- Home

- »

- Electronic Devices

- »

-

U.S. Industrial Refrigeration Systems Market, Industry Report, 2030GVR Report cover

![U.S. Industrial Refrigeration Systems Market Size, Share & Trends Report]()

U.S. Industrial Refrigeration Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Compressors, Condensers), By Capacity, By Refrigerant, By Application, And Segment Forecasts

- Report ID: GVR-4-68040-216-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

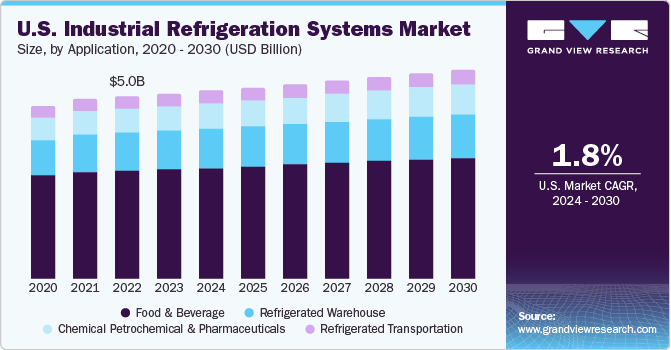

The U.S. industrial refrigeration systems market size was valued at USD 5.11 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 1.8% from 2024 to 2030. The market is anticipated to be driven by the rising need of industrial refrigeration in the chemical & pharmaceutical, and food & beverage industries. This can be attributed to an upsurge in the usage of processed and packed food & drinks in developing and developed countries and the need to prevent spoilage of semi-processed food & beverages. The growing government funding to support cold chain infrastructure is also expected to drive market growth.

In 2023, the U.S. accounted for over 24% of the industrial refrigeration systems market. Industrial refrigeration systems in the traditional form consisted of an ammonia-based cooling system. For thermal conduction, the system used a liquid refrigerant. Modern industrial refrigeration systems are controlled by the exact procedure for temperature and trends, which becomes a vital parameter in the process. Industrial refrigeration systems play an essential role in maintaining the overall stability of the industrial processes and directly impacting the final product's quality. Condensing modules, compressors, and evaporators are the three major components of the automated system.

The system is used to process fruits, vegetables, poultry, fish, meat, and dairy products in the food processing industry. With advancements in technology over time, industrial refrigeration systems have shown enhancement in their processes. Innovations have led to the manufacturing of smart and intelligent devices that monitor, set temperature, and notify the person as and when needed. The incorporation of Artificial Intelligence (AI) with the systems became a breakthrough in the market by enhancing productivity and lowering the operational cost for the organizations.

The COVID-19 pandemic impacted the market negatively due to the restrictions imposed by the government. Many industries stopped their operations during the period. Construction & transportation operations and supply chains were hindered on a global scale, leading to decreased refrigeration device manufacturing, which directly impacted the industrial refrigeration sector. The invention and extreme demand of COVID-19 vaccines initiated a hope for the market to grow over the period as this would increase cold storage, transportation, and supply.

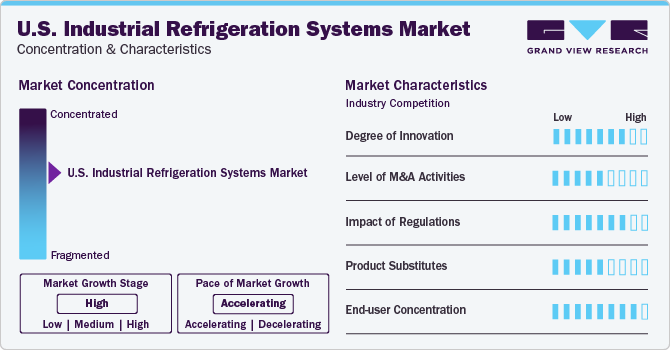

Market Concentration & Characteristics

The U.S. industrial refrigeration systems industry is driven by a high degree of innovation. This is due to the increased demand for technologically advanced industrial refrigeration system from different industries including food & beverages, chemicals, and healthcare & pharmaceuticals, etc.

