and portion control, making them ideal for on-the-go snacking. In addition, innovation in coatings, textures, and flavor layers has made bars more exciting than ever, ranging from chocolate-dipped options to bars with crunchy inclusions, caramel or fudge layers, and premium ingredients. Brands also use attractive packaging and limited editions to create impulse purchases at retail checkout freezers.

Ice cream cones is anticipated to witness a CAGR of 4.6% from 2026 to 2033. Cones provide a sensory and nostalgic eating experience that packaged formats can’t fully replicate. Consumers enjoy the combination of creamy ice cream with the crunch of a waffle or sugar cone, making it a more engaging and multi-textured treat. In addition, brands and parlors are innovating cone formats, offering chocolate-dipped rims, filled cone tips, flavored waffle cones, gluten-free or allergen-friendly versions, and even premium artisanal cones. These enhancements elevate cones from a basic serving format to a more premium, Instagram-friendly dessert experience.

Type Insights

Dairy & water-based segment held the largest revenue share of the U.S. ice cream industry in 2025, accounting for a share of 94.59%. They deliver the traditional taste, texture, and mouthfeel that people associate with classic ice cream. Dairy-based varieties provide the rich creaminess and indulgence that consumers expect. At the same time, water-based options, such as sorbets, popsicles, and fruit ices, offer lighter, refreshing alternatives that appeal during warmer months and to those seeking lower-calorie treats. Together, these two formats cover a broad spectrum of preferences, from indulgent to refreshing.

Vegan ice creams is anticipated to witness a CAGR of 8.3% from 2026 to 2033. Many people are adopting plant-based diets to reduce dairy intake, manage lactose intolerance, or pursue healthier, lower-cholesterol alternatives. Vegan ice cream aligns with these goals while still delivering an indulgent experience. As lactose intolerance affects a large segment of the U.S. population, dairy-free options naturally attract broader interest beyond strictly vegan consumers. At the same time, consumers are becoming increasingly aware of sustainability and animal welfare, driving growing interest in plant-based products across various categories.

Flavor Insights

Chocolate flavor held the largest revenue share of the U.S. ice cream industry in 2025, accounting for a share of 35.10%. Chocolate benefits from strong emotional and cultural associations; it is often linked to reward, celebration, and stress relief, which reinforces repeat purchases. Brands continually innovate with chocolate variations such as double chocolate, chocolate fudge, chocolate chip, rocky road, and chocolate-based novelties, keeping the flavor exciting and relevant.

Fruit flavor is anticipated to witness a CAGR of 4.0% from 2026 to 2033. Fruit flavors align with the broader trend of seasonal, artisanal, and globally inspired offerings. Consumers enjoy trying exotic or tropical fruit flavors, which add novelty and excitement to the category. Ice cream brands and parlors have also enhanced the quality of their fruit-based products by using premium fruit purées, reducing sugar, and incorporating vibrant, natural colors, making them more appealing.

Distribution Channel Insights

Retail channels held the largest revenue share of the U.S. ice cream industry in 2025, accounting for a share of 79.13%. They offer maximum convenience, accessibility, and a wide variety of products, making them the primary point of purchase for most consumers. Supermarkets, hypermarkets, and mass merchandisers stock a wide range of formats, pints, tubs, bars, cones, novelties, and multipacks, allowing shoppers to compare brands, flavors, and prices all in one place. Retail outlets frequently run promotions, discounts, and multipack deals, encouraging bulk purchases and repeat buying.

The food service channel is anticipated to witness a CAGR of 3.7% from 2026 to 2033. Consumers are seeking experiential and premium indulgences that go beyond what packaged retail ice cream can offer. Food service outlets offer freshly made servings, customizable toppings, unique textures, and interactive formats, such as sundaes, shakes, dipped cones, and mix-ins, creating a treat-driven experience that appeals especially to younger consumers and families.

