- Home

- »

- Next Generation Technologies

- »

-

U.S. Industrial Barrier Systems Market Size Report, 2030GVR Report cover

![U.S. Industrial Barrier Systems Market Size, Share & Trends Report]()

U.S. Industrial Barrier Systems Market (2023 - 2030) Size, Share & Trends Analysis Report Type (Bollards, Safety Fences, Safety Gates, Guardrails, Barriers For Machinery), And Segment Forecasts

- Report ID: GVR-4-68040-106-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

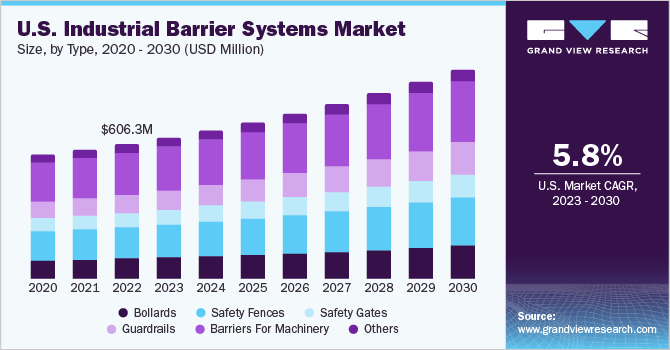

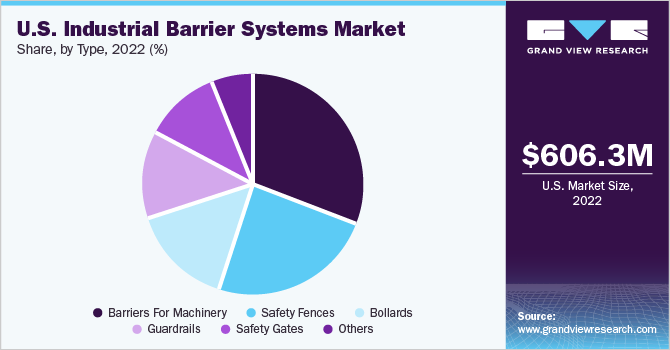

The U.S. industrial barrier systems market size was estimated at USD 606.3 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. The growth can be attributed to increased workplace safety awareness, stringent EHS regulations, improved digital infrastructure, rising business spending, and improved supply chain networks. Technological advancement, including integration of smart sensors and automation, has helped improve the efficiency of industrial barrier systems, resulting in increased adoption of industrial barrier systems in U.S. Leading market players have been involved in strategic initiatives such as partnerships and mergers to gain new consumers.

For instance, in December 2020, ATG Access Ltd, a U.S.-based residential and commercial solution provider, partnered with ESCO Pte. Ltd., a Singapore-based security solution provider, to strengthen its position in vehicle mitigation solutions across Asia. Both companies had signed a three-year agreement granting ESCO Pte. Ltd. rights for manufacturing, supplying, installing, and maintaining Haydock-based ATG access equipment. Such initiatives are expected to help bring new products to industrial barrier market, which, in turn, could attract new consumers to market.

Market Dynamics

The growing adoption of industrial barrier systems in U.S. can be attributed to growing need for risk mitigation and rising security concerns in various industries. An increasing number of businesses across industries are recognizing importance of implementing robust physical barriers to protect their assets, employees, and sensitive information from threats like terrorism, theft, vandalism, and unauthorized access. Airports, government buildings, industrial facilities, and critical infrastructure sites require effective perimeter protection to restrict unauthorized entry and security breaches.

Industrial barrier systems, including fences, drop arms, and bollards, act as physical deterrents, limiting access to designated areas and providing a visible and formidable barrier against intrusion. These barriers help control pedestrian and vehicular traffic, ensuring that only authorized personnel can access restricted areas and risk of unauthorized entry or malicious activities is reduced. Many industrial facilities, warehouses, distribution centers, and critical infrastructure sites require robust barriers to control access and prevent unauthorized entry. Industrial fences, including high-security fencing systems, can withstand cutting, climbing, and tampering attempts, protecting against trespassing and theft. These factors would further supplement growth of U.S. industrial barrier systems industry during forecast period.

Market players are also increasingly focusing on developing advanced systems in terms of technology, material used, and product design, among others, to gain better traction in the highly competitive market. For instance, in March 2022, OTW Safety, a U.S.-based manufacturer of barrier systems, announced launch of its new barricade fence panel made of galvanized steel pipe that can be easily installed. Moreover, these fence panels can be integrated with JSS-42×72, OTW42x72 LCD, and JSS-32×72 barricades. The presence of several leading industrial barrier system manufacturers in U.S., improving regulations, and growing safety concerns across the globe together contribute to the growth the U.S. market for industrial barrier systems.

The integration of IoT and connectivity has been revolutionizing U.S. industrial barrier systems market. Introducing smart sensors, cloud computing, and wireless communications into barriers has enabled real-time remote monitoring. The connectivity enables industrial processes and systems for automated responses and predictive maintenance. Additionally, real-time collected data from barrier systems helps analyze patterns, optimize operations, and improve safety and efficiency across industrial facility.

The ongoing advancements in technologies and their integration into industrial barrier systems offer new possibilities, enhanced functionality, and increased efficiency in ensuring safety, security, and operational excellence. The emergence of Internet of Things (IoT) and sensor technologies allows for real-time monitoring, data collection, and automated responses within industrial environment. Industrial barriers can be equipped with sensors, such as proximity sensors, motion detectors, or video analytics, to provide real-time information about potential threats, unauthorized access attempts, or anomalies in traffic patterns. These factors would further supplement growth of U.S. market for industrial barrier systems during forecast period.