The market also witnesses moderate to high M&A activities by the leading companies in order to expand market share and diversify the product portfolio. For instance, in March 2023, Industrial Refrigeration Pros (IR Pros) acquired Refrigerated Mechanical Solutions (RMS), a company specializing in planning, construction, design, and installation of industrial refrigeration systems.

The market is subject to increasing regulatory scrutiny due to the rising number of regulations aimed at reducing the environmental impact of industrial refrigerators. The U.S. Environmental Protection Agency (EPA) regulation governs the use of refrigerants in industrial systems. The Occupational Safety and Health Administration (OSHA) regulations are aimed at safe operation and maintenance of industrial refrigeration systems. Regulations associated with the energy efficiency of industrial refrigeration have further led to the development of more efficient refrigeration systems.

End-user concentration is high in the U.S. industrial refrigeration systems industry, as several industry verticals are adopting various industrial refrigeration systems. Food and beverage, pharmaceutical, chemical, and energy companies are among the prominent end users of industrial refrigeration systems.

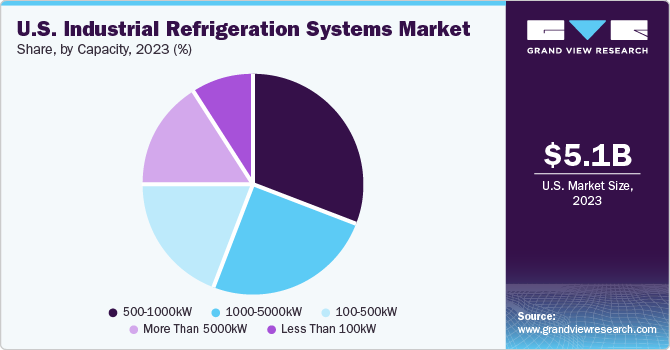

Capacity Insights

Based on capacity, the 500kW-1000kW segment accounted for the highest revenue share in 2023. The capacity range is majorly used by the food & beverage storage as well as processing, especially for the perishable and processed products. It is also used by dairy plants to keep the items stored for a longer period of time without contamination. This medium-level capacity range is considered as an optimal cooling environment in industrial plants for preventing large quantities of edible items from spoiling.

The 1000-5000kW segment is estimated to grow at the highest CAGR over the forecast period. The ranges are used for cold storage purposes of items such as vaccines, petrochemicals, and other items that can be deterred due to the lack of cool storage premises. The temperature range in the inner infrastructure of high-scale power plants is between 50-100 degrees Celsius. Modern refrigeration systems with capacities ranging between this segment can counteract the effect of high temperatures on shop floors, demand for systems with capacities of the same kind is anticipated to grow in the coming years.

Component Insights

Based on components, the compressor segment accounted for a substantial revenue share of 21.78% in 2023. Compressors are primarily used in commercial and industrial refrigeration, heat pumps, and air-conditioning applications such as HVAC, chillers, and humidifiers. In industrial refrigeration equipment, compressors play an essential role in maintaining appropriate temperature by increasing the refrigerant vapor pressure in the condenser for preservation and food storage applications.

The ability of this equipment to control the load over the evaporators makes it a significant unit in industrial refrigeration systems. This component is the heart of the refrigeration system that moves refrigerant through the entire system. The introduction of innovative compressor solutions by market companies to meet efficiency and refrigerant regulations associated with industrial refrigeration is expected to create lucrative growth opportunities for the market.

Application Insights

The food & beverage segment accounted for the largest revenue share in 2023. The growing disposable income and the rising population have augmented the demand for frozen and processed food products. This increasing need for convenience products has led to a surge in the number of refrigerated warehouses, with improved capacity, in the past few years.

The chemical, petrochemical, and pharmaceutical application segment is expected to expand at the highest CAGR during the forecast period. The augmented demand for vaccinations to diminish the coronavirus infections has witnessed an upsurge in the past few year. The vaccinations require a higher level cooling units to store and distribute across the globe. Such demand for a cold storage system in the COVID-19 crisis has led to the increase in the deployment of industrial refrigeration systems, thereby exponentially spurring the revenue generation of this application area at a longer run.