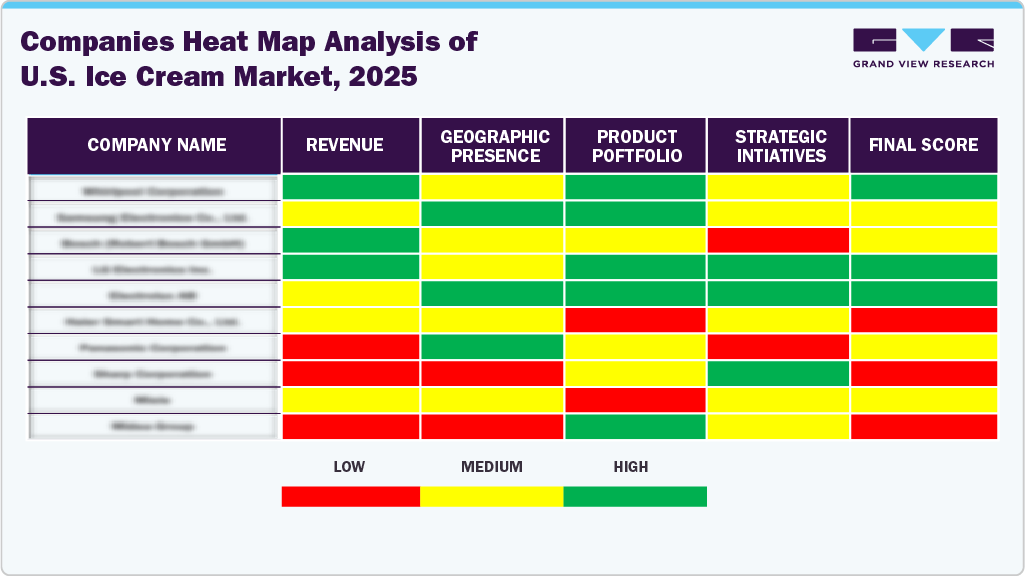

Key U.S. Ice Cream Company Insights

Leading players in the U.S. market include Tillamook County Creamery Association, Unilever PLC, and Turkey Hill Dairy. The market remains highly competitive, with major brands expanding their presence across supermarkets, convenience stores, and fast-growing e-commerce channels to enhance consumer accessibility. Companies are heavily investing in flavor innovation, premium and health-oriented formulations, and advanced production technologies to meet evolving American preferences for indulgence, clean-label ingredients, and higher product quality. These efforts are helping brands differentiate in a mature market while catering to the rising demand for both premium treats and vegan ice cream options.

Key U.S. Ice Cream Companies:

- Tillamook County Creamery Association

- Unilever PLC

- Turkey Hill Dairy

- Inspire Brands, Inc. (Baskin-Robbins)

- American Dairy Queen Corporation

- Nestlé SA

- Blue Bell Creameries

- Cold Stone Creamery

- Danone S.A.

- Wells Enterprises

Recent Developments

-

In October 2025, Wells Enterprises announced the launch of two premium frozen treats, Nutella Ice Cream and Kinder Bueno Frozen Dessert, for the U.S. market. The products were introduced in both pint and single-serve cone formats and were showcased at the NACS Show, held from October 14 to 17, 2025.

-

In March 2025, A U.S. baby-care brand, Frida, announced the upcoming launch of a “breast-milk-flavoured” ice cream as a promotional tie-in with its new 2-in-1 manual breast pump. While the product does not contain actual human breast milk (which is not approved for use in commercial ice cream), the company claims it mimics the taste and nutritional profile of breast milk by including Omega-3 fats, lactose, and vitamins such as iron, calcium, B12, D, and zinc.

U.S. Ice Cream Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 22.42 billion

Revenue forecast in 2033

USD 30.00 billion

Growth rate (revenue)

CAGR of 4.2% from 2026 to 2033

Actuals

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, flavor, distribution channel

Key companies profiled

Tillamook County Creamery Association; Unilever PLC; Turkey Hill Dairy; Inspire Brands, Inc. (Baskin-Robbins); American Dairy Queen Corporation; Nestlé SA; Blue Bell Creameries; Cold Stone Creamery; Danone S.A.; Wells Enterprises

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Ice Cream Market Report Segmentation

This report forecasts revenue growth at regional levels and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the U.S. ice cream market based on product, type, flavor, and distribution channel:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cartons

-

Tubs

-

Cups

-

Cones

-

Bars

-

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Dairy & Water-based

-

Vegan

-

-

Flavor Outlook (Revenue, USD Billion, 2021 - 2033)

-

Chocolate

-

Vanilla

-

Fruit

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Foodservice

-

Retail

-

Frequently Asked Questions About This Report

b. The U.S. ice cream market size was estimated at USD 21.64 billion in 2025 and is expected to reach USD 22.42 billion in 2026.

b. The U.S. ice cream market is expected to witness 4.2% revenue growth from 2026 to 2033 to reach USD 30.00 billion by 2033.

b. The ice cream bars market accounted for the largest share of 31.44% of the revenue in 2025 due to convenience, portability, and portion control, making them ideal for on-the-go snacking.

b. The key market players in the U.S. ice cream market include Tillamook County Creamery Association; Unilever PLC; Turkey Hill Dairy ; Inspire Brands, Inc. (Baskin Robbins); American Dairy Queen Corporation; Nestlé SA; Blue Bell Creameries; Cold Stone Creamery; Danone S.A.; Wells Enterprises

b. Growth in the U.S. ice cream market is being primarily driven by rising demand for premium products, expanding flavor options, and a growing shift toward healthier and specialty alternatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.