Industrial barrier systems also play a vital role in traffic management and accident prevention. In environments with heavy vehicular traffic, such as parking lots, warehouses, and distribution centers, barriers like bollards, guardrails, and drop arms help regulate traffic flow, prevent accidents, and protect pedestrians and infrastructure. These barriers provide a physical separation between vehicles and pedestrians, guiding traffic in designated areas and minimizing the risk of collisions or vehicle-related incidents.

Leading vendors in U.S. industrial barrier have been introducing industrial barrier systems with enhanced capabilities, such as increased ability to withstand impact. For instance, in June 2023, Ritehite launched RiteLoad, a new generation dock leveler that featured advanced controlling systems, reinforced construction, and improved design by focusing on enhanced safety measures. The stability and durability are achieved by optimized plateau construction and telescopic lip guidance, which facilitates ten years warranty on the construction and steelwork.

Type Insights

Safety fences segment dominated the market with largest revenue share of 23.44% in 2022. The growth of safety fences segment can be attributed to increasing number of companies offering innovative safety fences designed for multiple purposes. For instance, in March 2023, Mezzanine Safety-Gates, Inc., a U.S.-based protection equipment provider, announced a new design of the Roly safety gate, which protects both people and products. The roly confinement design incorporates a high strength, high visibility netting system on safety gate to prevent employees from reaching into loading zone with their hands. Such initiatives for product launches are expected to drive growth of safety fences segment.

Guardrails segment is anticipated to grow at a CAGR of 7.7% during forecast period. The growth can be attributed to rising number of companies offering guardrails with enhanced capabilities. For instance, in March 2022, Diamon-Fusion International, Inc., a U.S.-based restoration and protection products provider, announced a partnership with Q-railing, a German railing system provider, to provide Diamon-Fusion Protective coating on Q-railing glass guardrail systems. These systems are designed for light commercial, commercial, and residential applications and offer benefits such as prevention of staining, repelling of water, and low-cost maintenance. Such initiatives for product launches are expected to drive growth of the guardrails segment.

Key Companies & Market Share Insights

The key players operating in the market adopt various inorganic growth tactics, such as mergers, acquisitions, and partnerships to broaden their product offerings. For instance, in March 2023, Mezzanine Safety-Gates, Inc. launched a new design of the Roly safety gate to facilitate fall protection for distribution centers, manufacturing, material handling, and warehouse. This design aimed to provide a high-visibility netting system on the ledge side gate, which prevented objects from falling from an elevated storage structure. Some prominent players in the U.S. industrial barrier systems market include:

-

A-Safe

-

BOPLAN

-

Ritehite

-

Fabenco by Tractel

-

Wildeck

-

McCue

-

Barrier1

-

Betafence

-

Mezzanine Safety-Gates, Inc.

-

Saferack

-

CAI Safety Systems, Inc.

-

PS Safety Access

-

TrafFix Devices, Inc.

-

Innoplast

-

B.I.G. Enterprises

Recent Development

-

In March 2023, Ritehite debuted new GuardRite polymer safety barriers at ProMat, an expert in fire protection and high-performance insulation for the construction sector. These GuardRite polymer safety barriers are made of modified polypropylene and scratch resistance and are less expensive than steel barriers.

-

In March 2023, Wildeck has expanded its operations not only in Waukesha but also in Arizona facility. Through this expansion, the company aimed to triple the size of the Arizona facility by helping customers meet the region's needs.

-

In December 2022, A-Safe launched a landing age for its website: Virtual A-Safe. It allowed users to explore integral parts of the business, from manufacturing to testing and research & development. It also facilitated its users' visiting test by designs, which included quality, performance, and safety solutions tests.

-

In August 2022, McCue launched a sustainable BumperSign Solar, a high-strength signage solution operated by solar energy. The solution was designed for parking lots, pedestrian traffic guidelines, online pickup, and other pickup options. The eco-friendly sign is designed using LED batteries connected with rechargeable batteries and a solar panel that generates power virtually.

U.S. Industrial Barrier Systems Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 942.3 million

Growth rate

CAGR of 5.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type

Key companies profiled

A-Safe; BOPLAN; Ritehite; Fabenco by Tractel; Wildeck; McCue; Barrier1; Betafence; Mezzanine Safety-Gates, Inc.; Saferack; CAI Safety Systems, Inc.; PS Safety Access; TrafFix Devices, Inc.; Innoplast; B.I.G. Enterprises

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Industrial Barrier Systems Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. industrial barrier systems market report based on type:

-

U.S. Industrial Barrier Systems Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Bollards

-

Safety Fences

-

Safety Gates

-

Guardrails

-

Barriers For Machinery

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. industrial barrier systems market size was estimated at USD 606.3 million in 2022 and is expected to reach USD 635.1 million by 2023.

b. The U.S. industrial barrier systems market is expected to grow at a compound annual growth rate of 5.8% from 2023 to 2030 to reach USD 942.3 million by 2030.

b. Barriers for machinery dominated the U.S. industrial barrier systems market with a share of 31.19% in 2022. The growth of this segment can be attributed to the growing safety, improving Environmental Health and Safety (EHS) regulation, rising purchasing power, and improving digital infrastructure. Moreover, the increasing complexity of machinery/equipment has increased the demand for safety equipment.

b. Some key players operating in the U.S. industrial barrier systems market include A-Safe, BOPLAN, Ritehite, Fabenco by Tractel, Wildeck, McCue, Barrier1, Betafence, Mezzanine Safeti-Gates, Inc., Saferack, CAI Safety Systems, Inc., PS Safety Access, TrfFix Devices, Inc., Innoplast, and B.I.G. Enterprises

b. The U.S. industrial barrier systems market growth can be attributed to increased workplace safety awareness, stringent EHS regulations, improved digital infrastructure, rising business spending, and improved supply chain networks.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.