Key U.S. Industrial Refrigeration Systems Company Insights

Some of the key companies operating in the market include EVAPCO Inc., GEA Group Aktiengesellschaft, and Emerson Electric Co.

-

Emerson Electric Co. operates its business through two segments, namely Commercial & Residential Solutions, and Automotive Solutions. The company offers actuators, valves, software, regulators, analytical and measurement instrumentation, and process control systems.

-

GEA Group Aktiengesellschaft specializes in machinery, plants, and process technology and component. The company offers process technology, services, and solutions to marine, dairy farming, dairy processing, pharma, food, and beverage industries.

Danfoss and LU-VE S.p.A are some other participants in the U.S. industrial refrigeration systems market.

- Danfoss is a supplier of HVAC products. The company delivers technologies and solutions for AC drives, power, heating, and cooling applications.

Key U.S. Industrial Refrigeration Systems Companies:

- BITZER Kuhlmaschinenbau GmbH

- DAIKIN Industries Ltd.

- Danfoss

- Emerson Electric Co.

- EVAPCO Inc.

- GEA Group Aktiengesellschaft

- Guntner GmbH & Co. KG

- Johnson Controls

- LU-VE S.p.A

- MAYEKAWA MFG Co. Ltd.

Recent Developments

-

In January 2023, Johnson Controls acquires Hybrid Energy to enhance industrial heat pump portfolio. This acquisition is expected to enable Johnson Controls to provide high-temperature heat pumps in rapidly growing district heating and industrial markets.

-

In January 2023, Danfoss collaborated with Microsoft to empower sustainable food retail through digitization. This collaboration is expected to help Danfoss develop digital services to track temperature and the use of energy in supermarket refrigeration.

U.S. Industrial Refrigeration Systems Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.11 billion

Revenue forecast in 2030

USD 5.78 billion

Growth Rate

CAGR of 1.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, Capacity, Refrigerant, Application

Regional scope

U.S.

Key companies profiled

Johnson Control; Emerson Electric Co; Danfoss; DAIKIN Industries Ltd.; GEA Group Aktiengesellschaft; MAYEKAWA MFG Co. Ltd.; BITZER; EVAPCO Inc.; Guntner GmbH & Co. KG; and LU-VE S.P.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Industrial Refrigeration Systems Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. industrial refrigeration systems market report based on the component, capacity, refrigerant, and application:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Compressors

-

Rotary Screw Compressor

-

Centrifugal Compressor

-

Reciprocating Compressors

-

Diaphragm Compressors

-

Others

-

-

Condensers

-

Evaporators

-

Controls

-

Others

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Less than 100kW

-

100-500kW

-

500-1000kW

-

1000-5000kW

-

More than 5000kW

-

-

Refrigerant Outlook (Revenue, USD Million, 2018 - 2030)

-

Ammonia

-

Carbon Dioxide

-

Hydrofluorocarbon

-

Hydrochlorofluorocarbons

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Refrigerated Warehouse

-

Food & Beverage

-

Chemical Petrochemical & Pharmaceuticals

-

Refrigerated Transportation

-

Frequently Asked Questions About This Report

b. The U.S. industrial refrigeration systems market size was estimated at USD 5.11 billion in 2023 and is expected to reach USD 5.20 billion in 2024.

b. The U.S. industrial refrigeration systems market is expected to grow at a compound annual growth rate of 1.8% from 2024 to 2030 to reach USD 5.78 billion by 2030.

b. The food & beverage segment accounted for the largest revenue share in 2023. The growing disposable income and the rising population have augmented the demand for frozen and processed food products.

b. The key players in this U.S. industrial refrigeration systems market include BITZER Kuhlmaschinenbau GmbH, EVAPCO Inc., GEA Group Aktiengesellschaft, and Emerson Electric Co., among others.

b. Key factors that are driving the market growth include the rising demand for frozen food products such as dairy and meat, along with the demand for refrigeration solutions from chemical, petrochemical, and pharmaceutical applications across the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.